Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 1 in SRW, up 4 3/4 in HRW, down 1/2 in HRS; Corn is up 3; Soybeans up 1/4; Soymeal down $0.06; Soyoil down 0.02.

For the week so far wheat prices are up 17 1/4 in SRW, up 27 1/4 in HRW, up 20 in HRS; Corn is up 10 1/2; Soybeans up 49 1/4; Soymeal up $1.25; Soyoil up 2.09.

For the month to date wheat prices are up 1/4 in SRW, up 62 1/2 in HRW, up 10 3/4 in HRS; Corn is up 23 1/4; Soybeans down 1 1/2; Soymeal down $9.50; Soyoil down 4.68.

Year-To-Date nearby futures are down 10.9% in SRW, down 1.4% in HRW, down 6.5% in HRS; Corn is down 3.7%; Soybeans down 2.7%; Soymeal down 4.4%; Soyoil down 13.2%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JUL 23) Soybeans down 22 yuan; Soymeal down 4; Soyoil up 28; Palm oil up 16; Corn down 2 — Malaysian palm oil prices overnight were up 81 ringgit (+2.19%) at 3788.

There were changes in registrations (-11 Soybeans, -4 HRW Wheat). Registration total: 2,537 SRW Wheat contracts; 23 Oats; 73 Corn; 166 Soybeans; 613 Soyoil; 1 Soymeal; 37 HRW Wheat.

Preliminary changes in futures Open Interest as of March 29 were: SRW Wheat up 1,417 contracts, HRW Wheat down 2,556, Corn down 8,197, Soybeans up 8,540, Soymeal up 583, Soyoil up 4,952.

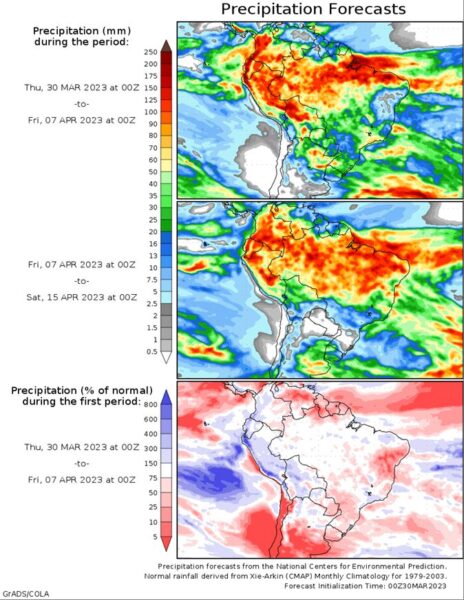

Brazil Grains & Oilseeds Forecast: Wet season showers have become isolated through central Brazil and are forecast to remain that way through April, leaving some concern for enough available soil moisture for developing safrinha corn. Systems moving through Argentina will bring showers into southern Brazil, however, which may enhance showers there at times.

Argentina Grains & Oilseeds Forecast: Argentina continues to be active with several more fronts moving through with more showers going into April. Heavy rain last week and this week is too late to turn around damaged corn and soybeans. Temperatures look to waffle a bit more as it starts to come to fall harvest time..

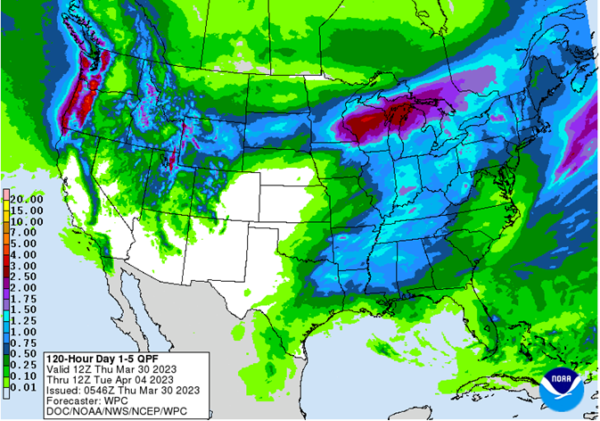

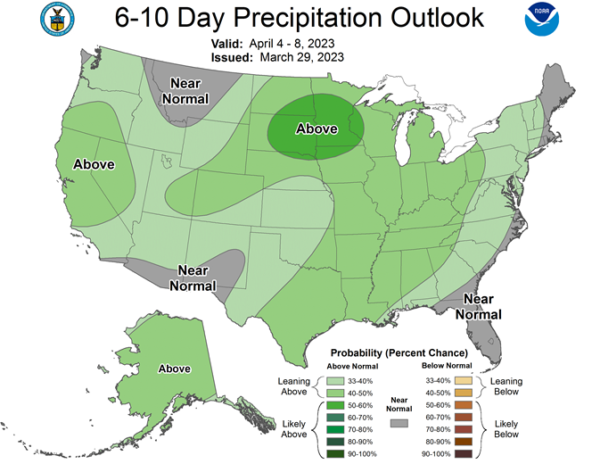

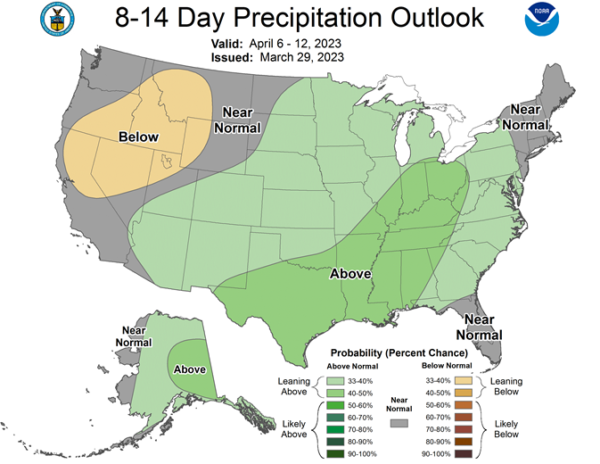

Northern Plains Forecast: Some occasional snow continues in the Northern Plains and Canadian Prairies through Thursday, with a heavier band in South Dakota moving through on Friday that could add to the snowpack. Cold temperatures will limit melting for yet another week, and the risk of significant flooding will increase when temperatures turn higher, perhaps abruptly.

Central/Southern Plains Forecast: A larger storm builds across the Central and Southern Plains Thursday into Friday. Northern and eastern areas again look to have the best chance for precipitation while strong winds develop elsewhere, sapping soil moisture. The outlook for the southwestern Plains remains grim as this area gets missed by yet another large storm. A similar large storm is expected next week.

Midwest Forecast: Another strong storm will move through the Midwest Thursday into Saturday with widespread precipitation, severe storms, strong winds, and a band of snow across the north as we turn the calendar to April. The wetter conditions across a lot of the region are causing a slow start to fieldwork.

Eastern Midwest Forecast: Isolated to scattered showers through Saturday. Mostly dry Sunday. Temperatures near to below normal Wednesday-Thursday, above normal Friday, near to below normal Saturday-Sunday. Outlook: Isolated to scattered showers Monday-Wednesday. Mostly dry Thursday-Friday. Temperatures above normal Monday-Tuesday, below normal Wednesday-Thursday, near normal Friday.

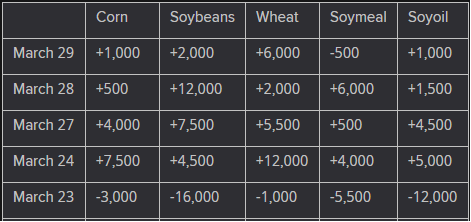

The player sheet for 3/29 had funds: net buyers of 6,000 contracts of SRW wheat, buyers of 1,000 corn, buyers of 2,000 soybeans, sellers of 500 soymeal, and buyers of 1,000 soyoil.

TENDERS

- CORN SALES: The U.S. Department of Agriculture on Wednesday confirmed exporters sold 204,000 tonnes of U.S. corn to China for delivery in the 2022/23 marketing year that began Sept. 1, 2022.

- WHEAT PURCHASE: Turkey’s state grain board TMO has purchased 395,000 tonnes of milling wheat out of a tender for 695,000 tonnes held on Tuesday

- NO PURCHASE IN FEED BARLEY TENDER: Jordan’s state grain buyer is believed to have made no purchase in an international tender for 120,000 tonnes of animal feed barley which closed on Wednesday

PENDING TENDERS

- CORN TENDER: Algerian state agency ONAB issued an international tender to purchase up to 70,000 tonnes of animal feed corn to be sourced from Argentina or Brazil.

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 121,800 tonnes of rice.

US BASIS/CASH

- Basis bids for corn shipped by barge to the U.S. Gulf Coast firmed on Wednesday, as corn export sales to China continued and empty barge freight costs eased, traders said.

- Rates for empty barges on parts of the Mississippi and Illinois Rivers declined.

- Cargill Inc said it would no longer handle Russian grain at its export terminal after July, although the company’s shipping unit will continue to carry grain from Russia’s ports.

- As of Wednesday afternoon, traffic resumed with restrictions on the Ohio River, after a navigation accident occurred early on Tuesday near the lower McAlpine Dam at mile 606.8, Louisville Emergency Management Services said.

- Two barges remained pinned against the dam structure, the office said.

- Ingram Barge Company said it owns the barges but was not operating them when the accident occurred.

- CIF soybean barges loaded in January traded at 114 cents over May futures.

- CIF Gulf soybean barges loaded in March were bid at 107 cents over May, down 1 cent from Tuesday. April soy barges were bid up 3 cents at 100 cents over futures.

- FOB basis offers for April soybean export loadings were around 117 cents over futures, up 1 cent from Tuesday; May offers were also up 1 cent at around 111 cents over futures.

- CIF corn barges loaded in May traded at 88 cents over May.

- For corn, CIF barges loaded in March were bid at 95 cents over May futures, up 1 cent, while April corn barges were bid up 2 cents at 94 cents over futures.

- FOB basis offers for April corn export loadings were offered at 104 cents over futures, up 1 cent from Tuesday, while May loadings were steady at around 100 cents over futures.

- Spot basis bids for corn were steady to weak at U.S. Midwest processors and river terminals on Wednesday, grain dealers said.

- Cash bids for soft red winter wheat also were steady to weak at processors, dropping by 10 cents a bushel near Chicago.

- The cash basis for both grains was flat at the region’s interior elevators.

- Soybean bids held steady at processors, elevators and river terminals.

- Spot basis bids for soybeans rose at river terminals and elevators around the interior of the U.S. Midwest on Wednesday morning, dealers said.

- The soy basis held steady at the region’s processors.

- Farmer sales of soybeans have slowed in recent weeks as futures weakness dragged cash prices lower.

- Dealers were using higher cash bids to try to spark a fresh round of sales.

- Cash bids for corn were steady to weak at ethanol plants and processors, and steady to firm at grain elevators.

- The corn basis was unchanged at river terminals.

- Spot basis bids for hard red winter wheat held steady at truck and rail market elevators across the southern U.S. Plains on Wednesday, grain dealers said.

- Farmer sales were slow as growers were waiting to see how their drought-stressed crops develop in the coming weeks before booking new deals, Oklahoma dealer said.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City were strong, rising by 3 cents a bushel for wheat with protein content ranging from of 11.6% through 14%, according to the latest CME Group data.

- Premiums rose by 13 cents a bushel for wheat with protein content of 11%, 11.2% and 11.4% and by 15 cents a bushel for ordinary protein wheat.

- U.S. spot cash millfeed values firmed on Wednesday, as run times at some mills began to slow, supplies began to tighten, and corn futures have rallied this week, ingredient dealers said.

- Supplies of the alternative animal feed product are expected to tighten from now through next week, as mills begin to shorten run times ahead of the Good Friday holiday on April 7, brokers said.

- Mills in parts of the northeast and the “Central States” region covering Ohio and neighboring states have seen slow run times and flour orders backing up in the second quarter of this year, two brokers said.

- One broker said run times may have slowed as consumers and food companies balk at higher prices for baked goods and flour.

- Spot basis offers for soymeal fell at truck market processors in the western half of the U.S. Midwest on Wednesday, dealers said.

- The basis was flat at eastern truck processors and in the rail market.

- Demand was edging higher as end users scrambled to book their orders for April shipment, an Iowa dealer said.

DOE: US Ethanol Stocks Fall 2.5% to 25.527M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 25.992 mln bbl

- Plant production at 1.003m b/d, compared to survey avg of 1.001m

Brazil may supply up to 50% of Argentina’s soy imports in 2023, analysts say

Brazil is poised to supply up to half of the soybeans that Argentina will import after the worst drought in 100 years devastated its fields and cut 2023 output nearly in half, analysts said.

Argentina, which is expected to reap round 25 million tonnes this season, may have to import up to 10 million tonnes of soy, more than double than in previous years, mainly from Paraguay and Brazil, they said.

Brazil is harvesting a record crop and could increase sales to Argentina by at least 10 times, said Sol Arcidiacono, the Rosario-based head of Latam Grains at hEDGEpoint Global Markets.

Brazil will export at least 3 million tonnes to Argentina, but if international soymeal prices pay off, that volume can reach 5 million tonnes, Arcidiacono said, adding that Argentine crushers’ margins are currently negative.

Argentina’s slowest farmer selling in 20 years is also driving imports, Arcidiacono added.

The U.S. Department of Agriculture estimates the Paraguayan 2022/23 harvest at 10 million tonnes. It also expects Argentina to remain the world’s biggest soymeal exporter despite the nation’s soy crop and crushing woes.

Brazil may export up to 97 million tonnes to all destinations on the back of a bumper crop, said Carlos Gogo, a consultant. Some 5 million tonnes may be shipped to Argentina, or more, depending on Chinese demand, he added.

Bolivia and Uruguay will supply soy to Argentina, analysts said.

There are reports of shipments of Brazilian soybeans leaving for Argentina from Porto Murtinho, in the state of Mato Grosso do Sul, and Santarem, in the state of Para, a market source said.

“I understand that the price in Brazil dropped so much with the record harvest, that it became feasible to export (to Argentina) from Northern ports,” the source said.

Agrinvest soybean analyst Eduardo Vanin said if Brazilian soy premiums continued to fall, Brazilian suppliers will remain competitive against their Paraguayan counterparts to sell to Argentina.

Grain companies in Mato Grosso do Sul are estimating a record export of 1.6 million tonnes of soybeans to Argentina via Porto Murtinho and across the dry border to Concepcion, Paraguay, he said.

It is possible that there are shipments from other ports, but the options are limited, Vanin added.

USDA February soybean crush seen at 175.7 million bushels

U.S. soybean processors likely crushed 5.272 million short tons, or 175.7 million bushels, of soybeans in February, the most ever for the second month of the year, according to the average forecast of nine analysts surveyed by Reuters ahead of a monthly U.S. Department of Agriculture (USDA) report.

If the estimate is realized, the crush would be down from the 191.1 million bushels that USDA reported as processed in January but up from the February 2022 crush of 174.4 million bushels. It would also be the largest February crush on record, topping the 175.3 million bushels processed in February 2020.

Crush estimates ranged from 172.0 million bushels to 180.0 million bushels, with a median of 175.2 million bushels.

The USDA is scheduled to release its monthly fats and oils report at 2 p.m. CDT (1900 GMT) on Monday, April 3.

U.S. soyoil stocks as of Feb. 28 likely declined to 2.339 billion lbs, based on the average of estimates from six analysts.

If realized, the supply would be down from 2.356 billion lbs at the end of January and below stocks totaling 2.566 billion lbs at the end of February 2022.

Estimates for soyoil stocks ranged from 2.324 billion to 2.385 billion lbs, with a median of 2.325 billion lbs.

National Oilseed Processors Association (NOPA) members, which account for about 95% of soybeans processed in the United States, crushed 165.414 million bushels of soybeans last month, down 7.6% from the 179.007 million bushels processed in January but up 0.2% from the February 2022 crush of 165.057 million bushels.

Soyoil supplies held by NOPA members as of Feb. 28 fell to 1.809 billion lbs, down 1.1% from January.

Ukraine’s grain exports exceed 5 mln tonnes in March – ministry

Ukraine’s grain exports have reached 5.1 million tonnes so far in March compared to 1.4 million tonnes in March 2022, the agriculture ministry data showed on Wednesday.

Ukrainian Black Sea ports, main routes for grain exports, were blocked after the Russian invasion in February 2022, causing a sharp fall in shipments which were available only via small Danube river ports or via western border.

The ministry said Ukraine’s overall grain exports fell by 16.7% to 37.4 million tonnes so far in the 2022/23 July-June season from the same period in 2021/22.

The volume so far in the current season included about 12.8 million tonnes of wheat, 22 million tonnes of corn and 2.27 million tonnes of barley.

After an almost six-month blockade caused by Russia’s invasion, three Ukrainian Black Sea ports were cleared at the end of July under a deal between Moscow and Kyiv brokered by the United Nations and Turkey.

A major grain producer and exporter, Ukraine is likely to see a drop in grain output to about 53 million tonnes in clean weight in the 2022 calendar year from a record 86 million tonnes in 2021.

Officials have blamed the fall on hostilities in the country’s eastern, northern and southern regions.

The government has said Ukraine can harvest 44.3 million tones of grain, including 16.6 million tonnes of wheat, in 2023.

Argentina’s grains inspectors union to launch strike

Argentina’s grains inspectors union said it will launch a indefinite strike over wage demands starting after midnight on Thursday targeting grains storage facilities.

The URGARA union is an association of grain technicians who analyze grains held in storehouses and loaded on ships, so their strike could affect the country’s grain trade.

Argentina is the world’s leading exporter of soybean oil and meal, and the third-largest exporter of corn.

The union said in a statement that the strike, which will follow the expiration of a government-mandated conciliation period, would target grains storage facilities rather than ports.

Their demands come at a time when inflation has surged, with annual inflation exceeding 102% in February, which has hammered the purchasing power of Argentines and outstripped wages.

“We request the timely scheduled review of the sector’s salaries in order to correct the serious deterioration suffered by the salaries of our members in the face of the continuous and serious inflationary spiral that has destroyed them,” URGARA said in the statement.

India Asks Farmers to Harvest Matured Crops to Avoid Hail Damage

Farmers should complete harvesting of matured crops in some northern states, including Punjab, Haryana, Uttar Pradesh and Rajasthan, to prevent any damage from hailstorms and gusty winds, according to the India Meteorological Department.

- Rains and hailstorms are expected in some parts of northwestern, central and eastern regions for two days from Thursday, the weather office said in statement Wednesday

- Showers seen in northeastern parts for five days from Wednesday

- Farmers should drain out excess water from fields and provide “mechanical” support to horticultural crops in the northeastern region

- No heat waves likely in any part of the country during next five days

- Maximum temperatures may fall by 2-4C for four days from Thursday in northwestern region; could drop by 2-4C for three days from Friday in eastern parts

- Temperatures will rise by 2-3C in western state of Maharashtra from Saturday

Kazakhstan Plans to Halt Imports of Wheat by Road for Six Months

Kazakhstan’s agriculture ministry plans to stop wheat imports by road for six months, it said in a statement.

- Decision is because the Kazakh grain and flour market is suffering from illegal shipments of grain, ministry says

- Imported wheat is re-exported to other countries to avoid tariffs, ministry says

- NOTE: Kazakhstan is part of a customs union with Russia

Fertilizer Outlook at Risk as Cool Spring Threatens Plantings

Nitrogen costs have eased from 2022 levels but remain elevated

Farmers could switch from corn to soybean depending on weather

By Kim Chipman and Michael Hirtzer

(Bloomberg) —

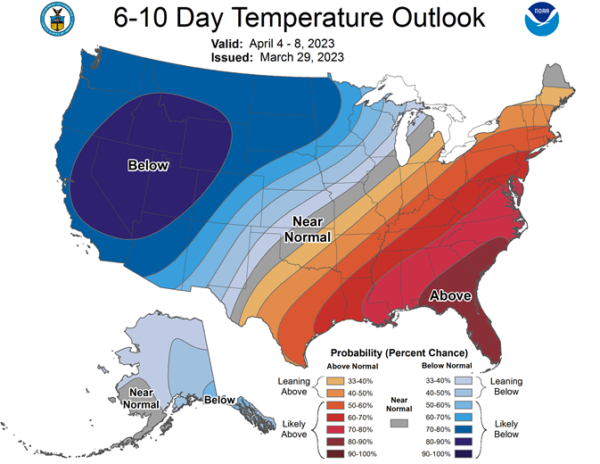

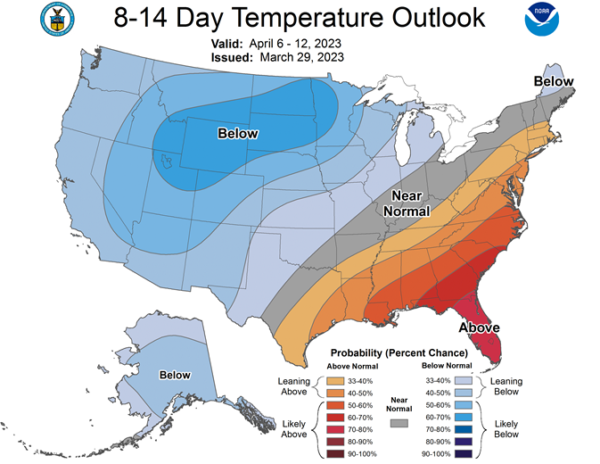

A colder-than-normal spring threatens to cut into US grain seedings, potentially crimping fertilizer use just as the world’s biggest crop nutrient companies are banking on higher demand.

The industry has hopes for more acreage and fertilizer applications following last year’s massive market disruptions after Russia’s invasion of Ukraine. Nutrien Ltd., the world’s largest fertilizer company, is among producers predicting bigger grain plantings, with weather as the sole caveat.

“If it’s a cool spring then farmers’ planting season for corn gets compressed and they switch over to soybeans, which requires less nitrogen,” Nutrien Chief Executive Officer Ken Seitz said Tuesday in an interview at Bloomberg’s New York headquarters.

While nitrogen costs have eased from the surging levels of 2022, prices remain elevated, leading corn farmers to delay purchases. The northern Plains in particular could see corn cutbacks.

“Growers in the Upper Midwest may be biting their nails as a heavy snowpack threatens to push back spring nitrogen applications,” said Jacqueline Holland, an analyst at Farm Futures.

Snow depth in the Upper Midwest is as much as double the amount a year ago, according to government weather data. The market will get its first outlook for this year’s acreage Friday when the US Department of Agriculture issues its prospective plantings report. The numbers will be updated at the end of June.

US Fertilizer Prices Slide as Weather Delays Spring Fieldwork

Most nitrogen prices remain weak in the US as buyers delay spring purchases, with ammonia dropping again to spur sales. Application is underway in the South, while the Corn Belt awaits warmer weather and California battles incessant rain. China’s domestic stockpiles and urea production rates are rising as the world’s marginal producer pins hopes on a big crop.

Major Drop in Tampa Ammonia Expected in Wednesday Whisper

Another huge drop in Tampa ammonia is imminent, with most market participants citing low natural gas prices in Europe and the US, along with plentiful ammonia supplies. The March price was down $200 a metric ton (mt) from February. New Orleans urea prices again dipped below $300 a short ton, and there was pressure at other US hubs. However, Brazil urea prices strengthened. Phosphate and potash prices were flat-to-down depending on location, with Brazil potash plunging some $40/mt. Brazil ammonium sulfate also continued to slip.

Brazil Purchases Delayed as Fertilizer, Crop Prices Fall

Most fertilizer prices continued to drop in Brazil amid stalled negotiations and declining crop prices, though urea rebounded slightly amid fewer offers. Suppliers are reportedly unloading large quantities of phosphates and potash in bonded warehouses even as buyers remain on the sidelines.

Brazil Urea Rebounds, Potash Prices Plunge: Wednesday Whisper

Urea in Brazil firmed to $310-$330 a metric ton (mt) vs. last week’s $310-$320, with some sellers raising prices in response to fewer offers in the market. Ammonium sulfate fell $5/mt from last week, to $180-$190/mt. Potash in Brazil plunged to $400-$440/mt vs. last week’s $440-$460, with the low reported as the cost-and-freight (CFR) equivalent of a large local purchase. Sanctioned potash fell in the $400-$410/mt range, but other suppliers are competing at these levels to find liquidity for large inventories. Brazil monoammonium phosphate (MAP) prices slipped to $610-$635/mt vs. last week’s $620-$635 as more tons become available from Jordan.

Orange Corn Gets USDA Grant for Better Chicken Feed, Eggs

Famously yellow corn could be getting a color change to orange in an effort to produce chicken eggs with darker yolks and added health benefits.

Indiana-based NutraMaize has received a $650,000 grant from the USDA to prove that they can scale up their orange corn to use as feed for birds. The company, founded by Purdue agronomy professor Torbert Rocheford and his son Evan Rocheford, says it aims to help poultry farmers fight off some common diseases and improve the nutritional value of eggs for consumers.

Evan and Torbert Rocheford

The orange corn contains carotenoids, natural antioxidant pigments that give a carrot its orange color, according to a Wednesday release from Purdue University. They also have health benefits for birds like reducing cases of the common condition footpad dermatitis, NutraMaize Chief Executive Officer Evan Rocheford said in the release.

“We are particularly interested in working with organic egg producers since they have limited options for disease management,” he said.

NutraMaize plans to conduct field studies with researchers from the USDA and Purdue University to produce the feed, the company said.

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |