Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 1/2 in SRW, up 1 1/4 in HRW, down 2 1/4 in HRS; Corn is down 3/4; Soybeans up 2 1/2; Soymeal up $0.12; Soyoil up 0.10.

For the week so far wheat prices are up 9 3/4 in SRW, up 13 1/2 in HRW, up 13 3/4 in HRS; Corn is up 4 1/4; Soybeans up 16 1/2; Soymeal up $0.21; Soyoil up 1.38.

For the month to date wheat prices are down 7 in SRW, up 48 3/4 in HRW, up 4 1/2 in HRS; Corn is up 17 1/4; Soybeans down 34 1/4; Soymeal down $19.90; Soyoil down 5.39.

Year-To-Date nearby futures are down 11.8% in SRW, down 3.0% in HRW, down 7.2% in HRS; Corn is down 4.6%; Soybeans down 4.9%; Soymeal down 6.5%; Soyoil down 14.4%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JUL 23) Soybeans up 7 yuan; Soymeal up 6; Soyoil up 112; Palm oil up 136; Corn down 1 — Malaysian palm oil prices overnight were up 112 ringgit (+3.13%) at 3688.

There were changes in registrations (-11 Soybeans, -30 HRW Wheat). Registration total: 2,537 SRW Wheat contracts; 23 Oats; 73 Corn; 177 Soybeans; 613 Soyoil; 1 Soymeal; 41 HRW Wheat.

Preliminary changes in futures Open Interest as of March 27 were: SRW Wheat up 1,128 contracts, HRW Wheat up 554, Corn down 2,419, Soybeans up 6,992, Soymeal down 1,954, Soyoil up 3,208.

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Isolated showers Tuesday-Friday. Temperatures near normal Tuesday, above normal Wednesday-Friday. Mato Grosso, MGDS and southern Goias: Isolated showers through Friday. Temperatures near to above normal through Friday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Mostly dry Tuesday. Isolated shower Wednesday-Friday. Temperatures above normal Tuesday-Wednesday, near to below normal Thursday-Friday. La Pampa, Southern Buenos Aires: Isolated showers Tuesday. Mostly dry Wednesday. Isolated showers Thursday-Friday. Temperatures above normal Tuesday-Wednesday, near to below normal Thursday-Friday.

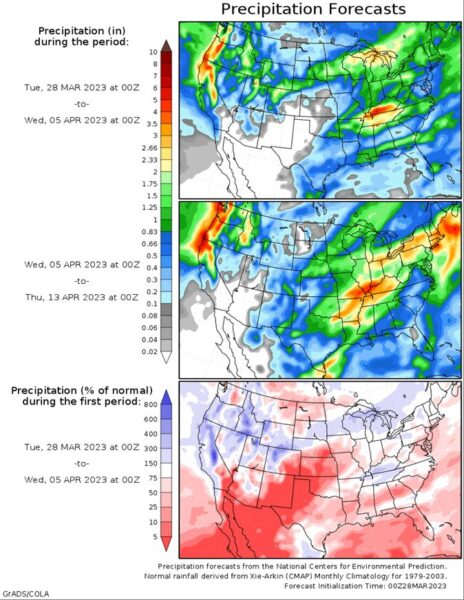

Northern Plains Forecast: Isolated showers through Thursday. Scattered showers south Friday. Temperatures below to well below normal through Friday. Outlook: Isolated to scattered showers Saturday-Tuesday. Mostly dry Wednesday. Temperatures below to well below normal Saturday-Wednesday.

Central/Southern Plains Forecast: Mostly dry Tuesday-Wednesday. Isolated to scattered showers Thursday-Friday. Temperatures below normal Tuesday, near normal Wednesday, near to above normal Thursday-Friday. Outlook: Mostly dry Saturday-Sunday. Isolated to scattered shower Monday-Tuesday. Mostly dry Wednesday. Temperatures near to below normal Saturday, near to above normal Sunday-Monday, near to below normal Tuesday-Wednesday.

Western Midwest Forecast: Isolated to scattered showers through Friday. Temperatures below normal through Wednesday, below normal north and above normal south Thursday-Friday.

Eastern Midwest Forecast: Isolated to scattered showers through Friday. Temperatures near to below normal through Wednesday, near to above normal Thursday-Friday. Outlook: Isolated to scattered showers Saturday-Wednesday. Temperatures variable Saturday-Wednesday.

The player sheet for 3/27 had funds: net buyers of 5,500 contracts of SRW wheat, buyers of 4,000 corn, buyers of 7,500 soybeans, buyers of 500 soymeal, and buyers of 4,500 soyoil.

TENDERS

- CORN SALES: The U.S. Department of Agriculture on Monday confirmed private sales of 112,800 tonnes of U.S. corn to “unknown” destinations for delivery in the 2022/23 marketing year that began Sept. 1, 2022.

PENDING TENDERS

- CORN TENDER: Algerian state agency ONAB issued an international tender to purchase up to 70,000 tonnes of animal feed corn to be sourced from Argentina or Brazil

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 121,800 tonnes of rice

- WHEAT TENDER: Turkey’s state grain board TMO issued an international tender to purchase an estimated 695,000 tonnes of milling wheat.

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy up to 120,000 tonnes of milling wheat which can be sourced from optional origins.

US BASIS/CASH

- Basis bids for soybeans and corn shipped by barge to the U.S. Gulf Coast were relatively steady on Monday, as barge freight costs continued to firm, traders said.

- Rising river conditions on the Ohio, Illinois and Lower Mississippi Rivers are impacting barge towing sizes, according to the Ingram Marine Group. Improved shipping conditions on the Mississippi River are making U.S. supplies attractive to Chinese buyers, analysts said.

- Empty barges on the Mississippi River at St. Louis were offered Monday at 475% of tariff, up from 460% on Friday, and traders also noted increased demand for spot freight and rising freight costs on the Illinois River.

- Two export grain brokers said farmer customers along the southern parts of the Ohio River, and near the Kentucky and Tennessee state border, are gearing up to start planting corn this weekend.

- CIF Gulf soybean barges loaded in March were bid at 105 cents over May, steady from Friday. April soy barges were bid up 2 cents at 98 cents over futures.

- FOB basis offers for April soybean export loadings were around 116 cents over futures, steady from Friday, and May offers were steady at 110 cents over futures.

- For corn, CIF barges loaded in March were bid at 92 cents over May, up 1 cent from Friday. April corn barges were bid at 91 cents over futures.

- FOB basis offers for April corn export loadings held at around 103 cents over futures, and May loadings were offered around 100 cents over futures.

- Spot basis bids for corn weakened at processors, river terminals and ethanol plants around the U.S. Midwest on Monday morning, grain dealers said.

- The corn basis was unchanged at the region’s interior elevators.

- Cash bids for soybeans were steady to firm at river terminals and interior elevators.

- Processors bids for soybeans were flat.

- Spot basis bids for soybeans and corn were mostly steady at U.S. Midwest processors, grain elevators and river terminals on Monday, dealers said.

- Country movement was light, with farmers shrugging off a rally in the futures market that pulled cash prices higher.

- Most growers were waiting to see if the U.S. Agriculture Department’s annual Prospective Plantings report on Friday sparks a rally that moves prices closer to targets they had set earlier, an Ohio dealer said.

- Analysts were expecting the report to show farmers planned to seed 90.88 million acres of corn and 88.242 million acres of soybeans in 2023.

- Although the basis was mostly steady, processor bids rose by 10 cents a bushel in Des Moines, Iowa.

- Spot basis bids for hard red winter wheat were flat at grain elevators across the southern U.S. Plains on Monday, dealers said.

- Farmer sales were slow, with the combination of low prices and concerns that dry weather will limit the size of this year’s harvest chilling growers’ interest in booking new deals, an Oklahoma dealer said.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City rose by 3 cents a bushel for wheat with protein content ranging from 12% to 12.8%, according to the latest CME Group data.

- Premiums were 12 cents higher for wheat with protein content of 11.6% or 11.8% and unchanged for all other protein grades.

- Spot basis offers for U.S. soymeal were mostly unchanged at rail and truck market processors on Monday, dealers said.

- Demand was light but was expected to pick up in the coming days, a dealer said.

- Many end users had been delaying their orders for April shipments as futures prices had fallen sharply during March.

- Those end users would have to make deals this week to ensure they would have enough soymeal to last them through April, the dealer added.

- Although the truck basis was mostly steady, offers rose by $5 a ton in Mankato, Minnesota.

- On the export front, offers for soymeal loaded onto ocean-going vessels at the U.S. Gulf were weak.

- CIF offers for soymeal barges headed for the Gulf were unchanged.

US Winter Wheat Crop Conditions by State for March 26: USDA

The following table shows the most current winter wheat conditions for selected states as of March 26, according to the USDA’s state crop progress and conditions reports.

- Kansas good/excellent rating held at 19% for the week

- Oklahoma conditions raised by 5 percentage points to 34% good/excellent

- Texas conditions lowered by 5 points to 18% good/excellent

US Inspected 666k Tons of Corn for Export, 889k of Soybean

In week ending March 23, according to the USDA’s weekly inspections report.

- Corn: 666k tons vs 1,192k the previous wk, 1,615k a yr ago

- Soybeans: 889k tons vs 720k the previous wk, 632k a yr ago

- Wheat: 392k tons vs 375k the previous wk, 344k a yr ago

Canada Canola Processing Rose 29.1% Y/y in February: StatCan

Canola processing rose 29.1% in February from a year ago, according to Statistics Canada data released Monday on agency’s website.

- Oil production totaled 337k tons, and meal output at 482k tons

- Aug.-Feb. crushings up 12.2% from year ago to 5.703m tons

- NOTE: Canada is the world’s top canola grower

Brazil 2022/23 Soy Harvest 70% Done as of March 23: AgRural

Compares with 62% in the previous week and 75% a year earlier, consulting firm AgRural says in emailed report.

- NOTE: Estimate for 2022/23 soy crop was revised by AgRural to 150.3m tons on March 16, from 150.9m tons

- Center-South’s winter corn planting was 96% done, compared to 91% in the previous week and 100% a year ago

- Summer corn harvest reached 58% in the Center-South, compared to 51% in the previous week and 54% a year ago

WHEAT/CEPEA: Quotations fade in Brazil and abroad

Wheat prices are fading in the Brazilian and the international markets. In Brazil, the lack of purchasers in the market pressed down quotations in the last days – agents from mills consulted by Cepea reported to have stocks. On the other hand, sellers are interested in closing deals, aiming to make room in warehouses for the summer crop. Abroad, devaluations were linked to the progress in the export agreement from the Black Sea.

Cepea surveys show that, between March 17-24, the prices paid to wheat farmers dropped 5.5% in Paraná, 2.29% in Santa Catarina and 0.22% in Rio Grande do Sul. In the wholesale market (deals between processors), values decreased 2.37% in São Paulo and 0.63% in PR but rose 1.07% in RS and 0.26% in SC. In the same period, the US dollar decreased 0.5%, to BRL 5.248 on March 24th.

In the United States, quotations followed opposite trends at the stock exchanges of Chicago and Kansas last week. In Chicago, contracts were pressed down by the renewal of the grains export agreement from the Black Sea, high supply from both Russia and Australia, higher quality of the crops in the USA and the low prices of the Russian cereal. On the other hand, in Kansas, quotations were underpinned by technical corrections – after previous decreases – and the possible halt in the Russian exports, due to the recent devaluations and/or higher export tariffs.

Based on data from Conab (Brazil’s National Company for Food Supply), between March 13-17, the import parity price for the wheat from Argentina delivered to Paraná State was USD 360.02/ton. Considering the average of the US dollar in that period, at BRL 5.2657, the wheat imported was sold at BRL 1,895.76/ton, while for the Brazilian wheat traded in Paraná, the average was lower, at BRL 1,644.16/ton, according to data from Cepea. In Rio Grande do Sul, the price of the product from Argentina closed at USD 337.88/ton, which accounts for BRL 1,779.16/ton – against BRL 1,450.21/ton on the average of the State calculated by Cepea.

USDA attache sees larger Canadian canola crop in 2023/24, smaller soy crop

Following are selected highlights from a report issued by the U.S. Department of Agriculture’s (USDA) Foreign Agricultural Service (FAS) post in Ottawa:

“Dryness persists in scattered growing areas of Alberta and Saskatchewan. However, there is still time for spring precipitation. Meanwhile, most eastern soybean producers await warmer temperatures to dry the heavy-to-adequate snow accumulation. MY (marketing year) 2022/23 canola seed production rebounded on improved growing conditions, and exports to China increased after access was reinstated for Canada’s two largest canola-handling companies. … In MY 2023/24, Canada’s net total production of oilseeds (canola, soybean, and sunflower seeds) is forecast to decrease by less than 1% to 24.7 million metric tons (MT). Canola production is forecast to increase while soybean production is forecast down. Statistics Canada’s planting intentions survey was not available at the time of this report.”

Brazil courts Chinese investment in farm infrastructure

Brazil is courting fresh investment from top Chinese grains trader COFCO, as the company plays a growing role in the South American nation’s booming farm exports, Agriculture Minister Carlos Favaro told Reuters on Monday.

Favaro proposed investing in Brazilian railways and waterways to COFCO’s board during a meeting in Beijing last week, he said, as well as financing the restoration of farmland.

State-owned COFCO could not be reached for comment after business hours.

COFCO has already invested in Santos, Brazil’s top soybean port, and is currently expanding its export terminal capacity to 14 million tonnes to help it feed China’s voracious demand for soybeans.

But Brazil is also a new supplier of corn to China. COFCO was a key player in opening up the market late last year to Brazilian supplies, said Favaro, and behind the purchase of all 1.5 million tonnes of corn shipped to China so far.

Favaro travelled to Beijing last week, ahead of a planned visit by Brazil’s President Luiz Inacio Lula da Silva. Lula cancelled his visit after falling ill with pneumonia but is expected to reschedule the trip in coming months.

China’s customs authority approved four new Brazilian meat plants for export to the country during Favaro’s visit.

More are expected in coming weeks, said Favaro, who was speaking through a translator, after a list of 50 more beef, pork and chicken facilities was presented with customs.

An agreement to allow for electronic certification of meat export facilities will be signed when Lula travels to Beijing, which will speed up approvals, added Favaro.

The minister plans to visit state-owned ChemChina’s Syngenta laboratories on Tuesday to discuss gene editing.

US Hog and Pig Inventory Survey Before USDA Report

The US hog herd as of March 1 seen rising 0.4% from a year earlier to 72.97m head, according to the average in a Bloomberg Survey of seven analysts.

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |