Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 21 1/2 in SRW, down 22 1/4 in HRW, down 15 in HRS; Corn is down 6 3/4; Soybeans down 12 1/4; Soymeal up $0.06; Soyoil down 0.85.

For the week so far wheat prices are down 63 1/2 in SRW, down 61 3/4 in HRW, down 52 3/4 in HRS; Corn is down 37; Soybeans down 76 1/2; Soymeal down $1.67; Soyoil down 3.22.

For the month to date wheat prices are down 66 3/4 in SRW, down 50 3/4 in HRW, down 39 1/4 in HRS; Corn is down 14 3/4; Soybeans down 90 3/4; Soymeal down $17.30; Soyoil down 0.91.

Year-To-Date nearby futures are down -4% in SRW, up 3% in HRW, down -12% in HRS; Corn is up 3%; Soybeans up 11%; Soymeal up 8%; Soyoil up 18%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans up 35 yuan; Soymeal down 3; Soyoil down 74; Palm oil down 100; Corn down 27 — Malaysian palm oil prices overnight were down 153 ringgit (-3.65%) at 4040.

There were changes in registrations (-14 Soyoil). Registration total: 2,653 SRW Wheat contracts; 0 Oats; 0 Corn; 1 Soybeans; 135 Soyoil; 71 Soymeal; 1 HRW Wheat.

Preliminary changes in futures Open Interest as of August 17 were: SRW Wheat up 4,952 contracts, HRW Wheat down 530, Corn down 2,295, Soybeans up 1,053, Soymeal up 1,713, Soyoil up 2,450.

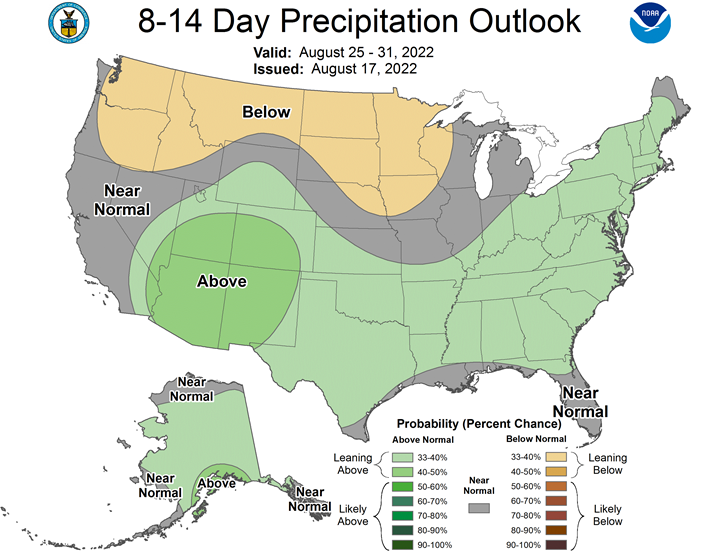

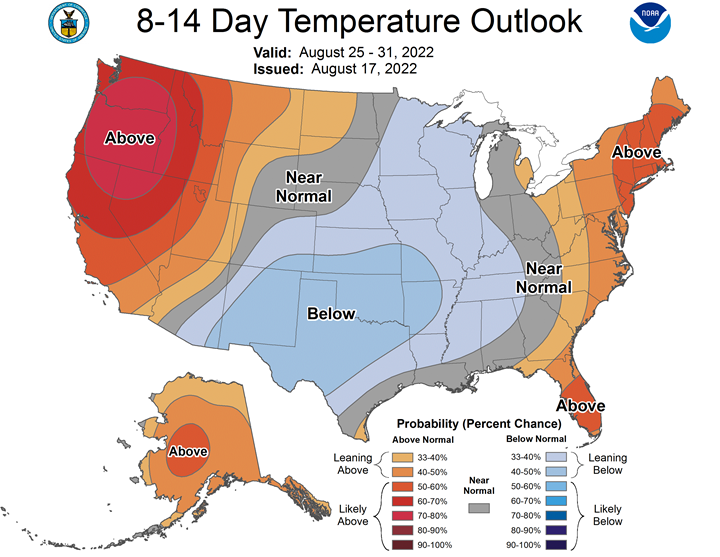

Northern Plains Forecast: Isolated to scattered showers east and mostly dry west Thursday. Pockets of steady light rain east and mostly dry west Friday. Scattered light showers east and mostly dry west Saturday. Mostly dry Sunday. Temperatures above normal west and near to below normal east through Sunday. Outlook: Mostly dry Monday. Isolated to scattered showers Tuesday-Wednesday. Isolated showers to mostly dry Thursday-Friday. Temperatures above normal west and near to below normal southeast Monday, near normal Tuesday-Friday.

Central/Southern Plains Forecast: Isolated to scattered showers moving south with isolated showers northeast through Friday. Mostly dry to isolated showers Saturday. Isolated to scattered showers Sunday. Temperatures near to below normal through Sunday. Outlook: Isolated to scattered showers Monday-Friday. Temperatures near to below normal Monday-Friday.

Western Midwest Forecast: Isolated to scattered showers through Sunday. Temperatures near to below normal through Sunday.

Eastern Midwest Forecast: Mostly dry through Friday. Isolated to scattered showers Saturday-Sunday. Temperatures near to below normal Thursday, near normal Friday-Sunday. Outlook: Isolated showers Monday-Tuesday. Isolated to scattered showers northwest and mostly dry otherwise Wednesday. Isolated to scattered showers Thursday-Friday. Temperatures near normal Monday-Friday.

The player sheet for Aug. 17 had funds: net sellers of 9,000 contracts of SRW wheat, buyers of 1,500 corn, sellers of 3,000 soybeans, buyers of 1,500 soymeal, and sellers of 2,500 soyoil.

TENDERS

- FEED BARLEY TENDER PASSED: Jordan’s state grain buyer made no purchase in an international tender for 120,000 tonnes of animal feed barley which closed on Wednesday

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat

PENDING TENDERS

- WHEAT TENDER: Iranian state agency Government Trading Corporation issued an international tender to purchase about 60,000 tonnes of milling wheat

- WHEAT AND RICE TENDER: Iraq’s state grains buyer issued tenders to buy a nominal 50,000 tonnes of milling wheat and 50,000 tonnes of rice with both to be sourced from the United States only

- FEED WHEAT AND BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by Nov. 30 and arrive in Japan by Jan. 26 via a simultaneous buy and sell (SBS) auction that will be held on Aug. 19.

US BASIS/CASH

- Basis bids for corn shipped by barge to the U.S. Gulf Coast fell on Wednesday on softening demand from exporters in thin trade, brokers said.

- But traded values for soybean barges loaded in August rose as exporters scrambled to cover their immediate needs until the new-crop harvest begins.

- For corn, CIF barges loaded in August were bid at around 108 cents over September futures, down 2 cents from Tuesday. September corn barges were bid around 98 cents over futures, down a penny.

- FOB corn export premiums for September loadings at the Gulf were nominally offered at around 135 cents over September futures, down 5 cents from Tuesday, and October premiums were around 144 cents over December futures, down 3 cents.

- For soybeans, barges loaded in August traded at 290 cents over November, up 10 to 15 cents from Tuesday’s trades, but were re-bid at 270 cents over futures, steady with Tuesday’s late bid.

- September CIF soy barges were bid at 170 cents over November, unchanged from Tuesday, and first-half October barges traded at 135 cents over futures.

- FOB export premiums for first-half October soybean loadings, the first available delivery period, were around 195 cents over November and last-half October premiums were around 175 cents over futures, unchanged from Tuesday

- CIF basis bids for hard red winter wheat at the Texas Gulf were flat for August at 159 cents over K.C. September and September bids held at 165 cents over futures.

- Spot basis bids for soybeans delivered to processors around the U.S. Midwest were steady to higher on Wednesday, while bids at elevators were mixed, grain dealers said.

- Spot basis bids for corn at rail terminals were flat to lower and mixed at processors and elevators.

- The spot soybean basis rose by 10 cents a bushel at a large processor in Decatur, Illinois. The bid for deliveries by September 10 was at a premium of $1.40 or more to bids for beans arriving after that date.

-

- A soy processor in Des Moines, Iowa, raised its spot bid by 10 cents a bushel for a second straight day.

- Spot basis bids for corn delivered to interior U.S. Midwest elevators, ethanol plants and other processors were flat to lower on Wednesday, while bids at barge-loading river elevators were mixed, dealers said.

- Spot soybean basis bids were steady to firm at Midwest processing plants on improved demand from some facilities following seasonal maintenance downtime. Soy bids at elevators were mixed.

- Farmer sales of corn and soy remained slow on Wednesday as a moderate uptick in Chicago Board of Trade futures prices recuperated only a small share of the price declines in recent sessions.

- U.S. spot cash millfeed prices were steady to weaker on Wednesday with values softening in the Buffalo, New York, truck market, brokers said.

- Supplies were a bit heavy in the Northeast relative to demand from animal feed mixers.

- Bids and offers held steady elsewhere, supported by robust demand for livestock feed in the Plains and Midwest, where dry conditions have stunted growth on grazing pastures.

- However, high costs for scarce supplies of freight were limiting the amount of millfeed available for shipment from the eastern half of the country to western regions, one broker said.

- Spot basis bids for hard red winter wheat held mostly steady at truck and rail market terminals around the southern U.S. Plains on Wednesday, underpinned by slow farmer selling and sinking futures values, grain dealers said.

- Protein premiums for wheat delivered by rail to or through Kansas City were unchanged for all protein grades, according to the latest CME Group data.

- Spot basis offers for soymeal delivered by rail or truck around the U.S. Midwest were mostly steady to weaker on Wednesday on rising supplies in areas of the eastern farm belt, dealers said.

- Some soy processors in the northern Midwest remain down for seasonal maintenance while others in the eastern Midwest are coming back online after downtime over recent weeks. As a result, meal supplies have increased in some eastern markets.

- The steep inverse in the soymeal futures market, with the spot September contract $35 above October, is likely to pressure meal basis offers as processors roll their offers to the deferred-month contract, a dealer said.

DOE: US Ethanol Stocks Rise 0.8% to 23.446M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 23.28 mln bbl

- Plant production at 0.983m b/d, compared to survey avg of 1.022m

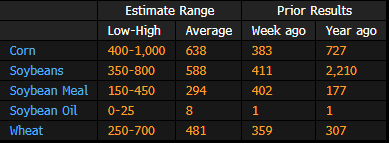

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

Estimate ranges are based on a Bloomberg survey of five analysts; the USDA is scheduled to release its export sales report on Thursday for week ending Aug. 11.

- Corn est. range 400k – 1,000k tons, with avg of 638k

- Soybean est. range 350k – 800k tons, with avg of 588k

China July Imports

General Administration of Customs says on website.

- July Corn Imports 1.54M Tons, -46.3% Y/y

- YTD corn imports fell 16.7% y/y to 15.13m tons

- July wheat imports 780,000 tons, -11.7% y/y

- YTD wheat imports fell 8.4% y/y to 5.72m tons

- July sugar imports 280,000 tons, -35.2% y/y

- YTD sugar imports fell 17% y/y to 2.04m tons

- July cotton imports 120,000 tons, -17% y/y

- YTD cotton imports fell 25.4% y/y to 1.26m tons

- July edible palm oil imports 310,000 tons, -12.9% y/y

- YTD edible palm oil imports fell 64.5% y/y to 870,000 tons

- July rice imports 500,000 tons, +72% y/y

- YTD rice imports rose 43.5% y/y to 4.08m tons

- July barley imports 40,000 tons, -95.4% y/y

- YTD barley imports fell 40.8% y/y to 3.8m tons

- July sorghum imports 1.32m tons, +19.6% y/y

- YTD sorghum imports rose 24.5% y/y to 7.34m tons

- July pork imports 120,000 tons, -65.1% y/y

- YTD pork imports fell 65.1% y/y to 930,000 tons

- July beef imports 270,000 tons, +41.8% y/y

- YTD beef imports rose 7.4% y/y to 1.42m tons

- July fertilizer exports 1.94m tons, -48.6% y/y

- YTD fertilizer exports fell 43.2% y/y to 11.36m tons

Drought Hammers German Corn Crop, Delays Rapeseed Planting: DRV

This year’s corn harvest is now seen at 3.61m tons, down from a July outlook for 4.07m tons, German agricultural cooperatives group DRV said in a report

- Persistent drought is spurring massive yield losses, and the supply shortfall could intensify, said DRV grain-market analyst Guido Seedler

- Because of a lack of fodder for livestock, more corn that was originally intended for grain production is being harvested as silage

- Wheat crop estimate raised to 22.6m tons, from 22.5m tons

- Barley crop estimate raised to 10.9m tons, from 10.7m tons

- Rapeseed crop estimate raised to 4m tons, from 3.8m tons

- Plantings for the next season, which are usually soon underway, will be delayed by the lack of moisture, Seedler says

- Without significant rain by mid-September, plantings will likely decline y/y

- Drought is also hampering logistics, with difficulties for shipping spurring a greater dependence on rail and road routes to deliver grain to food and feed processors

Three Grain Vessels Departed Ukraine, Four More Inspected: JCC

Three food-laden ships left Ukraine ports on Wednesday carrying 33,750 metric tons of corn and sunflower oil and meal, Joint Coordination Centre says in emailed statement. Also, four inbound commercial ships were inspected today and were cleared to sail.

- Petrel S left Chornomorsk carrying 18.5k metric tons of sunflower meal for delivery to Amsterdam

- Sara left Odesa carrying 8k metric tons of corn heading to Istanbul

- Efe left Odesa carrying 7.25k metric tons of sunflower oil for delivery to Gubre, Turkey

- Four inbound ships inspected at the Marmara Sea and allowed to head to Ukrainian ports:

- Foyle heading to Pivdennyi

- Ganosaya and Mohammad Y heading to Odesa

- Maranta heading to Chornomorsk

- Thursday, JCC will inspect four outbound vessels and other four inbound ships

- The outbound ships are: Osprey S, Ramus, Brave Commander and Bonita

- The inbound ships are: Aviva, Seaeagle, Zhe Hai 505 and Ascanios

Ukrainian Port Expects 5 More Crop Ships to Come Wednesday: IFX

The Ukrainian port of Chornomorsk expects five new vessels to load with grain and vegetable oil Wednesday, reports Interfax-Ukraine citing the Facebook statement of Ukrainian Sea Ports Authority.

- The number of vessels to arrive within a day is a record since the grain corridor started

- Ships are to be loaded with a combined total of 70k tons of wheat, bran, sunflower oil and corn

Ukraine’s Grain Exports Down 46% Y/y in Season Through Aug. 15

Grain exports during the season that began July 1 totaled 2.65m tons as of Aug. 15, compared with 4.92m tons in a similar period a year earlier, according to data from Ukraine’s agriculture ministry.

- Wheat exports at 658k tons, versus 2.09m tons

- Barley shipments at 226k tons, versus 1.66m tons

- Corn exports at 1.75m tons, versus 1.15m tons

Argentina’s 2022/23 corn planting area expected to shrink 2.6%

Argentina’s corn planting area for the 2022/23 harvest is expected to shrink 2.6% from the previous cycle to 7.5 million hectares, the Buenos Aires Grains exchange said on Wednesday.

Manitoba Says Winter Wheat, Fall Rye Yields Seen as ‘Average’

Crop conditions range from good to very good in most parts of the province, Manitoba’s agriculture ministry says in a report posted on its website.

- 57% of winter wheat and 22% of fall rye crop harvested as of Aug. 16

- Fall rye yields are averaging 75-85 bushels per acre

- Winter wheat yields 60-75 bushels per acre

- “Quality has been variable”

- Canola crops are variable across Manitoba with many in excellent condition and others rated as poor

Brazil 2022 fertilizer consumption to drop, consultancy says

Brazil is expected to reduce fertilizer consumption to 43 million tonnes in 2022, as farmers are poised to cut applications when the planting of crops like soybeans begins in September, consultancy MB Agro said on Wednesday.

Last year, Brazilian farmers used an estimated 45.85 million tonnes of crop nutrients, according to Anda, a fertilizer industry group.

MB Agro’s director Alexandre Mendonça de Barros said at an event that crop failure in the last soybean season helped the soil retain some nutrients, potentially driving a fall in applications when the next season starts.

Barros does not see the risk of crop yields suffering as a result of lower applications, but cautioned that farmers may not be able to keep doing that in coming planting seasons.

“There is not much room, you are using what the soil retained and there is a limit for that,” Barros said.

Fertilizer prices have shot up in recent months, a trend exacerbated by the war Ukraine, which sparked sanctions against major global supplier Russia.

In spite of that, Brazil, which is heavily dependent on imports, continued to buy record volumes. (Full Story)

Recently, Norway’s Yara YAR.OL, which operates in Brazil, said fertilizer deliveries to local farmers would stabilize or potentially fall in 2022, citing the global rise in prices that has also caused domestic logistical bottlenecks. (Full Story)

Brazil relies on imports for about 85% of its needs. It imports crop nutrients from Russia, Morocco, Jordan, China and Canada, among others.

Fertilizer Price Relief on the Horizon as Farmers Assess 4Q Use

Most nitrogen prices are up after aggressive summer fill, yet they’re down sharply from spring highs, portending relief ahead of the US fall season. Corn Belt retail ammonia costs are down 30% since July 1, while corn prices are strengthening, which should fuel robust fall application. Brazilian potash imports are tracking 33% above 2021 amid reports of full warehouses and muted demand

Natural Gas Spike Fuels Bullish Ammonia

Near-record natural gas prices in Europe raise the likelihood that more ammonia production will go offline, which may push Tampa levels up again in September following August’s increase of $140 a metric ton (mt). Prices were up for ammonia in the Pacific Northwest, and for urea, urea ammonium nitrate (UAN) and ammonium sulfate in Western Canada after earlier fill-program offers ended. Phosphate and potash remained weak, however, with New Orleans (NOLA) barges trading at the low end of the prior week’s ranges. Slow demand and ample supply continue to pressure urea, phosphate and potash prices in Brazil, with urea slipping after the previous week’s increase.

Brazil Urea Prices Avoid Natural Gas Impact Amid Slow Demand

After recent increases, nitrogen prices in Brazil fell as suppliers compete for new buyers amid slow seasonal demand. The decline comes even though high natural gas prices continue to pressure nitrogen markets higher globally. Potash and phosphate prices in Brazil also fell further as buyers pull back on imports due to oversupply.

Urea Price Hikes Offset by Slow Demand: Wednesday Whisper

Brazil urea prices didn’t sustain last week’s increases, dropping $20-$40 a metric ton (mt) this week amid slow demand. Though natural gas spiked in Europe early this week, urea buyers were pushing for even lower prices, suggesting that bids below $600/mt are on the horizon as demand in Brazil keeps retracting and India remains out of the global market. Potash appears to be down $30/mt and phosphates hinted at a $60/mt decrease, with both markets pressured by full inventories and a lack of interest in new imports.

Crop Handler Andersons Hires Ameropa’s Ex-Grains Trading Chief

- Cedric Mayor to head non-US trading as Andersons expands reach

- Firm seeks to bulk up its recently created Swiss trading desk

Andersons Inc., one of the five largest U.S. grain handlers, has hired Cedric Mayor to oversee trading outside the US as the agriculture company works to expand its global reach.

Mayor, former grains trading chief at Swiss commodities firm Ameropa AG, joined Andersons to head international grains trading, US-based Andersons confirmed.

“Cedric Mayor has joined The Andersons and we look forward to leveraging his leadership and trading experience in our Lausanne, Switzerland office,” Bill Krueger, president of Andersons’ trade and processing group, said via email.

Andersons set up a trading desk in Switzerland last year and has hired several other Ameropa traders, including Sebastien Henry and Sebastien Thilmany, according to people familiar with the matter who asked not to be named because details of the job haven’t been made public. The company is seeking to bolster its presence in the region as Switzerland is a key trading hub for agriculture giants including Louis Dreyfus Co. and Cargill Inc.

Andersons executives earlier this month said its Swiss trading desk is on track to meet expectations and that the team has done well in the face of market disruptions stemming from Russia’s invasion of Ukraine.

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |