The CME and Total Farm Marketing offices will be closed Monday, September 5, 2022, in observance of Labor Day.

Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 6 1/2 in SRW, down 7 in HRW, down 11 1/2 in HRS; Corn is down 6 1/4; Soybeans down 8 1/4; Soymeal up $0.35; Soyoil down 1.68.

For the week so far wheat prices are up 19 3/4 in SRW, up 23 1/4 in HRW, up 8 1/2 in HRS; Corn is down 1/4; Soybeans down 47; Soymeal down $0.99; Soyoil down 1.08.

Year-To-Date nearby futures are up 5% in SRW, up 15% in HRW, down -7% in HRS; Corn is up 13%; Soybeans up 12%; Soymeal up 12%; Soyoil up 27%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 41 yuan; Soymeal up 4; Soyoil down 114; Palm oil down 76; Corn up 2 — Malaysian palm oil prices overnight were down 144 ringgit (-3.47%) at 4000.

There were changes in registrations (1 Oat, 39 HRW Wheat). Registration total: 3,084 SRW Wheat contracts; 1 Oat; 0 Corn; 0 Soybeans; 61 Soyoil; 0 Soymeal; 40 HRW Wheat.

Preliminary changes in futures Open Interest as of August 31 were: SRW Wheat up 2,219 contracts, HRW Wheat up 1,841, Corn up 4,308, Soybeans up 3,293, Soymeal up 495, Soyoil up 3,756.

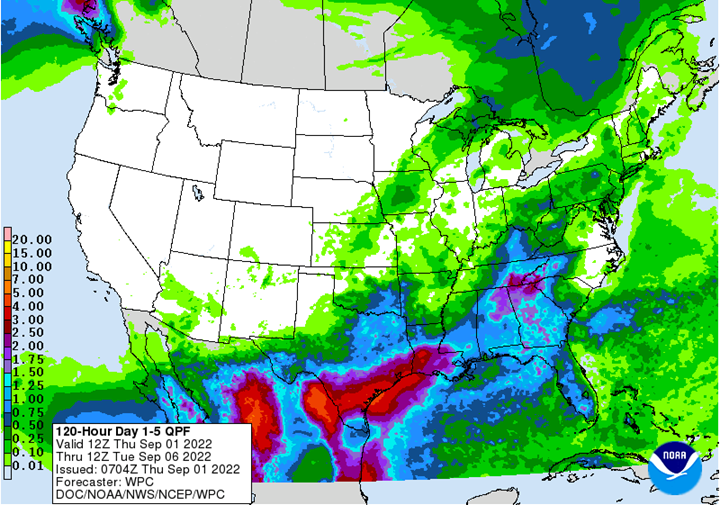

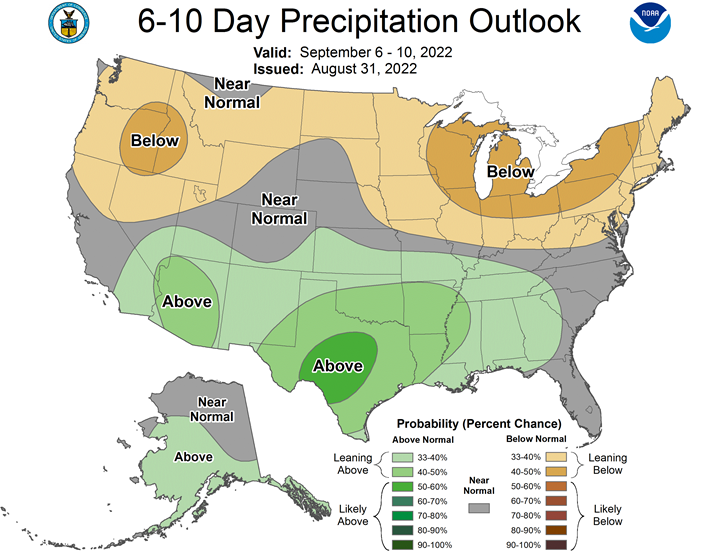

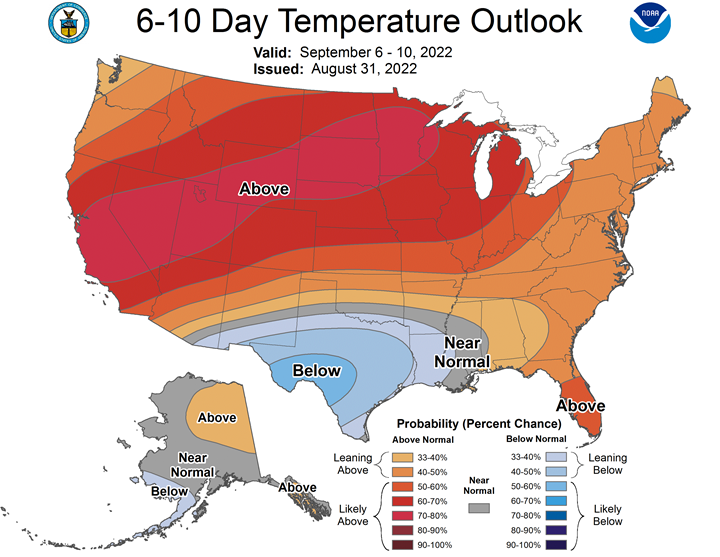

Northern Plains Forecast: Mostly dry through Sunday. Temperatures near to above normal through Sunday. Outlook: Mostly dry Monday-Wednesday. Scattered showers Thursday-Friday. Temperatures above to well above normal Monday-Wednesday, near to above normal Thursday-Friday.

Central/Southern Plains Forecast: Isolated showers through Sunday, mostly in Texas. Temperatures near to above normal north and near to below normal south through Sunday. Outlook: Isolated showers south Monday-Thursday. Scattered showers Friday. Temperatures near to above normal north and near to below normal south Monday-Tuesday, near to above normal Wednesday-Friday.

Western Midwest Forecast: Mostly dry Thursday. Isolated showers north Friday-Saturday. Mostly dry Sunday. Temperatures near to above normal through Sunday.

Eastern Midwest Forecast: Mostly dry through Friday. Isolated showers Saturday-Sunday. Temperatures near to above normal through Sunday. Outlook: Mostly dry Monday-Thursday. Scattered showers Friday. Temperatures above normal Monday-Friday.

The player sheet for Aug. 31 had funds: net buyers of 5,000 contracts of SRW wheat, sellers of 5,500 corn, buyers of 6,000 soybeans, sellers of 5,500 soymeal, and buyers of 3,000 soyoil.

TENDERS

- SOYBEAN SALE: The U.S. Department of Agriculture confirmed private sales of 167,000 tonnes of U.S. soybeans for shipment to China in the 2022/23 marketing year.

- CORN SALE: The Korea Feed Association (KFA) purchased some 63,000 tonnes of animal feed corn expected to be sourced from either South America or South Africa in a deal on Wednesday

- CORN SALE: South Korea’s Major Feedmill Group (MFG) on Wednesday purchased around 135,000 tonnes of animal feed corn expected to be supplied from either South America or South Africa

- BARLEY SALE: Jordan has bought 60,000 tonnes of barley from Louis Dreyfus in an international purchasing tender, a government source told Reuters on Wednesday.

- BARLEY TENDER: Jordan’s trade ministry is seeking 120,000 tonnes of barley in a tender, a government source said. The deadline for submission of offers is Sept. 7 for shipment during February and March, the source said.

- CORN TENDER: Taiwan’s MFIG purchasing group has issued an international tender to buy up to 65,000 tonnes of animal feed corn which can be sourced from the United States, Brazil, Argentina or South Africa.

PENDING TENDERS

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy 95,497 tonnes of food-quality wheat from the United States and Canada in regular tenders that will close on Sept. 1.

- RICE TENDER: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of rice, traders said. The deadline for submission of price offers is Sept. 6.

- SOYBEAN TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued international tenders to purchase around 30,000 tonnes of soybeans free of genetically modified organisms

- WHEAT TENDER: Bangladesh’s state grains buying agency postponed the deadline for submission of price offers in its international tender to purchase 50,000 tonnes of wheat from Sept. 1 to Sept. 18.

US BASIS/CASH

- Basis bids for soybeans shipped by barge to U.S. Gulf Coast export terminals were steady to sharply higher on Wednesday on good demand from exporters and higher barge freight rates, traders said.

- Nearby soybean barge values have also been supported by concerns about tight supplies of export-grade soybeans after ripe Delta crops received heavy rain.

- Chinese soy importers booked at least two more cargoes of U.S. soybeans for shipment between September and November, exporters said. China has been booking almost-daily purchases for at least the past week, including the latest sale of 167,000 tonnes.

- U.S. soybeans are priced competitively with Brazilian supplies for shipments to Asia, traders said.

- Spot river freight rates around the Midwest jumped by 25 percentage points of tariff on Wednesday as shippers sought barges following an increase in farmer sales.

- Soybean barges loaded in August were bid around 350 cents over November futures, 40 cents higher on the day amid tight supplies. September soy barges traded at 225 cents over futures, up about 40 cents from bids late on Tuesday.

- Soybean export premiums held steady. Early October soybean export premiums were quoted around 250 cents over November.

- Corn barge basis bids were steady to firm on higher barge freight costs and thin spot supplies. Muted export demand limited gains.

- CIF barges loaded in August were bid 10 cents higher at 145 cents over September futures. September barges were bid 2 cents higher at 108 cents over futures.

- September corn export premiums held steady at 148 cents over futures.

- Spot basis bids for soybeans were mixed in Iowa on Wednesday, rising at processing plants looking to boost crush rates due to strong profit margins, but falling at elevators ahead of what is expected to be a bumper harvest in the state.

- The soybean basis was unchanged at elevators, processors and river terminals around the rest of the U.S. Midwest.

- Cash bids for corn were weak at river terminals, with light demand for U.S. supplies on the export market pressuring basis levels.

- The corn basis held steady at interior elevators and processors.

- Farmer sales have been slow this week, with cash prices well below levels hit earlier this year chilling growers’ interest in booking new deals.

- Spot basis bids for corn fell at river terminals around the U.S. Midwest early on Wednesday, grain dealers said.

- Cash bids for corn were steady to weak at ethanol plants and processors, and steady to firm at the region’s interior elevators.

- The spot basis for soybeans was steady to firm at processors, rising by 20 cents a bushel in Lafayette, Indiana.

- Strong profit margins at processors due to good soymeal demand supported the basis gains.

- The soybean basis was steady to weak at interior elevators and flat along rivers.

- Spot cash millfeed prices held mostly steady around the United States on Wednesday, underpinned by tight supplies and strong demand for the animal feed ingredient, brokers said.

- Some mills are sold out of millfeed for delivery next week and were not quoting spot prices, a broker said.

- Flour mill downtime around the U.S. Labor Day holiday next Monday has limited available supplies of millfeed. One large mill in the Buffalo, New York, market is due to be down all of next week, a broker said.

- Spot basis offers for U.S. soymeal were flat at rail market processors on Wednesday and steady to weak in the truck market, dealers said.

- Demand was weak, with most livestock and poultry producers staying on the sidelines due to high cash prices, a Minnesota dealer said.

- The high prices have prevented some end users from booking contracts to ensure that they have enough soymeal to last them through September, the dealer added.

- Offers fell by $5 per ton in the Kansas City area.

Statement from FAS Administrator Daniel Whitley Regarding Weekly Export Sales Reporting

August 31, 2022 | News Release

WASHINGTON, Aug. 31, 2022 – USDA Foreign Agricultural Service Administrator Daniel Whitley issued the following statement today regarding weekly export sales reporting:

“As a result of unanticipated difficulties with the launch of the new Export Sales Reporting and Maintenance System, USDA’s Foreign Agricultural Service will temporarily revert to the legacy system while we work to fully resolve the issues with the new system. FAS will be unable to publish weekly export sales data on Thursday, Sept. 1 or Thursday, Sept. 8, but we expect to resume regular reporting on Thursday, Sept. 15.

“Since the system relies on data submissions by exporters, FAS is working closely with individual exporters to ensure that past, current, and future export sales data are accurate. Our staff will continue to conduct outreach and provide support to both data reporters and data users in anticipation of the re-launch of the new system.

“Data integrity, credibility, and transparency are top priorities for FAS. The timely and accurate reporting of agricultural export sales data is vital to effectively functioning markets. The new Export Sales Reporting and Maintenance System is designed to assure data security and availability. It will also provide a platform for future automations and enhancements that benefit both data reporters and data users.

“FAS recognizes the impacts of the problems that arose from this rollout. Despite the measures taken over many months to transition to the new system, we understand that further action is necessary to ensure credible and accurate data reporting. We are working to resolve the problems and are committed to keeping our stakeholders informed as we do so.

DOE: US Ethanol Stocks Fall 1.2% to 23.533M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 23.877 mln bbl

- Plant production at 0.97m b/d, compared to survey avg of 0.971m

CROP SURVEY: US Soybean Crush and Corn for Ethanol

The following is from a Bloomberg survey of six analysts.

- Soybean crush seen at 180.8m bu in July, an 8.7% rise from a year ago

- Crude and once-refined soybean-oil reserves at end of July seen at 2.219b lbs, up from 2.07b

- Corn used in ethanol production seen down 0.4% y/y to 448.3m bu

- The USDA is scheduled to release its July Fats and Oils report along with the Grain Crushings report on Sept. 1 at 3pm

Allendale Inc survey puts U.S. corn yield at 172.39 bu/acre

A farmer survey conducted by agricultural commodity brokerage and analysis firm Allendale Inc forecast the U.S. 2022 corn yield at 172.39 bushels per acre, the company said on Wednesday.

The survey forecast the 2022 U.S. soybean yield at 50.86 bushels per acre.

Allendale projected 2022 U.S. corn production at 14.108 billion bushels and soybean production at 4.435 billion bushels.

The yield survey, conducted from Aug. 15-28, was based on producer-calculated yields in 26 states covering 86% of corn production and 83% of soybean production.

The firm’s production figures were based on the U.S. Department of Agriculture’s estimates of harvested acres.

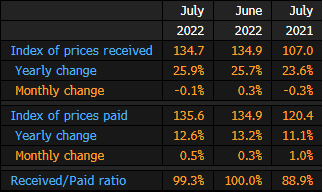

U.S. July Agricultural Prices Paid and Received

Europe’s Worst Heat Wave Since the Renaissance

European officials say this year is on track to be drier than any time in the past five centuries, with almost two-thirds of the region under a drought warning or alert. That’s wreaking havoc on broad sectors of the economy, from agriculture to energy to transport. Lawns in England are brown, Norway’s hydroelectric stations have run short of water, and Germany’s rivers—key trade routes—have been too shallow for barges to navigate.

Cheap Ammonia in the Rear View as Producers Eye 4Q Price Gains

Global prices of ammonia, the key component of nitrogen fertilizers, are set to firm into 4Q after European plant closings removed more than 9 million metric tons of high-cost production. Margins of North American producers CF Industries and Nutrien could widen relative to European peers as restricted supply boosts costs of natural gas feedstock

High-Cost Production Stumbles, Shutters in Europe

Over two-thirds of European ammonia production has been shut due to high natural gas costs, with almost 10 million metric tons of capacity closed in August. Supply curtailments will firm ammonia prices, but we don’t expect them to top 2Q’s record. The price of ammonia, the key input for nitrogen fertilizers, is up 15% in 3Q, trailing a near-doubling of European gas costs. In response, the region’s producers are importing lower-cost ammonia from the Americas and the Middle East to make their upgraded nitrogen products.

Europe is the world’s highest-cost ammonia producer. Annual demand of 182 million metric tons is exceeded by global capacity of 234 million tons, leaving room for closures when production costs exceed the market price. Yara, BASF and OCI are among companies with production sites in Europe.

India Tender Aids Brazil Urea: Wednesday Whisper

Nitrogen prices in Brazil appear to be strengthening after India’s urea tender call on Aug. 30 stirred the global market. Arab Gulf offers are reportedly trending up $100 a metric ton (mt) for Brazil urea, but negotiations are few as buyers await more details on the tender. Also roiling the market are Iranian urea offers that remain significantly lower, but only for limited deals with a few companies. Potash and phosphate prices suggest additional discounts inland as players focus on selling existing storage volumes rather than on purchasing new imports.

Nitrogen Prices Rally

Higher prices for major nitrogen products led the way, with ammonia about 26% higher than a week ago at inland hubs and urea ammonium nitrate up 15%. Urea again tracked news of nitrogen outages in Europe, with higher prices inland and New Orleans and at major international points, Egypt and Brazil, and expectations that urea-hungry India will soon follow. Ammonium sulfate and ammonium nitrate also firmed. Phosphate prices were mixed depending on type and location, while potash keeps drifting lower.

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |