Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 7 1/2 in SRW, up 8 1/4 in HRW, up 6 1/2 in HRS; Corn is up 1 1/2; Soybeans up 12; Soymeal up $0.45; Soyoil up 0.20.

For the week so far wheat prices are up 1/2 in SRW, up 21 in HRW, up 2 1/4 in HRS; Corn is down 2; Soybeans down 5 1/4; Soymeal down $1.06; Soyoil up 1.80.

For the month to date wheat prices are down 4 in SRW, up 15 1/4 in HRW, up 1 1/2 in HRS; Corn is down 4 1/4; Soybeans down 10 3/4; Soymeal up $1.70; Soyoil down 1.31.

Year-To-Date nearby futures are down 4.4% in SRW, up 0.7% in HRW, down 1.6% in HRS; Corn is down 0.4%; Soybeans up 0.5%; Soymeal up 1.5%; Soyoil down 4.2%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAR 23) Soybeans down 29 yuan; Soymeal down 15; Soyoil up 108; Palm oil up 94; Corn down 4 — Malaysian palm oil prices overnight were up 59 ringgit (+1.50%) at 3998.

There were changes in registrations (-30 Soymeal). Registration total: 2,723 SRW Wheat contracts; 0 Oats; 0 Corn; 797 Soybeans; 479 Soyoil; 7 Soymeal; 192 HRW Wheat.

Preliminary changes in futures Open Interest as of February 7 were: SRW Wheat up 4,881 contracts, HRW Wheat up 1,063, Corn up 4,160, Soybeans up 5,885, Soymeal down 6,025, Soyoil down 3,027.

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Mostly dry Wednesday. Isolated showers Thursday-Friday. Mostly dry Saturday. Temperatures near to above normal through Saturday. Mato Grosso, MGDS and southern Goias: Scattered showers through Saturday. Temperatures near normal through Saturday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Isolated showers Wednesday. Mostly dry Thursday-Friday. Isolated showers Saturday. Temperatures above normal through Saturday. La Pampa, Southern Buenos Aires: Isolated showers Wednesday. Mostly dry Thursday-Friday. Isolated showers Saturday. Temperatures above normal through Saturday.

Northern Plains Forecast: Mostly dry Tuesday. Isolated showers Wednesday-Thursday. Mostly dry Friday-Saturday. Temperatures above to well above normal through Thursday, near to above normal Friday-Saturday. Outlook: Mostly dry Sunday-Monday. Isolated to scattered showers Tuesday-Thursday. Temperatures above normal Sunday-Tuesday, near to below normal Wednesday, below normal Thursday.

Central/Southern Plains Forecast: Scattered showers southeast Tuesday-Wednesday. Isolated showers Thursday-Friday. Mostly dry Saturday. Temperatures near to above normal through Thursday, near to below normal Friday-Saturday. Outlook: Mostly dry Sunday. Scattered showers Monday-Thursday. Temperatures near to above normal Sunday-Wednesday, near to below normal Thursday.

Western Midwest Forecast: Scattered showers south Tuesday-Wednesday. Scattered showers Thursday-Friday. Mostly dry Saturday. Temperatures above to well above normal through Thursday, near normal Friday-Saturday.

Eastern Midwest Forecast: Scattered showers through Friday. Mostly dry Saturday. Temperatures above to well above normal through Friday, near normal Saturday. Outlook: Mostly dry Sunday-Monday. Scattered showers Tuesday-Thursday. Temperatures near to above normal Sunday, above to well above normal Monday-Wednesday, near to above normal Thursday.

The player sheet for Feb. 7 had funds: unchanged SRW wheat, sellers of 4,000 corn, sellers of 3,000 soybeans, sellers of 4,500 soymeal, and buyers of 4,500 soyoil.

TENDERS

- WHEAT PURCHASE: Algeria’s state grains agency OAIC started buying milling wheat in an international tender which closed on Tuesday

- CORN PURCHASE: South Korea’s Major Feedmill Group (MFG) purchased an estimated 138,000 tonnes of animal feed corn in an international tender

- FEED WHEAT & BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said on Wednesday that it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by May 31 and arrive in Japan by July 27, via a simultaneous buy and sell (SBS) auction that will be held on Feb. 15.

- WHEAT TENDER PASSED: Jordan’s state grain buyer is believed to have made no purchase in an international tender to buy 120,000 tonnes of milling wheat which closed on Tuesday

PENDING TENDERS

- SOYBEAN TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued international tenders to purchase around 19,000 tonnes of food-quality soybeans free of genetically-modified organisms (GMOs)

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 79,439 tonnes of rice.

- WHEAT TENDER: The Taiwan Flour Millers’ Association issued an international tender to purchase 48,100 tonnes of grade 1 milling wheat to be sourced from the United States.

- RICE TENDER: Egypt’s state grains buyer, GASC, is seeking at least 25,000 tonnes, plus or minus 10% at the buyer’s preference, of white rice in a tender-practice on the account of the Holding Company for Food Industries. Offers should be submitted on Feb. 14. Payment will be submitted on a cost, insurance, and freight (CIF) basis in U.S. dollars, and will be at sight and via 180-day letters of credit. GASC will choose between either.

US BASIS/CASH

- Basis bids for soybeans and corn shipped by barge to the U.S. Gulf Coast declined on Tuesday, as barge freight costs fell, traders said.

- Bids for empty barges on the Illinois River for this week tumbled to 550% of tariff on Tuesday, from 625% a day earlier, barge sources said. Offers for spot barges fell about 25 percentage points on the Ohio River.

- CIF corn barges loaded in February were bid at 81 cents over March corn futures, down 5 cents from Monday’s last bid. Corn barges loaded in March traded at both 86 cents and 85 cents over futures and were re-bid at 84 cents over futures.

- FOB basis offers for February corn shipments were steady at around 90 cents over March futures, and offers for March shipments held at 99 cents over futures.

- For soybeans, CIF barges loaded in February traded at 94 cents over March soybeans, down 6 cents from Monday’s trades, and were re-bid at 92 cents over futures, down 6 cents from Monday’s last bid.

- FOB offers for February soybean shipments were around 118 cents over futures and March shipments were offered around 110 cents over futures, both down 2 cents from Monday.

- Spot basis bids for soybeans delivered to processors and barge-loading river elevators around the U.S. Midwest were steady to lower on Tuesday, while bids at interior elevators were unchanged.

- Seasonally slowing soybean export demand weighed and rising supplies at soy crush plants weighed on basis values.

- More dealers rolled their soybean basis bids to the Chicago Board of Trade May soybean futures contract SK3 from the March contract SH3.

- Spot corn basis bids were mixed. An elevator in Chicago raised its bid by 5 cents a bushel while bids for rail-delivered corn fell by 20 cents in Texas.

- Farmer sales of both commodities were minimal on Tuesday as futures retreated and market participants awaited Wednesday’s release of monthly U.S. Department of Agriculture supply and demand projections.

- Spot basis bids for U.S. soybeans were steady to lower at processors and river elevators on Tuesday and mostly unchanged at interior elevators, grain dealers said.

- Seasonally slowing export demand weighed on soy basis values at barge-loading river terminals. Bids at soy processors have also eased following an increase in farmer marketings over recent days that boosted crushing supplies.

- Spot corn basis bids were steady to firmer at river locations and mostly unchanged to weaker at interior elevators and processors.

- Farmer sales of corn and soybeans were slow on Tuesday as futures prices retreated ahead of a monthly U.S. Department of Agriculture (USDA) supply and demand report scheduled for release on Wednesday.

- Spot basis bids for hard red winter wheat were unchanged at rail and truck market elevators across the southern U.S. Plains on Tuesday in muted trading ahead of a monthly government crop report due at midweek, grain dealers said.

- Farmer sales of wheat were light on Tuesday despite firmer futures prices, grain merchants said.

- In a weekly report late on Monday, the USDA rated 13% of the Texas wheat crop in good to excellent condition, down 1 point from the prior week.

- Spot basis offers for soymeal were steady to lower around the U.S. Midwest on Tuesday as an accelerated processing pace bolstered supplies, dealers said.

- Soymeal basis values at Gulf Coast export terminals were mixed.

- Demand remained moderate as elevated prices kept some end-users from booking larger forward purchases. Soymeal futures scaled to a nine-year peak last week.

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Feb. 3 are based on five analyst estimates compiled by Bloomberg.

- Production seen lower than last week at 1.017m b/d

- Would be the first decline after four weeks of increases

- Stockpile avg est. 25.014m bbl vs 24.442m a week ago

Canada Wheat Stocks on Dec. 31 Up 32.6% From Year Ago

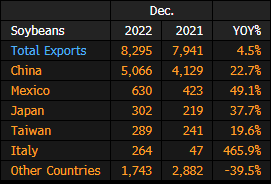

US Exports of Corn, Soybean, Wheat, Cotton in December

UkrAgroConsult Sees Drop in Ukraine Grain Exports From February

Ukraine’s monthly total grain exports are likely to decline on a m/m basis from February-March, before recovering later in the year, according to UkrAgroConsult analysts.

- A “decline in deliveries by the grain corridor and switching to Danube ports is highly likely” as traders assess the risks of renewing the safe-corridor grain deal, they wrote in a weekly report; this also happened in November last year

- NOTE: Ukraine grain deal is up for renewal on March 18

- Ukragroconsult expects grain deal to be prolonged in March

- Local sales of wheat and barley may rise in February-March as farmers seek to earn money for spring fieldwork

- UkrAgroConsult sees grain exports recovering after harvesting in June-July

EU Soft-Wheat Exports Rise 6.7% Y/y, Corn Imports Increase 69%

The European Union’s soft-wheat exports for the season that began July 1 reached 19m tons by Feb. 5, compared with 17.8m tons a year earlier, the European Commission said on its website.

- Leading destinations include Morocco with 2.76m tons, Algeria with 2.59m tons and Egypt at 1.63m tons

- EU barley exports were 3.16m tons, compared with 5.28m tons a year earlier

- Corn imports were 16.7m tons versus 9.87m tons the year before

- NOTE: The commission says some export figures for Germany may be inaccurate due to its recent shift to a new declaration system

- NOTE: Soybean imports were 6.45m tons, compared with 7.98m tons the year before. Click here for figures on oilseed trade.

Russia Divides Grain-Export Quota Among 203 Traders: Union

Russia’s Agriculture Ministry allocated the country’s grain export quota to 203 traders, according to the Union of Grain Exporters.

- Quota size is 25.5m tons and is based on historical trading volumes; it will apply from Feb. 15 through June

- Biggest shares went to Rif (4.91m tons), Grain Gates (3.24m tons), Aston (2.77m tons), Viterra Rus (2.11m tons), OZK (1.11m tons)

- NOTE: Russia originally introduced the quota and grain-export taxes as part of efforts to cool food inflation, though this year’s quota volume is so high that it effectively removes limits on grain exports, according to SovEcon

MGEX Spring Wheat Stocks Down 23.8% From Year Ago: Feb. 5

Stocks of hard spring wheat stored in Minnesota and Wisconsin warehouses fell to 16.002m bushels in the week ending Feb. 5, according to the Minneapolis Grain Exchange’s weekly report.

- Stockpiles rose by 13k bu from the previous week

- Stockpiles in Duluth/Superior warehouses up 89k bu

Biden Is Urged by Iowa Ethanol Group to Get E15 Shift On Track

Corn-based biofuel advocates in Iowa are urging President Joe Biden to “rein in” White House regulatory officials and clear the path for permanent year-round sales of higher-ethanol gasoline.

- The Iowa Renewable Fuels Association claims the Biden administration is late in acting on a push by Midwestern farm states designed to enable year-round sales of E15 gasoline containing 15% ethanol

- Iowa RFA executive director Monte Shaw said the White House “put the brakes on” and delayed moves by EPA to implement the change

- “We must raise our voices to demand the Midwest E15 fix be put in place for this summer,” Shaw said at his group’s biofuels conference in Des Moines, Iowa

- Representatives of the EPA did not immediately comment

- NOTE: EPA Administrator Michael Regan said in September the Biden administration would move swiftly to permanently allow year-round sales of E15

- NOTE: Shaw’s comments follow a letter by seven Midwest attorneys general who faulted the EPA delay in acting

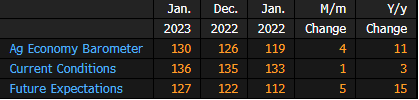

US Agriculture Sentiment Rises in January: Purdue Univ.

The Purdue University/CME Group’s agricultural sentiment index increased to 130 points in Jan. from 126 in Dec., according to a survey of 400 agricultural producers.

- Current conditions component improved by 1 point from Dec.

- Future expectations up by 5 points

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |