Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 4 1/2 in SRW, up 4 1/2 in HRW, up 1 1/4 in HRS; Corn is up 3 1/4; Soybeans down 1/2; Soymeal down $0.12; Soyoil down 0.15.

For the week so far wheat prices are down 24 3/4 in SRW, down 21 in HRW, down 19 1/4 in HRS; Corn is up 4 1/4; Soybeans up 12 1/4; Soymeal up $0.66; Soyoil down 0.95.

For the month to date wheat prices are up 3 1/2 in SRW, up 1 3/4 in HRW, down 10 in HRS; Corn is up 11; Soybeans up 38 1/4; Soymeal up $13.00; Soyoil down 2.47.

Year-To-Date nearby futures are up 8% in SRW, up 14% in HRW, down -6% in HRS; Corn is up 15%; Soybeans up 10%; Soymeal up 6%; Soyoil up 20%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans up 6 yuan; Soymeal up 12; Soyoil down 160; Palm oil down 240; Corn down 12 — Malaysian palm oil prices overnight were up 37 ringgit (+1.00%) at 3737.

There were no changes in registrations. Registration total: 3,084 SRW Wheat contracts; 0 Oats; 0 Corn; 5 Soybeans; 48 Soyoil; 147 Soymeal; 40 HRW Wheat.

Preliminary changes in futures Open Interest as of September 19 were: SRW Wheat up 590 contracts, HRW Wheat up 2,436, Corn up 2,334, Soybeans up 1,590, Soymeal up 7,590, Soyoil down 452.

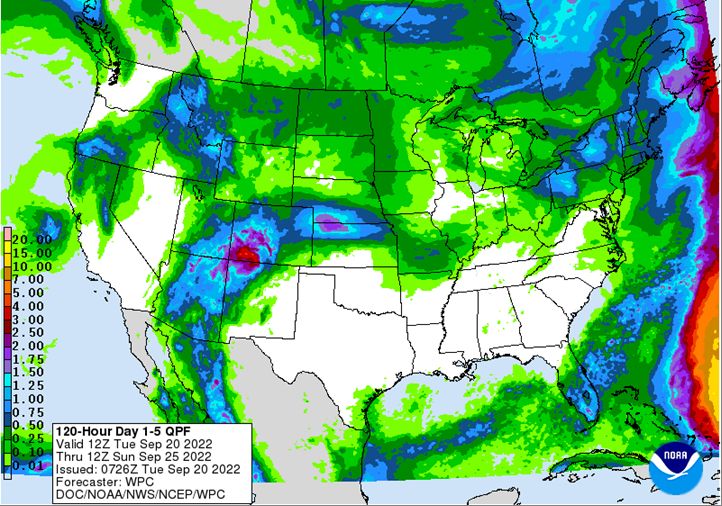

Northern Plains Forecast: Isolated to scattered showers Tuesday. Mostly dry Wednesday. Scattered showers Thursday-Friday. Temperatures near to above normal Tuesday, near to below normal Wednesday-Thursday, near to above normal Friday. Outlook: Isolated showers Saturday. Mostly dry Sunday-Wednesday. Temperatures above to well above normal Saturday-Wednesday.

Central/Southern Plains Forecast: Mostly dry Tuesday. Isolated showers Wednesday-Friday, mostly north. Temperatures above to well above normal through Wednesday, near to above normal Thursday-Friday. Outlook: Isolated showers Saturday-Sunday. Mostly dry Monday-Wednesday. Temperatures above to well above normal Saturday-Wednesday.

Western Midwest Forecast: Isolated showers Tuesday-Wednesday. Mostly dry Thursday. Isolated showers Friday. Temperatures above to well above normal through Wednesday, near to below normal Thursday-Friday.

Eastern Midwest Forecast: Isolated showers Tuesday-Thursday. Mostly dry Friday. Temperatures above to well above normal through Wednesday, near to below normal Thursday-Friday. Outlook: Isolated showers Saturday-Tuesday. Mostly dry Wednesday. Temperatures near normal Saturday-Sunday, near to below normal Monday-Wednesday.

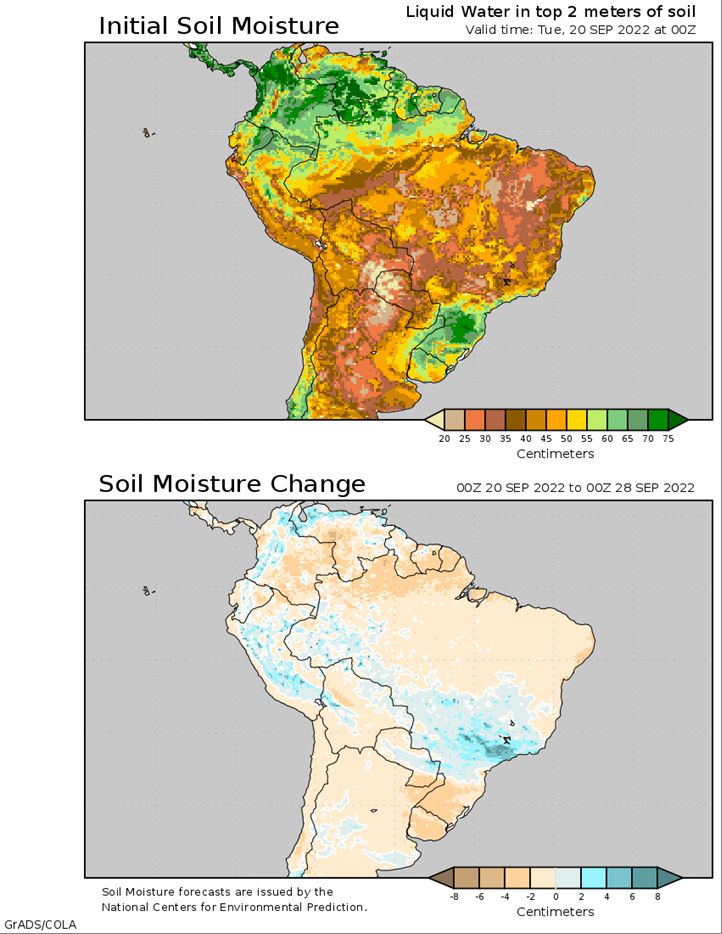

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Scattered showers north Tuesday. Scattered showers Wednesday-Thursday. Mostly dry Friday. Temperatures near to above normal Tuesday-Wednesday, below normal Thursday-Friday. Mato Grosso, MGDS and southern Goias: Isolated showers Tuesday. Scattered showers Wednesday-Friday. Temperatures near to above normal Tuesday, near to below normal Wednesday, below normal Thursday-Friday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Isolated showers through Wednesday. Mostly dry Thursday-Friday. Temperatures near to below normal through Thursday, near to above normal Friday. La Pampa, Southern Buenos Aires: Mostly dry Tuesday-Friday. Temperatures near to below normal through Thursday, near to above normal Friday.

The player sheet for Sept. 19 had funds: net sellers of 8,500 contracts of SRW wheat, sellers of 0 corn, sellers of 2,500 soybeans, buyers of 4,500 soymeal, and sellers of 2,500 soyoil.

TENDERS

- SOYBEAN SALE: The U.S. Department of Agriculture confirmed private sales of 136,000 tonnes of U.S. soybeans for shipment to China in the 2022/23 marketing year.

- WHEAT SALES: Saudi Arabia’s main state wheat-buying agency, the Saudi Grains Organization (SAGO), on Monday said it has purchased about 556,000 tonnes of wheat in an international tender.

- WHEAT TENDER: A government agency in Pakistan has issued a new international tender to purchase and import 300,000 tonnes of wheat

- WHEAT TENDER: Iraq’s Trade ministry will announce an international tender seeking 300,000 tonnes of wheat from various origins in the coming days, Iraqi state news agency said on Monday, citing a ministry official.

- WHEAT TENDER CANCELED: Bangladesh’s state grains buyer has canceled and withdrawn an international tender to purchase and import 50,000 tonnes of wheat with no purchase made, an official said on Monday, confirming reports from European traders.

PENDING TENDERS

- WHEAT TENDER: Jordan’s grain state buyer is seeking 120,000 tonnes of wheat in an international tender that closes on Sept. 20, traders said.

- BARLEY TENDER: Jordan’s state grain buyer is seeking 120,000 tonnes of barley in a tender closing on Sept. 21, a government source said.

US BASIS/CASH

- Basis bids for soybeans shipped by barge to Gulf Coast terminals were mixed on Monday as some nearby values slipped from last week’s highs, while deferred bids were steady to firm on moderate demand for autumn shipments, traders said.

- CIF corn basis was steady to lower on rising supplies and competition from cheaper South American grain.

- Both corn and soybean CIF values remain inverted, with barges for prompt shipment commanding premiums as exporters scramble to cover nearby orders as the harvest ramps up.

- Stiff competition from South American soybeans limited demand for U.S. soybean shipments and capped basis gains, traders said.

- Soybean demand has also been lackluster as top importer China has sought fewer cargoes amid a slow economy. China’s imports this year through August, are down 9%, according to customs data.

- Bids for CIF soybean barges loaded in September were down about 15 cents at 160 cents above November futures. However, bids for soy barges arriving at points near the Gulf before the end of the month were bid as high as 350 cents over futures.

- Export premiums for soybean shipments in late-October were around 190 cents over November futures.

- Bids for corn barges loaded in September dropped 2 cents to 118 cents over December futures.

- Export premiums for October corn loadings were unchanged at around 147 cents over futures, while deferred basis offers were down as much as 4 cents.

- Spot basis bids for corn and soybeans fell at processors in the eastern half of the U.S. Midwest on Monday, grain dealers said.

- The soy basis was steady to firm at processors in areas west of the Mississippi River, rising by 20 cents a bushel in Des Moines, Iowa.

- Soybean bids were steady to weak at river terminals, falling by 25 cents a bushel at a facility in Morris, Illinois.

- Bids for both commodities were flat at elevators around the interior of the region.

- Country movement was light, with most farmers busy making final preparations for soybean harvest.

- Soy harvest has already started in some areas and will expand quickly across the region in the coming weeks, an Ohio dealer said.

- Spot cash millfeed values were mostly steady to higher around the United States on Monday on strong demand and tight supplies of the feed ingredient as flour mill run times have been inconsistent in the Midwest and Plains, ingredient dealers said.

- Spot millfeed prices are at a premium to deferred values as feed users are filling near-term needs with the wheat-based feed ingredient ahead of the corn harvest.

- Dry conditions across portions of the Great Plains have limited grazing pasture growth and lifted demand for supplemental feed.

- Several large flour mills have taken longer-than-normal downtime in recent weeks in the Midwest and Northeast for maintenance, repairs and other mill improvements, a broker said. The slowdown in flour milling has kept millfeed supplies tight.

- Spot basis bids for soybeans eased at processors, elevators and river terminals around the U.S. Midwest early on Monday as the pace of early harvest accelerated in key growing areas, grain dealers said.

- U.S. farmers will soon begin delivering massive amounts of soybeans to terminals around the region to satisfy contracts they had previously booked.

- Cash bids for corn were mixed at interior grain elevators and processors.

- The corn basis was steady to firm at processors and steady to weak at river terminals.

- Spot basis bids for hard red winter wheat were unchanged at rail and truck market terminals around the southern U.S. Plains on Monday, grain dealers said.

- Farmer selling was slow, with sharp declines in the futures market pulling cash prices well below target prices, an Oklahoma dealer said.

- Some farmers were starting planting of the new crop, but most growers remained on the sidelines, hoping for rain before beginning their seeding tasks, the dealer said.

- Soils have been parched due to a summer drought.

- Protein premiums for wheat delivered by rail to or through Kansas City were unchanged for all grades of wheat, according to the latest CME Group data.

- Spot basis offers for soymeal fell at truck market processors around the U.S. on Monday, dealers said.

- Rail market offers were flat.

- Demand was steady as end users with immediate feeding needs looked to place orders for small amounts.

- Livestock and poultry producers concerned about future shipments, while buyers were reluctant to lock in offers as the falling basis raised hopes that prices would fall further by the time they would need soymeal.

- A processing plant in Mankato, Minnesota, was shut down for the week for seasonal maintenance, a dealer in that area said.

- The shutdown will likely shift demand to a plant in Fairmont, Minnesota, the dealer added.

USDA CROP PROGRESS: Corn Conditions 52% G/E, Soybeans 55%

- Corn harvest 7% vs 5% last week, and 9% a year ago

- Corn 52% G/E vs 53% last week, and 59% a year ago

- Corn dented 87% vs 77% last week, and 92% a year ago

- Corn mature 40% vs 25% last week, and 54% a year ago

- Soybeans 55% G/E vs 56% last week, and 58% a year ago

- Soybean drop leaves 42% vs 22% last week, and 55% a year ago

- Soybeans harvested 3% vs 5% a year ago

- Spring wheat harvest 94% G/E vs 85% last week, and 100% a year ago

- Winter wheat planted 21% vs 10% last week, and 20% a year ago

- Winter wheat emerged 2% vs 3% a year ago

- Cotton 33% G/E vs 33% last week, and 64% a year ago

- Cotton harvested 11% vs 8% last week, and 8% a year ago

- Sorghum 20% G/E vs 20% last week, and 56% a year ago

US Inspected 549k Tons of Corn for Export, 519k of Soybean

In week ending Sept. 15, according to the USDA’s weekly inspections report.

- Soybeans: 519k tons vs 342k the previous wk, 280k a yr ago

- Corn: 549k tons vs 474k the previous wk, 403k a yr ago

- Wheat: 790k tons vs 758k the previous wk, 568k a yr ag

US Corn, Soybean, Wheat Inspections by Country: Sept. 15

China’s August Commodity Imports

China’s exports of rare-earth products rose 3.7% from a year ago in Aug., according to figures released by the Beijing-based Customs General Administration.

- Soybean imports -24.5% y/y to 7.17M tons

- Copper concentrate imports +20.6% y/y to 2.27M tons

- Corn imports -44.4% y/y to 1.8M tons

- Wheat imports -25.4% y/y to 0.53M tons

China’s Soybean Imports From Brazil Contract 31% in August Y/y

China’s soybean imports from Brazil fell 31% in August from a year earlier, according to customs data Tuesday. Shipments from the country’s top soybean supplier came in at 6.25 million tons.

- The amount was also below the 6.97 million tons of imports in July

- Soybean shipments from the US in August were 287,864 tons, up from 17,576 tons a year earlier, but down from 382,018 tons in July

- NOTE: China’s total soybean imports in August fell 24% y/y, while shipments in the first eight months shrank 8.6%

- Corn imports from the US were 1.78 million tons in August, down from 2.93 million tons a year earlier; shipments from Ukraine were just 209 tons in August, compared with 301,383 tons a year ago.

EU Corn Yield Outlook Cut Further, But Drought Is Easing: MARS

“The summer drought that kept its grip on Europe came to an end in most regions,” the EU’s Monitoring Agricultural Resources unit said Monday in a report.

- Still, the improved weather came too late to significantly benefit summer crops

- Drought still continues in Spain, raising concerns for the 2023 season as soils are very dry

- Rains since mid-August have improved planting conditions for winter crops, including rapeseed

- Here are the latest crop forecasts from MARS, in tons per hectare:

Turkey Wheat Crop Seen Up 9% Y/y After Summer Rains: MARS

Below-normal temperatures and rainy weather in June and July aided winter-grain crops in Turkey, the EU’s Monitoring Agricultural Resources unit said Monday in a note.

- Wheat harvest is seen at 19.2m tons, up 9% y/y

- That’s still 3% below the five-year average

- NOTE: Turkey is among the world’s biggest wheat importers and a major flour exporter

- Barley harvest is seen at 7.51m tons, up 37% y/y

- Corn harvest is seen at 7.13m tons, up 6% y/y

Ukraine Corn Crop Outlook Raised 0.5M Tons on Good Weather: UAC

Ukraine’s 2022 corn harvest is now estimated at 27m tons, up 0.5m tons from a prior outlook, analyst UkrAgroConsult says in an emailed report.

- Based on favorable weather in August, with sufficient precipitation

- Wheat crop estimate raised to 18.9m tons, up 0.4m tons from prior outlook

- EU expected to remain a significant buyer of Ukrainian grain, after drought damaged the bloc’s corn crop

- NOTE: Russia’s invasion is still restraining Ukrainian farm output

- Ukraine produced 42m tons of corn and 32m tons of wheat last year

Ukrainian winter wheat sowing 9% complete, says agriculture ministry

Ukrainian farms in all government-controlled regions have started sowing winter wheat for the 2023 harvest, seeding 364,000 hectares, or 9% of the expected area, the agriculture ministry said on Tuesday.

The ministry did not provide a forecast, although Agriculture Minister Mykola Solsky told Reuters last month that the area could fall to 3.8 million hectares from 4.6 million a year earlier due to the Russian invasion. (Full Story)

The minister said Ukraine’s winter barley sowing area for the 2023 harvest could also fall by 20% from last year, while the winter rapeseed area would remain unchanged.

A senior agriculture official said this month the Ukrainian army’s successes in recapturing a significant swathe of land in the northeast and the south of Ukraine, could lead to improved forecasts for the winter sowing area for the 2023 grain crop.

The ministry said in a statement that farmers had already sown 32,000 hectares of winter barley, or 5% of the expected area, and 15,300 hectares of rye, or 18% of the forecast.

It also said farmers had sown 948,000 hectares of winter rape, 98% of the expected sowing area.

Ukraine harvested 19 million tonnes of wheat this year compared with around 32.2 million tonnes in 2021. The sharp decline was the result of hostilities in many regions and the occupation of large areas by Russian forces.

Argentina Central Bank Tightens FX Controls on Soy Exporters

Argentina’s central bank is banning soy exporters from accessing the country’s official currency market and from transactions using the blue-chip swap rate, according to a statement published Monday evening.

- Measure to take effect Tuesday, according to statement

- Argentina’s blue-chip swap rate, known locally by the acronym CCL, weakened to 303.8 pesos per dollar Monday versus 281.5 per dollar a week ago

Ukraine Grain-Corridor Shipments Top 3.5m Tons, Lineup Data Show

More than 3.5 million tons of grain and foodstuffs have been shipped from Ukraine’s Black Sea ports under an export corridor that opened in early August, according to the latest lineup posted by the United Nations.

- Of the total, about 491,230 tons was inspected at Istanbul for exit from the Black Sea in the week to Sept. 16

- Compares with 687,564 tons the prior week

- NOTE: Additional ships have been authorized to depart in recent days; final destinations of cargoes may change

- NOTE: The agreement that formed the corridor was signed in late July and is valid for an initial 120 days

- Some Ukrainian ports remain blocked by Russia’s invasion. The nation’s total grain exports for the 2022-23 season are running 46% below last year, government data show

Pakistan’s Wheat Stocks Enough for 153 Days Consumption

Government plans procurements to meet the country’s 30.5 million tons annual wheat demand, National Flood Response Coordination Centre comments in a statement after its meeting, citing secretary Zafar Hasan

Sufficient stock of wheat and other food items is available for six months consumption; no danger of shortage

WHEAT/CEPEA: Higher supply continues to press down wheat quotations

Estimates for higher wheat production in the 2022/23 season in Brazil and abroad are pressing down quotations. The harvesting is in progress in Brazil, raising wheat supply in the spot market. Brazilian agents are aware of the worse conditions of wheat crops in Argentina, the major wheat supplier to Brazil.

BRAZILIAN MARKET – Cepea surveys show that, between September 9 and 16, the prices paid to wheat farmers (over-the-counter market) dropped by 5.21% in Paraná, 4.77% in Santa Catarina and 2.43% in Rio Grande do Sul. In the wholesale market (deals between processors), quotations decreased by 2.34% in PR, 2.11% in RS, 1.82% in São Paulo and 1.8% in SC. In the same period, the US dollar rose by 2.08%, to BRL 5.257 on Friday, 16.

Based on data from Conab (Brazil’s National Company for Food Supply), between September 5 and 9, the import parity price for the wheat from Argentina delivered to Paraná State was USD 400.75/ton. Considering the average of the US dollar in that period, at BRL 5.192, the wheat imported was sold at BRL 2,080.68/ton, while for the Brazilian wheat traded in Paraná, the average was lower, at BRL 1,793.76/ton, according to data from Cepea. In Rio Grande do Sul, the import parity for the product from Argentina would be of USD 376.33/ton (BRL 1,953.88/ton), against BRL 1,797.99/ton on the average of the state surveyed by Cepea.

ESTIMATES – According to the USDA, the world production of wheat in the 2022/23 season is estimated at 783.9 million tons, a record, 0.6% higher than that forecast in August/22 and 0.5% above that last season. The monthly increase is majorly linked to higher production estimates for Russia (+3.4% compared to that from August and +21.1% against that last season) and Ukraine (+5.1% from that estimated in August but a steep 37.9% down from that in the 2021/22 season).

CROPS – According to data from Seab/Deral, by Sept. 12, 19% of the wheat crop in Paraná had been harvested. Of the crops not harvested yet, 78% are in good conditions; 19%, in average conditions; and 3%, in bad conditions, all stable compared to the data released in the previous week.

Indonesia trimming palm oil stocks with discounts, India sales

- India could buy 2 mln T in Aug-Nov from Indonesia

- Export levy waiver boosts Indonesia’s exports

- Stocks could fall to 4.5 mln T by end-Sept

- Indonesian sellers offer discount vs Malaysian suppliers

Indonesian palm oil producers are whittling down their hefty inventory overhang with discounts versus rivals and aggressive sales to India, where demand is picking up for next month’s Diwali festival, industry officials said.

Backed by Jakarta’s waiver of palm oil export levies, which was recently extended to Oct. 31 and reversed course from an export ban in May that had shut them out of global trade, producers are moving in to lighten up their stocks at tempting prices.

And India, the world’s biggest importer of vegetable oils, is buying – offering potential support to benchmark palm oil futures prices while threatening to undercut imports of rivals soyoil and sunoil.

“India has been aggressively buying palm oil from Indonesia since prices are attractive and festival demand is approaching,” said Sandeep Bajoria, the chief executive of vegetable oil brokerage and consultancy Sunvin Group.

“We are expecting imports of 2 million tonnes between August to November.”

That would be triple India’s palm oil imports from Indonesia, the world’s largest producer, in the previous four months, from April to July, according to data compiled by trade body The Solvent Extractors’ Association of India (SEA).

The momentum in shipments could help to bring Indonesia’s palm oil stocks, which ballooned to 6.69 million tonnes by end-June from around 4 million tonnes at end-2021, back to 4.5 to 5 million tonnes by end-September, said Eddy Martono, Secretary General at the Indonesian Palm Oil Association (GAPKI).

The drawdown will also get some help, he said, from a slowdown in production now that the peak harvest period has passed.

The stocks were built up during Jakarta’s steady escalation of export restrictions early this year, culminating in the drastic three-week export ban.

The government was aiming to bring down local edible oils prices but in the process caused world prices to surge, hitting a record 7,268 Malaysian ringgit ($1,598) per tonne.

Producers in Malaysia, the second-largest palm oil producer, along with rival oils like soyoil and sunoil, rushed in to grab Indonesia’s market share.

Sunvin Group’s Bajoria noted that soyoil and sunoil, usually substantially more expensive than palm oil, became comparable in price for a few months and squeezed demand from India.

Malaysia has also displaced Indonesia so far in the 2021/22 marketing year to end-October as the top palm oil supplier to India, according to SEA data.

The Indonesian government ended up scrapping the ban, and in mid-July also began waiving export levies that had been used to fund biodiesel and replanting programmes, growing more worried instead about bulging palm oil stocks and beleaguered palm farmers.

“Indonesian sellers are now trying hard to regain the lost market share by offering discounts,” a New Delhi-based palm oil dealer said.

Palm oil futures prices have now dropped by nearly half from their record high and palm oil is again at a sizeable discount to rival oils, offered at $940 a tonne including cost, insurance and freight (CIF) to India for September shipment, compared with $1,288 for crude soyoil, dealers said.

And Indonesian producers are taking back business from their Malaysian neighbours with aggressive discounting.

“Right now, Indonesia sellers are very competitive compared to Malaysia. They are giving a discount of up to $5 per tonne under Malaysia,” said a Mumbai-based dealer with a global trading firm.

They had been offering discounts of as much as $15 in July-August, when the export levy was first removed, he said.

Indonesian Trade Minister Zuklifli Hasan also urged India to buy more palm oil from his country when he visited India last month, said a senior industry official who attended the minister’s meeting with Indian buyers. The official asked not to be named as the meeting was private.

With Indonesia’s stocks returning to normal during this window of waived export levies and robust India demand, however, market players expected it was only a matter of time before Jakarta returns to its typical export levies.

“Once stocks come down, it will start levying the exports,” said a Mumbai-based dealer. “Palm oil is big contributor in its tax kitty. It can’t waive off taxes indefinitely.”

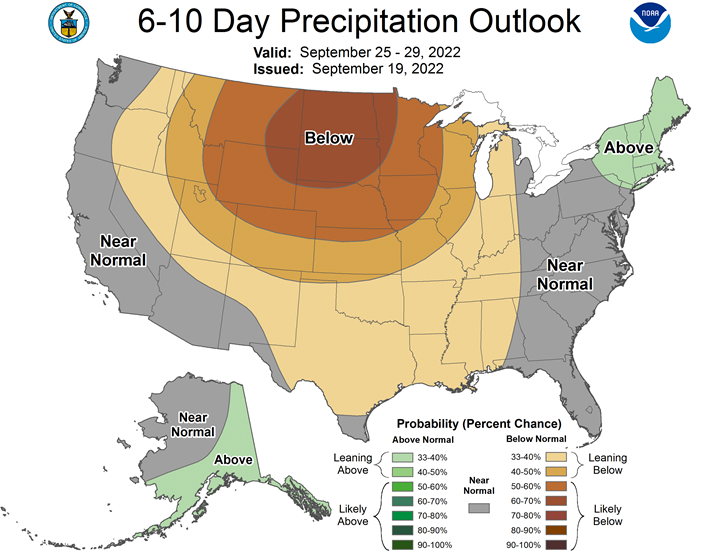

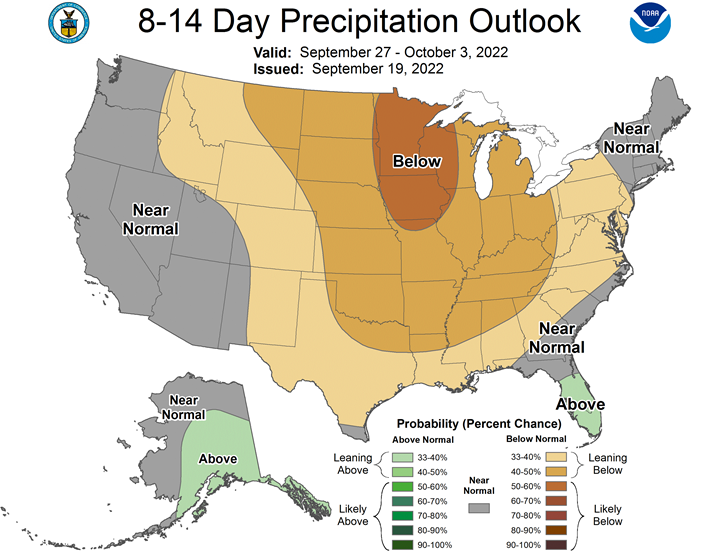

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |