Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 3/4 in SRW, up 1 3/4 in HRW, up 8 in HRS; Corn is up 2 3/4; Soybeans up 6 1/2; Soymeal up $0.44; Soyoil up 0.31.

For the week so far wheat prices are down 19 in SRW, down 13 1/4 in HRW, down 23 3/4 in HRS; Corn is down 11 3/4; Soybeans up 4 1/2; Soymeal up $0.90; Soyoil down 1.83.

For the month to date wheat prices are down 17 1/4 in SRW, down 10 3/4 in HRW, down 20 1/4 in HRS; Corn is down 2; Soybeans up 45 1/4; Soymeal up $23.00; Soyoil down 0.65.

Year-To-Date nearby futures are down 14.8% in SRW, down 9.2% in HRW, down 11.1% in HRS; Corn is down 6.1%; Soybeans up 0.7%; Soymeal up 4.9%; Soyoil down 7.9%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAY 23) Soybeans up 82 yuan; Soymeal up 12; Soyoil down 42; Palm oil down 28; Corn down 8 — Malaysian palm oil prices overnight were up 24 ringgit (+0.57%) at 4204.

There were changes in registrations (-33 Corn, -40 Soyoil, -70 HRW Wheat). Registration total: 2,587 SRW Wheat contracts; 43 Oats; 62 Corn; 228 Soybeans; 652 Soyoil; 0 Soymeal; 135 HRW Wheat.

Preliminary changes in futures Open Interest as of March 8 were: SRW Wheat up 9,544 contracts, HRW Wheat down 1,076, Corn up 14,414, Soybeans up 3,211, Soymeal down 625, Soyoil down 1,392.

Brazil Grains & Oilseeds Forecast: Scattered showers continue for much of Brazil’s growing regions for the next week outside of Minas Gerais and Rio Grande do Sul, where showers will be more limited. Despite recent rains, many areas have made significant progress with regard to soybean harvest and corn planting. However, some areas are behind, somewhat significantly, and will expose more of the corn crop to the dry season which is forecast start up in April. Corn already in the ground will benefit from good soil moisture.

Argentina Grains & Oilseeds Forecast: Dry conditions continue to be a concern for immature corn and soybeans in Argentina moving forward. Any showers will be limited for at least the next week, though isolated showers may move through at times. Southern areas stand the best chance at continued precipitation going into next week, but for most areas, the rain is too late to have much of an impact. Heat that developed last week continues through next week. The heat and dryness are keeping stresses high for both crops in various stages of growth.

Northern Plains Forecast: Waves of snow will continue across the Northern Plains through the weekend, adding up to some hefty amounts for a lot of the region over the course of this week. Colder air will also be in place across the Northern Plains and Canadian Prairies for a while, with higher inputs than normal required for livestock.

Central/Southern Plains Forecast: Scattered showers continue in the Central and Southern Plains through Thursday. Temperatures will waffle around over the next 10 days, but mainly be cooler than normal. Another system will move through over the weekend with some showers, but precipitation continues to be limited for southwestern areas where drought remains in control.

Midwest Forecast: Waves of precipitation continue for the Midwest through Monday with some heavier amounts expected, including snow across the north. Cooler temperatures will replace the recent warmth but will not be extremely cold.

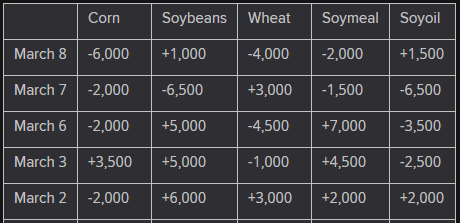

The player sheet for 3/8 had funds: net sellers of 4,000 contracts of SRW wheat, sellers of 6,000 corn, sellers of 1,000 soybeans, sellers of 2,000 soymeal, and buyers of 1,500 soyoil.

TENDERS

- WHEAT PURCHASE: Tunisia’s state grains agency is believed to have purchased about 100,000 tonnes durum wheat in an international tender on Wednesday seeking the same volume, European traders said.

- CORN PURCHASE: Taiwan’s MFIG purchasing group bought about 52,000 tonnes of animal feed corn to expected to be sourced from South Africa in an international tender on Wednesday

- CORN PURCHASE: South Korean animal feed maker Nonghyup Feed Inc. (NOFI) bought an estimated 117,000 tonnes of animal feed corn from optional origins in an international tender for up to 138,000 tonnes on Wednesday

- CORN PURCHASE: South Korea’s Major Feedmill Group (MFG) purchased an estimated 68,000 tonnes of animal feed corn expected to be sourced from South America in an international tender for up to 70,000 tonnes on Wednesday

- FEED BARLEY PURCHASE: Jordan’s state grain buyer purchased about 50,000 tonnes of animal feed barley to be sourced from optional origins in an international tender which closed on Wednesday.

- FEED BARLEY PURCHASE: Japan will import 380 tonnes of feed-quality barley via a simultaneous buy and sell (SBS) auction that closed late on Wednesday, the Ministry of Agriculture, Forestry and Fisheries (MAFF) said. The ministry had sought 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by June 30 and arrive in Japan by August 31 in the tender.

- VEGETABLE OILS TENDER: A Tunisian state agency issued an international tender to purchase up to 9,000 tonnes of vegetable oils.

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy up to 120,000 tonnes of milling wheat which can be sourced from optional origins.

PENDING TENDERS

- WHEAT TENDER: Algeria’s state grains agency OAIC issued an international tender to purchase a nominal 50,000 tonnes of durum wheat

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking a total of 80,570 tonnes of food-quality wheat from the United States and Canada in a regular tender that will close on March 9.

US BASIS/CASH

- Basis values for soybeans and corn shipped by barge to the U.S. Gulf Coast weakened on Wednesday as costs for barge freight ticked lower, traders said.

- Barge loadings were resuming in some locations on the mid-Mississippi River this week after seasonal winter closures, traders said.

- Empty barges were offered on the Illinois River this week at 480% of tariff, down from 490% a day earlier, and barges on the Memphis-to-Cairo segment of the Mississippi River were offered at 300% of tariff, down from 325% a day ago.

- At the Gulf, CIF soybean barges loaded in March were bid at 88 cents over May futures and offered at 98 cents over May futures, down 4 cents from Tuesday’s offers.

- FOB offers for March soybean shipments were around 111 cents over May, unchanged from Tuesday

- For corn, CIF barges loaded in March were bid at 86 cents over May, down a penny from Tuesday.

- FOB basis offers for March corn shipments were around 91 cents over May, steady with Tuesday.

- Spot corn basis bids were mostly steady on Wednesday at U.S. Midwest processors and interior elevators and steady to firm at barge-loading river terminals, grain merchants said.

- Spot basis bids for rail-delivered corn were weaker in the eastern Midwest and unchanged in the southern Plains.

- Soybean basis bids were mostly unchanged around the interior U.S. Midwest and at processing plants, but flat to lower at river locations.

- Farmer sales remained limited on Wednesday as futures prices remained below recent highs. Growers have been waiting for higher prices before booking additional sales to elevators and processors.

- Spot basis bids for soybeans delivered to U.S. Midwest elevators and river terminals were steady to lower on Wednesday morning while basis values at soy crush plants held mostly unchanged, grain merchants said.

- Spot corn basis bids were steady to higher at Midwest ethanol plants and river terminals and mixed at other processors and interior elevators.

- Many farmers have booked sales at higher prices and were waiting to see if the prices improved before committing to new deals.

- Spot basis bids for hard red winter wheat held mostly steady at grain elevators across the southern U.S. Plains on Wednesday on slow farmer sales as futures prices eased, dealers said.

- A recent futures market drop has dragged cash grain prices well below growers’ sales targets. Crop development concerns amid an ongoing drought in the U.S. Plains further discouraged marketing.

- U.S. cash millfeed values held steady on Wednesday, stabilizing after recent weakness as animal feed mixers began incorporating more of the ingredient in their rations.

- Spot basis offers for soymeal were steady to lower around the United States on Wednesday, weighed down by slow demand, dealers said.

- Elevated soymeal prices have blunted end-user demand for the high-protein feed ingredient. Soymeal use is expected to decline as cattle and dairy producers begin putting their livestock out to graze on pastures in the spring.

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

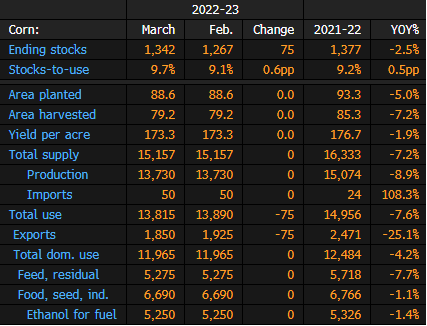

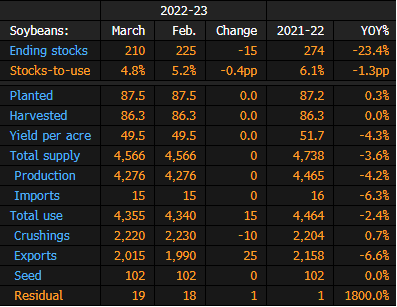

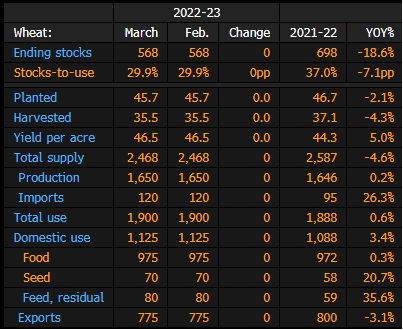

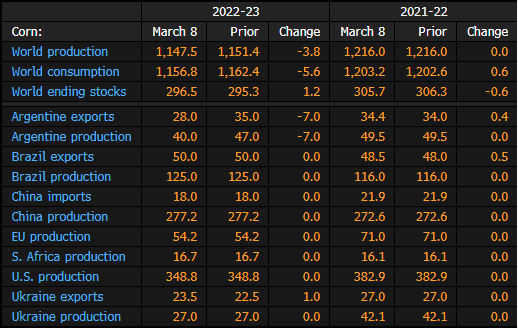

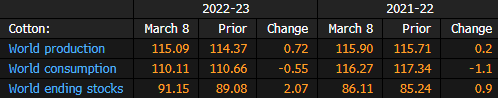

WASDE Headline Results Table

US Crop Estimates From USDA March Report

World Crop Estimates From USDA March Report:

US Exports of Corn, Soybean, Wheat, Cotton in January

DOE: US Ethanol Stocks Rise 2.2% to 25.32M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 24.918 mln bbl

- Plant production at 1.01m b/d, compared to survey avg of 1.012m

Rosario Slashes Argentina Soy Estimate to 27m Tons From 34.5m

The Rosario Board of Trade axed its soybean production forecast by 22% m/m amid a drought that’s “unprecedented in modern agricultural history.”

- It’d be the worst harvest in 15 years, even worse than the 2009 season (31.8m metric tons)

- Bourse warns of more cuts since weather shows no sign of improving

- “There’s no weather event on the horizon that allows us to put floors under yields or under the acreage that won’t get harvested at all”

- Corn estimate also slashed to 35m from 42.5m

Brazil Soymeal Exports Seen Reaching 1.905 Million Tns In March Versus 1.37 Million Tns In Same Month A Year Ago

- BRAZIL SOY EXPORTS SEEN REACHING 14.662 MILLION TNS IN MARCH VERSUS 12.16 MILLION TNS IN SAME MONTH A YEAR AGO- ANEC

- BRAZIL CORN EXPORTS SEEN REACHING UP TO 803,219 TNS IN MARCH VERSUS 107,232 TNS IN SAME MONTH A YEAR AGO- ANEC

- BRAZIL WHEAT EXPORTS SEEN REACHING 612,824 TNS IN MARCH VERSUS 508,164 TNS IN SAME MONTH A YEAR AGO- ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.905 MILLION TNS IN MARCH VERSUS 1.37 MILLION TNS IN SAME MONTH A YEAR AGO- ANEC

Ukraine Grain, Oilseeds Exports Seen at 51m Tons This Season

Ukraine is expected to ship about 51m tons of grain and oilseeds by the end of the season in June, President of the Ukrainian Grain Association Nicholay Gorbachev says at an IFPRI webinar.

- Sees production of grain and oilseeds falling to about 70-72m tons in 2022-23 season, and to about 65m tons in 2023-24

- “Even with this production of grain and even with this potential export, I am not sure we will be able to export all this volume,”

- “The question is how the grain corridor will work”

- Gorbachev says grain corridor is not working well and exporters pay $30-$40 in demurrage charges per ton on each vessel when they are delayed

- If farmers just grow wheat and corn, they will go bankrupt because they are forced to sell at a loss: Gorbachev

Argentina allows exporters to reschedule corn shipments as drought hobbles harvest

Argentina announced on Wednesday it would allow exporters to reschedule planned corn shipments for up to 180 days as the country’s agricultural sector has been hobbled by a historic drought, causing harvests to wither.

The measure, published in Argentina’s Official Gazette, was announced the same day the Rosario Grains Exchange cut its corn harvest estimate for the 2022/2023 season to 35 million tonnes, around two-thirds the estimate at the beginning of the season.

Argentina is the world’s No. 3 corn exporter. However, the South American nation has limited shipments out of the country to guarantee supply for domestic demand, which the government estimates at around 21 million tonnes per harvest season.

Exporters are currently allowed to ship up to 20 million tonnes of this season’s corn, but Argentina could roll back that number as the drought is expected to continue to tackle the toll.

So far, exporters have declared 10.8 million tonnes of corn sales from the 2022/2023 season, which began harvesting in recent weeks.

The extension granted Wednesday follows a similar decision by the government in November, when wheat exporters were granted a nearly year-long extension due to the drought’s impact on the harvest.

Ukraine’s Grain Harvest May Fall 37% Y/y: Agriculture Academy

The grain harvest may fall 37% y/y to 34m tons this year because of war, dry weather in late summer and commodity prices, the National Academy of Agrarian Sciences said on its website on Wednesday.

- Oilseeds harvest may rise 13% y/y to 19.3m tons

- Smaller winter-grain planting may partially be compensated by spring grains

- NOTE: The NAAS is a state-owned self-governed academic institution

UN Says Russia Delegation to Head to Geneva for Grain-Deal Talks

The UN expects a Russian delegation in Geneva next week for discussions, Farhan Haq, a spokesperson for the UN’s secretary-general, said at a press briefing when asked about the next steps in talks to renew the Black Sea Grain Initiative.

- It will include discussions with Rebeca Grynspan, who has been working to clear obstructions for Russian exports, including fertilizer, he said

- NOTE: Grynspan is the secretary-general of the UN Conference on Trade and Development

Argentina Grants Delay for Corn Exports Amid Drought-Hit Crop

Argentine exporters that have lined up corn cargoes between March 1 and July 31 are allowed to postpone shipments by as much as 360 days, according to an Agriculture Secretariat resolution.

- The government says it has taken the measure to help exporters fulfill sales to global clients as a drought cripples the upcoming harvest, also implying that it is protecting domestic livestock-feed buyers

- “As a result of the great drought affecting all of Argentina, and with corn highly impacted, it’s necessary to adopt measures to mitigate its consequences and their implications for exports”

- “In the face of this extraordinary situation, it’s necessary to try to look after all of the parties involved throughout the grain trade”

- NOTE: Through March 1 exporters had registered 10.6m metric tons of the upcoming 2022-23 corn crop for shipment

- NOTE: The Rosario Board of Trade, which leads other crop prognosticators, is scheduled to publish new monthly production estimates in the next 24 hours

Uruguay Farm Giant ADP Sees Drought Boosting Winter Crops

Farmers stung by a deep summer drought that has shriveled soy and corn fields will probably plant more winter crops such as rapeseed, wheat and barley, Agronegocios del Plata executive director Marcos Guigou said in an interview.

- ADP, as the company is known, could plant 10% more hectares in the coming Southern hemisphere winter, said Guigou, who runs one of Uruguay’s biggest farm companies

- Farm sector is well positioned to rebound from drought thanks to good harvests in 2021-22, reasonable debt levels and equipment investments

- “It’s like a slap in the face to a boxer who is in good shape,” Guigou said. “The biggest impact will be for the country because there will be a strong drop in soy exports”

- Yields on ADP’s 20,000 hectares of soy could fall 50% y/y to around 1,400 kilos to 1,500 kilos per hectare

- “There are going to be big losses on soy and corn,” Guigou said. “The outlook for productivity gets worse week by week”

- NOTE: Uruguay 2023 Soy Crop Seen Falling 36% y/y to 2.1M Tons: Exante

- Falling international costs of inputs such as fertilizers and herbicide will help farmers’ bottom line next year

- ADP, which raises 45,000 to 50,000 head of cattle a year, has observed stronger demand for cows by meatpackers in the last 15 days

China’s Sinograin to start buying soybeans from Inner Mongolia, Heilongjiang

China Grain Reserves Corporation Group, known as Sinograin, will soon start purchasing domestic soybeans from Inner Mongolia region and Heilongjiang province, the company said on its website on Thursday.

The purchase price will be announced later by local media in Heilongjiang and Inner Mongolia, said the announcement.

Paraguay soybean production down as late season dryness lowers yields – Refinitiv Commodities Research

2022/23 PARAGUAY SOYBEAN PRODUCTION: 9.2 [8.4–9.9] MILLION TONS, DOWN 3% FROM LAST UPDATE

2022/23 Paraguay soybean is lowered by 3% to 9.2 [8.4-9.9] million tons as foreseeable dryness into the late season affects yields over the key crop areas southeastern Oriental belt. Our median production estimate is slightly below the USDA World Agricultural Outlook Board (WAOB)’s 10 million tons, which assumes national level area and yield at 3.45 million hectares and 2.9 tons per hectare (tph), respectively (vs. Refinitiv Ag Research’s 3.53 thousand hectares and 2.6 tph, respectively).

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |