Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 4 in SRW, up 6 3/4 in HRW, up 5 in HRS; Corn is down 1 3/4; Soybeans down 9; Soymeal down $0.28; Soyoil up 0.23.

For the week so far wheat prices are down 69 1/2 in SRW, down 70 1/2 in HRW, down 62 1/4 in HRS; Corn is down 28 1/4; Soybeans down 58; Soymeal down $1.28; Soyoil down 3.47.

For the month to date wheat prices are down 72 3/4 in SRW, down 59 1/2 in HRW, down 48 3/4 in HRS; Corn is down 6; Soybeans down 72 1/4; Soymeal down $13.40; Soyoil down 1.16.

Year-To-Date nearby futures are down -5% in SRW, up 2% in HRW, down -13% in HRS; Corn is up 4%; Soybeans up 12%; Soymeal up 8%; Soyoil up 18%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 61 yuan; Soymeal up 7; Soyoil down 56; Palm oil down 78; Corn down 15 — Malaysian palm oil prices overnight were up 65 ringgit (+1.61%) at 4108.

There were changes in registrations (-1 Soybeans). Registration total: 2,653 SRW Wheat contracts; 0 Oats; 0 Corn; 0 Soybeans; 135 Soyoil; 71 Soymeal; 1 HRW Wheat.

Preliminary changes in futures Open Interest as of August 18 were: SRW Wheat up 4,262 contracts, HRW Wheat up 557, Corn down 4,098, Soybeans up 4,234, Soymeal up 576, Soyoil up 3,445.

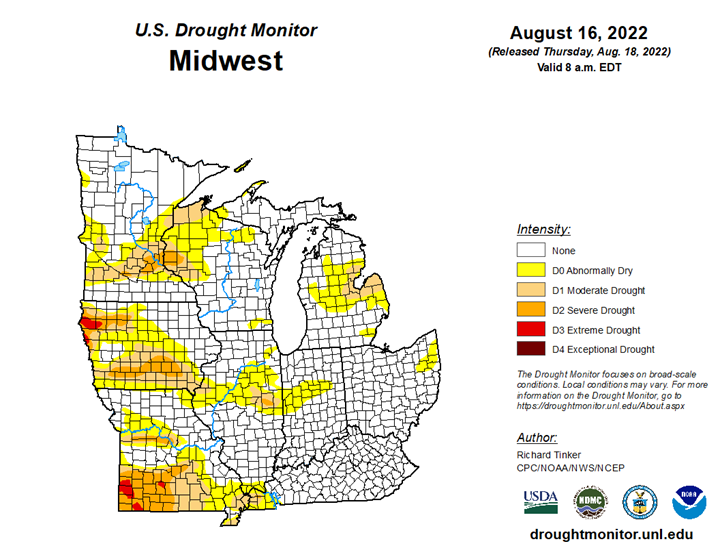

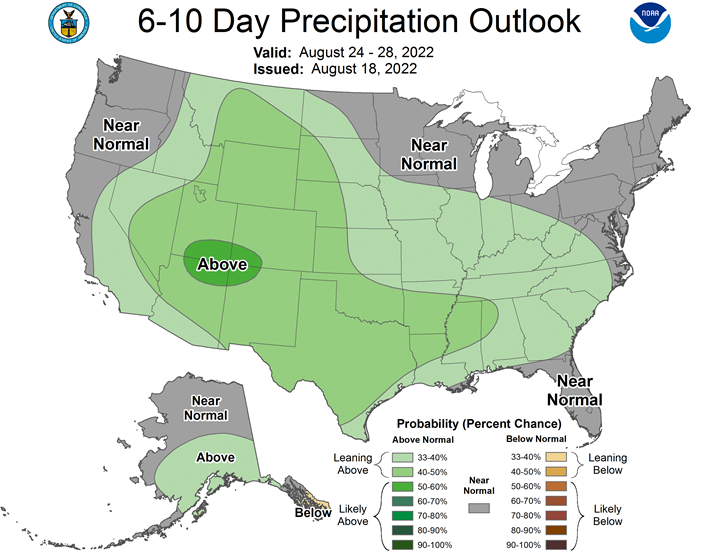

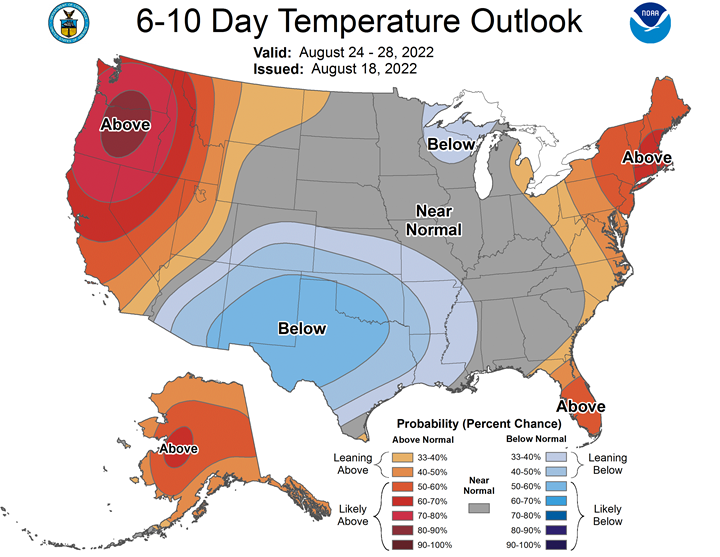

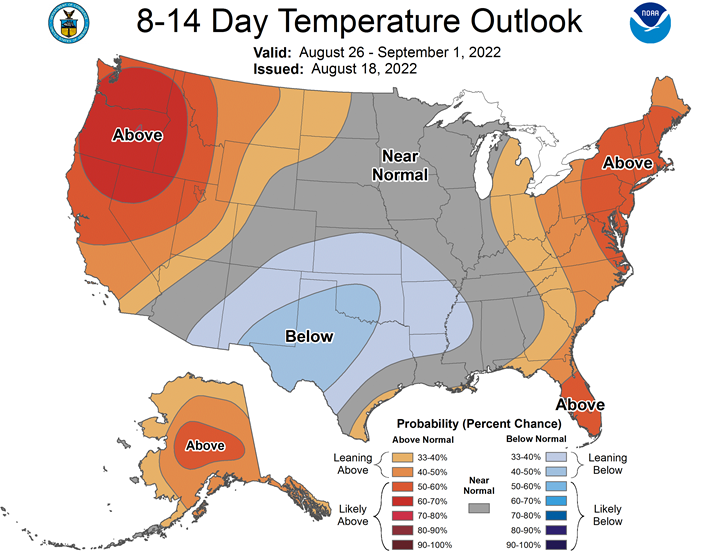

Northern Plains Forecast: Pockets of steady light rain east and mostly dry west Friday. Scattered light showers east and mostly dry west Saturday. Mostly dry Sunday-Monday. Temperatures above normal west and near to below normal east through Monday. Outlook: Isolated to scattered showers Tuesday-Thursday. Isolated showers to mostly dry Friday-Saturday. Temperatures near to above normal Tuesday-Saturday.

Central/Southern Plains Forecast: Isolated to scattered showers moving south with isolated showers northeast Friday. Mostly dry to isolated showers Saturday. Mostly dry north and scattered showers south Sunday-Monday. Temperatures near to below normal through Monday. Outlook: Isolated to scattered showers Tuesday-Saturday. Temperatures near to below normal Tuesday-Saturday.

Western Midwest Forecast: Isolated to scattered showers through Sunday. Isolated showers Monday. Temperatures near to below normal through Monday.

Eastern Midwest Forecast: Mostly dry Friday. Isolated to scattered showers Saturday-Sunday. Isolated showers Monday. Temperatures near normal Friday-Monday. Outlook: Isolated showers Tuesday. Isolated to scattered showers northwest and mostly dry otherwise Wednesday. Isolated to scattered showers Thursday-Saturday. Temperatures near normal Tuesday-Saturday.

The player sheet for Aug. 18 had funds: net sellers of 9,500 contracts of SRW wheat, buyers of 2,500 corn, sellers of 6,000 soybeans, buyers of 3,500 soymeal, and sellers of 1,500 soyoil.

TENDERS

- WHEAT TENDER: The Taiwan Flour Millers’ Association has issued an international tender to purchase 34,025 tonnes of grade 1 milling wheat to be sourced from the United States,

PENDING TENDERS

- WHEAT TENDER: Iranian state agency Government Trading Corporation issued an international tender to purchase about 60,000 tonnes of milling wheat

- FEED WHEAT AND BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by Nov. 30 and arrive in Japan by Jan. 26 via a simultaneous buy and sell (SBS) auction that will be held on Aug. 19.

- WHEAT TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of milling wheat

US BASIS/CASH

- Spot basis bids for corn and soybeans delivered to elevators and processors around the U.S. Midwest were mixed on Thursday as futures prices climbed but farmer sales remained light, grain dealers said.

- The spot soybean basis rose by 10 cents a bushel at a large processor in Decatur, Illinois, for a second straight day and the crusher sought supplies ahead of the local harvest. The bid for deliveries after mid-September were $1.95 lower than the spot bid.

- A large corn processor in Decatur, Illinois, rolled its spot corn bid from the September contract to basis December futures. As a result, the flat cash price offered to farmers was down 4 cents.

- Spot basis bids for hard red winter wheat were mostly steady to firm around the southern U.S. Plains on Thursday as futures prices fell sharply and farmer selling remained slow, grain dealers said.

- Farmer sales were muted on Thursday. Southern Plains wheat belt farmers have sold a sizable share of their latest harvest earlier in the summer as prices hovered near multi-year peaks.

- Protein premiums for wheat delivered by rail to or through Kansas City were 5 cents per bushel lower for all protein grades, according to the latest CME Group data.

- Spot basis bids for corn delivered to interior U.S. Midwest elevators, ethanol plants and other processors were steady to lower on Thursday, while bids at barge-loading river elevators were mostly steady to firmer, dealers said.

- Spot soybean basis bids were steady to higher at Midwest processing plants, unchanged at elevators and mixed at river terminals.

- Farmer sales of corn and soy were limited on Thursday as prices remain well below recent highs. Farmers are assessing their harvest prospects before booking additional new-crop sales, dealers said.

- Soybean processors have been firming their basis bids over the past week as some facilities are resuming crush operations after recent seasonal maintenance downtime. A large crusher in Decatur, Illinois, lifted its spot basis bid by 20 cents a bushel on Thursday after raised it by 20 cents earlier in the week.

- U.S. spot cash millfeed prices were steady to higher on Thursday, firming in several Midwest and Plains markets as a shortage of growth on grazing pastures continued to lift demand for supplemental livestock feed, dealers said.

- “We just can’t stay ahead of the demand,” one ingredient broker said.

- High costs for scarce supplies of freight restricted the amount of millfeed available for shipment from the eastern half of the country to western regions.

- Spot basis offers for soymeal delivered by rail or truck around the U.S. Midwest were mostly steady to lower on Thursday on rising supplies, dealers said.

- A steep inverse in the soymeal futures market, with the September contract about $35 above October, is expected to pressure meal basis offers as the spot contract nears its delivery period and processors prepare to roll their basis to the deferred month contract, a dealer said.

- Some crushers in the northern Midwest remain down for seasonal maintenance while others in the eastern Midwest are restarting after recent downtime. Soymeal supplies have increased in some eastern markets.

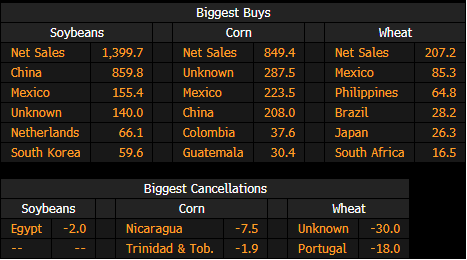

US Sold 1.4M Tons of Soybeans Last Week; 849K of Corn: USDA

USDA releases net export sales report on website for week ending Aug. 11.

- Soybean sales rose to 1,400k tons vs 411k in previous week

- Corn sales rose to 849k tons vs 383k in previous week

All wheat sales fell to 207k tons vs 359k in previous week

US Export Sales of Pork and Beef by Country

IGC Cuts Global Grain Output Estimate on Shrinking Corn Crop

World grain production in the 2022-23 season is now seen at 2.248b tons, down from a July estimate for 2.252b tons, the International Grains Council said on Thursday in a report.

- That’s mainly due to smaller corn and sorghum crops, while wheat prospects are rising

- Global grain stockpiles cut to 577m tons, from 583m tons

CORN

- Production outlook cut to 1.179b tons, from 1.189b tons

- Stockpiles cut to 265m tons, from 271m tons

WHEAT

- Production outlook raised to 778m tons, from 770m tons

- Stockpiles raised to 275m tons, from 272m tons

IGC Raises Ukraine Grain Export Outlook 8M Tons, Cuts Russia

Ukraine’s grain exports in the 2022-23 season are now seen at 30.4m tons, up from a July outlook for 22.6m tons, the International Grains Council said Thursday.

- Wheat exports seen at 13m tons, versus 10m tons

- Corn exports seen at 15.5m tons, versus 12m tons

- Russia grain exports now seen at 44.5m tons, versus 45.1m tons

- Wheat exports cut to 36.5m tons, from 37.5m tons

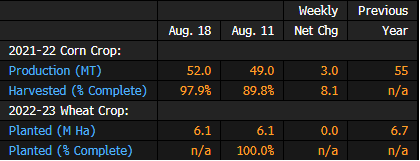

Argentine Corn, Wheat Crop Estimates Aug. 18: Exchange

The Buenos Aires Grain Exchange releases weekly report on website.

- 2021-22 corn production raised to 52m tons from 49m

2020-21 crop revised up to 55m tons from 52.5m

Corn-Laden Vessel I Maria Leaves Ukrainian Port for Turkey

I Maria departs Chornomorsk Thursday carrying 27,982 tons of corn, Joint Coordination Centre says in emailed statement.

- Vessel is heading to Istanbul

- Two inbound vessels — Canga Star and Pretty Lady — are authorized to move to Chornomorsk pending inspection

- Bellis is authorized to move to Odesa, also pending inspection

- Inspections on four inbound vessels — Aviva, Ascanios, Seaeagle and Zhe Hai 505 — took place Thursday, and vessels are cleared to sail

- Two outbound vessels — Osprey S and Bonita — are also cleared to sail

- Three inbound and five outbound ships to be inspected Friday

- Note: Total tons of grain and foodstuffs exported from the three Ukrainian ports as of Aug. 18 is 625,049 tons, JCC says

French Corn Ratings Drop, Only Half in Good Condition: AgriMer

The share of France’s corn crop that’s in good or very good condition dropped to 50% as of Aug. 15, crops office FranceAgriMer said on its website.

- NOTE: That’s the lowest rating for this time of year in at least a decade, after heat and dryness gripped French farms

- Amount compares to 53% a week earlier and 91% a year earlier

- NOTE: The International Grains Council this week cut its French corn crop estimate to 12m tons, from 12.6m tons

- The country produced 15.3m tons in 2021

Russia to Send Trial Grain Shipment to Vietnam This Fall: IFX

Russia plans to send a trial batch of grain to Vietnam in September or October, with the aim of resuming active sales in the southeast Asian nation, Interfax reported Friday, citing information from Russian agriculture watchdog Rosselkhoznadzor.

- Exports to Vietnam have been hampered by thistle seeds in Russian wheat

- In 2021, the country shipped just 188k tons of wheat to Vietnam, versus 1.7m-2.6m tons in 2017 and 2018

- Says Russia has worked to minimize the risk of weeds entering grain intended for Vietnam and is ready to accept Vietnamese inspectors to control the phytosanitary condition of exports

Bayer Says Ukraine Seed Availability Not an Issue for Next Crop

Bayer AG doesn’t see seed availability as a problem for Ukraine farmers planting 2023 crops, says Rodrigo Santos, president of the crop science division.

- Bayer was able to produce seeds for the next season, Santos says in interview

- “We were able to plant our fields this year to produce seeds. That’s a good sign that hopefully everything continues to go well in Ukraine,” he says

- Bayer announced investments of 30 million euros ($30.4 million) for the next few years in a seed plant in Pochuiky, Ukraine.

- “We are supporting farmers in several fronts and we have solid plans for Ukraine, that is important for agriculture. We have our R&D and supply-chains there and we will increase our investments in the future.”

- Bayer has more than 700 employees in the agriculture division in Ukraine

Saskatchewan Says Harvest Progress Behind Five-Year Average

Harvest progress is 5%, trailing the five-year average of 8%, the province’s agriculture ministry says Thursday in a report.

- One year ago, 20% of crop was harvested

- Multiple storms in the past week brought rain, hail and wind

- Parts of Humboldt received as much as 83 millimeters (3 inches) of rain

- Meanwhile, many producers in Saskatoon-Outlook area have received less than 150 mm (6 inches) of rain this growing season

- There are water shortages across the southwest and west-central areas

China’s Sinograin and COFCO Set up Grain Storage Joint Venture

China’s national stockpiler Sinograin and state-owned food conglomerate COFCO Corp. have set up a joint venture to manage the country’s central grain reserves.

- The move, part of China’s overhaul of its massive state-controlled agriculture giants, would improve efficiency and better safeguard the country’s grain security, Sinograin said on its official WeChat account late on Thursday

- The new unit, called China Enterprise United Grain Reserve Co., includes some grain storage firms earlier managed by COFCO; Sinograin controls the joint venture

- The two companies will also set up an oilseed processing venture, which will be managed by COFCO, the government said earlier this year

Brazil 2021/2022 corn crop to rise almost 33%, poll shows

Brazilian farmers are expected to harvest a record corn crop in the 2021/2022 season, according to the average of 11 forecasts in a Reuters poll on Thursday.

Projections point to a potential 115.78 million tonne harvest, an increase of almost 33% from the last season, when frosts and drought spoiled part of the crop.

An 8.17% area expansion and higher yields have boosted Brazil’s corn prospects this year, analysts said.

Brazil plants at least two large corn crops annually, three in some regions.

From this point on, because farmers have harvested about 90% of their second corn crop, the national corn projections will unlikely change much, according to the analysts polled.

Brazil’s second corn crop, which represents 70-75% of production in a given year, helps the country compete with the United States in global corn markets during the second half.

Rabobank’s Marcela Marini expects Brazil will reap a record corn crop based on both the increase in area and improved productivity from a year ago.

“The planting of the second corn, which largely took place within the ideal climate window, minimized the negative impacts of the drier weather from April onwards,” she said.

Enilson Nogueira, analyst at consulting firm Celeres, said Brazil’s second corn crop has shown yields above 90 bags per hectare, which is considered excellent.

Such productivity allowed for a hefty rise of 50% in output in relation to last year’s second corn crop, boosting the overall national production to almost 116 million tonnes.

A larger crop, combined with strong global demand after problems in Ukraine and potentially lower supplies from the United States, will boost Brazil’s export potential, Nogueira added.

He predicts annual exports above 40 million tonnes through February 2023.

Russia Wheat-Export Tax to Fall to 4,794.7 Rubles/Ton: Interfax

Russia’s wheat-export customs duty will fall to 4,794.7 rubles ($80.45) a ton next week from the current 5,018.1 rubles, Interfax reported, citing the agriculture ministry.

NOTE: Russia started calculating the export tax in rubles earlier this summer; previously, it was calculated in dollars, and the amount was markedly higher

U.S. generation of renewable fuel credits fell in July – EPA

The United States generated fewer renewable fuel blending credits in July versus the month prior, data from the Environmental Protection Agency (EPA) showed on Thursday.

About 1.21 billion ethanol (D6) blending credits were generated in July, versus 1.29 billion in June, according to the data.

About 421 million biodiesel (D4) blending credits were generated in July, versus 491 million the month prior.

The credits are used by oil refiners and importers to show compliance with EPA-mandated ethanol blending quotas for petroleum-based fuels. They are generated with every gallon of biofuel produced.

The following is a table of the credit generation for the month of July by credit type.

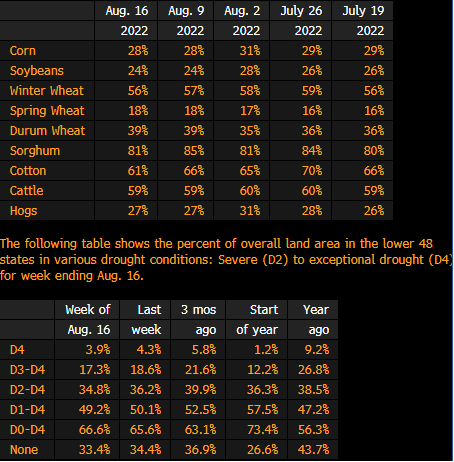

US Crops in Drought Area for Week Ending Aug. 16: USDA

The following table shows the percent of US agricultural production within an area that experienced drought for the week ending Aug. 16, according to the USDA’s weekly drought report.

- Corn area experiencing moderate to intense drought remained at 28% in the week

- Soybean drought area also unchanged

Cotton area in drought eased to 61% from 66%

US Barge Shipments of Grain Fell 29% Last Week: USDA

Shipments along the Mississippi, Illinois, Ohio and Arkansas rivers declined in the week ending Aug. 13 from the previous week, according to the USDA’s weekly grain transportation report.

- Barge shipments of corn fell 49% from the previous week

- Soybean shipments down 27% w/w

Dicamba Can Harm Plants, Animals, Workers, EPA Analysis Says

- EPA updates dicamba risk analysis; comments due Oct. 17

- Assessment precedes any changes to allowed uses

Birds, bees, and plants could be harmed by the widely used weedkiller dicamba, and some workers may need respirators, the EPA said Thursday.

The analysis was part of the Environmental Protection Agency’s revised draft environmental and human health conclusions about the herbicide’s risks. The agency is now seeking public comment.

Ecological damage occurs mostly when the herbicide drifts off crops that are genetically engineered to resist the herbicide onto other crops and plants that aren’t, the EPA said. The agency received 3,500 incident damage reports for the 2021 growing season, the EPA said, referring to information released in December.

Worker protections already required for most uses of the herbicide are sufficient, but respirators will be needed for some workers, the agency said.

Dicamba kills weeds among corn, cotton, sorghum, soybeans, sugarcane, and other crops and on golf courses, roadsides, railways, and rights-of-way along utility lines. The herbicide’s use on cotton and soybean crops that are genetically engineered to resist damage from it, however, has turned farmers against each other.

Dicamba can drift off fields where it’s sprayed and damage other crops such as fruits and vegetables and soybeans that don’t carry the trait that makes them resistant to it. Suits alleging such damage have been filed against manufacturers, including BASF Corp., Bayer AG, and Syngenta AG.

Approval Saga

The EPA approved dicamba in 2018 for two years after farmers filed more than 4,200 official complaints that alleged it had damaged at least 4.7 million acres of soybeans.

The US Court of Appeals for the Ninth Circuit vacatedthree approved uses of dicamba in June 2020, prompting the agency to soon cancel them.

But in October 2020, the agency approved five-year registrations for Bayer’s XtendiMax with VaporGrip Technology, BASF’s Engenia Herbicide, and Syngenta’s Tavium Plus VaporGrip Technology. These registrations applied to certain uses of dicamba on soybean and cotton crops that are genetically engineered to resist dicamba. The registrations expire in 2025.

Soon after President Joe Biden came into office, the EPA named the dicamba decision made during President Donald Trump’s years in office as one suspected of being politically manipulated and violating the agency’s scientific principles.

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |