Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 5 1/4 in SRW, down 2 1/4 in HRW, down 2 3/4 in HRS; Corn is up 1/4; Soybeans down 2 1/2; Soymeal down $0.22; Soyoil up 0.29.

For the week so far wheat prices are down 14 1/4 in SRW, down 17 in HRW, down 21 1/4 in HRS; Corn is down 4; Soybeans down 5 3/4; Soymeal up $0.46; Soyoil down 2.27.

For the month to date wheat prices are down 12 3/4 in SRW, down 15 3/4 in HRW, down 16 3/4 in HRS; Corn is up 4 1/4; Soybeans up 34; Soymeal up $18.50; Soyoil down 1.09.

Year-To-Date nearby futures are down 13.5% in SRW, down 9.3% in HRW, down 9.9% in HRS; Corn is down 4.9%; Soybeans up 0.4%; Soymeal up 4.5%; Soyoil down 8.9%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAY 23) Soybeans down 46 yuan; Soymeal down 7; Soyoil down 82; Palm oil down 144; Corn up 9 — Malaysian palm oil prices overnight were down 24 ringgit (-0.57%) at 4181.

There were changes in registrations (-9 Soyoil, -147 HRW Wheat). Registration total: 2,587 SRW Wheat contracts; 43 Oats; 95 Corn; 228 Soybeans; 692 Soyoil; 0 Soymeal; 205 HRW Wheat.

Preliminary changes in futures Open Interest as of March 7 were: SRW Wheat up 4,179 contracts, HRW Wheat up 592, Corn up 6,139, Soybeans up 2,660, Soymeal up 3,562, Soyoil up 15,170.

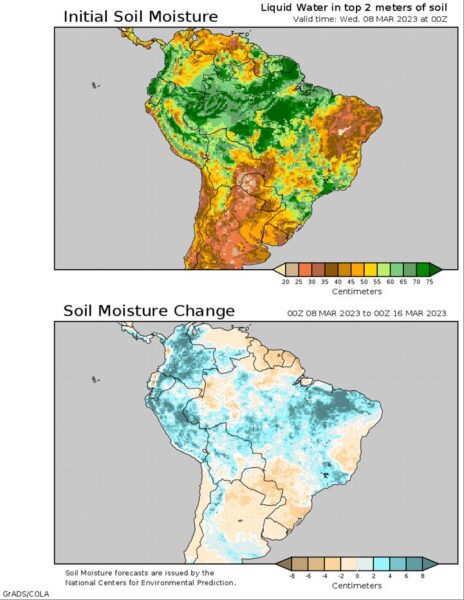

Brazil Grains & Oilseeds Forecast: Scattered showers continue for much of Brazil’s growing regions for the next week outside of Minas Gerais and Rio Grande do Sul, where showers will be more limited. Despite recent rains, many areas have made significant progress with regard to soybean harvest and corn planting. However, some areas are behind, somewhat significantly, and will expose more of the corn crop to the dry season which is forecast to start up in April. Corn already in the ground will benefit from good soil moisture.

Argentina Grains & Oilseeds Forecast: Dry conditions continue to be a concern for immature corn and soybeans moving forward. Any showers will be limited for at least the next week, though isolated showers may move through at times. Southern areas stand the best chance at continued precipitation going into next week, but for most areas, the rain is too late to have much of an impact. Heat that developed last week continues for the next week. The heat and dryness are keeping stresses high for both crops in various stages of growth.

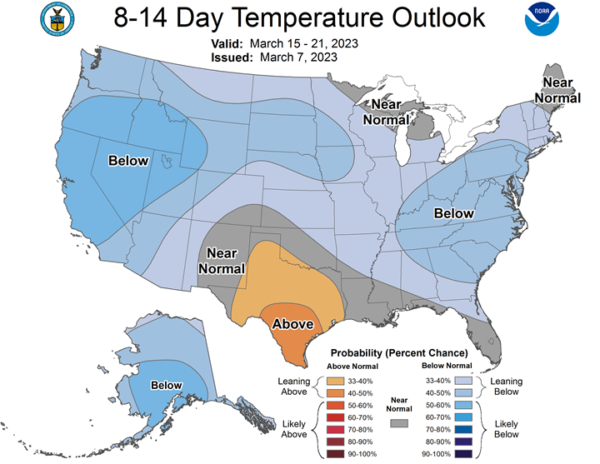

Northern Plains Forecast: A system moved into the Northern Plains over the weekend and Monday with areas of heavier snow. Additional waves of snow will press through the region throughout the week, adding up to some hefty amounts for a lot of the region. Colder air also will be in place for both the Northern Plains and Canadian Prairies, with higher inputs than normal required for livestock.

Central/Southern Plains Forecast: A front will slide south through the Central and Southern Plains Tuesday, with some scattered showers through Thursday and falling temperatures. Temperatures will waffle around over the next 10 days, but mainly be below-normal in the north and above-normal in the south. Another system will move through over the weekend with some showers, but precipitation continues to be limited for southwestern areas where drought remains in control.

Midwest Forecast: A system brought precipitation across the Midwest Monday and will be followed by additional waves of precipitation throughout the rest of the week, especially across the west. Cooler temperatures will replace the recent warmth but will not be extremely cold. Another system moves through over the weekend with widespread precipitation as well.

India: A long-duration heatwave will develop later this week across most of India and continue through a good portion of the middle of March. Along with little or no precipitation, temperatures exceeding 100F may be very stressful for filling winter wheat.

The player sheet for 3/7 had funds: net buyers of 3,000 contracts of SRW wheat, sellers of 2,000 corn, buyers of 6,500 soybeans, sellers of 1,500 soymeal, and sellers of 6,500 soyoil.

TENDERS

- WHEAT PURCHASE: Jordan’s state grains buyer purchased about 60,000 tonnes of hard milling wheat to be sourced from optional origins in an international tender on Tuesday

- CORN PURCHASE: Taiwan’s MFIG purchasing group bought about 52,000 tonnes of animal feed corn to expected to be sourced from South Africa in an international tender on Wednesday

- WHEAT TENDER: Tunisia’s state grains agency issued an international tender to purchase about 100,000 tonnes of durum wheat

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking a total of 80,570 tonnes of food-quality wheat from the United States and Canada in a regular tender that will close on March 9.

- CORN TENDER: Leading South Korean feedmaker Nonghyup Feed Inc (NOFI) has issued an international tender to purchase up to 138,000 tonnes of animal feed corn to be sourced from optional origins

PENDING TENDERS

- WHEAT TENDER: Algeria’s state grains agency OAIC issued an international tender to purchase a nominal 50,000 tonnes of durum wheat

- FEED WHEAT AND BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by June 30 and arrive in Japan by Aug. 31, via a simultaneous buy and sell (SBS) auction that will be held on March 8.

- WHEAT TENDER: Jordan’s state grain buyer has issued an international tender to buy up to 120,000 tonnes of milling wheat which can be sourced from optional origins

- FEED BARLEY TENDER: Jordan’s state grains buyer issued an international tender to purchase up to 120,000 tonnes of animal feed barley.

US BASIS/CASH

- Basis values for soybeans shipped by barge to the U.S. Gulf Coast firmed slightly on Tuesday in subdued trade, supported by exporter demand and a slow pace of farmer offerings into Midwest river marketing channels, traders said.

- Barge loadings were resuming in some locations on the mid-Mississippi River this week after seasonal winter closures, traders said.

- CIF soybean barges loaded in March were offered at 102 cents over May, up 2 cents from Monday’s offers.

- FOB offers for March soybean shipments were around 111 cents over May, up a penny from Monday.

- For corn, CIF barges loaded in March were bid at 87 cents over May, compared with Monday’s bid of 77 cents over March.

- FOB basis offers for March corn shipments were around 91 cents over May futures, up 1 cent from Monday.

- Spot basis bids for soybeans delivered to processors were steady to firm in the eastern half of the U.S. Midwest on Tuesday and steady to weak in the western half of the region, dealers said.

- The soybean basis held steady at the region’s river terminals and elevators around the Midwest interior.

- Cash bids for corn held steady at processors, interior elevators and river terminals.

- Farmer sales of both commodities were light.

- Spot basis bids for hard red winter wheat were unchanged at grain elevators across the southern U.S. Plains on Tuesday, dealers said.

- Farmer sales were slow, as recent declines in the futures market have pulled cash prices well below growers’ targets.

- Concerns about crop development also have deterred farmers from booking new deals, dealers said.

- Good-to-excellent ratings in Texas held steady at 19% and good-to-excellent ratings in Oklahoma rose 3% points to 39%.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City were unchanged for all grades of wheat, according to the latest CME Group data.

- Spot basis bids for soybeans were mixed at U.S. Midwest processors early on Tuesday, dealers said.

- The soybean basis was steady to weak at interior elevators and unchanged at river terminals.

- Cash bids for corn were firm at the region’s ethanol plants and grain elevators but flat at processors and river terminals.

- Country movement of both commodities was slow on Tuesday.

- Growers had booked sales at higher prices and were waiting to see if prices rallied back to those levels before committing to new deals.

- U.S. cash millfeed values were mostly steady on Tuesday with a few mixed changes as demand increased from feed mixers in the Upper Midwest and Plains following a recent slide in prices, brokers said.

- Spot basis offers for U.S. soymeal fell at rail market processors on Tuesday, dealers said.

- The basis was mixed at truck market processors in Iowa.

- Around the rest of the Midwest, the basis at truck market processors was unchanged.

- Demand was expected to ease in the coming weeks as more livestock producers put animals out to pasture to graze during the spring, a rail dealer said.

- Additionally, a recent pickup in the processing pace at plants has boosted the amount of soymeal for sale.

- High futures prices that have left cash prices stuck at more than $500 a ton also have contributed to light demand with many end users searching for alternative sources of protein, brokers said.

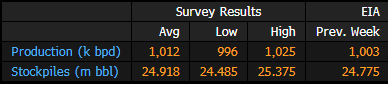

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending March 3 are based on six analyst estimates compiled by Bloomberg.

- Production seen higher than last week at 1.012m b/d

- Stockpile avg est. 24.918m bbl vs 24.775m a week ago

CROP SURVEY: Brazil 2022-23 Soybean Output Seen at 152.8M Tons

Brazil soybean production seen mostly unchanged from the national forecast agency’s previous est., according to the avg in a Bloomberg survey of eight analysts.

- The range of estimates varied from 150.8m tons to 154.7m tons

- Brazil’s corn crop seen 3.2m tons higher at 127m tons

SovEcon Cuts Russia 2022-23 Wheat-Export Outlook on Weather

Russia’s 2022-23 wheat exports are seen at 44.1m tons, down 100k tons from previous estimate, researcher SovEcon said in an emailed note.

- Revision is due to lower February exports because of stormy weather; February exports seen at 2.9m tons

- Still expects record-high pace of shipments in the rest of the season, but does not see a sharp increase

- “Current global prices are too low for the current world wheat S&D balance sheet and do not reflect the risk of disruption of shipments from the Black Sea”

U.S. CORN EXPORTS TO INCREASE IN THE UPCOMING MONTHS AS BRAZIL FOCUS ON SOYBEANS – Refinitiv Commodities Research

UNITED STATES: The U.S. corn exports have been far from the expected this season; however, Brazil, Argentina, and Ukraine might not have the provisions to meet the increased global corn demand in the upcoming months. On average, March is the busiest month for U.S. corn exports, and the U.S. corn export inspections for the week ending on March 2 illustrated the increased demand. Last week U.S. corn exports reported one of the highest volumes in the season at 900 thousand tons. Two significant flash sales on March 5 supported this increase in sales, 110 thousand tons to Japan and 182.4 thousand tons to an unknown destination.

In February, the U.S. corn exports totaled a preliminary 2.6 million tons, half below the 3-year average for the month and the lowest in the last ten years. There is no doubt that Brazil’s ability to ship corn to China has diminished U.S. corn exports to that country. In addition, Japan, the third largest U.S. corn importer, has also turned to Brazil’s corn. In the 2022/23 season, Japan has only imported 1.8 million tons of U.S. corn, down from 5.8 million tons during the same accumulated period last season and the lowest over the past 20 years.

As of March 6, U.S. corn exports in 2022/23 are at 15.3 million tons, 33.4% below the 3-year average. The U.S. outstanding sales totaled 14.2 million tons of corn as of February 23, down from 22.3 million tons a year ago and more than a half below the 33 million tons in 2021. Based on these market indicators, Refinitiv maintains the 2022/23 corn exports at 46.9 million tons, 2 million tons below USDA’s February estimate. At the mid-2022/23 season, U.S. corn export sales for the current season totaled 29.5 million tons, 62.9% of Refinitiv’s forecast for the entire season.

BRAZIL: Brazil’s corn exports closed at a historic high. In February, Brazil’s corn exports reached 1.9 million tons. This represents a decrease from the 4.6 million tons shipped in January, still the highest volume for the month in the last seven years. Brazil reported its preliminary 2021/22 corn exports at 46.8 million tons, an all-time high according to Refinitiv trade flows.

As Brazil ends its corn export season, the focus turns to soybeans. As a result, Brazil’s corn exports from March to June are meager. The latest lineup report (released on March 3) shows 862 thousand tons of corn scheduled to deliver in March. Despite second crop Safrinha sowing delays, Brazil’s 2022/23 harvest is forecast at 125.2 million tons, 10 million tons above last season. In addition, Brazilian corn has obtained a solid global demand and favorable corn competitiveness due to the strong U.S. dollar. Refinitiv increases the 2022/23 Brazil corn export to 50.3 million tons, 3 million tons above the February estimate, and 0.3 million tons above USDA’s February Wasde estimate.

ARGENTINA: Argentinian corn exports reached 1.9 million tons in February, a 7-year high according to Refinitiv trade flows. According to the Global Port Inspections flow data, Argentina closed its preliminary 2021/22 corn exports at 33.7 MMT. Refinitiv maintains the 2021/22 Argentina corn exports at 35.9 MMT, 0.9 above USDA’s February update.

Refinitiv lowered Argentina’s 2022/23 corn production forecast to 43.4 million tons. According to the Rosario Grains Exchange (BCR), Argentinian corn exports might fall around 40% between March and June compared to last year. In addition to the weather impacts, some leading Argentinian corn importers, such as Vietnam and Malaysia, have started to purchase Indian corn as their demand increased and the Argentinian supplies shrunk. Refinitiv lowers the 2022/23 Argentina corn exports to 31.6 million tons, 2 million tons below the last estimate and 1.4 million tons below the February Wasde estimate.

UN’s Guterres, Zelenskiy to Discuss Black Sea Grain Deal

- UN Secretary-General Antonio Guterres arrived Tuesday in Poland, en route to Ukraine, according to an emailed statement from Stephane Dujarric, spokesman for the secretary-general

- He will meet Wednesday with Ukrainian President Volodymyr Zelenskiy in Kyiv “to discuss the continuation of the Black Sea Grain Initiative in all its aspects, as well as other pertinent issues”

- Separately, UN spokesperson Farhan Haq said at daily briefing that “prior to leaving New York, the secretary-general had a conversation” with Sergei Vershinin, Russia’s deputy foreign minister, on the grain deal; said there are no plans to visit Moscow

- NOTE: The latest 120-day run of the Black Sea grain-export deal ends in mid-March

- Its terms stipulate that it can be extended, unless one of the parties notifies the others of an intent to modify or terminate it

Mosaic To Invest $155M to Increase Potash Production in Brazil

Mosaic Co. expects to increase potash production in Sergipe, northeast Brazil, to 450k tons in 2024 from 370k last year, the company says in emailed statement.

- Resources will be used to buy machinery, improve local infrastructure

- Investments seen allowing Mosaic to extend operations on Sergipe’s mining and chemical complex through at least 2030

EU Soft-Wheat Exports Rise 7.7% Y/y; Corn Imports Increase 60%

The European Union’s soft-wheat exports for the season that began July 1 reached 21m tons by March 5, compared with 19.5m tons a year earlier, the European Commission said on its website.

- Leading destinations include Morocco (3.12m tons), Algeria (2.85m tons) and Nigeria (1.82m tons)

- EU barley exports were 4.06m tons, versus 5.83m tons

- Corn imports were 18.6m tons, versus 11.6m tons

- NOTE: Commission says some export figures for Germany may be inaccurate due to its recent shift to a new declaration system and Italy import data is only available through November

China’s Corn Consumption Weak on Poor Livestock Margins: CASDE

Corn consumption in China, the world’s biggest importing country, remains weak because of poor livestock margins, with processors only buying hand-to-mouth, the agriculture ministry said.

The country’s demand for the main agricultural commodities, including soybeans, cotton and sugar, is improving as the economy recovers, it said in its latest China Agricultural Supply & Demand Estimates.

More from the report:

- Corn supplies are rising with farmers selling more of the grain as warm weather makes storage harder, and this is weighing on prices

- Demand for soybeans improved slowly after the Lunar New Year holiday. Sales of cotton picked up on expectations for stronger demand for textile products and clothes

- Sugar demand climbed, while production of the sweetener in the 2022-23 year is seen at 9.33 million tons, some 720,000 tons less than last month’s forecast because of lower yields

- Production, import and consumption estimates for corn, soybeans, cotton and edible oils in 2022-23 are unchanged

Palm Oil May Surge to 5,000 Ringgit by August, Mistry Predicts

- Shifting weather patterns threaten Southeast Asia production

- ‘We cannot be bearish on agriculture prices anymore:’ Mistry

Palm oil may soar as high as 5,000 ringgit ($1,106) a ton in the coming months on worries that changing weather patterns will hurt production in the top suppliers, according to trader Dorab Mistry.

Futures in Malaysia will trade between 4,000 ringgit and 5,000 ringgit from now until August, said Mistry, a director at Godrej International Ltd. This is up from his forecast in December for prices to hold above 3,500 ringgit through May. Palm oil is currently at around 4,195 ringgit.

“We cannot be bearish on agriculture prices anymore,” Mistry said in slides prepared for a conference in Kuala Lumpur. “With aggravated climate change, we cannot project normal crops anymore. God knows which crop will be affected by aberrations in climate in 2023.”

Agricultural production globally is coming under threat from climate change. Drought and severe heat in various parts of the world in the past year damaged wheat and oilseed crops at a time when global supplies are being squeezed by the war in Ukraine. This year, a looming shift to El Nino from La Nina could parch palm oil estates in Indonesia and Malaysia.

“For 2023, weather is going to be the biggest factor for palm,” said Mistry, who has traded cooking oils for more than four decades. “Prices will reflect the vagaries of climate.”

More details from Mistry’s slides:

- A new El Nino could drive prices higher so as to destroy demand. If there’s no El Nino, prices will decline after August

- Ukraine’s sunflower seed output could fall 30% this year from 2022

- In terms of demand, India’s vegetable oils consumption and imports look very healthy and pipelines have been replenished

- The Indian government is concerned about inflation, so hikes in import duty are unlikely

- Stockpiles in China are high and need to be trimmed; Chinese demand has not been buoyant, but an upturn will eventually come

- Some developing countries that are major vegetable oil importers have been suffering from a dollar shortage, affecting consumption

Palm Oil Supply From Top Grower Indonesia Capped by Old Trees

- Slow replanting due to high costs and potential loss of income

- ‘With El Nino, we can really suffer,’ planter Golden Agri says

Indonesia’s slow replanting of old and unproductive oil palm trees will likely keep output growth subdued in the world’s biggest supplier, according to plantation company Golden Agri-Resources Ltd.

Production may only climb by 500,000 tons to 1 million tons year-on-year, Tony Kettinger, chief operating officer of the Singapore-based firm, said in an interview Tuesday. That would suggest a rise of roughly 1% from last year.

Replanting aging oil palm trees is important for Indonesia as it helps to maintain or raise yields without increasing use of land. For smallholders, that can be challenging because of the high costs and a potential loss of income during the replanting process. Production also faces risks from the expected shift in weather patterns from La Nina to El Nino this year.

There’s some replanting going on, but most of the trees are getting older and not increasing productivity, Kettinger said. “We don’t see big production increases coming. Very slow increases in fact. That’s if the weather is good. History has shown us that with El Nino, we can really suffer.”

Replanting is a big undertaking as it requires a huge investment and affects revenue for a few years, according to Golden Agri. This is a tough decision for growers especially when prices are high. Global palm oil futures have doubled in the past four years and currently trade at about 4,200 ringgit ($939) a ton.

Indonesia’s palm oil exports to fall in 2023 -industry official

Indonesia’s palm oil exports are set to fall in 2023 as Jakarta has decided to increase use of the tropical oil in biodiesel, reducing the surplus available for overseas sales, an industry official said on Wednesday.

The country’s palm oil production is also likely to fall marginally in 2023, Fadhil Hasan, head of the trade and promotion division at the Indonesian Palm Oil Association (GAPKI) told a conference.

Palm Oil Market to Tighten on Biofuel and Weather, Fry Says

- Global food prices remain elevated even after recent pullback

- Expansion of renewable diesel in the US is key factor to watch

Palm oil supplies for the global market are set to moderate this year due to higher biofuel use, adverse weather, aging trees in the world’s top growers, according to agriculture consulting firm LMC International Ltd.

The growth in palm oil available for exports from Indonesia and Malaysia combined may only be around 1 million tons this year, said James Fry, chairman of LMC. That compares with a normal surplus of 2 million to 3 million tons in previous years, he said in an interview Tuesday.

The outlook for tighter availability of palm oil — the world’s most-consumed cooking oil — comes as food prices remain elevated globally, even after a pullback in recent months. Weather risks are also increasing, with a shift from La Nina to El Nino expected this year. This could parch parch oil palm estates in Southeast Asia, where the bulk of global supply is produced.

Deep-rooted labor issues and the rising number of overaged palm trees will contribute to supply constraints, Fry said on the sidelines of a conference in Kuala Lumpur. Replanting has been slow due to the high costs involved.

Production from Malaysia, the second-biggest grower, may fall short of 19 million tons this year. Indonesian output may increase by just 1 million tons, said Fry, who has worked in the industry for more than 40 years.

Fry expects palm oil to fall to 3,350 ringgit ($741) a ton by year-end, pulled down by gas oil. Prices will average 3,760 ringgit over the full year, he said in a presentation Wednesday. Futures are currently at around 4,195 ringgit.

More from the interview:

- Palm oil prices seen supported in the short-term due to Indonesia’s tightened export policies and flooding in some areas. Prices may ease in April-May when Indonesia relaxes curbs on shipments.

- A key factor to watch is growing biodiesel demand worldwide, as well as the expansion of renewable diesel in the US, which is absorbing soybean oil as a feedstock.

- China is set to import more soybeans to crush into meal to feed pigs. This will lead to higher availability of soybean oil in the country.

Global Vegetable Oils Market May Move to Deficit in 2H: Mielke

This is partly driven by surging demand for biodiesel, which increases consumption of vegetable oils, Thomas Mielke, executive director of Hamburg-based Oil World, said at conference in Kuala Lumpur.

- Biofuel is very small portion of overall energy demand but requires large amount of vegetable oils to produce

- There’s concern that governments are overdoing what the global market for oils and fats can satisfy

- Vegetable oil prices are seen rising for the rest of the year as market heads into deficit

- Growth in rapeseed and sunflower seed production will disappear next season

- Palm oil production faces threat from El Nino in 2H 2023 and 1H 2024

- “If demand continues for food and biofuel combined, there’s a risk we’ll soon enter a deficit situation”

- Malaysian palm oil production may increase 0.6m tons to 19m tons this year; Indonesia output to climb 1.2m tons to 47.7m tons

- Indonesia palm oil exports will decline slightly this year to 27m tons as domestic consumption outpaces production

- RBD palm olein to average $1,150 a ton in July-Dec. on FOB basis

Malaysia Palm Oil Output to Rise About 3% This Year: Bek-Nielsen

Palm oil production from Malaysia will probably increase by 600,000 to 700,000 tons this year as a labor shortage eases, United Plantations Bhd. Chief Executive Director Carl Bek-Nielsen said in an interview Wednesday.

- NOTE: That represents an increase of about 3% over production last year, which was about 18.5m tons

- Top grower Indonesia may boost production by around 1.2 million tons this year, Bek-Nielsen estimates

- “Palm oil supply is going to be there but I don’t see it growing as rapidly as it used to”

- He expects palm oil prices to remain supported by weather-related supply risks and growing demand for biofuels

Malaysia Should Resume Rollout of B20 Biodiesel Mandate: Group

Malaysian Biodiesel Association urged the government to resume an implementation of the B20 biodiesel mandate this year, President U. R. Unnithan said in an interview Wednesday.

- Government is likely to be supportive because the mandate will help it reduce unwanted subsidies and move toward targeted fuel subsidies

- Biodiesel will become more competitive against non-subsidized diesel

- Group is seeking a meeting with new government to discuss the issue

- NOTE: Malaysia, the world’s No. 2 palm oil producer, slowed implementation of B20 in transport last year to prioritize vegetable oil supply for food

- If higher mandate is implemented, country’s biodiesel production could climb to 1.5 million tons this year from 1.16m in 2022

- As global demand for biofuels surge, Malaysia is lagging behind

- Malaysia was once a leader in biofuel but is becoming a laggard, he said

- Malaysian biodiesel exports may slump further in 2023 to a six-year low of 300,000 tons

- Used cooking oil exports may extend a climb to 800,000 to 900,000 tons this year from a record 700,000 tons last year due to stronger demand from Europe

Philippines confirms African swine fever outbreak in Cebu

The Philippines’ agriculture department on Wednesday confirmed an outbreak of African swine fever in central Cebu province, and has deployed response teams to detect the extent of infection.

The department’s Bureau of Animal Industry said 58 out of 149 blood samples from Carcar City in Cebu tested positive for the diseases, which is not harmful to humans but is highly contagious among pigs.

The latest outbreak adds to the list of active African swine fever cases in 12 of the Southeast Asian country’s more than 80 provinces, based on the agriculture department’s latest data.

“All swine raisers and stakeholders are encouraged to report any unusual pig mortalities and sickness to their respective agriculture/veterinary offices,” the bureau said in a statement.

African swine fever was first detected in the Philippines in 2019, prompting the culling of thousands of pigs since then and significantly reducing the domestic hog population.

Reduced domestic pork supply prompted the Philippines to ramp up meat importation as local prices shot up, adding pressure on inflation.

Bioceres to market GMO wheat in Argentina this year after Brazil win, CEO says –

Argentine biotech firm Bioceres Crop Solutions Corp BIOX.O will market its drought-tolerant genetically modified wheat in Argentina this year, its chief executive said, after a key Brazil approval and dry weather bolstered the case for GMO.

Bioceres is leading the push globally to establish GMO wheat and break a taboo over transgenic wheat going back decades due to consumer fears that allergens or toxicities could emerge in a staple used worldwide for bread, pasta and pastries.

Those fears are now starting to ease as high food prices, the war in Ukraine and more regular droughts hitting crop harvests shift the needle for farmers and flour millers.

In an interview on Tuesday, Bioceres CEO Federico Trucco told Reuters the firm would start to market HB4 wheat this year, though it would focus on working with seed “multipliers,” dedicated to increasing seed numbers versus turning the grain to flour.

“In the first year it will probably only be the multipliers able to scale it, but there may be some bags for producers who want to test the technology,” said Trucco.

The plans come after Brazil approved HB4 wheat for planting last week, and after early trials in Argentina, which has been battered by drought since last year, showed HB4 yields outperforming regular wheat by as much as 43% in dry conditions.

Trucco said the trials used “twin” wheat strains, “identical in all genes except the presence or absence of HB4.”

“We made comparisons between twins in 20 different places in Argentina and the difference was undisputable because there is not a single case where the twin that has HB4 performed less well than the one that does not,” he said.

Bioceres, however, faces a long road ahead, despite approvals and improving acceptance by potential buyers. Brazil, a major food producer, is the largest buyer of Argentine wheat.

The giant South American country is planning to expand testing of HB4 wheat, though it will take four years to test the seed’s adaptability to tropical conditions and it needs more seeds to be able to do large-scale testing.

Trucco said for the 2023/24 season, which starts in May, the firm would work with seed multipliers who could then offer seeds to their own producers. Until now, Bioceres produced HB4 wheat only through direct private deals with farmers.

In Brazil he said HB4 wheat could help eventually expand the wheat planting area by around 50% by making wheat more drought- tolerant. Brazil plants some 3 million hectares with wheat, mostly in southern states like Rio Grande do Sul and Parana.

Beyond Brazil, HB4 wheat has gained approvals for consumption in Australia and New Zealand, as well as Nigeria, where the entry of the GMO grain is allowed.

Bioceres is also keen to make progress in the United States, where it has received a green light from the Food and Drug Administration, but is waiting for approval from the U.S. Department of Agriculture, Trucco said.

“We have had a very active dialogue with the U.S. wheat associations,” said Trucco. “We are working with some American universities that have the germplasm for the area of interest to us, which is mainly the Great Plains.”

US Agriculture Sentiment Fell in February: Purdue Univ.

The Purdue University/CME Group’s agricultural sentiment index fell to 125 points in Feb. from 130 in Jan., according to a survey of 400 agricultural producers.

- Current conditions component declined by 2 points from Jan.

- Future expectations down by 6 points

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |