The CME and Total Farm Marketing offices will be closed Monday, February 20, 2023, in observance of Presidents Day

Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 3 1/4 in SRW, up 2 1/2 in HRW, up 2 3/4 in HRS; Corn is down 1 1/2; Soybeans down 3 1/4; Soymeal down $0.13; Soyoil up 0.02.

For the week so far wheat prices are down 18 3/4 in SRW, down 11 1/4 in HRW, down 3 in HRS; Corn is down 5 3/4; Soybeans down 17 1/4; Soymeal down $0.66; Soyoil up 0.80.

For the month to date wheat prices are up 6 1/2 in SRW, up 13 3/4 in HRW, up 5 1/4 in HRS; Corn is down 5; Soybeans down 14; Soymeal up $5.10; Soyoil down 1.03.

Year-To-Date nearby futures are down 3.3% in SRW, up 1.0% in HRW, down 1.2% in HRS; Corn is down 0.6%; Soybeans up 0.2%; Soymeal up 2.4%; Soyoil down 4.0%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAY 23) Soybeans up 17 yuan; Soymeal down 33; Soyoil up 8; Palm oil up 10; Corn up 1 –Malaysian palm oil prices overnight were up 128 ringgit (+3.25%) at 4064.

There were changes in registrations (-275 Soybeans). Registration total: 2,587 SRW Wheat contracts; 0 Oats; 0 Corn; 302 Soybeans; 467 Soyoil; 0 Soymeal; 192 HRW Wheat.

Preliminary changes in futures Open Interest as of February 15 were: SRW Wheat down 907 contracts, HRW Wheat up 1,199, Corn down 6,357, Soybeans down 7,608, Soymeal up 3,042, Soyoil up 1,406.

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Scattered showers north Thursday-Sunday. Temperatures near to above normal Thursday, near to below normal Friday-Sunday. Mato Grosso, MGDS and southern Goias: Scattered showers through Sunday. Temperatures near normal through Sunday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Isolated showers east Thursday-Friday. Mostly dry Saturday-Sunday. Temperatures below to well below normal Thursday-Sunday. La Pampa, Southern Buenos Aires: Isolated showers east Thursday-Friday. Mostly dry Saturday-Sunday. Temperatures below to well below normal Thursday-Sunday.

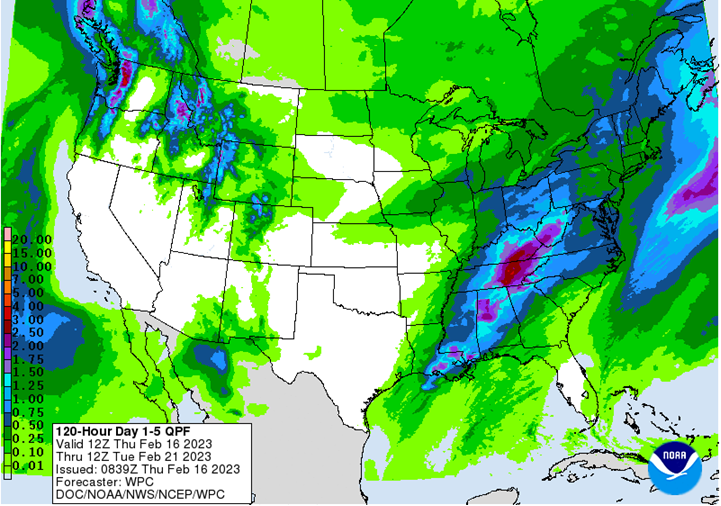

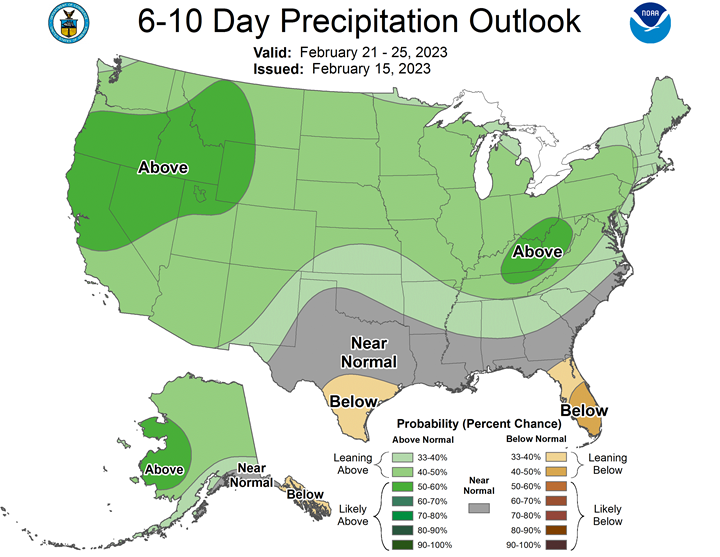

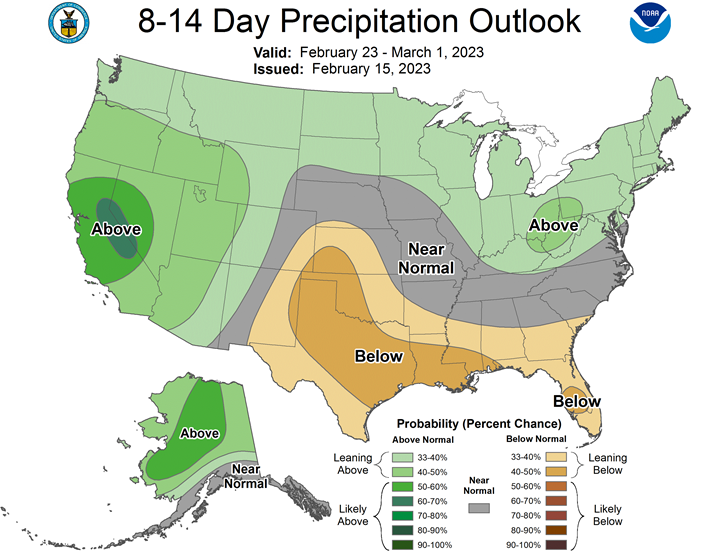

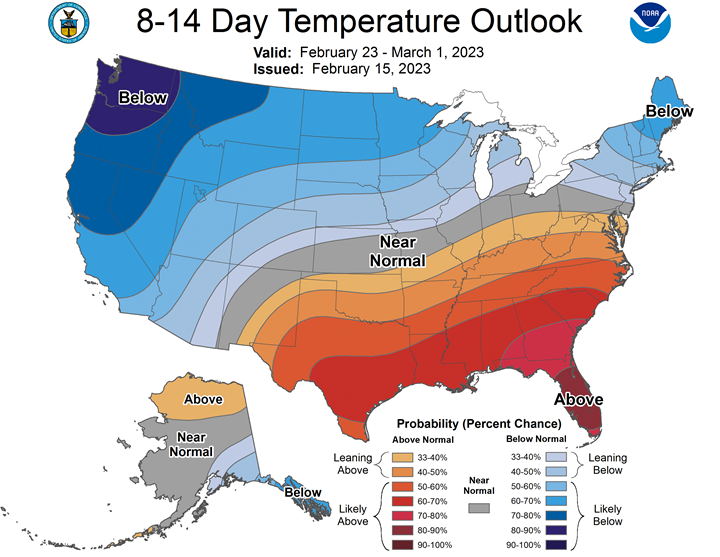

Northern Plains Forecast: Mostly dry through Friday. Isolated showers Saturday-Sunday. Temperatures below normal Thursday, near to above normal Friday-Sunday. Outlook: Isolated to scattered showers Monday-Friday. Temperatures near to below normal Monday, below to well below normal Tuesday-Friday.

Central/Southern Plains Forecast: Scattered showers Thursday. Mostly dry Friday-Sunday. Temperatures below normal Thursday-Friday, near to below normal Saturday, near to above normal Sunday. Outlook: Mostly dry Monday. Isolated to scattered showers Tuesday-Friday. Temperatures near to above normal Monday, below normal north and above normal south Tuesday, near to well below normal Wednesday-Friday.

Western Midwest Forecast: Scattered showers Thursday. Mostly dry Friday-Saturday. Isolated showers north Sunday. Temperatures near to below normal Thursday-Friday, above normal Saturday-Sunday.

Eastern Midwest Forecast: Scattered showers Thursday. Isolated lake-effect snow Friday. Mostly dry Saturday-Sunday. Temperatures above to well above normal Thursday, near to below normal Friday, above normal Saturday-Sunday. Outlook: Isolated to scattered showers Monday-Friday. Temperatures above normal Monday, below normal northwest and above normal southeast Tuesday-Thursday, below to well below normal Friday.

The player sheet for Feb. 15 had funds: net sellers of 8,000 contracts of SRW wheat, sellers of 5,000 corn, sellers of 4,000 soybeans, sellers of 4,000 soymeal, and buyers of 1,500 soyoil.

TENDERS

- CORN SALE: Exporters sold 213,370 tonnes of U.S. corn to Mexico for delivery during 2022/2023 marketing year, the U.S. Department of Agriculture said.

- WHEAT PURCHASE: An importer in Thailand is believed to have bought about 60,000 tonnes of animal feed wheat expected to be sourced from Australia.

- BARLEY TENDER: Jordan’s state grains buyer has issued a new international tender to purchase up to 120,000 tonnes of animal feed barley.

- NO OFFERS IN WHEAT, BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it received no offers for feed-quality wheat or barley in a simultaneous buy and sell (SBS) auction.

PENDING TENDERS

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 79,439 tonnes of rice.

- RICE TENDER: Egypt’s state grains buyer, GASC, is seeking at least 25,000 tonnes, plus or minus 10% at the buyer’s preference, of white rice in a tender-practice on the account of the Holding Company for Food Industries. Offers should be submitted on Feb. 14.

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 76,203 tonnes of food-quality wheat from the United States, Canada and Australia in a regular tender that will close on Feb. 16.

US BASIS/CASH

- Basis bids for corn and soy shipped by barge to the U.S. Gulf Coast were mostly flat on Wednesday, while bids slipped for hard red winter wheat barges, traders said.

- Brazilian soybeans maintain a significant discount to U.S. soy for delivery to China, the world’s top importer of the oilseed, brokers said.

- CIF corn barges loaded in February were bid at about 79 cents over March corn. Corn barges loaded in March were bid around 83 cents over futures.

- FOB basis offers for February corn shipments were around 87 cents over March. Offers for March shipments were around 90 cents over futures.

- CIF March soy barges were bid at about 95 cents over March futures. FOB offers for February and March soybean shipments were each around 105 cents over March.

- CIF February hard red winter wheat barges were bid at about 152 cents over K.C. March hard red winter wheat futures, down a penny. FOB offers for March hard red winter wheat shipments were steady at about 190 cents over futures.

- Spot basis bids for soybeans and corn were mostly unchanged at elevators, processors and river terminals around the U.S. Midwest on Wednesday, grain dealers said.

- Farmers were reluctant to book deals for their crops as weakness in the futures market pulled cash prices lower, an Iowa dealer said.

- Although the basis was mostly steady, corn bids fell by 10 cents a bushel at a processor near Chicago.

- Spot basis bids for soybeans and corn were flat at river terminals and interior elevators around the U.S. Midwest early on Wednesday, grain dealers said.

- The corn basis was steady to weak at processors and steady to firm at ethanol plants.

- Processor bids for soybeans were steady to firm, rising by 5 cents a bushel in Lafayette, Indiana.

- Farmers were showing little interest in booking new sales on Wednesday morning, an Iowa dealer said.

- Weakness in the futures market pushed prices below growers’ targets. Most farmers had enough cash on hand from prior sales to wait and see whether prices rebound before committing to new deals.

- Spot basis bids for hard red winter wheat were unchanged at grain elevators across the southern U.S. Plains on Wednesday, grain dealers said.

- Farmers have shown little interest in booking sales this week, with prices too low to spark a fresh round of country movement.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City fell by 20 cents a bushel for wheat with protein content between 12% and 14%, according to the latest CME Group data.

- Premiums were 10 cents lower for wheat with protein content ranging from 11% to 11.8% and 6 cents lower for ordinary protein wheat.

- U.S. spot cash millfeed values tumbled in the middle of the country on Wednesday as a lack of sustained cold weather limited demand, dealers said.

- Livestock often consume more feed to stay warm in cold weather, but conditions have been relatively mild recently in much of the Corn Belt, dealers said.

- Millfeed values were also too high around the Christmas and New Year’s holidays and needed to come down, a dealer said.

- Spot basis offers for U.S. soymeal were mixed at truck market processors around the Midwest on Wednesday, dealers said.

- The basis was flat in the rail market.

- Demand was weak, with cash prices of more than $500 per ton keeping most end users on the sidelines, an Indiana dealer said.

- Additionally, processors still needed to fill orders that had been delayed due to maintenance shutdowns at facilities during January, a Minnesota dealer said.

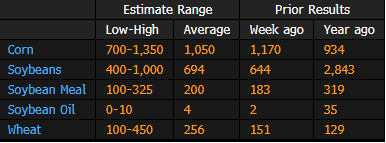

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

DOE: US Ethanol Stocks Rise 3.8% to 25.339M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 24.532 mln bbl

- Plant production at 1.014m b/d, compared to survey avg of 1.004m

NOPA January soybean crush below average estimate at 179.007 million bushels

The U.S. soybean crush rose in January for the first time in three months while soyoil stocks increased for a fourth straight month, although both gains were smaller than expected, according to National Oilseed Processors Association (NOPA) data released on Wednesday.

NOPA members, which account for around 95% of soybeans processed in the United States, crushed 179.007 million bushels of soybeans last month, up 0.8% from the 177.505 million bushels processed in December but down 1.8% from the January 2022 crush of 182.216 million bushels.

The monthly crush fell short of the average trade estimate of 181.656 million bushels in a Reuters survey of nine analysts. Estimates ranged from 176.980 million to 187.000 million bushels, with a median of 180.000 million bushels.

The January crush was about steady to higher than the prior month in the eastern Midwest and in the U.S. Southeast and Southwest, but lower in the northern Plains and the western Midwest, including in top crushing state Iowa, NOPA data showed.

December’s crush pace had been impeded by harsh winter weather and heavy snow in some parts of the country, and some soy processing facilities struggled to resume normal operations even in January, analysts said.

Soyoil supplies among NOPA members as of Jan. 31 rose to 1.829 billion pounds, up 2.1% from the 1.791 billion pounds in NOPA stocks at the end of December but 9.7% below the year-ago figure of 2.026 billion pounds.

Soyoil supplies at the end of January had been expected to climb to 1.906 billion pounds, according to the average of estimates gathered from seven analysts. Estimates ranged from 1.816 billion to 2.050 billion pounds, with a median of 1.898 billion pounds.

USDA Baseline Projections for 2023 Crop Acreage

SovEcon Raises Russian Wheat-Export Forecast to 44.2m Tons

The wheat-export forecast for 2022-23 has been raised by 0.1m tons to 44.2m tons, consultant SovEcon said in a report.

- Exports are expected to be a record high in the February-June period, supported by a weaker ruble, large domestic stockpiles and strong demand from importing countries

- Russian exports in first half of 2023 to “be a noticeable obstacle to a global rally in prices”

- But weather and infrastructure constraints, as well as competition from Australia, will limit Russian shipments

- SovEcon trimmed Russian barley and corn export estimates by 0.2m tons to 5.6m tons and 3.4m tons, respectively

India Jan. Vegetable Oil Imports Rise to 1.66m Tons: SEA

India’s vegetable oil imports rose to 1.66m tons in January from 1.57m tons in December, according to the Solvent Extractors’ Association of India.

- Palm oil imports fell to 833,667 tons from 1.11m tons in December

- Soybean oil imports rose to 366,625 tons from 252,525 tons in December

- Sunflower oil imports rose to 461,458 tons from 194,009 tons in December

India 2022 Wheat Crop Cut, Bumper Harvest Looms in ‘23: USDA FAS

India’s wheat production is seen at 100m tons in the 2022-23 season, which runs through March, the USDA’s Foreign Agricultural Service said in a report.

- That’s below the last official USDA estimate of 103m tons

- Outlook cut as local prices have soared to record highs, despite India’s wheat-export ban, suggesting “tighter domestic supplies”

- However, India is on track for a bumper wheat crop in the approaching 2023-24 season, as long as good weather holds through the harvest in April, report says

- Weather has been favorable through early February and plantings were large

Western Australian Farmers Deliver Record Grains Crop, CBH Says

Western Australia has delivered its biggest grains crop ever, with most farmers ending up with exceptional yields, according to CBH Group, the country’s top grain exporter.

Grain deliveries from this year’s harvest totaled 22.7 million tons, up from 21.3 million tons a year earlier, CBH said in a press release Thursday. Some grain is still trickling in, so the final total could be higher, it said.

Australia is the world’s second-biggest wheat exporting country, and shipments from its western and eastern growing regions have been key to capping global prices. World supplies have been tightened by a slump in Ukrainian exports after the Russian invasion and dry weather in US growing areas.

CBH added storage capacity across the state of Western Australia and made a special effort to move as much of the previous crop to customers as possible, creating space for new supplies, it said. More than 5 million tons of storage has been added to the network in the past two years.

Some 6.7 million tons of grain were exported between October and January, almost 40% more than ever achieved in the past, CBH said. The company is now targeting monthly exports of 2 million tons to create space for the next harvest, it said.

Russian Wheat Stocks Up 59.5% Y/y in January, Rosstat Says: IFX

Russia’s wheat stockpiles as of January rose to 19.8m tons, compared to 12.4m tons at the same time last year, Interfax reported, citing data from statistics service Rosstat.

- Total grain stocks were at 32.3m tons, up 47% on last year

- Oilseed stocks were also 46.5% higher

Argentina confirms first cases of bird flu, declares sanitary emergency

Argentina’s agriculture secretary Juan Jose Bahillo said on Wednesday the South American country has confirmed its first cases of bird flu in wild birds, leading it to declare a sanitary emergency and reinforce measures against the disease.

Bird Flu Spreads in South America As Uruguay Reports First Cases

Uruguay reported death of black neck swans due to highly pathogenic avian influenza virus, according to a statement from the nation’s Agriculture Ministry.

- That’s the first time the virus is reported in Uruguay

- Episodes were reported between Maldonado and Rocha departments

- Coordination actions are being carried out for the epidemiological investigation and tracking of birds with compatible symptoms in the properties of the affected zone

- The consumption of poultry meat or eggs from sick animals doesn’t affect human health, though the virus may cause high damages to poultry production

- South American transmission been reported through migratory birds that fly from contaminated areas in the north

Lawmakers Urge US to Launch Trade Dispute With Mexico Over Corn

House Republicans Jason Smith and Adrian Smith ask Biden administration officials to initiate a formal dispute against Mexico over its planned restrictions on imports of genetically modified US corn.

In a letter to US Trade Representative Katherine Tai and Agriculture Secretary Tom Vilsack, the lawmakers say “it is time to aggressively enforce” the Mexican government’s obligations under the United States-Mexico-Canada Agreement (USMCA)

Fertilizer Giants See Demand Rebound Amid Free-Falling Prices

- Companies sees demand emerging to support global prices

- Prices have tumbled as production plants come back online

Two of the world’s largest fertilizer companies see the nutrient market tightening even as manufacturing plants ramp up and prices fall.

CF Industries Holdings Inc., the world’s biggest nitrogen fertilizer company, expects “substantial agriculture demand will emerge, supporting global nitrogen prices,” according to a statement on Wednesday.

Meanwhile, top crop-nutrient supplier Nutrien Ltd. is also forecasting constrained fertilizer supplies.

Fertilizer supplies are piling up after Russia’s invasion of Ukraine almost a year ago prompted a run-up in prices that has now eased. Retailers and distributors in Europe and North America have been reluctant to buy and are holding off in anticipation of even lower prices.

There is little evidence fertilizer prices will rise in the near term amid adequate supplies and tepid demand in some regions, TD Securities analyst Michael Tupholme said in a Feb. 8 note.

The outlooks came as CF posted disappointing fourth-quarter sales and Nutrien fell short of profit expectations. CF rose as much as 1.3% in after-hours trading while Nutrien slipped as much as 3.3%.

Nutrien said it’s slowing its ramp-up of potash production. It now expects to reach annual operational capacity of 18 million tons of potash by 2026, a year later than the previous target, saying it wants to stay in line with the pace of demand recovery.

TD Securities downgraded Nutrien, saying it will be affected by lower potash demand and elevated inventories.*

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |