Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 19 1/2 in SRW, down 18 1/2 in HRW, down 21 1/4 in HRS; Corn is down 9 1/4; Soybeans down 13; Soymeal up $0.37; Soyoil down 1.98.

For the week so far wheat prices are down 27 in SRW, down 26 1/2 in HRW, down 29 3/4 in HRS; Corn is down 19 1/2; Soybeans down 75 1/2; Soymeal down $1.55; Soyoil down 4.38.

For the month to date wheat prices are down 27 in SRW, down 26 1/2 in HRW, down 29 3/4 in HRS; Corn is down 19 1/2; Soybeans down 75 1/2; Soymeal down $15.50; Soyoil down 4.38.

Chinese Ag futures (SEP 22) Soybeans up 19 yuan; Soymeal down 70; Soyoil down 238; Palm oil down 374; Corn down 1 –Malaysian palm oil prices overnight were down 219 ringgit (-5.39%) at 3841.

There were no changes in registrations. Registration total: 2,653 SRW Wheat contracts; 0 Oats; 0 Corn; 0 Soybeans; 164 Soyoil; 0 Soymeal; 1 HRW Wheat.

Preliminary changes in futures Open Interest as of August 1 were: SRW Wheat up 2,597 contracts, HRW Wheat up 188, Corn up 8,251, Soybeans down 2,150, Soymeal down 1,280, Soyoil up 9,716.

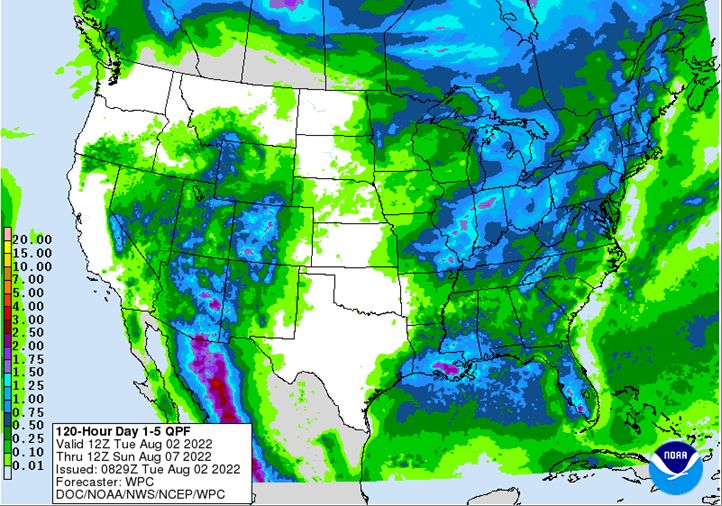

Northern Plains Forecast: Isolated showers Tuesday. Mostly dry Wednesday-Thursday. Isolated showers Friday. Temperatures near to above normal through Friday. Outlook: Isolated showers Saturday. Mostly dry Sunday-Tuesday. Isolated showers Wednesday. Temperatures near to above normal Saturday-Wednesday.

Central/Southern Plains Forecast: Mostly dry Tuesday. Isolated showers Wednesday-Thursday. Mostly dry Friday. Temperatures near to above normal through Friday. Outlook: Isolated showers Saturday-Wednesday. Temperatures near to above normal Saturday-Wednesday.

Western Midwest Forecast: Isolated showers Tuesday-Wednesday, south Thursday. Mostly dry Friday. Temperatures above normal Tuesday-Wednesday, near to above normal Thursday-Friday.

Eastern Midwest Forecast: Mostly dry Tuesday. Isolated to scattered showers Wednesday-Friday. Temperatures near to above normal Tuesday, above normal Wednesday-Thursday, near to above normal Friday. Outlook: Isolated to scattered showers Saturday-Monday. Mostly dry Tuesday-Wednesday. Temperatures near to above normal Saturday-Wednesday.

The player sheet for Aug. 1 had funds: net sellers of 4,500 contracts of SRW wheat, sellers of 6,500 corn, sellers of 24,500 soybeans, sellers of 8,000 soymeal, and sellers of 8,000 soyoil.

TENDERS

- WHEAT TENDER: Algeria’s state grains agency OAIC on Sunday issued an international tender to buy soft milling wheat, to be sourced from optional origins

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy 122,103 tonnes of food-quality wheat from the United States, Canada and Australia in regular tenders that will close on Thursday.

- FEED CORN TENDER: Taiwan’s MFIG purchasing group issued an international tender to buy up to 65,000 tonnes of animal feed corn which can be sourced from the United States, Brazil, Argentina or South Africa, European traders said. The deadline for submission of price offers in the tender is Aug. 3

PENDING TENDERS

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy 120,000 tonnes of milling wheat which can be sourced from optional origins

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 92,100 tonnes of rice to be sourced from the United States, China and other origins

- BARLEY TENDER: Jordan’s state grains buyer issued an international tender to buy 120,000 tonnes of animal feed barley

- WHEAT TENDER: The Taiwan Flour Millers’ Association issued an international tender to purchase 50,910 tonnes of grade 1 milling wheat to be sourced from the United States

US BASIS/CASH

- Basis bids for corn shipped to the U.S. Gulf Coast for export eased on Monday, while soybean barge bids were steady-to-softer, though barge freight prices underpinned values, traders said.

- Spot barge bids firmed, with spot barges on the Illinois River offered on Monday at 450% of tariff, up from 425% on Friday, while bids on the Mississippi river at St. Louis climbed to 425% of tariff versus 415% last week. The Lower Ohio River bid barges were at 475% of tariff, up from 450%.

- CIF corn barges loaded in July were bid on Monday at around 135 cents over September corn, down 10 cents from Friday. November corn barges traded at 102 cents over December futures.

- Corn export premiums at the U.S. Gulf for August loadings held steady at around 170 cents over futures.

- For soybeans, CIF barges loaded in July were bid 1 cent higher at about 108 cents over August futures, while barges loaded in August traded at 88 cents over futures, down 5 cents from Friday.

- Some brokers rolled their July barge offers to November, quoting bids at 300 cents over November futures.

- FOB export premiums for August soybean loadings held at around 155 cents over August futures.

- Spot basis bids for corn and soybeans delivered to elevators and processors around the U.S. Midwest were broadly mixed on Monday as futures prices fell sharply, grain dealers said.

- Demand was also mixed following a rise in farmer sales of corn and soy last week that boosted supplies at some locations.

- A soy processor in Lafayette, Indiana, dropped its spot basis bid by 35 cents a bushel. A soybean elevator in Sioux City, Iowa, lowered its spot basis bids by 15 cents, while an elevator in Council Bluffs lifted its spot bid by 20 cents.

- A Chicago corn processor raised its spot bid by 25 cents a bushel, but river elevators in Bettendorf, Iowa, and in Morris, Illinois, cut their spot basis bids by 10 and 32 cents, respectively.

- Spot basis bids for hard red winter wheat held mostly steady at rail and truck market terminals across the southern U.S. Plains on Monday, underpinned by slow farmer sales and sinking futures prices, grain dealers said.

- Farmer sales were light as growers sought higher prices for their grain, dealers said. Prices were lower on Monday and well below multiyear peaks notched in May.

- Farmers in Kansas, Texas and Oklahoma have largely completed harvesting their wheat. Other producing states are wrapping up their harvests.

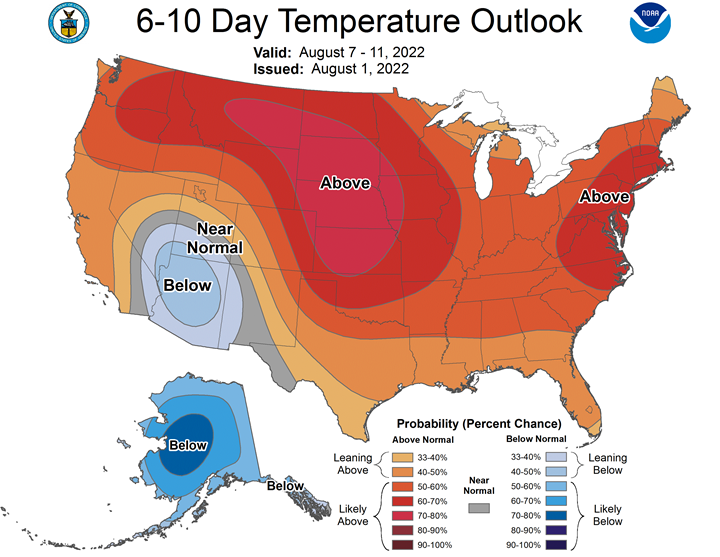

- Spot cash millfeed values eased across parts of the central U.S. Midwest on Monday as mills and livestock producers prepared for extreme heat across the region, dealers said.

- Offers eased at locations in Chicago, Minneapolis, Minnesota and Kansas City, Kansas.

- Upcoming heat across the central U.S. is expected to curb immediate demand for animal feed.

- Spot basis bids for corn and soybeans were steady to lower on Monday at grain elevators and processors across the U.S. Midwest after accelerated farmer selling last week.

- Farmer sales of corn and soybeans increased last week as futures prices on the Chicago Board of Trade rallied to multi-week highs. The sales replenished stocks at processors and elevators.

- Light soybean exports and a seasonal slowdown in domestic crushing added further pressure to soy basis bids.

TODAY

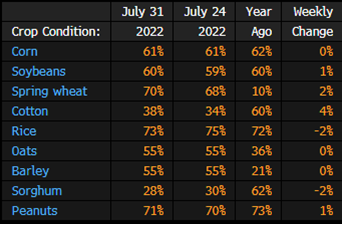

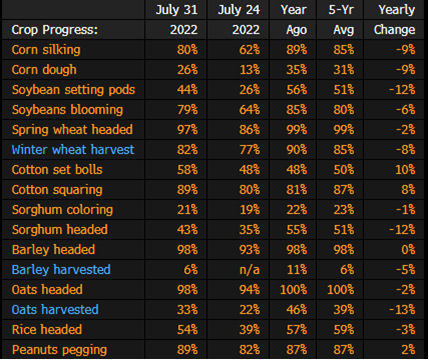

US Crop Progress and Conditions for July 31: Summary

US Soybean Crushings at 174M Bushels in June: USDA

- Crushing 7.6% higher than same period last year

- Crude oil production 8.4% higher than same period last year

- Crude and once-refined oil stocks up 10.2% y/y

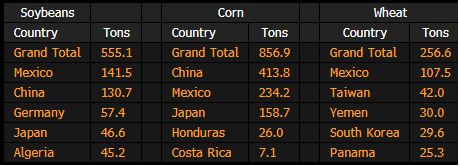

US Inspected 857k Tons of Corn for Export, 555k of Soybean

In week ending July 28, according to the USDA’s weekly inspections report.

- Soybeans: 555k tons vs 392k the previous wk, 186k a yr ago

- Wheat: 257k tons vs 476k the previous wk, 405k a yr ago

- Corn: 857k tons vs 754k the previous wk, 1,467k a yr ago

Ukraine Grain Shipments to Start Slowly Over 2 Weeks: Minister

Shipments will be limited during a two-week trial period to make sure the route is safe, Ukraine Infrastructure Minister Oleksandr Kubrakov tells Bloomberg TV.

- Ukraine to send no more than three vessels with grain a day during trial period: minister

- Grain export may ramp up to 3m tons per month in 4-6 weeks

- Expect next vessels will go from Chornomorsk, Odesa and Pivdennyi sea ports

Brazil C-S Winter Corn Harvest 73% Done as of July 28: Agrural

This compares with 62% a week earlier and 49% a year ago, according to an emailed report from consultancy firm AgRural.

- The week was marked by good progress in Parana state, where the faster loss of moisture from the grains – a result of drier and hotter weather – took the harvest to about half of the cultivated area in the state, AgRural said

- AgRural estimates Brazilian winter corn production in 2022 at 87.3m tons, against 60.7m in 2021 season

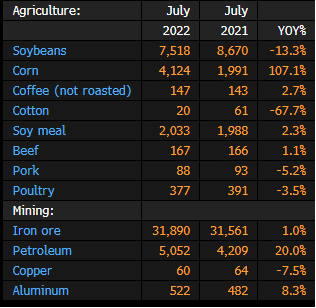

Brazil July Agriculture, Mining Exports by Volume: MDIC

Following is a summary of key Brazilian agriculture and mining exports by volume, from the Brazilian Trade Ministry.

- Soybean exports fell 13% y/y

- Coffee exports rose 3% y/y

- Iron ore exports up 1% y/y

China may grant Brazilian soymeal export permits in two months

Brazilian Agriculture Minister Marcos Montes said on Monday Chinese authorizations for Brazilian soymeal exporters may be granted in the space of two months.

Speaking at an event in São Paulo, Montes explained Brazilian government officials will inspect the plants as part of the process to obtain the desired export permits from Beijing.

Last week, the Brazilian government confirmed that China had opened its market to soybean meal produced in the South American country, but said certain bureaucratic hurdles would need to be removed. (Full Story)

Andre Nassar, president of Brazilian oilseeds lobby Abiove, said initially, accreditation of soy crushers for the sale of soymeal to China would be handled directly by Chinese authorities.

That changed after Brazil’s agriculture ministry negotiated a different approach.

There is no timetable for Brazilian inspectors to visit soy crushing plants, but a meeting between the government and the industry is scheduled to take place on Friday, when that may become clearer, Nassar said.

Conceivably, a list or approved soymeal plants could be produced in two months’ time, Nassar noted.

Regarding when shipments per se would start, Nassar said it will depend on market dynamics.

Aside from soymeal, Brazilian companies hope to start selling corn to China.

Last week, Montes said Brazilian corn shipments to China could be expedited after a re-discussion of an agreement that initially established only Brazil’s 2023 corn crop would be exported. (Full Story)

Montes predicted the first Brazilian corn shipments to the Asian country could happen in around three months, pending adjustments of a bilateral trade protocol.

Brazil 2022/2023 Soybean Crop Seen At 152.57 Million Tns – Stonex

- BRAZIL 2022/2023 SOYBEAN CROP SEEN AT 152.57 MILLION TNS – STONEX

- BRAZIL 2022/2023 TOTAL CORN CROP SEEN AT 125.53 MILLION TNS – STONEX

German 2022 winter wheat crop up 1% on year- farm association

Germany’s 2022 winter wheat harvest will increase about 1% on the year to an estimated 21.38 million tonnes, the DBV association of German farmers said on Tuesday.

Winter wheat harvesting is approaching completion in many German regions, the association said.

Wheat in some regions had suffered from the heat-wave and dryness this summer, but yields in other areas were reasonable, it said.

Nationally, German winter wheat harvest yields were up some 4% on the year to an estimated 7.64 tonnes a hectare, it said.

Germany is generally the European Union’s second largest wheat producer after France and a major grain exporter. German traders are hoping for a good wheat harvest this year to meet strong import demand after war disrupted Ukrainian grain exports. [nL1N2ZD04Y

Germany’s harvest of winter rapeseed, used for edible oil, animal feed and biodiesel production, will rise about 13% on the year to an estimated 3.96 million tonnes. Rapeseed oil content is also satisfactory, it said.

The winter barley crop, largely used for animal feed, will increase about 3% on the year to 9.16 million tonnes.

But the crop of silage maize is believed to have suffered from the recent heat-wave which could threaten feed grain supplies to farms, it added.

Kazakhstan’s Grain Union sees 2022 wheat crop at 14.4 mln T

Kazakhstan’s Grain Union forecasts the 2022 wheat crop at 14.4 million tonnes in clean weight, it said on Tuesday, above the government forecast of 13 million to 13.5 million tonnes.

With exports unlikely to increase as competitor Russia expects a bumper crop, such volumes could put pressure on domestic prices, the union said

Normal Rain Forecast for Second Half Boosts India Crop Prospects

India’s monsoon, which irrigates more than half of the country’s farmland and is critical for economic growth, will likely be normal in the second half of the four-month season after bountiful showers in July, helping farmers boost crop output.

Rainfall in the August-September period will likely be between 94% and 106% of the long-term average of 422.8 millimeters, Mrutyunjay Mohapatra, director general of the India Meteorological Department, said at an online briefing on Monday. Showers are expected to be normal this month as well, he said.

Rains had a poor start in June before gathering pace in July. Still some main crop-growing areas in the eastern and northern regions received deficient showers. That cut area under rice, India’s biggest food grain crop, to the lowest since 2019-20, according to the farm ministry. Normal rains in the second half of the season will likely bring relief to farmers and spur production of crops such as rice, soybeans, corn and pulses, and help in softening foodprices. Bountiful rains would also fill reservoirs, which in turn would brighten prospects for winter crops, usually planted during October and November.

The livelihood of millions of farmers in the country of about 1.4 billion people depends on rains brought by winds from the Indian Ocean. The farm sector is the main source of income for about 60% of India’s population and accounts for 18% of the economy. India is forecast to witness a normal rainy season for a fourth year.

Some key points from the briefing:

- Showers in July, generally the wettest month in a year, were 16.9% more than average this year.

- Rain during the month were the highest since July 2005, when it was 18.9% more than normal.

- Normal to above-normal rainfall likely over most parts of southern region during August-September period.

- Below-normal showers are likely over many parts of the west coast and some areas of east-central, east and northeast regions during the two-month period.

- Normal to above-normal rainfall is very likely over most parts of southeast, northwest and adjoining west-central regions this month.

- Below-normal showers are likely over the west coast and many parts of east-central, east and northeast regions

- Maximum temperatures are likely to be above normal over many parts of east and northeast and some parts of northwest and southern regions.

- Normal to below-normal maximum temperatures are likely over remaining parts of the country.

- Currently, La Nina conditions are prevailing over the equatorial Pacific region and are likely to continue until end of the year.

Brazil to Harvest a Record Soybeans Crop Next Year: StoneX

Brazil’s 2022-23 soybean crop may reach a record 152.6m tons, almost 20% more than the previous year, according to StoneX’s first estimate of the upcoming harvest set to start next February.

- Area planted increased 3.9%, yields are back at trend after crops suffered a strong drought last season caused by La Niña

- Exports should reach 100m tons, also a record, if verified

- Paraná and Rio Grande do Sul, 2nd- and 3rd-biggest producing states behind Mato Grosso, will see increases in production of 70% and 101.5%, respectively

- Both states suffered heavy losses because of the dry weather

- The 2022-23 corn crop could reach 125.5m tons, with 45m tons of exports, higher than the record 2021-22 crop of 121.6m tons: StoneX.

WHEAT/CEPEA: Prices drop in Brazil, but rise abroad

Wheat prices faded in the Brazilian market last week, majorly in the wholesale market, while abroad quotations increased, reflecting the higher world demand, lower quality of wheat crops in the United States and uncertainties about the exports of grains through the Black Sea.

BRAZILIAN MARKET – The steep dollar devaluation in the last day pressed down wheat quotations in Brazil, since it favors imports. Between July 22 and 29, the American currency dropped by 5.87%, to BRL 5.178 on Friday, 29.

Cepea surveys show that, between July 22 and 29, prices in the wholesale market (deals between processors) decreased by 3.33% in Paraná (PR), 1.24% in Rio Grande do Sul (RS), 0.94% in São Paulo (SP) and 0.39% in Santa Catarina (SC). On the other hand, in the over-the-counter market (values paid to farmers), quotations rose by 2.51% in SC and 0.76% in PR, but decreased by 1.19% in RS. As for sales, low supply and the fact that domestic mills have built stocks are expected to keep deals sporadic until the new crop arrives at the market.

As for the monthly averages in July, the nominal average price for the State of Rio Grande do Sul in July was higher than that in Paraná, which had not been observed since November 2020. In real terms (based on the IGP-DI), the monthly averages in RS and in Santa Catarina set records in the series of Cepea.

BRAZILIAN CROP – By July 23, 96.6% of the national wheat crop had been sown, according to data from Conab.

EXPORTS – According to Secex, in the four weeks of July, Brazil imported 356.75 thousand tons of wheat, against 534.87 thousand tons in July 2021. Import values averages USD 415.8/ton (FOB origin), 51.8% higher than that in the same period of 2021.

Ukraine Sees Slow Return of Grain Exports as World Watches

- First ship since invasion set sail with corn from Odesa Monday

- Obstacles to ramping up exports include insurance, crew

Ukraine laid out plans to cautiously ramp up grain exports, as the first shipment since Russia’s invasion was hailed as an encouraging early step toward unblocking millions of tons of crops and easing global food prices.

The first two weeks will be treated as a trial period, with no more than three vessels a day in each direction through new safe-passage corridors established under the agreement with Russia, Turkey and the United Nations, Ukraine Infrastructure Minister Oleksandr Kubrakov told Bloomberg TV on Monday. If successful, exports could increase to as much as three million tons per month in four to six weeks’ time, he said.

Wheat, corn and soybean futures extended declines in Chicago on Tuesday. Ukraine is one of the world’s most important suppliers of grains and oilseeds and the collapse in exports following Russia’s invasion jolted global agriculture markets, driving up prices and leaving importing nations scrambling to secure alternative supplies.

But while the first shipment is encouraging, there is still a long road ahead before exports get anywhere near to pre-war levels. It took over a week from signing the deal before the first departure, and traders and shippers say there is little clarity on the process going forward. The three ports included in the deal accounted for just over half of Ukraine’s seaborne grain exports in the 2020-21 season.

In his evening address on Monday, President Volodymyr Zelenskiy said it’s still too early to draw any conclusions about the way forward, but that Monday’s shipment can be seen a “first positive signal that there is a chance to stem the unfolding global food crisis.”

The pace of shipments will be important — to help reduce food insecurity and hunger, but also because Ukraine’s farmers have warned they are running out of space to store crops, which could have a negative effect on how much grain is sown for next year’s harvest.

Scores of ships are stuck in the ports dotted along the Black Sea and are expected to begin moving out in “caravans” if all goes well. But they will need insurance for the vessels and cargo, and crews to operate the ships. And there are other risks — vessels will need to navigate the mine-ridden seas through safe corridors and trust that Russia will keep its promises as part of the deal.

“It’s important for us to make it clear that this route is safe, and then we’ll start increasing the number of vessels,” Kubrakov said.

The Ukrainian Sea Ports Authority is receiving applications from ship owners to participate in caravans and working to organize their departure, it said in a Facebook posting. There is 480,000 tons of grains and oilseeds loaded on vessels in the three ports covered by the deal — Pivdennyi, Odesa and Chornomorsk.

Standard operating procedures for the shipping corridors are close to being finalized and will be made public once they are agreed, a UN spokesperson told reporters at a briefing on Monday.

If the corridor is “even mildly successful,” corn exports could more than double from 9 million tons to 18-22 million tons per year, according to Michael Magdovitz, senior commodities analyst at Rabobank.

“To put the additional 9 million tons of corn exports in perspective, the US and EU have nearly lost that amount of grain in the recent heat wave.”

France Has Driest July on Record With Crops Taking a Battering

- High temperatures have spread forest fires, stressed corn

- Country faces another heat wave this week, Meteo France says

France experienced its driest July on record as searing heat spread across Europe, putting strain in key crops.

The average precipitation across the country was 8.1 millimeters (0.3 inches), making it the driest month since March 1961, forecaster Meteo France said on its website. Rainfall in Brittany, Auvergne and Corsica was at least 95% below the norm.

The scorching temperatures and dryness have led to forest fires on France’s west coast and hit the nation’s farmers, hampering the key flowering period for corn fields. The share of the country’s corn crop in good or very good condition fell to 68% as of July 25 from 75% a week earlier, FranceAgriMer said on Friday.

France faces a new heat wave this week, with temperatures expected to peak at about 40 degrees Celsius (104 degrees Fahrenheit) in the south of the country on Wednesday.

Europe’s dry, hot summer is a stark reminder of the unfolding climate crisis, with heat waves becoming more frequent and intense. England had its driest July since 1935, with record temperatures sparking fires near London, triggering rail and flight cancellations and forcing power stations to operate at low levels to prevent overheating.

Malaysia to Cap Prices of 5 Kilogram Palm Cooking Oil Bottles

Malaysia will set a ceiling price for cooking oil sold in 5 kilogram bottles from Aug. 8, according to a statement from the Domestic Trade and Consumer Affairs Minister Alexander Nanta Linggi.

- The price for August has been set at 34.70 ringgit based on the average price of crude palm oil of 4,603 ringgit a ton in July: statement

- The price cap will be revised on the 8th of every month

Indonesia Sets CPO Reference Price at $872.27/Ton for Aug. 1-15

Indonesia, the world’s largest palm oil exporter, sets crude palm oil reference price at $872.27/ton for August 1-15 period, Musdhalifah Machmud, deputy for food and agriculture at the Coordinating Ministry for Economic Affairs, says in text messages.

- CPO export tax set at $33/ton for the first two weeks of this month, according to related finance ministers decree

- Export tax was at the highest rate of $288/ton in July

Indonesia Considers Extending Waiver on Palm Oil Export Levy

Indonesia is considering extending the export levy waiver for palm oil beyond the existing end-August timeline, as part of measures to boost shipments and local fresh fruit bunch prices, according to Syailendra, acting director general of domestic trade at the trade ministry.

- Govt is trying to boost exports while ensuring supply for domestic market, Syailendra, who goes by single name, said by phone Tuesday

- Accelerating exports will reduce high level of palm oil reserves and increase buying of fresh fruit bunches from farmers

- The trade ministry increased domestic market obligation and exports ratio to 1:9 from 1:7 starting Aug. 1

- The ministry is focusing on controlling bulk cooking oil prices in several provinces including East and South Kalimantan that have not reach the target of 14,000 rupiah/liter

GAIL Has Cut Supplies to Some Fertilizer Plants by 10%: Reuters

GAIL has cut supplies to some fertilizer plants by 10% and restricted gas sales to industrial clients to the lower tolerance limit of 10%-20% as imports from Gazprom Marketing and Trading Singapore were hit, Reuters reports, citing people familiar with the matter.

GAIL and India’s fertilizer ministry did not respond to Reuters’ requests for comments

Potash Prices Slip Amid Producers’ MOP Fill; China Supply Drops

US potash prices fell below Nutrien and Mosaic’s 3Q US fill offers last week, with Nutrien’s order book expected to close on Aug. 3. Global potash inventory appears to be rising, except in China. Its port inventory of 1.6 million metric tons is near the strategic-reserve level, which we believe could signal 3Q buying*

China Holds Direction to Slumping Potash Prices: Weekly Wrap

A decline in China’s potash port inventory could spur the world’s largest importer to increase 2H purchases. At 1.6 million metric tons, the inventory is near the strategic-reserve level (the lowest level authorities will theoretically allow). China is still importing Belarusian potash, despite western sanctions that limit Belaruskali’s ability to ship supply. China imported 4.1 million tons of potash in 1H, down 11% from 1H21. Belarus accounted for 25% of China’s monthly 1H imports. Belaruskali is seeking export alternatives to Lithuania, now inaccessible due to sanctions.

Nutrien and Mosaic are the largest publicly traded potash producers. Belarus accounts for about one-fifth of the global potash trade.

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |