Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 1 in SRW, up 1/2 in HRW, up 3 1/2 in HRS; Corn is up 2 1/4; Soybeans up 10; Soymeal up $0.33; Soyoil up 0.35.

For the week so far wheat prices are up 45 1/4 in SRW, up 32 1/2 in HRW, up 29 in HRS; Corn is up 10 3/4; Soybeans up 23 1/4; Soymeal up $2.06; Soyoil down 0.56.

For the month to date wheat prices are up 73 1/4 in SRW, up 55 in HRW, up 38 1/4 in HRS; Corn is up 17 1/4; Soybeans up 48 3/4; Soymeal up $27.00; Soyoil down 2.13.

Year-To-Date nearby futures are up 17% in SRW, up 21% in HRW, down -1% in HRS; Corn is up 16%; Soybeans up 11%; Soymeal up 12%; Soyoil up 21%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans up 37 yuan; Soymeal up 39; Soyoil up 90; Palm oil up 162; Corn unchanged — Malaysian palm oil prices overnight were down 42 ringgit (-1.08%) at 3845.

There were no changes in registrations. Registration total: 3,084 SRW Wheat contracts; 0 Oats; 0 Corn; 5 Soybeans; 48 Soyoil; 147 Soymeal; 40 HRW Wheat.

Preliminary changes in futures Open Interest as of September 21 were: SRW Wheat up 2,791 contracts, HRW Wheat up 384, Corn up 4,331, Soybeans up 6,549, Soymeal up 464, Soyoil up 930.

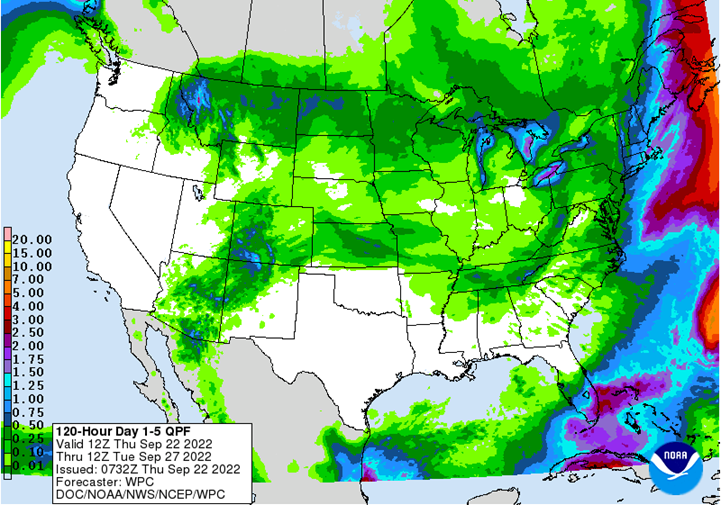

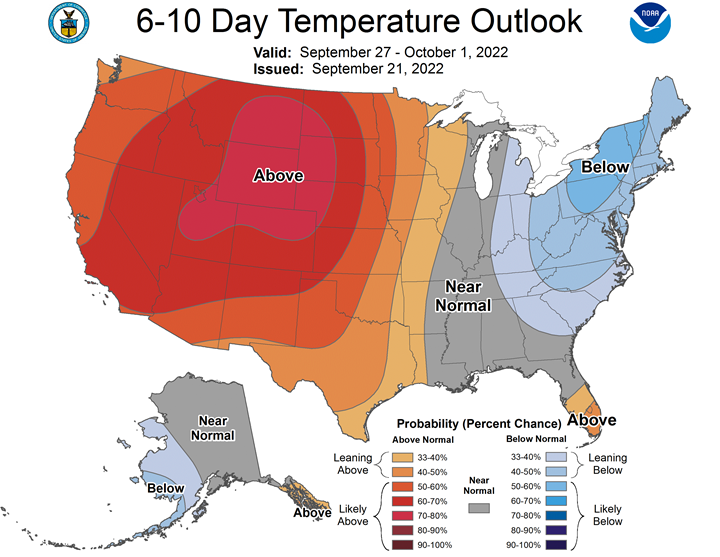

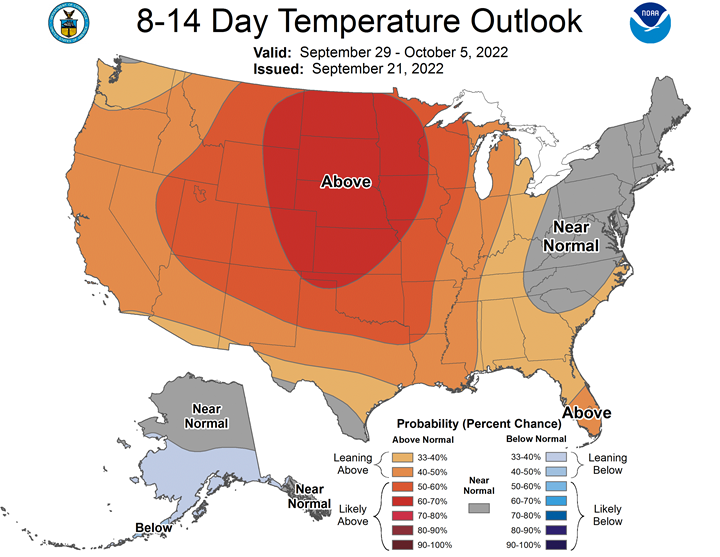

Northern Plains Forecast: Isolated to scattered showers through Friday, mostly north. Mostly dry Saturday. Isolated showers Sunday. Temperatures near to below normal north and above normal south Thursday, near to above normal Friday-Sunday. Outlook: Mostly dry Monday-Friday. Temperatures near to above normal Monday-Tuesday, above to well above normal Wednesday-Friday.

Central/Southern Plains Forecast: Scattered showers Thursday-Friday. Isolated showers Saturday. Mostly dry Sunday. Temperatures near to below normal Thursday, near to above normal Friday-Sunday. Outlook: Mostly dry Monday-Friday. Temperatures near to above normal Monday-Tuesday, above to well above normal Wednesday-Friday.

Western Midwest Forecast: Mostly dry Thursday. Isolated showers Friday-Sunday. Temperatures near to below normal Thursday-Friday, near to above normal Saturday-Sunday.

Eastern Midwest Forecast: Isolated showers Thursday. Mostly dry Friday. Isolated showers Saturday-Sunday. Temperatures near to below normal Thursday-Friday, near to above normal Saturday-Sunday. Outlook: Isolated showers east Monday. Mostly dry Tuesday-Friday. Temperatures near to below normal Monday-Wednesday, near to above normal west and near to below normal east Thursday-Friday.

The player sheet for Sept. 21 had funds: net buyers of 3,000 contracts of SRW wheat, sellers of 4,000 corn, buyers of 6,000 soybeans, and sellers of 2,000 soyoil.

TENDERS

- FEED WHEAT TENDER: An importer group in the Philippines has issued a tender to purchase around 45,000 tonnes of animal feed wheat

- BARLEY TENDER: Jordan’s state grain buyer is seeking 120,000 tonnes of barley for shipment in March and April in a international tender closing Sep. 28, a government source said.

- FAILED BARLEY TENDER: Jordan’s state grain buyer is believed to have made no purchase in an international tender for 120,000 tonnes of animal feed barley which closed on Wednesday.

PENDING TENDERS

- WHEAT TENDER: A government agency in Pakistan has issued a new international tender to purchase and import 300,000 tonnes of wheat

- WHEAT TENDER: Jordan’s trade ministry is seeking 120,000 tonnes of wheat shipped in March and April in an international tender closing Sept. 27, a government source said. Jordan’s state grains buyer opened the new tender after making no purchase in a Tuesday tender.

US BASIS/CASH

- Basis bids for soybeans shipped by barge to U.S. Gulf Coast export terminals were steady to firm on Wednesday on tight spot supplies, rising freight costs and lower futures prices, traders said.

- Export demand for U.S. soybeans was moderate at best amid competitively priced South American beans and a slower-than-normal buying pace from China. China has largely filled its soybean import needs through October, traders said.

- Bids for soybean barges arriving at Gulf terminals over the next week were at a steep premium to deferred shipments as exporters need higher-quality beans to fulfill sales obligations. Some of the Delta crop, normally available before the larger Midwest harvest, was damaged by rain this year.

- Barge freight rates are rising as the harvest gathers pace and as low water on the lower Mississippi River restricts loadings and vessel movement. Spot barge freight on Midwest rivers was up 50 to 75 percentage points of tariff on Wednesday, industry sources said.

- Soybean barges loaded through the end of September were bid 5 cents higher at 175 cents over November futures.

- FOB basis offers for soybeans shipped in late-October were around 195 cents over November futures, up 5 cents.

- Corn barge bids were also steady to firm on lower futures and rising freight costs, although weak export demand limited basis gains. Wheat basis bids were flat.

- Bids for corn barges loaded in September were up 2 cents at 120 cents over December futures, while October export premiums gained 2 cents to 149 cents over futures.

- U.S. spot cash millfeed values held mostly steady on Wednesday amid solid demand for the feed ingredient and tight supplies in several key markets following recent flour mill downtime, dealers said.

- Millfeed supplies in the Northeast and in the Midwest and Plains were limited as some large flour mills have taken longer-than-normal stretches of downtime this month for maintenance and repairs.

- Spot demand for millfeed was good as feed users are relying on the wheat-based feed ingredient for immediate needs, while waiting for more corn to be harvested.

- Spot basis bids for soybeans dropped at U.S. Midwest processors on Wednesday, grain dealers said.

- The soybean basis was flat at elevators and river terminals.

- Cash bids for corn weakened at river elevators but held steady around the interior.

- Farmer sales were slow, with weakness in the futures further chilling growers’ interest in booking new deals.

- Most growers had their expected cash flow needs covered by sales they booked for supplies they will deliver in the coming weeks as harvest progresses.

- Spot basis bids for corn were mixed at processors around the U.S. Midwest on Wednesday morning, grain dealers said.

- The corn basis was weak at elevators around the interior of the region and river terminals.

- At ethanol plants, corn bids were steady to weak, falling by 10 cents a bushel in Linden, Indiana.

- Soybean bids were steady to firm at interior elevators, steady to weak at processors, and flat at the region’s river terminals.

- Fresh farmer sales were slow, an Iowa dealer said.

- Some growers were making deliveries of recently harvested supplies of both commodities they had previously contracted, but most were reluctant to book new deals at current levels.

- Spot basis bids for hard red winter wheat delivered to southern U.S. Plains truck and rail market elevators were flat on Wednesday, grain dealers said.

- Sales on the cash market were slow, an Oklahoma dealer said.

- Growers had booked some deals for wheat they will deliver in the summer of 2023 when prices broke through $9.25 a bushel on the back of a futures market rally on Tuesday, another dealer said.

- But the selling interest dried up when prices retreated on Wednesday morning.

- Protein premiums for wheat delivered by rail to or through Kansas City fell by 10 cents a bushel for wheat with protein content ranging from ordinary through 11.8%, according to the latest CME Group data.

- Premiums were 8 cents lower for 12.0% through 12.6% protein wheat and 1 cent lower for wheat with protein content between 12.8% and 14.0%.

- Basis offers for U.S. soymeal were steady to weak on the cash market at both rail and truck market processors on Wednesday, dealers said.

- Scattered maintenance shutdowns at plants have shifted demand to processors that were still crushing, an Iowa dealer said.

- But the overall level of soymeal being purchased was routine and the plants that were down were likely to re-open soon as harvest was expanding across the Midwest, the dealer added.

- Processors were expected to boost crushing levels in the coming weeks as a flood of newly harvested beans they had previously contracted to buy begin arriving at plants.]

DOE: US Ethanol Stocks Fall 2.8% to 22.501M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 23.012 mln bbl

- Plant production at 0.901m b/d, compared to survey avg of 0.98m

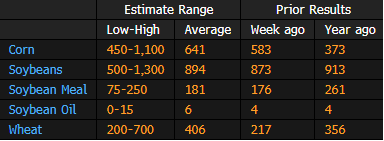

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

Estimate ranges are based on a Bloomberg survey of five analysts; the USDA is scheduled to release its export sales report on Thursday for week ending Sept. 15.

- Corn est. range 450k – 1,100k tons, with avg of 641k

- Soybean est. range 500k – 1,300k tons, with avg of 894k

China Says Food Security Hinges on Cutting Overseas Soy Demand

- Even small shifts in soy ratio help with costs and inflation

- Argentine sales surge after nation devalues its currency

China is redoubling its efforts to bolster food security by trying to cut the amount of soybeans that get turned into animal feed.

In a notice this week, the farm ministry identified feed grains as the most pressing problem for food supplies. It urged the feed sector to learn from some of the top producers that have successfully reduced the amount of soybean meal — derived from crushing soybeans — used in livestock rations as their main source of protein.

China is by far the world’s biggest importer of soybeans, which account for the bulk of its consumption. Last year, the import bill was over $50 billion, not counting smaller quantities of meal, shipped by far-flung suppliers in South America and the US. Those costs have risen further in recent months as food inflation has gripped the world in the wake of Russia’s war in Ukraine.

The wholesale price of pork, China’s staple meat, has risen by about two-thirds in the last year, in part due to higher feed prices. The move has caught the eye of the authorities and prompted the release of state reserves to cool the market.

So, even modest shifts in soy consumption would be helpful in controlling both import costs and inflation — and represent a worry for the legions of overseas farmers that rely on Chinese demand.

The soy ratio in animal feed nationwide dropped last year to 15.3%, from 17.8% in 2017, the ministry said on Tuesday. That’s a cumulative saving of 11 million tons of meal, or 14 million tons of beans. Standout performers included farming giants Muyuan Foods Co., which lowered the ratio to just 6.9%, and New Hope Liuhe Co., which got it down to 10.7%.

The techniques employed by the companies include adding synthetic amino acids to feed and enhancing nutrition levels via fermentation.

Record Indonesia Stockpiles Still Weighing on Vegoil Market: Fry

The global vegetable oil market is “wrestling” with the build-up of record stockpiles in Indonesia even as the top producer is ramping up exports, according to James Fry, chairman of LMC International.

- The current export wave will bring its stockpiles back to trend, but partly by shifting the burden of stockholding onto Malaysia, Fry said in slides prepared for Globoil conference in India’s Agra city

- Demand in the world’s two biggest consumers are diverging, with China suffering from a property market slowdown and strict Covid curbs, while India’s demand is growing strongly this year

- India’s vegoil demand is up 11% in January-August

- There are signs of relatively good grain and oilseed crops as long as La Nina doesn’t cause damage in South America

- Investors should keep an eye on rising inflation and interest rates, which make a general recession inevitable

- They should also pay close attention to gasoil prices as a high premium could provide support for the vegoil market

French Wheat Protein Levels Slightly Below Normal, Groups Say

The average protein content of this year’s soft-wheat harvest in France is 11.4%, compared to the prior five-year average of 11.9%, crops office FranceAgriMer said on its website, citing near-final survey results it collected together with Arvalis.

- About 59% of the crop is considered superior or premium quality

- Crop quality overall is very satisfactory, despite the impact of drought and high temperatures in spring and summer

India’s Monsoon-Sown Rice Production Seen Falling 6.1% Y/y

Output of monsoon-sown rice in India, the world’s biggest exporter, is forecast to fall by 6.1% y/y to 104.99m tons in 2022-23, according to a statement by the farm ministry.

- Sugarcane production is likely to surge to record 465.05m tons, from 431.81m tons, according the ministry’s first advance estimates

- NOTE: Monsoon-sown crops are generally planted in June-July and harvested in October-November

- Corn output seen at record 23.1m tons vs 22.63m tons a year earlier

- Total food grains output expected at 149.92m tons vs 156.04m tons

- Production estimates for other commodities during the season (2022-23 vs 2021-22)

- Coarse cereals: 36.56m tons vs 35.91m tons

- Output of pulses seen steady at 8.37m tons

- Soybeans: 12.89m tons vs 13m tons

- Total oilseeds: 23.57m tons vs 23.89m tons

- Cotton: 34.19m bales (of 170 kg each) vs 31.2m bales

Brazil’s wheat crop estimate revised to 10.9 mln T, a record

Brazilian wheat production should total 10.935 million tonnes in 2022 as four states are likely to increase output in what will be a record season for local farmers, according to agribusiness consultancy Safras & Mercado on Wednesday.

The new estimate represents an increase from the 10.5 million tonnes previously expected.

The adjustment takes into account the likely rise in output in the states of Parana, Sao Paulo, Goias, Bahia and in the Federal District.

The new forecast underscores that Brazil is on track to produce all of the wheat it needs in the space of 10 years or less, as the government has predicted.

The country remains a net importer and buys most of its wheat from neighboring Argentina, but that may soon change.

If projections are confirmed, Brazil’s wheat production this year will be 41.2% higher than the 7.745 million tonnes in 2021, which was already a record, Safras said.

Thanks to the development of new wheat varieties, Brazilian farmers are able to cultivate wheat plants adapted to tropical conditions.

This has boosted the country’s production potential as cultivation moves to hotter and drier farms in the center of the country, in the Cerrado biome, where growers traditionally plant corn and soybeans.

Safras said Parana will be the second largest producing state this season, with 4.2 million tonnes, behind top producer Rio Grande do Sul, Brazil’s southernmost state, where farmers are expected to reap 5.1 million tonnes this season.

Louis Dreyfus Profit Soars as Ukraine War Adds to Market Turmoil

- Trading house takes provisions and impairments over Ukraine

- Company yet to estimate impact on project in southern Russia

Crop trading giant Louis Dreyfus Co. capitalized on turbulent agricultural markets to almost double first-half profit.

The company — the “D” in the “ABCD” grouping of the biggest agricultural trading houses — posted net income of $662 million in the six months through June. The trader, controlled by billionaire Margarita Louis-Dreyfus, took provisions and impairments of $118 million in relation to its Ukraine business, but is yet to estimate the potential impact of the war on its project in southern Russia.

Russia’s invasion of Ukraine has turned the key Black Sea grain-exporting region into a war zone. That pushed prices to record levels amid a global rush to secure alternative supplies of corn, wheat and vegetable oils.

The war “added to pre-existing drivers of global market uncertainty such as continued port congestion, accelerating climate challenges and concerns over the resurgence of Covid-19,” Louis Dreyfus Chief Executive Officer Michael Gelchie said in a statement Thursday.

The trading house held Ukraine assets of $245 million as of June 30, and liabilities for $127 million.

The other members of the “ABCDs” that dominate the world of agricultural

UNITED STATES

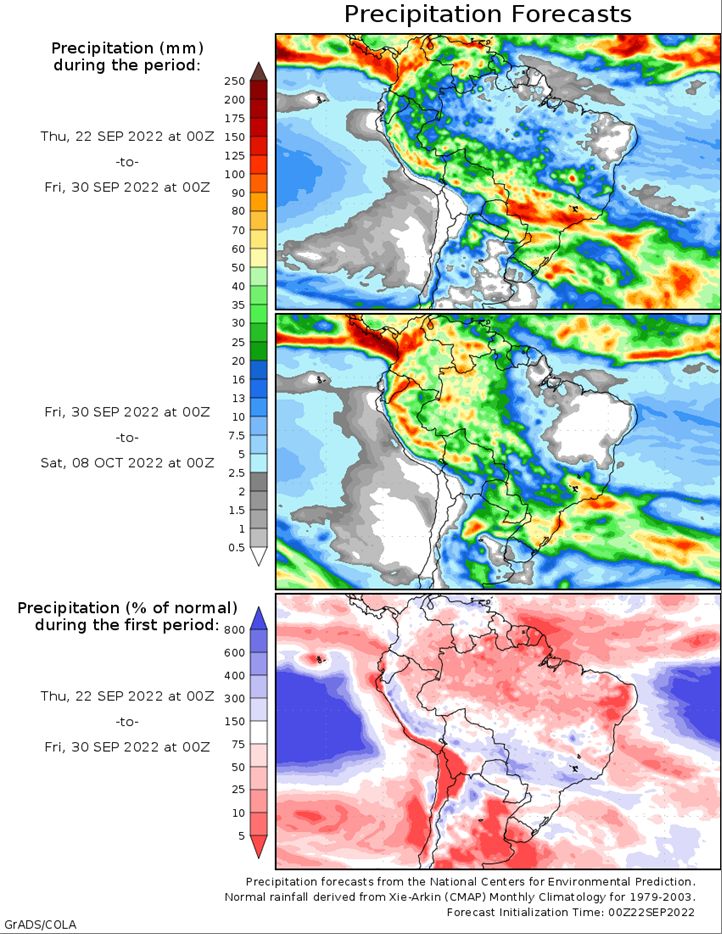

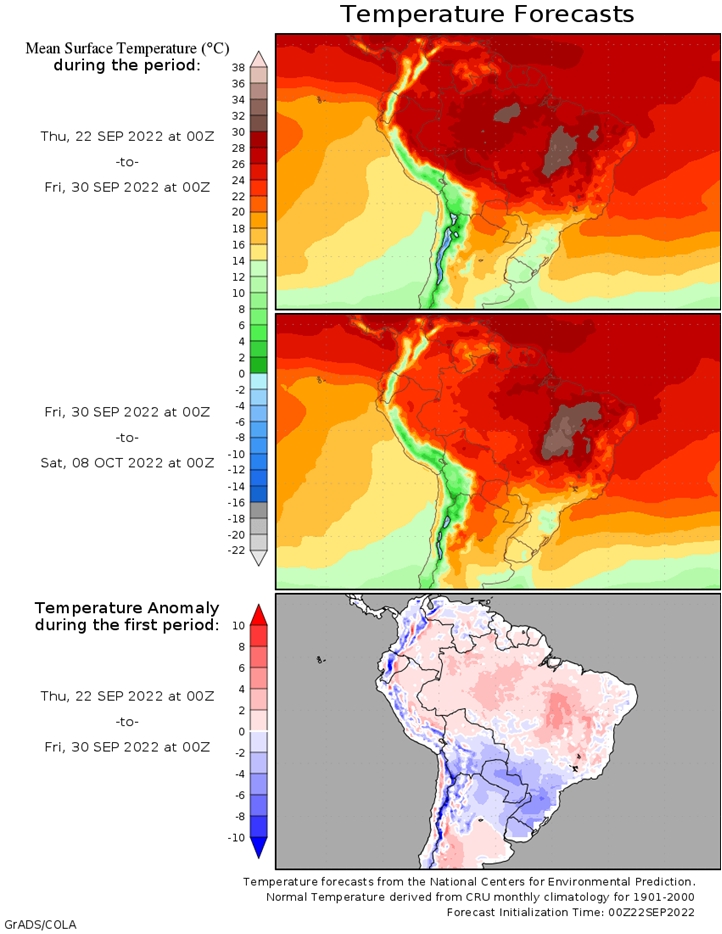

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |