Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 7 in SRW, down 10 1/2 in HRW, up 1 3/4 in HRS; Corn is down 1 1/4; Soybeans down 3 1/2; Soymeal up $0.07; Soyoil down 0.32.

For the week so far wheat prices are down 18 1/2 in SRW, down 10 3/4 in HRW, down 4 in HRS; Corn is up 2 1/2; Soybeans up 20 1/4; Soymeal up $0.69; Soyoil up 0.98.

For the month to date wheat prices are down 14 3/4 in SRW, up 11 1/4 in HRW, up 5 in HRS; Corn is up 1 3/4; Soybeans up 10 1/4; Soymeal up $13.80; Soyoil up 0.14.

Year-To-Date nearby futures are down 5.9% in SRW, up 0.5% in HRW, down 1.4% in HRS; Corn is up 0.3%; Soybeans up 1.8%; Soymeal up 4.1%; Soyoil down 2.0%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAY 23) Soybeans up 39 yuan; Soymeal up 12; Soyoil down 2; Palm oil up 26; Corn unchanged — Malaysian palm oil prices overnight were up 5 ringgit (+0.12%) at 4146.

There were changes in registrations (-40 HRW Wheat). Registration total: 2,587 SRW Wheat contracts; 0 Oats; 0 Corn; 302 Soybeans; 467 Soyoil; 0 Soymeal; 152 HRW Wheat.

Preliminary changes in futures Open Interest as of February 21 were: SRW Wheat down 3,199 contracts, HRW Wheat down 4,956, Corn down 22,955, Soybeans up 6,272, Soymeal up 1,997, Soyoil down 3,536.

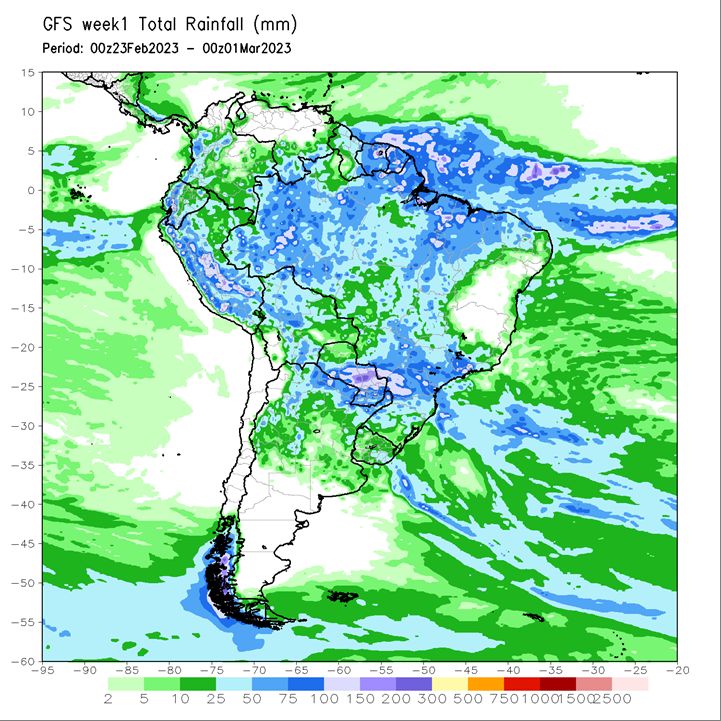

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Scattered showers north Wednesday. Scattered showers Thursday-Saturday. Temperatures near normal through Saturday. Mato Grosso, MGDS and southern Goias: Scattered showers through Saturday. Temperatures near normal through Saturday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Isolated showers Wednesday-Thursday. Mostly dry Friday-Saturday. Temperatures near to above normal through Saturday. La Pampa, Southern Buenos Aires: Isolated showers Wednesday-Thursday. Mostly dry Friday-Saturday. Temperatures near to above normal through Saturday.

Northern Plains Forecast: Scattered showers Wednesday. Mostly dry Thursday. Isolated showers southeast Friday-Saturday. Temperatures well below normal north and well above normal south Wednesday-Thursday, near to well below normal Friday, near normal Saturday. Outlook: Scattered showers Sunday-Monday. Mostly dry Tuesday-Wednesday. Scattered showers Thursday. Temperatures near to above normal Sunday-Thursday.

Central/Southern Plains Forecast: Heavy snow into Thursday. Mostly dry Friday-Saturday. Temperatures well below normal through Saturday. Outlook: Isolated to scattered showers Sunday. Mostly dry Monday-Tuesday. Isolated showers Wednesday-Thursday. Temperatures near to below normal Sunday-Thursday.

Western Midwest Forecast: Mixed precipitation through Thursday. Isolated showers Friday. Mostly dry Saturday. Temperatures below normal north and above normal south Wednesday, near to well below normal Thursday-Saturday.

Eastern Midwest Forecast: Mixed precipitation Wednesday-Thursday. Lake-effect snow Friday. Mostly dry Saturday. Temperatures above normal through Thursday, below normal Friday, near normal Saturday. Outlook: Scattered showers Sunday night-Tuesday. Mostly dry Wednesday. Scattered showers Thursday. Temperatures near to above normal Sunday-Thursday.

The player sheet for Feb. 21 had funds: net sellers of 6,000 contracts of SRW wheat, buyers of 2,500 corn, sellers of 9,000 soybeans, buyers of 3,500 soymeal, and buyers of 3,500 soyoil.

TENDERS

- WHEAT PURCHASE: Jordan’s state grains buyer purchased about 60,000 tonnes of hard milling wheat to be sourced from optional origins in an international tender which closed on Tuesday

- CORN PURCHASE: South Korea’s Major Feedmill Group (MFG) purchased an estimated 69,000 tonnes of animal feed corn to be supplied from any optional worldwide origins in a private deal on Friday without an international tender being issued

- CORN PURCHASE: South Korea’s Feed Leaders Committee (FLC) purchased about 65,000 tonnes of animal feed corn in a private deal on Friday expected to be sourced from the United States or South America without issuing an international tender, European traders said.

- RICE PURCHASE: Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC), on Tuesday said it had bought 50,000 tonnes of white rice in tender.

- WHEAT PURCHASE: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) bought a total of 94,387 tonnes of food-quality wheat from the United States, Canada and Australia in a regular tender that closed on Wednesday.

- WHEAT TENDER: Turkey’s state grain board TMO has issued an international tender to purchase an estimated 790,000 tonnes of milling wheat

- SUNFLOWER OIL TENDER: Turkey’s state grain board TMO has issued an international tender to purchase about 48,000 tonnes of crude sunflower oil

- VEGOIL TENDER: Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC), said it was seeking vegetable oils in an international tender for arrival April 1-20. The deadline for offers is Feb. 23.

- CORN TENDER: Algerian state agency ONAB issued an international tender to purchase about 30,000 tonnes to 40,000 tonnes of corn to be sourced from Argentina.

PENDING TENDERS

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 79,439 tonnes of rice.

- BARLEY TENDER: Jordan’s state grains buyer has issued a new international tender to purchase up to 120,000 tonnes of animal feed barley.

US BASIS/CASH

- Spot basis bids for corn and soybeans shipped by barge to the U.S. Gulf Coast were steady to firm on Tuesday while deferred bids were mostly weaker, traders said.

- CIF corn barges loaded in February were bid about 78 cents over March corn, up a penny. Corn barges loaded in March were bid unchanged at around 80 cents over futures.

- FOB basis offers for February and March corn shipments were around 85 cents over March futures.

- CIF February soy barges were bid at about 92 cents over March futures, up 2 cents. March soybean barges were bid 2 cents lower at 90 cents over futures.

- FOB offers for February and March soybean shipments were each around 105 cents over March futures.

- Spot basis bids for corn delivered to rail elevators were mixed around the U.S. Midwest on Tuesday, grain dealers said.

- The corn basis was flat at the region’s truck market elevators, processors and terminals along rivers.

- Soybean bids were unchanged around the region.

- Farmer sales of both commodities were slow.

- Spot basis bids for corn fell at grain elevators and ethanol plants in the eastern U.S. Midwest on Tuesday morning.

- Corn bids were mixed at Midwest processors and flat at the region’s river terminals, grain dealers said.

- The cash basis for soybeans was unchanged at processors, elevators and river terminals around the region.

- Farmers were showing little interest in making new deals for their crops on Tuesday morning.

- Growers already had plenty of chances to book sales at current price levels and were waiting to see if prices could jump another 50 cents before committing to new deals, an Iowa dealer said.

- Spot basis bids for hard red winter wheat were unchanged at grain elevators across the southern U.S. Plains on Tuesday.

- Activity on the cash market was light, with farmers showing little interest in booking deals for their wheat, a grain dealer in Oklahoma said.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City fell by 7 cents a bushel for all grades of wheat, according to the latest CME Group data.

- Spot basis offers for soymeal dropped at truck market processors around the U.S. Midwest on Tuesday, dealers said.

- Rail market offers were steady to firm, rising by $5 per ton in the Kansas City area.

- Demand was light.

- Cash prices of around $500 a ton were too expensive to generate fresh interest from livestock and poultry producers, dealers said.

- End users were content to wait for previously booked orders to be delivered.

2023-24 Projections Survey Results for USDA annual Outlook conference

US Inspected 623k Tons of Corn for Export, 1.578m of Soybean

In week ending Feb. 16, according to the USDA’s weekly inspections report.

- Wheat: 373k tons vs 472k the previous wk, 571k a yr ago

- Corn: 623k tons vs 563k the previous wk, 1,578k a yr ago

- Soybeans: 1,578k tons vs 1,693k the previous wk, 1,045k a yr ago

US Corn, Soybean, Wheat Inspections by Country: Feb. 16

Malaysia Keeps Crude Palm Oil Export Tax at 8% in March

Gazetted price for crude palm oil at 3,710.35 ringgit a ton, which incurs the maximum export tax of 8%, according to a statement from the customs department posted on the Malaysian Palm Oil Board’s website.

- NOTE: Tax has been kept at 8% since Jan. 2021, following government exemption in July-December 2020

- NOTE: Export duty structure starts at 3% when FOB prices for CPO are in the 2,250-2,400 ringgit per ton range

- Maximum tax rate is 8% when prices are above 3,450 ringgit per ton

China Willing to Expand Imports of Indonesian Commodities

China is willing to expand imports of Indonesian commodities and high quality agricultural and fish products, says China Foreign Minister Qin Gang after a meeting with counterpart Retno Marsudi in Jakarta on Wednesday.

Indonesia wants greater cooperation with China on highspeed train, green industrial park, new capital development and commodity downstreaming: statement

LIVESTOCK SURVEY: US Cattle on Feed Placements Seen Falling 2.9%

January placements onto feedlots seen falling y/y to 1.94m head, according to a Bloomberg survey of ten analysts.

That would be the fifth y/y decline in a row, and the lowest January amount since 2016

- Estimates range from -4.5% to -0.3% y/y change

- Feedlot herd as of Feb. 1 seen falling by 3.5% y/y to 11.77m head

- Marketings seen rising 3.9% y/y

Ohio Train Derailment Leads to Shipping Disruptions

After the derailment of a train in East Palestine, Ohio that was carrying roughly 20 cars of hazardous materials, a popular grain-shipping lane has been temporarily closed. “The market is questioning how much and how long disruptions may occur as Cincinnati closes Ohio River water intake as a safety precaution,” says Daniel Flynn of Price Futures Group in a note. “Despite reservations from some local residents, the officials say the water is safe to drink. Let’s see these officials drink it.” Midwestern rivers are common shipping lanes for US grains, with last year’s low river levels significantly impacting US export sales last summer. In trading, CBOT corn futures up 0.4%, soybeans up 1.3%, and wheat down 1.1%.

Farmers Get a Break as Fertilizer Prices Fall, Crop Prices Firm

Nitrogen prices remain weak in the US as buyers delay spring purchases. Producers lowered Midwest ammonia by as much as $260 a short ton in early February to spur sales. Chinese fertilizer inventory has rebounded, raising the possibility of above-trend crop production and a 2H end to export inspections.

Nitrogen, Potash Prices Fall as Spring Planting Nears

US ammonia prices remained under pressure, with additional declines reported for spring offers in Iowa, Nebraska and Oklahoma. Plentiful supply and low natural gas costs are also expected to push Tampa ammonia lower for March. Urea, urea ammonium nitrate (UAN) and ammonium sulfate moved lower at New Orleans (NOLA) and inland, with NOLA UAN falling $25-$45 a short ton (st) and ammonium sulfate dropping $10-$15 vs. last week. Potash prices also slipped another $5-$7/st at NOLA, while phosphates were unchanged vs. last week.

An Indian urea tender is expected soon, possibly over the weekend. The country is hoping to book a million or more tons for delivery in March and April, which may help stem the steady decline in urea prices observed in Brazil, the Arab Gulf and the US.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |