Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 1/2 in SRW, down 4 1/2 in HRW, down 1 1/4 in HRS; Corn is unchanged; Soybeans up 14; Soymeal up $0.53; Soyoil up 0.29.

For the week so far wheat prices are up 8 1/2 in SRW, up 18 1/2 in HRW, up 3 1/2 in HRS; Corn is up 1; Soybeans up 1 3/4; Soymeal down $0.58; Soyoil up 1.62.

For the month to date wheat prices are up 4 in SRW, up 12 3/4 in HRW, up 2 3/4 in HRS; Corn is down 1 1/4; Soybeans down 4 1/4; Soymeal up $6.40; Soyoil down 1.49.

Year-To-Date nearby futures are down 3.4% in SRW, up 0.4% in HRW, down 1.5% in HRS; Corn is unchanged 0.0%; Soybeans up 1.0%; Soymeal up 2.0%; Soyoil down 4.6%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAR 23) Soybeans up 12 yuan; Soymeal down 13; Soyoil down 8; Palm oil up 6; Corn down 15 — Malaysian palm oil prices overnight were down 24 ringgit (-0.60%) at 3973.

There were changes in registrations (-7 Soymeal). Registration total: 2,723 SRW Wheat contracts; 0 Oats; 0 Corn; 797 Soybeans; 479 Soyoil; 0 Soymeal; 192 HRW Wheat.

Preliminary changes in futures Open Interest as of February 8 were: SRW Wheat up 4,984 contracts, HRW Wheat up 1,670, Corn up 3,887, Soybeans up 2,443, Soymeal up 658, Soyoil down 176.

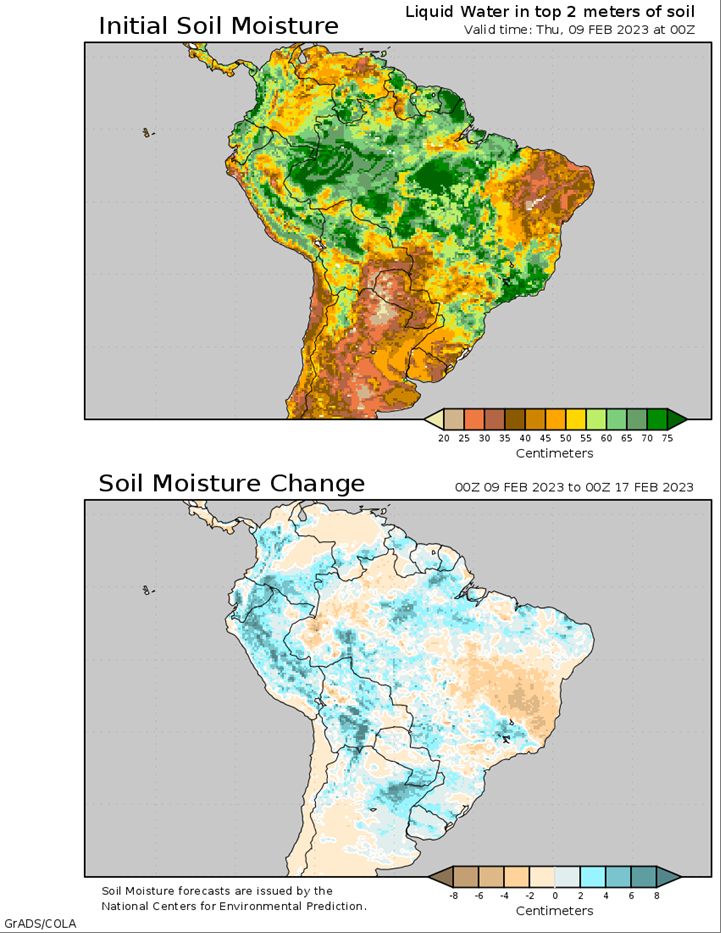

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Isolated showers Thursday-Friday. Mostly dry Saturday-Sunday. Temperatures near to above normal through Sunday. Mato Grosso, MGDS and southern Goias: Scattered showers through Sunday. Temperatures near normal through Sunday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Mostly dry Thursday-Friday. Isolated showers Saturday-Sunday. Temperatures above normal through Sunday. La Pampa, Southern Buenos Aires: Mostly dry Thursday-Friday. Isolated showers Saturday-Sunday. Temperatures above normal through Sunday.

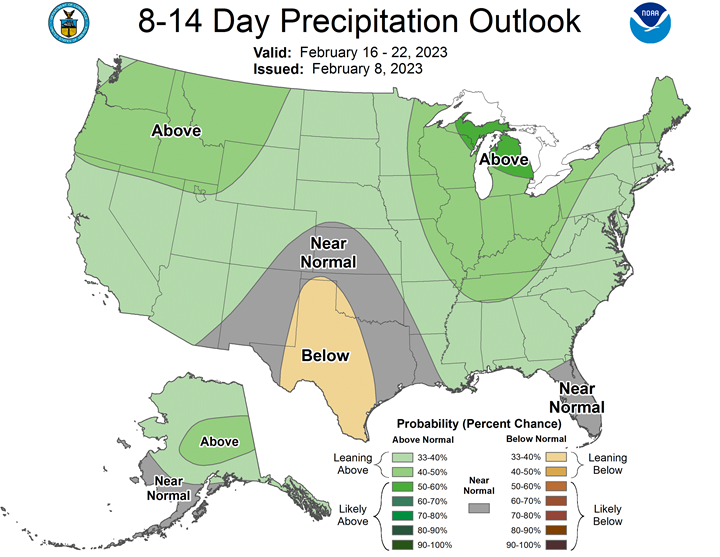

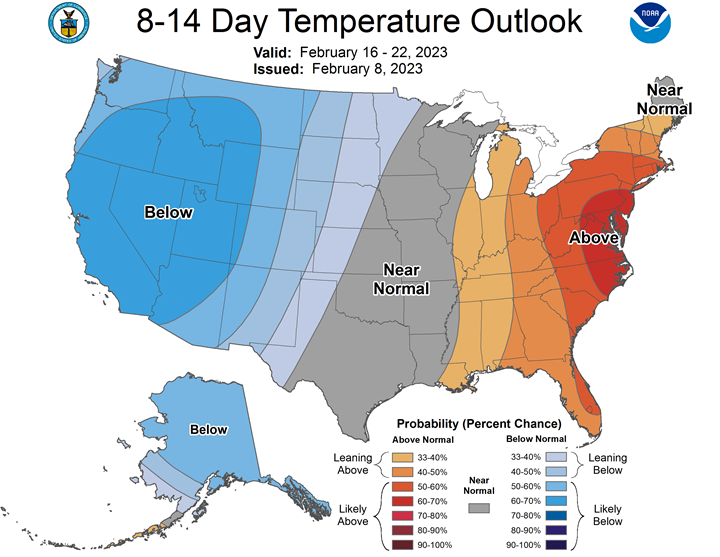

Northern Plains Forecast: Isolated showers Wednesday-Thursday. Mostly dry Friday-Sunday. Temperatures above to well above normal through Sunday. Outlook: Mostly dry Monday. Isolated to scattered showers Tuesday-Thursday. Mostly dry Friday. Temperatures above normal Monday-Tuesday, near to below normal Wednesday, below normal Thursday-Friday.

Central/Southern Plains Forecast: Scattered showers southeast. Temperatures near to above normal. Central/Southern Plains wheat and livestock forecast… Scattered showers southeast Wednesday. Isolated showers Thursday-Friday. Mostly dry Saturday-Sunday. Temperatures near to above normal through Thursday, near to below normal Friday-Saturday, near to above normal Sunday. Outlook: Scattered showers Monday-Thursday. Mostly dry Friday. Temperatures near to above normal Monday-Wednesday, near to below normal Thursday, below normal Friday.

Western Midwest Forecast: Scattered showers south Wednesday. Scattered showers Thursday-Friday. Mostly dry Saturday-Sunday. Temperatures above to well above normal through Thursday, near normal Friday, near to above normal Saturday, above normal Sunday.

Eastern Midwest Forecast: Scattered showers through Friday. Mostly dry Saturday-Sunday. Temperatures above to well above normal through Friday, near normal Saturday, near to above normal Sunday. Outlook: Mostly dry Monday. Scattered showers Tuesday-Friday. Temperatures above to well above normal Monday-Wednesday, near to above normal Thursday, near to below normal Friday.

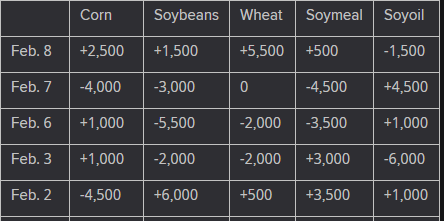

The player sheet for Feb. 8 had funds: net buyers of 5,500 contracts of SRW wheat, buyers of 2,500 corn, buyers of 1,500 soybeans, buyers of 500 soymeal, and sellers of 1,500 soyoil.

TENDERS

- WHEAT PURCHASE UPDATE: Algeria’s state grains agency OAIC is believed to have resumed buying milling wheat on Wednesday in an international tender which originally closed on Tuesday.

- FEED WHEAT AND BARLEY PURCHASE: An importer group Thailand purchased about 60,000 tonnes of animal feed wheat and an undisclosed volume of feed barley, both expected to be sourced from Australia, in a tender on Wednesday.

- WHEAT PURCHASE: The Taiwan Flour Millers’ Association purchased an estimated 48,100 tonnes of milling wheat to be sourced from the United States in a tender on Thursday

- FEED WHEAT AND BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by May 31 and arrive in Japan by July 27, via a simultaneous buy and sell (SBS) auction that will be held on Feb. 15.

PENDING TENDERS

- SOYBEAN TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued international tenders to purchase around 19,000 tonnes of food-quality soybeans free of genetically-modified organisms (GMOs)

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 79,439 tonnes of rice

- CORN TENDER: South Korea’s Major Feedmill Group (MFG) has issued an international tender to purchase up to 70,000 tonnes of animal feed corn to be sourced from South America only.

- RICE TENDER: Egypt’s state grains buyer, GASC, is seeking at least 25,000 tonnes, plus or minus 10% at the buyer’s preference, of white rice in a tender-practice on the account of the Holding Company for Food Industries. Offers should be submitted on Feb. 14. Payment will be submitted on a cost, insurance, and freight (CIF) basis in U.S. dollars, and will be at sight and via 180-day letters of credit. GASC will choose between either.

US BASIS/CASH

- Basis bids for corn shipped by barge to the U.S. Gulf Coast softened on Wednesday on sluggish demand from exporters and falling costs for barge freight, traders said.

- Soybean barges bids firmed by a few cents but FOB export premiums declined.

- Spot barges on the Illinois River were bid at 525% of tariff on Wednesday, down from 550% on Tuesday and lower from 625% to start the week, as slowing grain movement curbed demand for freight, barge sources said.

- CIF corn barges loaded in February were bid at 77 cents over March corn, down 4 cents from Tuesday’s last bid. Corn barges loaded in March traded at 85 cents over futures and were re-bid at 84 cents over futures, steady with Tuesday.

- FOB basis offers for February corn shipments were around 88 cents over March futures, down 2 cents from Tuesday, and offers for March shipments were around 94 cents over futures, down 5 cents.

- For soybeans, CIF barges loaded in February were bid at 94 cents over March soybeans, up 2 cents from Tuesday’s late bid. April soy barges traded at 96 cents over May.

- FOB offers for February soybean shipments were around 115 cents over March futures, down 3 cents from Tuesday, and March shipments were offered around 108 cents over futures, down 2 cents.

- Spot basis bids for corn were steady to lower on Wednesday at rail market terminals, while soybean bids were generally flat in the Midwest, grain dealers said.

- Cash corn bids fell by 6 cents a bushel at a rail terminal in Evansville, Indiana, and by 1 cent at a rail location in Columbus, Ohio.

- Spot basis bids for U.S. corn were steady to weaker at grain elevators, river terminals and ethanol plants on Wednesday, grain dealers said.

- Soy basis bids were flat to lower at elevators and processors.

- Farmer sales of corn and soybeans remained sluggish, dealers said.

- Spot basis bids for hard red winter wheat were flat to lower at rail and truck market elevators in the southern U.S. Plains on Wednesday, grain dealers said.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City were unchanged, according to CME Group data.

- Spot basis offers for soymeal were mostly steady in the U.S. Midwest on Wednesday as lofty prices limited large advance purchases, dealers said.

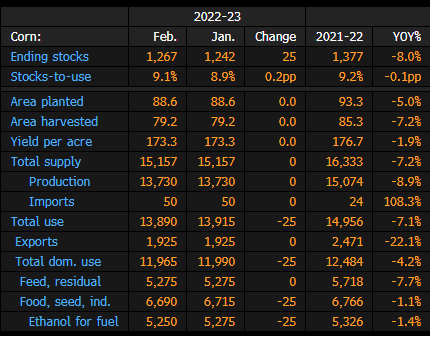

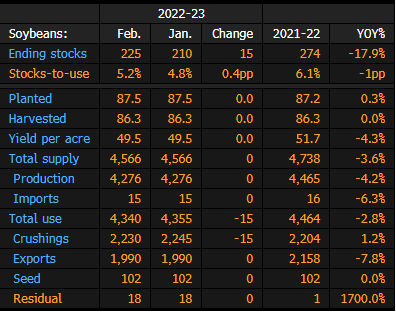

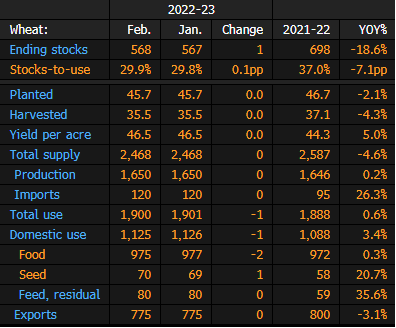

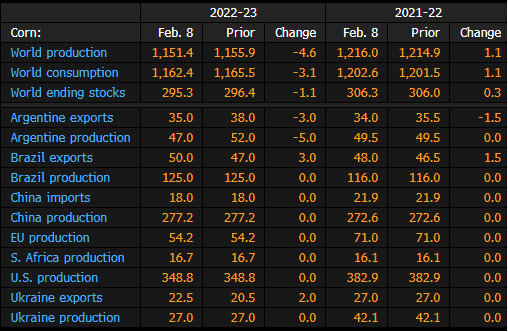

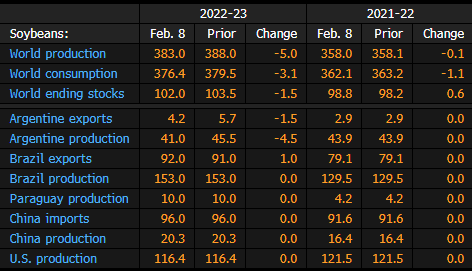

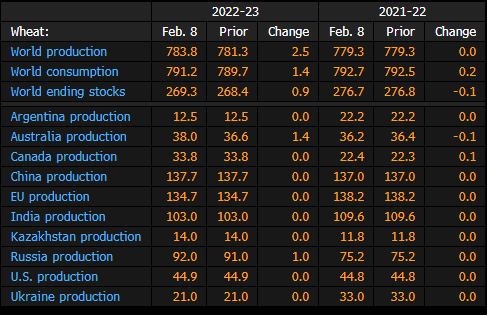

WASDE Headline Results Table

US Crop Estimates From USDA February Report

World Crop Estimates From USDA February Report

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

Estimate ranges are based on a Bloomberg survey of five analysts; the USDA is scheduled to release its export sales report on Thursday for week ending Feb. 2.

- Corn est. range 700k – 1,400k tons, with avg of 994k

- Soybean est. range 600k – 1,200k tons, with avg of 913k

Argentina exchange cuts soy, corn harvest forecasts

Argentina’s Rosario Grains exchange cut its forecast for the country’s 2022/23 soybean harvest to 34.5 million tonnes from a previous forecast of 37 million tonnes, it said on Wednesday, amid a historic drought.

The corn harvest for the 2022/23 season is now estimated at 42.5 million tonnes, it added, down from the 45 million tonnes previously estimated.

China becomes biggest Brazil corn buyer in January, revised trade data show

China became the main destination of Brazilian corn exports in January by volume, surpassing traditional importers like Japan, Iran and Spain, according to revised trade data released by the government on Wednesday.

Brazil sold 983,684 tonnes to China in the period, the second full month of corn trading action following Beijing’s authorizations for Brazilian sales of the cereal in late November.

The South American country already ships most of its soybeans to China, a massive importer which also buys meat and other food staples from Brazil.

Wooing a big customer like China will help Brazil grab an even larger share of the global corn trade.

Until recently, China used to import approximately 70% of U.S. corn and 29% of Ukrainian corn, Brazilian grain exporters group Anec said on Wednesday.

But after Russia’s invasion of Ukraine, China sought new suppliers.

Last year, China was already the destination of 1.16 million tonnes of corn from Brazil, with almost the totality shipped in December.

In 2023, despite the increase in domestic corn production, China will import a estimated 20 million tonnes, Anec said.

On Wednesday, government agency Conab rose Brazil’s export forecast to 47 million tonnes in the 2022/2023 season, up from 45 million tonnes.

By value, Brazilian corn exports to China totaled $271.4 million in January, representing about 15% of the $1.773 billion total exported for the month, according to revised trade data.

Japan, Brazil’s second biggest corn buyer by volume and first biggest by value last month, paid $275.2 million for 975,858 tonnes, the new trade data showed.

On Wednesday, the government also revised overall Brazilian corn exports for January, lowering the estimate to 6.16 million tonnes from a preliminary 6.34 million tonnes.

Brazil Feb. Soy Exports May Soar to Record at 9.7m Tons: Anec

Soybean shipments are seen between 7.6m and 9.7m metric tons in February, up from 944,385 in January, exporter group Anec says in report.

- Exports could exceed previous February record of 9.1m tons a year earlier

- Shipments in the past month were limited by low supplies due to harvest delays

- From Jan. 29 to Feb. 4., soy exports reached 785,000 tons

- In the week of Feb. 5-11, shipments are seen at 2.12m tons, Anec estimates based on line-up figures

EU Wheat Crop Outlook Raised, Conditions Good: Strategie Grains

EU soft-wheat production in the 2023-24 season is now seen at 129.7m tons, up from a January estimate for 129.3m tons, analysis firm Strategie Grains said in a report.

- Soft-wheat growing conditions have been “rather good so far, despite arduous planting conditions in southeast Europe because of overly dry weather”

- Still, dry conditions in Spain and France raise fears of a water deficit in early Spring

- European wheat and barley exports still facing “intense competition” from Russian grains

- “Marketing year 2023/24 will begin with a high level of grain stocks, especially wheat,”

Farming in Australia Set for Another Strong Year After Rains

- Country is world’s second-largest wheat and canola exporter

- Wheat supplies from Australia essential to cap world prices

Australia’s farm production, ranging from wheat to canola and beef, is poised for another strong year after rains soaked fields, although it’s unlikely to see a repeat of the exceptional outcome in 2022, Rabobank said.

Rain last year, excessive in east coast regions, replenished irrigation supplies and boosted soil moisture, providing a strong base for output, the bank said in a report. The farming industry will probably see good, but not record, prices this year amid elevated costs and a global recession, it said.

Australia is the world’s second-biggest exporting country for wheat, canola and beef. Its importance as a supplier increased even more after Russia’s war in Ukraine and weather disruptions reduced global supplies. A bumper wheat crop helped pull down global prices last year from a record in March.

The return to more normal production levels was highlighted in a separate report by Fitch Solutions Thursday. It expects the wheat crop to decline 18% in 2023-24 from a record 40 million tons a year earlier as La Nina rains end and more neutral conditions take over. Planting takes place from April to June.

Rabobank expects global wheat and corn prices to ease through the middle of the year, as a bumper corn crop is harvested in Brazil and a potential recession cuts demand. In the second half, wheat prices are expected to rise because of reduced Black Sea supplies, while corn continues to ease.

Ukraine is expected to see a 10-20% reduction in winter wheat planting this year, while dryness in Russia makes another record crop unlikely, the bank said. In addition, Australia’s crop will be lower year on year, it said.

Global supplies of canola have improved significantly, with ending stockpiles in Canada, Europe and Australia likely to be more than 70% higher than a year earlier by the middle of 2023, easing a global oilseed crunch, the bank said.

Ukraine Weighs Boosting Ship Tonnage for Grain-Corridor Vessels

Ukraine’s Coordination Council for Logistics in Agriculture proposed increasing the minimal tonnage of ships carrying grain from the country’s ports to 25,000 tons in order to speed exports, according to the agriculture ministry.

- The council will meet again on Thursday to decide on the proposal

- NOTE: Ukrainian traders and authorities have said Russia is slowing the pace of grain exports through a UN-backed sea corridor via Turkey’s Bosphorus Strait

- Currently there are 117 ships in the queue in Bosphorus

- Average number of ship inspections per day declined to 2.5 this year from 3.5 in December, according to Ukraine’s agriculture ministry

India may extend wheat export ban to preserve local supplies – govt sources

- Domestic wheat prices hit record high in January

- India to replenish stocks at govt warehouses – govt sources

- Wheat stocks at state warehouses drop to lowest in six years

India is considering extending a ban on wheat exports as the world’s second-biggest producer seeks to replenish state reserves and bring down domestic prices, government sources said.

The current ban was scheduled to be reviewed in April and top government officials from food, farm and trade ministries are likely to make a decision on an extension by the end of March, or early April, government and industry sources said, adding they don’t expect wheat exports to resume until mid-2024.

A jump in exports following Russia’s invasion of Ukraine has pushed up local wheat prices, prompting India to ban exports in May, but that failed to stop domestic prices rising, as a sudden spike in temperatures hit last year’s output.

Although the new season looks promising, slightly warmer than normal patterns in March, when farmers start harvesting, could still shrivel the crop.

“The idea is to ensure that the government’s own wheat procurement goes up this year,” said a government source who didn’t wish to be named, in line with official rules. “We do not want a repeat of last year.”

Higher food prices makes the government vulnerable to criticism from opposition parties ahead of state elections, which are due later this year.

Last year, state purchases of wheat fell by 53% to 18.8 million tonnes, as open market prices rose above the rate at which the government buys the staple from domestic farmers.

The government buys rice and wheat from farmers at state-set prices to run the world’s biggest food welfare programme.

“The priority is to build stocks and bring down prices,” said a second government source. “The focus is to buy as much as possible from farmers from the current season’s crop and build the wheat stockpile.”

Wheat stocks at government warehouses dropped 47.9% to 17.2 million tonnes on Jan. 1, the lowest for the month in six years.

In 2023, India is expected to harvest a record 112 million tonnes of wheat.

India’s local wheat demand is estimated at around 105 million tonnes, and traders estimate last year’s production dropped to about 95 million tonnes, resulting in record prices.

Domestic wheat prices hit an all-time high of 32,500 rupees ($393.53) a tonne in January, higher than 21,250 rupees a tonne – the price at which the government will buy the grain from local farmers this year.

Brazil’s Excess Fertilizer Contributes to Tight Global Liquidity

Fertilizer prices in Brazil remain under pressure amid record-high inventories. The absence of an Indian urea tender, expected in December, and delays in purchases from North American buyers have concerned sellers, who are turning to Brazil to offload stock and increase liquidity.

Urea Prices Continue Their Steep Decline

Brazilian urea prices appear to remain under pressure, in line with global trends, falling $40 a metric ton (mt) this week to $350-$360/mt. Market participants have also observed trades at lower prices among parties circumventing sanctions. Ammonium sulfate is declining $5 vs. the prior week to $225-$235/mt, albeit with limited volume. Muriate of potash (MOP) prices in Brazil appear to be declining to $500-$510/mt, a narrower range than last week, as sellers signal higher prices in March and April and buyers explore off-loading excess inventory.

Soybean-Fertilizers’ Affordability Returning to Average Levels

Potash and phosphate-based fertilizer affordability is returning to 2020-21 averages in Brazil, exhibited by early purchases from farmers. Rising commodity valuations and weakening crop-nutrient prices have allowed buyers in the central regions to purchase more than 50% of the fertilizer they plan to use during the 2023-24 soybean season. Barter ratios — how many bags of grain can buy 1 ton of fertilizer — are now at their lowest in 19-20 months, at approximately 15 bags of soy for one ton of potash. Phosphate’s affordability has also returned to levels from the last two years.

Exchange-rate variances factor into farmers’ decision-making as well. Since the beginning of 2023, 1 Brazilian Reais has been worth on average $5.18 USD, against a $5.25 USD average in 2H, another favorable backdrop for fertilizer purchases.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |