Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 2 1/2 in SRW, up 1 1/4 in HRW, down 1 1/2 in HRS; Corn is up 3 1/4; Soybeans up 8 3/4; Soymeal up $0.41; Soyoil up 0.27.

For the week so far wheat prices are down 10 in SRW, down 19 in HRW, down 8 3/4 in HRS; Corn is up 4 1/4; Soybeans up 1 1/4; Soymeal down $0.46; Soyoil down 0.33.

For the month to date wheat prices are down 58 1/2 in SRW, down 75 in HRW, down 45 3/4 in HRS; Corn is down 20 1/4; Soybeans down 30 1/4; Soymeal up $2.00; Soyoil down 1.23.

Year-To-Date nearby futures are down 7.4% in SRW, down 8.4% in HRW, down 4.9% in HRS; Corn is down 3.0%; Soybeans down 0.3%; Soymeal up 4.9%; Soyoil down 1.1%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAR 23) Soybeans up 19 yuan; Soymeal up 11; Soyoil down 26; Palm oil down 98; Corn down 4 — Malaysian palm oil prices overnight were down 73 ringgit (-1.83%) at 3911.

There were changes in registrations (-165 Soybeans). Registration total: 2,788 SRW Wheat contracts; 0 Oats; 154 Corn; 665 Soybeans; 479 Soyoil; 0 Soymeal; 280 HRW Wheat.

Preliminary changes in futures Open Interest as of January 10 were: SRW Wheat up 2,180 contracts, HRW Wheat up 4,309, Corn up 5,811, Soybeans up 6,792, Soymeal up 796, Soyoil up 1,193.

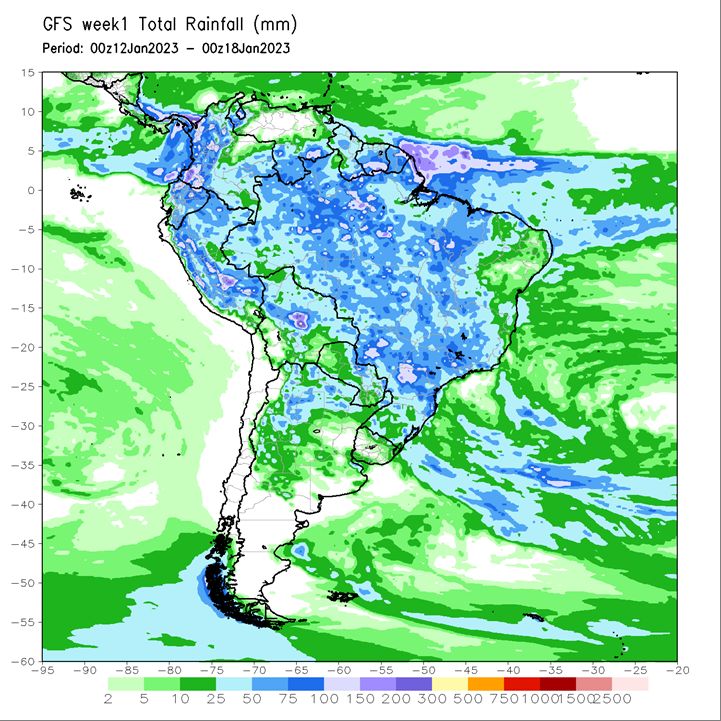

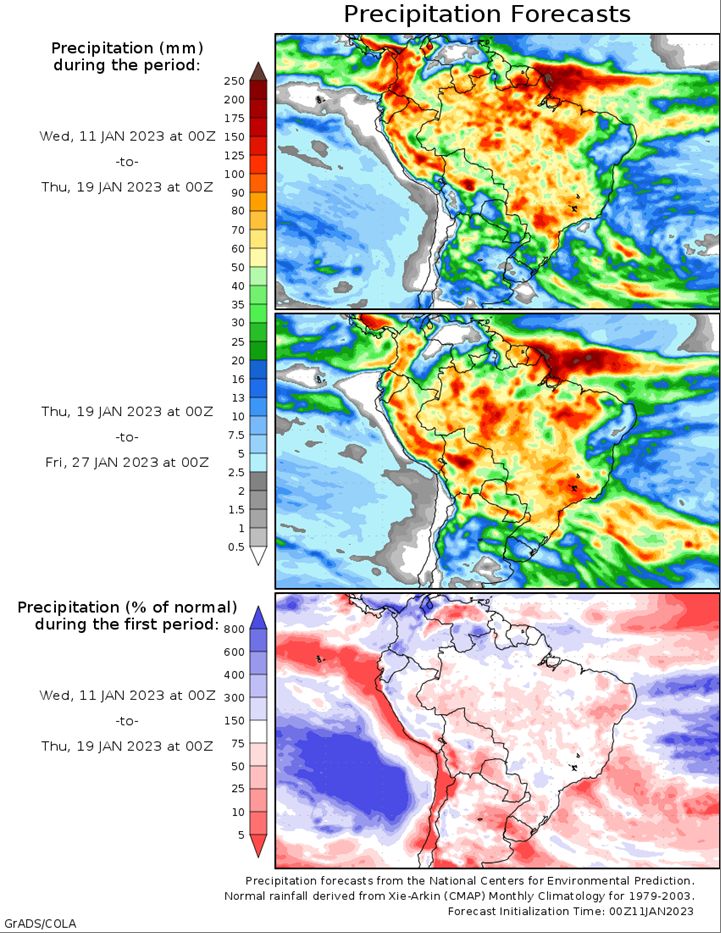

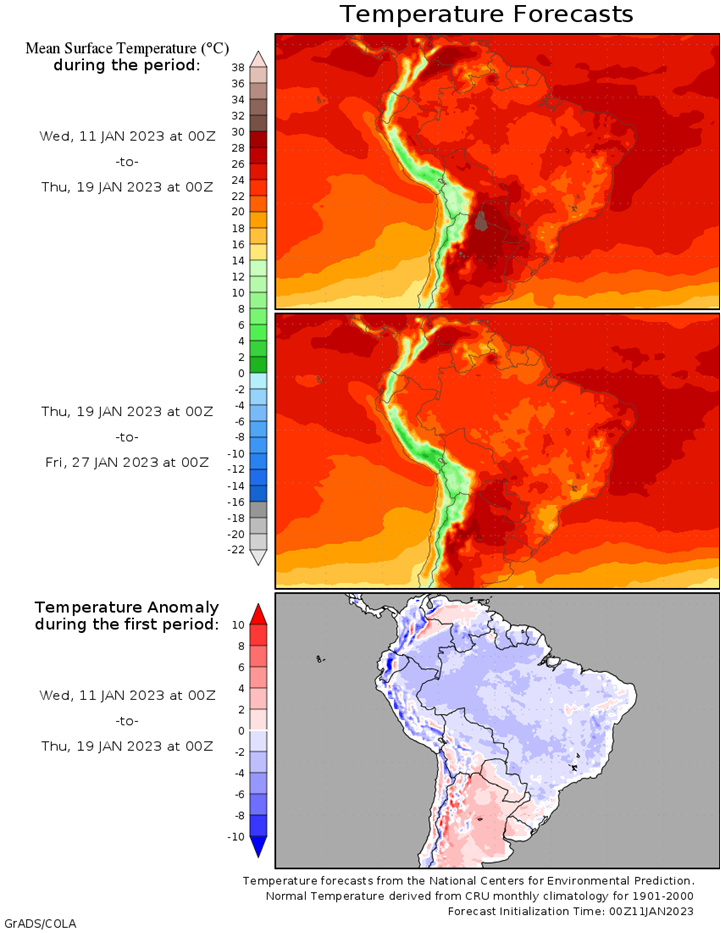

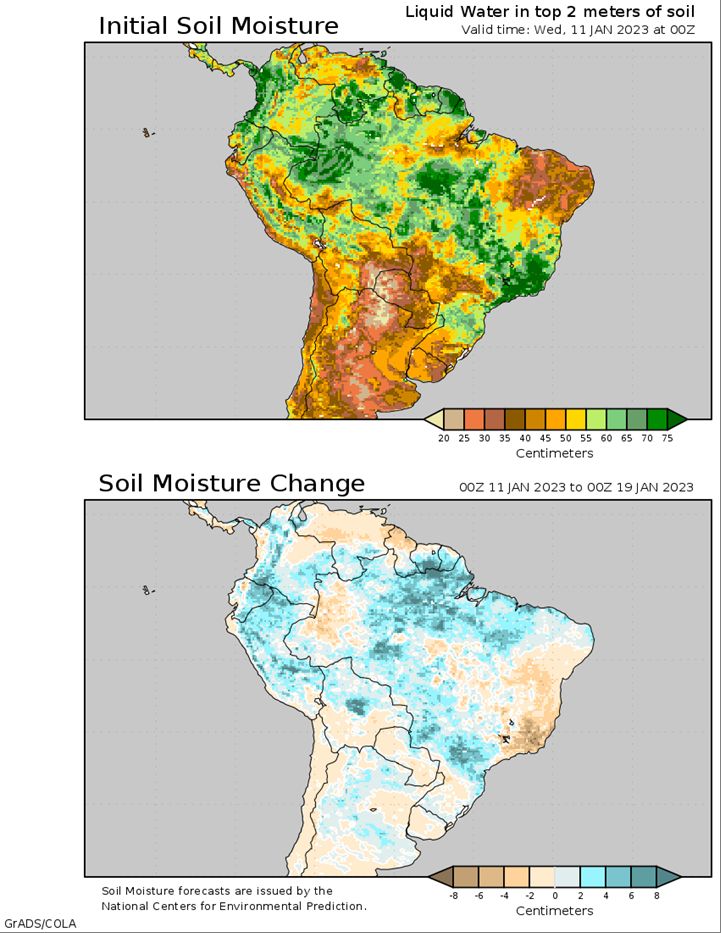

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Isolated showers Wednesday. Scattered showers Thursday-Saturday. Temperatures near normal through Saturday. Mato Grosso, MGDS and southern Goias: Scattered showers through Saturday. Temperatures near normal through Saturday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Isolated showers Wednesday. Mostly dry Thursday-Saturday. Temperatures near to below normal Wednesday-Friday, near to above normal Saturday. La Pampa, Southern Buenos Aires: Isolated showers Wednesday. Mostly dry Thursday-Saturday. Temperatures near to below normal Wednesday-Friday, near to above normal Saturday.

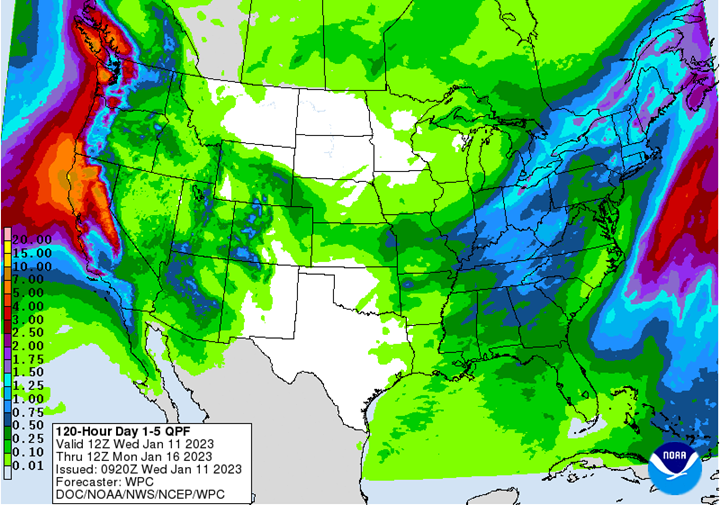

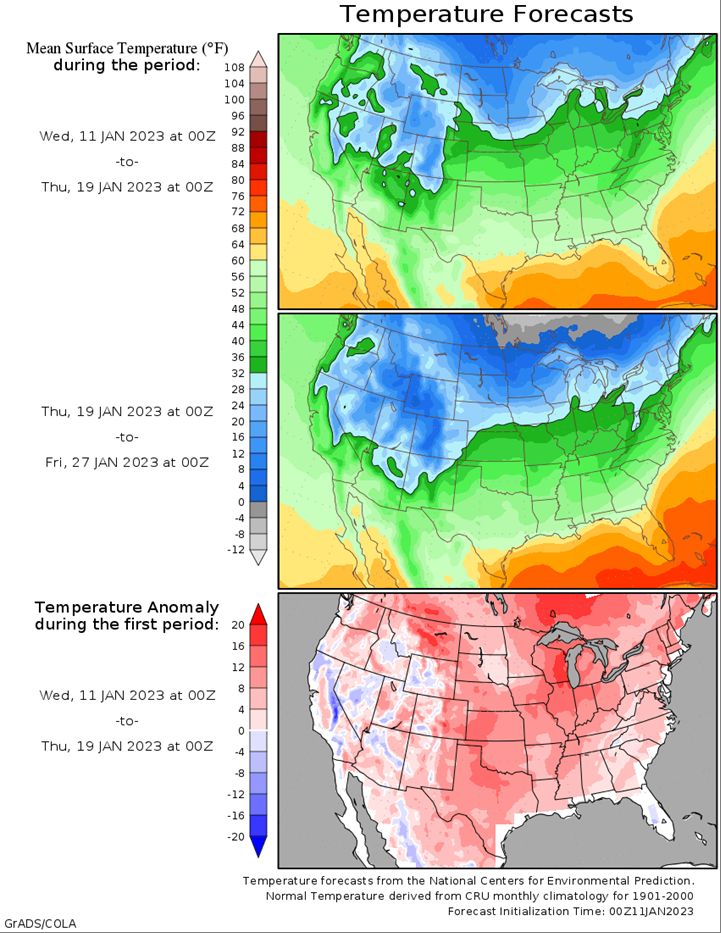

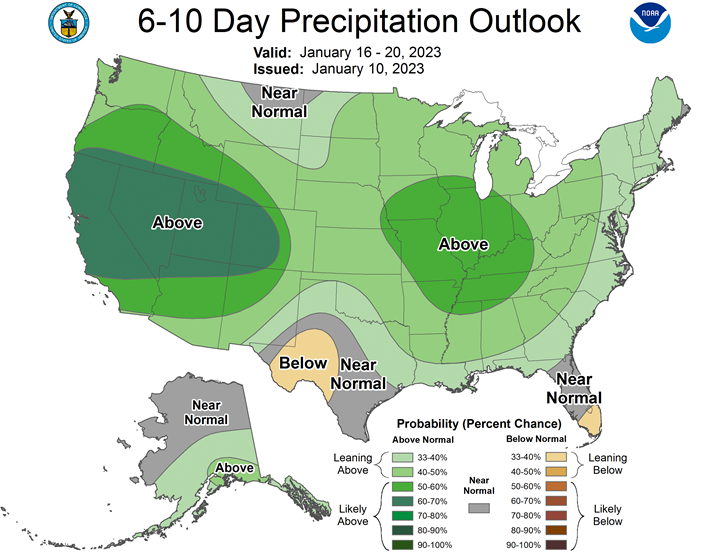

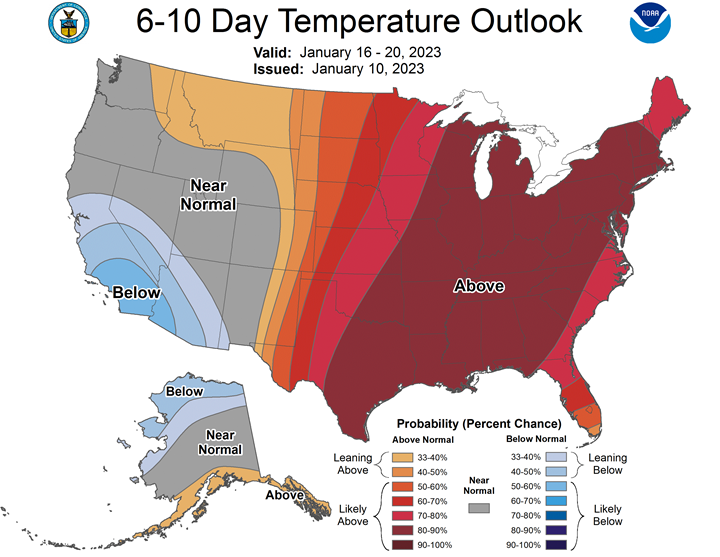

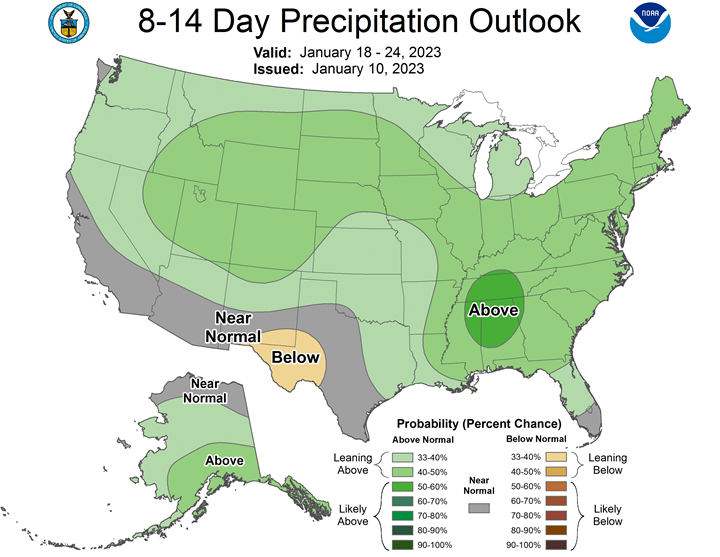

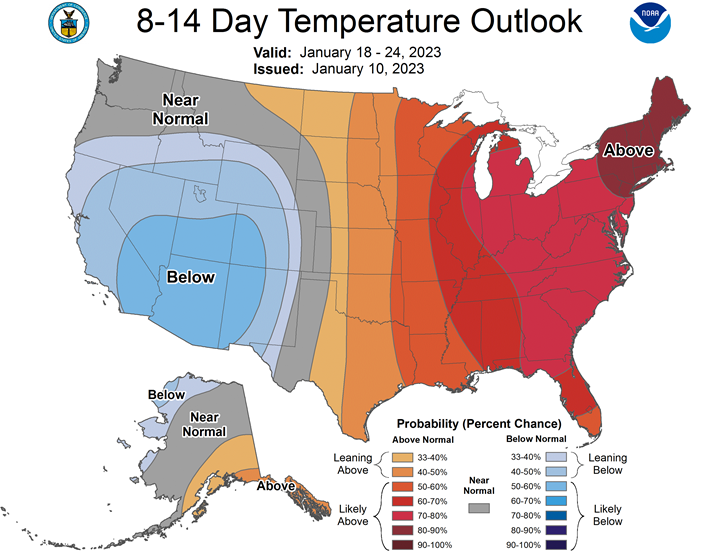

Northern Plains Forecast: Isolated showers Wednesday. Mostly dry Thursday-Saturday. Temperatures above normal Wednesday, near to above normal Thursday-Friday, above normal Saturday. Outlook: Mostly dry Sunday. Isolated showers Monday-Tuesday. Mostly dry Wednesday-Thursday. Temperatures above normal Sunday-Thursday.

Central/Southern Plains Forecast: Isolated showers Wednesday. Mostly dry Thursday-Saturday. Temperatures near to above normal Wednesday-Friday, above normal Saturday. Outlook: Isolated showers Sunday night-Wednesday. Mostly dry Thursday. Temperatures above normal Sunday-Thursday.

Western Midwest Forecast: Isolated showers north Tuesday night-Wednesday. Scattered showers south Wednesday night-Thursday. Mostly dry Friday-Saturday. Temperatures above normal through Thursday, near to below normal Friday, above normal Saturday.

Eastern Midwest Forecast: Isolated showers Wednesday. Scattered showers Thursday-Friday. Mostly dry Saturday. Temperatures above normal through Saturday. Outlook: Mostly dry Sunday. Scattered showers Monday-Thursday. Temperatures above to well above normal Sunday-Thursday.

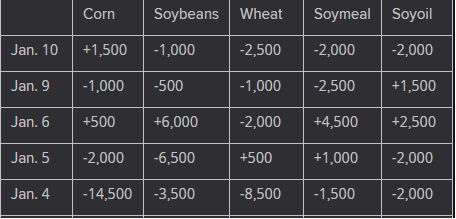

The player sheet for Jan. 10 had funds: net sellers of 2,500 contracts of SRW wheat, buyers of 1,500 corn, sellers of 1,000 soybeans, sellers of 2,000 soymeal, and sellers of 2,000 soyoil.

TENDERS

- SOYBEAN SALES: The U.S. Department of Agriculture confirmed private sales of 174,181 tonnes of U.S. soybeans to Mexico for delivery in the 2022/23 marketing year that began Sept. 1, 2022.

- WHEAT PURCHASE: Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC), is believed to have booked at least 60,000 tonnes of Russian wheat in an international tender, traders said. An additional 60,000 tonnes could be bought depending on the arrangement of bid bonds by the supplier Aston, traders added. More detailed estimates of the quantities purchased and price were expected later this week but traders believe the cargoes were offered at a price of $337 per tonne on a cost and freight basis.

- CORN PURCHASE: South Korea’s Major Feedmill Group (MFG) purchased an estimated 68,000 tonnes of animal feed corn expected to be sourced from South America in an international tender on Tuesday.

- CORN PURCHASE: Taiwan’s MFIG purchasing group bought about 65,000 tonnes of animal feed corn to expected to be sourced from the United States in an international tender on Wednesday

- WHEAT PURCHASE: South Korea’s Feed Leaders Committee (FLC) on Tuesday purchased up to 65,000 tonnes of animal feed wheat expected to be to be sourced from either the United States or Australia in a private deal without issuing an international tender

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 89,735 tonnes of food-quality wheat from the United States and Canada in a regular tender that will close on Jan. 12.

PENDING TENDERS

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 113,460 tonnes of rice to be sourced from the United States. The deadline for submissions of price offers was Dec. 29.

- WHEAT TENDER: Turkey’s state grain board TMO issued an international tender to purchase an estimated 565,000 tonnes of milling wheat

- WHEAT TENDER: The Taiwan Flour Millers’ Association issued an international tender to purchase 45,200 tonnes of grade 1 milling wheat to be sourced from the United States.

- SUNFLOWER OIL TENDER: Turkey’s state grain board TMO issued an international tender to purchase about 24,000 tonnes of crude sunflower oil.

US BASIS/CASH

- Basis bids for soybeans shipped by barge to the U.S. Gulf Coast were steady-to-firm on Tuesday with fresh export sales of U.S. soybeans to Mexico lending support, traders said.

- CIF soybean barges loaded in January were bid variously against the January and March futures contracts as January nears its Jan. 13 expiration. Soy barges loaded in January were last bid at 110 cents over January and also at 128 cents over March, compared with Monday’s last bid of 120 cents over March futures.

- Soy barges loaded in February were bid at 106 cents over March, flat from Monday, while soy barges loaded in the first half of February traded at 115 cents over March.

- Meanwhile, FOB offers for soybeans loaded at the U.S. Gulf in January held steady at around 140 cents over March.

- For corn, CIF barges loaded in January were bid at 92 cents over March, steady from Monday’s figures.

- Export premiums for January corn loadings were around 110 cents over March futures, down a nickel from Monday.

- Declining costs for barge freight kept a lid on CIF basis values for both crops. Empty barges for this week on the Mississippi River at St. Louis were offered Tuesday at 575% of tariff, down from 600% on Monday and down from 650% on Friday.

- Spot basis bids for corn and soybeans were unchanged at most elevators, processors and river terminals around the U.S. Midwest on Tuesday, grain dealers said.

- Farmers were busy delivering crops they had previously agreed to sell to elevators and processors.

- Good weather around much of the region allowed growers to access their storage bins and made it easier to truck corn and soybeans to facilities, an Ohio dealer said.

- Some growers also were booking fresh deals for small amounts of their crops, the dealer added.

- Many of the new deals were coming from farmers who wanted to protect themselves against a potential market downturn when the U.S. Agriculture Department releases closely watched reports on supply and demand on Thursday.

- Although the cash basis was mostly steady, soybean bids rose by 3 cents a bushel at a river terminal in Morris, Illinois.

- Spot basis bids for corn and soybeans firmed at grain elevators in the eastern half of the U.S. Midwest on Tuesday morning, dealers said.

- At processors, corn bids were steady to weak and soybean bids were flat.

- At terminals along the region’s rivers, soybean bids were steady to firm and corn bids were unchanged.

- Cash bids for corn were unchanged at ethanol plants.

- Farmer sales were slow, with most growers not even calling in to check on prices, an Iowa dealer said.

- Dealers have said that farmers have enough cash from sales they booked in 2022 but deferred payment on until January 2023 for tax purposes.

- Spot basis bids for hard red winter wheat were flat at truck and rail market elevators across the southern U.S. Plains on Tuesday, grain dealers said.

- Farmer sales were slow.

- Poor demand for U.S. supplies has pressured wheat futures, cutting into cash prices and chilling growers’ interest in booking deals for the supplies they have been holding in storage bins.

- Spot basis offers for U.S. soymeal fell at rail market processors on Tuesday, dealers said.

- The basis was mixed in the truck market, rising in Iowa but falling in Mankato, Minnesota.

- The Iowa basis was supported by downtime at a plant in Cedar Rapids, Iowa, which limited the amount of soymeal for sale in the area.

- A plant in Lafayette, Indiana, also was shut down. A dealer said the processor would re-open on Thursday.

- Demand was weak, with most end users delaying purchases unless they had immediate feeding needs to fill, a rail broker said.

- Signs of strength were noted on the export market, as high prices in Argentina were making U.S. offerings more attractive to overseas buyers, traders said.

Brazil Soybean Production, Exports Expected to See Record

Brazilian soybean production seen rising to 153m tons in 2022-23, from 148.5 million metric tons estimated in October, based on expanded planted area and improved yields, according to the US Department of Agriculture’s Brasilia post report.

- The record crop would be 20% higher compared to 126.6m tons in 2021/22, after adverse weather hurt yields last year

- Exports are now pegged at 97m tons, up from an estimated 95.7m tons

- If confirmed, exports will be above current record of 86.1m tons in 2020/21

- Crushing should be a record at 51.5m tons, “based available supplies, as well as increase in demand for soybean products”

- The agency’s Brasilia post now estimates a yield of 3.53 metric tons per hectare, up from the October forecast of 3.50 MT/HA

- Soybean planted area forecast at 43.3 million HA, up from 42.8m HA

- The USDA’s January monthly WASDE crop report to be released Thursday. In December, the crop was pegged at 152m tons and a Bloomberg survey shows the average estimate at 152.4m tons

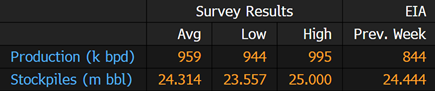

US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Jan. 6 are based on five analyst estimates compiled by Bloomberg.

- Production seen higher than last week at 959k b/d

- Stockpile avg est. 24.314m bbl vs 24.444m a week ago

Brazil’s Anec says corn exports to China already exceeds 1 mln tonnes in January

Anec, a Brazilian trade group representing grain exporters, on Tuesday said the country has booked shipments of more than 1 million tonnes of corn to China in January, putting Brazil on course to export a record overall volume in the current month.

Earlier in the day, Anec revised its Brazilian corn exports estimate for January to 5.024 million tonnes, up from 4.326 million tonnes forecast in the previous week, reflecting a surge in sales to China.

Chinese customs authorities updated a list of approved Brazilian corn exporters at the end of last year, a move that jump-started sales of the commodity to the world’s second-largest economy.

A potential surge of Brazilian corn exports to China may also reshape global trade flows and result in fewer corn sales from farmers in the United States, the world’s top corn supplier.

Brazil Soybean Production, Exports Expected to See Record

Brazilian soybean production seen rising to 153m tons in 2022-23, from 148.5 million metric tons estimated in October, based on expanded planted area and improved yields, according to the US Department of Agriculture’s Brasilia post report.

- The record crop would be 20% higher compared to 126.6m tons in 2021/22, after adverse weather hurt yields last year

- Exports are now pegged at 97m tons, up from an estimated 95.7m tons

- If confirmed, exports will be above current record of 86.1m tons in 2020/21

- Crushing should be a record at 51.5m tons, “based available supplies, as well as increase in demand for soybean products”

- The agency’s Brasilia post now estimates a yield of 3.53 metric tons per hectare, up from the October forecast of 3.50 MT/HA

- Soybean planted area forecast at 43.3 million HA, up from 42.8m HA

- The USDA’s January monthly WASDE crop report to be released Thursday. In December, the crop was pegged at 152m tons and a Bloomberg survey shows the average estimate at 152.4m tons

Brutal drought in Argentina seen ending in coming months, says grains exchange

A drought that has parched Argentina’s fields and slashed production of key cash crops is likely to break in coming months, though it could be March before rain and soil moisture levels fully return to normal, the Buenos Aires Grain Exchange (BdeC) said on Tuesday.

Argentina is one of the world’s top food producers, but dry conditions over much of the past year have taken a toll on its key agricultural regions, delaying its soy and corn crops and halving wheat production this season.

“Precipitation will pick up, improving soil moisture reserves and moderating the intensity of heat waves, but the process will be slow,” the exchange said in its monthly climate report.

“Only towards the end of March will the soils replenish their moisture reserves in most of the agricultural area,” the BdeC added.

Argentine farming has been strained for three years in a row by the La Nina weather phenomenon, which for the 2022/23 season caused a particularly painful drop in rainfall.

As a result, the exchange expects the 2022/23 wheat harvest to reach just 12.4 million tonnes, down from the 22.4 million tonnes harvested the prior year.

While the summer season, which began in late December, is likely to bring relief, the fall season could bring El Nino in late March, the exchange said.

Unlike La Nina, the El Nino phenomenon could cause higher-than-usual rainfall in Argentina’s agricultural provinces.

Brazil Wheat Exports Estimate Rises to 446,105 Tns For January – Anec

- BRAZIL SOY EXPORTS SEEN REACHING 1.969 MILLION TNS IN JANUARY VERSUS 1.314 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.403 MILLION TNS IN JANUARY VERSUS 1.337 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 5.024 MILLION TNS IN JANUARY VERSUS 4.326 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL WHEAT EXPORTS SEEN REACHING 446,105 TNS IN JANUARY VERSUS 280,715 TNS FORECAST IN PREVIOUS WEEK – ANEC

EU Soft-Wheat Exports Rise 5.2% Y/y; Corn Imports Top 15M Tons

EU’s soft-wheat exports in the season that began July 1 reached 17m tons as of Jan. 6, compared with 16.1m tons in a similar period a year earlier, the European Commission said on its website.

- NOTE: The weekly data typically runs through Sundays, but the commission says a “technical issue” limited this edition’s figures to Jan. 6

- Leading destinations include Morocco (2.4m tons), Algeria (2.19m tons), and Egypt (1.59m tons)

- EU barley exports were 2.93m tons, compared with 4.98m tons a year earlier

- Corn imports were 15.1m tons, against 7.89m tons a year earlier

Indonesia to Raise Jan. 16-31 CPO Reference Price, Export Duties

Indonesia to raise reference price to $920.57/ton for Jan. 16-31 period vs $858.96/ton in the first two weeks of this month, says Musdhalifah Machmud, deputy for food and agriculture at the coordinating ministry for economic affairs in a text message.

CPO export tax will be increased to $74/ton during the period, and the additional levy to be raised to $95/ton

China Opens Soybean Futures, Options to Foreign Traders

(Yicai Global) Jan. 11 — China, the world’s largest producer of non-genetically modified soybeans and its largest importer of GMO soybeans, has opened trading of a series of soybean futures and options to overseas traders for the first time.

Eight soybean-related futures and options contracts at the Dalian Commodity Exchange, including No. 1 Soybean, No. 2 soybean, soybean meal and soybean oil, became officially open to foreign traders on Dec. 26.

The step marked the first time that an exchange in China has introduced overseas traders to the full range of commodity products along the industry chain, Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said at a ceremony held on the same day.

The move shows China’s futures market has entered a new period of institutional opening-up in a more mature and confident manner, he added.

Widening access for foreign traders is expected to improve global price discovery, risk management, and resource allocation and help ensure China’s oil and oilseed security, Fang said, adding that overseas producers will be able to use China’s market information to make timely adjustments in output in order to maintain stability.

The market opening-up will help link global soybean production, processing, and trade systems more closely with the domestic market, and transmit market information in a timely manner through futures prices, according to Yan Shaoming, general manager of the Dalian Commodity Exchange.

In turn, that will enhance the engagement and resilience of the Chinese and international soybean supply and industry chains and better ensure global grain and oil security, Yan said.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |