Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 9 3/4 in SRW, up 10 in HRW, up 10 1/2 in HRS; Corn is up 2 3/4; Soybeans up 5 3/4; Soymeal up $0.15; Soyoil up 0.24.

For the week so far wheat prices are down 32 1/4 in SRW, down 16 1/2 in HRW, down 9 in HRS; Corn is up 3/4; Soybeans down 1; Soymeal down $0.81; Soyoil up 4.70.

For the month to date wheat prices are down 32 3/4 in SRW, down 16 1/2 in HRW, down 9 in HRS; Corn is up 3/4; Soybeans down 1; Soymeal down $8.10; Soyoil up 4.70.

Year-To-Date nearby futures are up 15% in SRW, up 22% in HRW, down -1% in HRS; Corn is up 14%; Soybeans up 3%; Soymeal down -3%; Soyoil up 24%. Malaysian palm oil prices overnight were up 141 ringgit (+3.81%) at 3841.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

China’s markets are closed and will re-open Monday.

There were changes in registrations (25 Soymeal). Registration total: 3,084 SRW Wheat contracts; 0 Oats; 0 Corn; 5 Soybeans; 39 Soyoil; 247 Soymeal; 40 HRW Wheat.

Preliminary changes in futures Open Interest as of October 6 were: SRW Wheat up 3,069 contracts, HRW Wheat up 619, Corn up 12,542, Soybeans up 946, Soymeal up 4,274, Soyoil up 711.

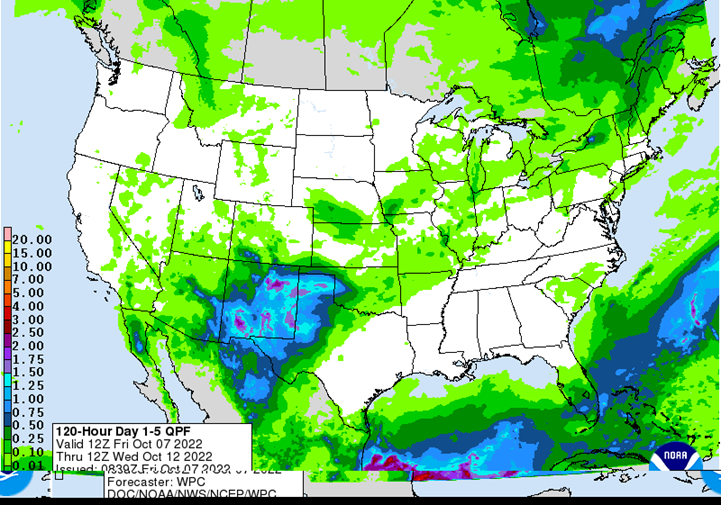

Northern Plains Forecast: Mostly dry Friday-Monday. Temperatures below normal Friday, near to below normal Saturday, near normal Sunday, above normal Monday. Outlook: Scattered showers Tuesday-Wednesday. Mostly dry Thursday-Saturday. Temperatures above normal Tuesday, near to below normal Wednesday-Thursday, above normal Friday-Saturday.

Central/Southern Plains Forecast: Isolated showers through Monday. Temperatures near to below normal Friday-Sunday, near to above normal Monday. Outlook: Isolated to scattered showers Tuesday-Thursday. Mostly dry Friday. Temperatures near to above normal Tuesday-Wednesday, near to below normal Thursday, near to above normal Friday-Saturday.

Western Midwest Forecast: Mostly dry through Saturday. Isolated showers north Sunday. Mostly dry Monday. Temperatures below normal Friday-Saturday, near normal Sunday-Monday.

Eastern Midwest Forecast: Mostly dry Friday-Sunday. Isolated showers Monday. Temperatures below normal Friday-Sunday, near to below normal Monday. Outlook: Isolated to scattered showers Tuesday-Thursday. Mostly dry Friday-Saturday. Temperatures above normal Tuesday-Wednesday, below normal Thursday-Friday, near to above normal Saturday.

The player sheet for Oct. 6 had funds: net sellers of 7,000 contracts of SRW wheat, sellers of 8,000 corn, sellers of 5,000 soybeans, sellers of 2,250 soymeal, and buyers of 1,500 soyoil.

TENDERS

- WHEAT SALE: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) bought a total of 97,343 tonnes of food-quality wheat from the United States and Canada in regular tenders that closed on Thursday.

PENDING TENDERS

- SOYMEAL TENDER: Leading South Korean animal feed maker Nonghyup Feed Inc (NOFI) has issued an international tender to purchase up to 60,000 tonnes of soymeal, European traders said on Friday.

- WHEAT TENDER: The World Food Programme, a United Nations agency, has issued an international tender to purchase about 100,000 tonnes of milling wheat, European traders said. The deadline for submission of price offers in the tender is Sept. 28 with an award expected on Sept. 30.

- DURUM TENDER: Algeria’s state grains agency OAIC has issued an international tender to purchase a nominal 50,000 tonnes of durum wheat, European traders said. The deadline for submissions of price offers in the tender is Oct. 6, with offers having to remain valid until Oct. 7, they said.

- BARLEY TENDER: Turkey’s state grain board TMO has issued an international tender to purchase and import a total of 495,000 tonnes of animal feed barley, European traders said. The deadline for submission of price offers in the tender is Oct. 11, they said.

- WHEAT TENDER: Jordan is seeking 120,000 tonnes of wheat in an international purchasing tender with a deadline for offers on Oct. 11, a government source told Reuters.

US BASIS/CASH

- Basis bids for corn and soybeans shipped by barge to the U.S. Gulf Coast were steady to firm on Thursday as low water on the southern Mississippi River stalled the flow of grain to export terminals, traders said.

- The lower Mississippi River has been closed in at least two locations this week as low water caused several barges to get stuck in the shipping channel. The U.S. Army Corps of Engineers is dredging the river to deepen the channel while hundreds of barges are waiting to pass. Only a small number of vessels have been cleared to pass.

- Spot barge freight rates eased back slightly on Thursday from all-time highs. The empty vessel supply remains very tight for near term shipments. BG/US

- Soaring barge freight costs have elevated export premiums as well and made U.S. Gulf shipments uncompetitive on the world market, traders said. Chinese demand for U.S. soybeans was also very light as many traders there are off for Golden Week holidays.

- Basis bids for corn barges loaded this month jumped 10 cents to 190 cents over December futures.

- FOB corn export premiums were unquoted for October due to a lack of available loading capacity. November premiums were nominally around 225 cents over December futures, up 25 cents from the prior day.

- Soybean barges loaded this month were bid at 185 cents over November futures, up 5 cents.

- FOB basis offers for soybeans shipped in October were unquoted. November shipments were offered around 225 cents over November futures.

- Spot basis bids for corn were mostly weaker on Thursday across the U.S. Midwest, while soybean basis firmed, grain dealers said.

- Corn basis fell at a Blair, Nebraska processor and a river terminal in Morris, Illinois.

- Corn firmed at an elevator in Council Bluffs, Iowa.

- Soybean bids firmed at a river terminal in Morris, Illinois and a Sioux City, Iowa elevator.

- Wheat basis was steady.

- Spot basis bids for corn and soy were mostly lower across the U.S. Midwest on Thursday morning, pressured by low river levels that slowed barge traffic to the U.S. Gulf, backing up grain and soybean supplies into the interior, dealers said.

- Corn basis eased in Blair, Nebraska and Seneca, Illinois.

- Soybean basis fell in Cincinnati, Ohio and a processor in Morristown, Indiana.

- The bid for corn firmed at an Ethanol plant in Annawan, Illinois

- Soybean bids firmed in Seneca, Illinois.

- Spot cash millfeed values held mostly steady around the United States on Thursday, underpinned by tight supplies in parts of the country and by moderate to good demand for supplemental feed ingredients, dealers said.

- Recent reductions in flour mill run times in the Plains, Midwest and Northeast markets tightened supplies of millfeed available. Accelerated milling this week has boosted supplies somewhat, but some mills are still slightly behind in their millfeed orders.

- Demand from calf producers in the Plains has slowed from a seasonal peak in the late summer, a dealer said.

- Spot basis bids for hard red winter wheat were steady across the southern U.S. Plains on Thursday, dealers said.

- Bids were steady at the U.S. Gulf, as well as for train loads coming from the U.S. Plains.

- Protein premiums for wheat delivered by rail to or through Kansas City fell by 4 cents for wheat with ordinary protein content, while firming by 13 cents for 12.8% protein wheat, according to the latest CME Group data.

- Spot basis offers for soymeal were steady at rail and truck terminals across the U.S. Midwest on Thursday, after dropping for much of the week as newly harvested beans resupplied processors, dealers said.

- Basis offers were also steady at the U.S. Gulf, as well as for barges loaded upriver of the gulf.

TODAY

US Agriculture Export Sales for Week Ending Sept. 29

US Export Sales of Soybeans, Corn and Wheat by Country

The following table shows US export sales of soybeans, corn and wheat by biggest net buyers for week ending Sept. 29, according to data on the USDA’s website.

- Mexico bought 233k tons of the 777k tons of soybeans sold in the week

- Mexico was also the top buyer of corn and Philippines led in wheat

US Corn, Soy, Wheat Ending Stocks Survey Before USDA WASDE

US Corn, Soybean Production Survey Before USDA WASDE

World Corn, Soybeans, Wheat Survey Before USDA WASDE Report

Brazil, Argentina Corn and Soy Survey Before USDA WASDE Report

Brazil 2022-23 Soybean Crop Seen at 152.4M Tons: Conab

Output seen rising 21% from 125.6m tons in 2021-22 season, Brazil’s national supply co. says in its monthly report.

- Analysts in a Bloomberg survey were expecting 152m tons

- Yield seen higher at 3,552 kg/ha vs 3,029 kg/ha last season

- Area planted raised to 42.893m ha vs 41.492m ha

- Corn production seen at 126.9m tons in 2022-23 vs 112.8m tons in 2021-22

Barges Stuck in Line as Coast Guard Works to Reopen Mississippi

Sections of the Mississippi River between Stack Island, Mississippi, and Memphis, Tennessee, remain closed due to low water levels and “an increase in commercial vessel groundings,” Capt. Eric Carrero, director of western rivers and waterways at Coast Guard Dist. 8, says in a statement.

- Waterway remains closed at mile markers 478-492, 676-686; officials intend to reopen the river with restrictions at some point on Friday

- At Memphis, there were 21 vessels and 273 barges queued up

- At Stack Island, the tally was 117 vessels and 2,048 barges

- Those figures account for north and southbound traffic

- U.S. Army Corps of Engineers is dredging near Stack Island as Coast Guard and “river industry partners” continue to survey affected areas

Ingram Barge Says Force Majeure Impacts Points Below Baton Rouge

Top US barge operator Ingram’s declaration Wednesday of force majeure due to low Mississippi River water levels only impacts areas below Baton Rouge, Louisiana, according to an emailed statement Thursday.

- “We want to emphasize that this only affects a limited part of our operating network,” Ingram Barge Co. Chief Executive Officer John Roberts says

- “We anticipate that available barge supply in the affected area will improve in the coming days”

- “Chronic low water conditions throughout the inland river system have had a negative effect on many who rely on the river”

- Statement confirms earlier reporting by Bloomberg of the notice of force majeure

IHS Markit lowers U.S. corn, soy production estimates – traders

- IHS MARKIT FORECASTS U.S. 2022 CORN PRODUCTION AT 13.839 BILLION BUSHELS (13.944 PREVIOUSLY); AVERAGE YIELD 171.2 BU/ACRE (172.5 PREVIOUSLY)- TRADERS

- IHS MARKIT FORECASTS U.S. 2022 SOY PRODUCTION AT 4.327 BILLION BUSHELS (4.378 PREVIOUSLY), AVERAGE U.S. YIELD AT 49.9 BPA (50.5 PREVIOUSLY)- TRADERS

Ukraine October grain exports 20.5% lower y/y -ministry

Ukrainian grain exports in the first 5 days of October were just 20.5% less than in the same period of 2021 despite the closure of several seaports and the Russian invasion, agriculture ministry data showed on Thursday.

The country’s grain exports have slumped since February as the war closed off Ukraine’s Black Sea ports, driving up global food prices and prompting fears of shortages in Africa and the Middle East.

Three Black Sea ports were unblocked at the end of July under a deal between Moscow and Kyiv, brokered by the United Nations and Turkey.

The ministry’s data showed that Ukraine has exported 468,000 tonnes of grain, mostly corn, so far in October, versus 589,000 tonnes in the same period of October, 2021.

The data also showed that Ukraine has exported a total of 9.17 million tonnes of grain so far in the 2022/23 July-June season compared with 14.95 million in the same period of 2021/22.

This season’s volume includes 3.2 million tonnes of wheat, 5.1 million tonnes of corn and 823,000 tonnes of barley.

Russia’s Novorossiysk Grain Plant Exports Fall 35% This Season

Major state-backed Russian grain terminal Novorossiysk Grain Plant said its shipments were down 35% so far this season, according to its website.

- Company exported 795,265 tons of grain from July- Sept this season, compared with 1.22m tons in July-Sept last season

- NOTE: Novorossiysk Grain Plant is 51% owned by exporter OZK; OZK controlling shareholder is the Russian state

Wheat Crop in Western Australia Will Near Record, Group Says

Perfect seasonal conditions in Western Australia have boosted the outlook for grain production in the key growing state, bolstering expectations that farmers will haul in a near-record crop this season, according to the Grain Industry Association of Western Australia.

- Wheat production is expected to rise to 12.1 million tons in 2022, compared with previous prediction of 10.75m tons

- There’s further upside to predicted tonnage as low-rainfall areas are “likely to yield better than they look” while southern areas will exceed current estimates if they remain frost-free

- Still, area planted to wheat is down on last year due to growers substituting canola, particularly in low-rainfall regions; that will tend to limit the upside in total tons, report says

- Canola output seen hitting 3.8 million tons, with upside potential due to very long grain-fill period setting more pods than normal, as well as expected very large seed size

- Above-average yields expected for all crops in all regions, driven by mild temperatures and no significant frost events

- Crop estimates from October forecast:

- Wheat 12.05m tons, +12.1% from Sept

- Barley 6.05m tons, +9.2%

- Canola 3.81m tons, +1.3%

- Oats 565,000 tons, no change

Argentina May See More Wheat Losses as Rains Falter: Exchange

The Buenos Aires Grain Exchange could cut its wheat crop forecast of 17.5m metric tons as dryness continues to reduce yield potential in northern and central areas, according to its weekly report.

- Wheat losses could increase if plants do not get rain in the next seven days

- Southern areas, which are Argentina’s wheat stronghold, are also coming under threat from the drought

- NOTE: The exchange recently slashed its wheat estimate to 17.5m tons from a pre-season figure in May of 20.5m

- NOTE: Argentina Rains in October Would Put End to Wheat Gloom

- Planting of the early corn crop remains extremely delayed because of the dryness

- If it doesn’t rain in the next few weeks, farmers will shift to late corn or soybeans

- NOTE: Drought, High Costs Push Argentine Farmers to Grow More Soy

Brazil 2023 Soy Exports Seen Jumping 22.5% on Record Crop: Conab

Soybean shipments seen at 95.87m tons next year, rising 22.5% from 2022, amid higher supplies, increasing foreign demand and an expected drop in US shipments in 2022-23 season, according to Conab, Brazil’s national supply company.

- NOTE: Brazil 2022-23 Soy Crop Seen Up 21% to 152.4M Tons: Conab

- Planted area seen rising 3.4% as soybeans expand in farms previously occupied by grains, pastures and new areas

- Average yield seen up 17.4% from previous season, when dryness curbed production in the nation’s south

- September rains allowed seeding start in the Center-West and in Parana state

- Sept. beneficial rain in the nation’s south improved soil moisture and may help the region to face below average precipitation expected for Oct., Nov. due to La Nina conditions

- Domestic crushing in 2022-23 seen up 4.8% y/y to 51.2m tons encouraged by increasing biodiesel demand

- Conab’s basic scenario for biodiesel demand considers a blend of 14% on the regular diesel next year

- Soy-meal production seen rising 4% amid increasing feed demand

Saskatchewan Says Harvest Advances Amid Dry Weather Conditions

A total of 90% of the crop has been harvested, ahead of the five-year average of 82%, the province’s agriculture ministry says Thursday in a report.

- “All areas of the province are reporting that they are either extremely dry or becoming drier each week”

- Very little rain over past week

- Some producers struggling with heavy fog, delaying harvest operations until the afternoon

Ukraine Grain Exports Down 39% Y/y in Season Through Oct. 5

Grain exports during the season that began July 1 totaled 9.17m tons as of Oct. 5, versus 14.95m tons in a similar period a year earlier, Ukraine’s agriculture ministry says on its website.

- Corn exports at 5.1m tons, versus 1.43m tons last year

- Wheat exports at 3.21m tons, versus 9.41m tons last year

- Barley exports at 823k tons, versus 3.89m tons last year

World Grain Stockpiles Outlook Rises as Demand Slumps: FAO

Global grains stockpiles in the 2022-23 season are now seen at 848m tons, up 2.9m tons from a September outlook, the UN’s Food and Agriculture Organization said in a report Friday.

- Consumption is shrinking, particularly for corn use in livestock feed

- Trade outlook also falls by 2.3m tons

- The fall in demand is offsetting a drop in production

- World output is now seen at 2.77b tons, down 5.9m tons from September

- Mainly stems from lower coarse-grain production, as dryness curbs US and EU corn harvests

French Soft-Wheat and Winter-Barley Planting Underway: AgriMer

About 67% of the French corn harvest was collected as of Oct. 3, up from 51% a week earlier, crops office FranceAgriMer said on its website.

- At this time last year, the corn harvest was only 6% done

- Soft-wheat crop was 3% planted, steady with a year earlier

- Winter-barley crop was 8% planted, also steady with a year earlier

World Food Prices Drop Again, Easing Pain of High Grocery Bills

Global food prices fell for a sixth month, potentially offering relief to consumers battered by across-the-board inflation.

Agricultural demand is easing on mounting worries about an economic downturn that risks curbing dairy sales and biofuel use. Plus, crop exports from Ukraine have picked up, buffering world grain supplies that had been threatened by Russia’s invasion.

A United Nations gauge of food prices declined 1.1% in September to the lowest since January. Costs for vegetable oils, sugar, meat and dairy products retreated, keeping the index in the longest slump since 2015, the agency’s Food and Agriculture Organization said Friday.

Food inflation flared worldwide this year as the war curbed crop supplies from the vital Black Sea region. While the picture improved somewhat in recent months after a deal was struck for Ukraine to resume seaborne shipments, much will depend on efforts to extend the crop-export corridor beyond mid-November.

World food-commodity prices are now about 15% below a record set in March, though the latest decline will take a while to trickle through to grocery stores. Supermarket prices are also determined by energy, transportation and labor costs.

Malaysia Sees Palm Oil Falling to 4,300 Ringgit as Supply Climbs

- Labor supply expected to improve in 2023: Finance Ministry

- Softening global economic growth to dampen energy demand

Palm oil may average 4,300 ringgit ($925) a ton in 2023, falling from 5,000 ringgit this year, as labor supply in plantations improves and production climbs, according to the world’s second-biggest grower Malaysia.

The oil palm sector will expand on higher crude palm oil output, following the increase in fresh fruit bunch production and better oil extraction rates, the finance ministry said in a report released with the state budget Friday. In addition, a government-backed consortium set up to promote mechanization and automation in the industry will boost harvesting and productivity, it said.

READ: Malaysia Gears for Election-Friendly Budget With Smaller Deficit

Palm, the world’s most-consumed edible oil, has tumbled more than 40% from a record close in April and is heading for the biggest annual drop in several years amid forecasts for surging supplies. That could offer the world some relief from high food inflation as the tropical oil is found in many grocery items from chocolate to pastries and ice cream.

Still, lingering labor problems on Malaysian estates, as well as concerns that weather and war may slash Black Sea sunflower oil exports, could underpin vegetable oil prices. The price forecast for 2023 is still well above the 10-year average as “supply of global edible oils and fats is anticipated to remain tight,” the finance ministry said. Benchmark futures in Kuala Lumpur were trading at 3,766 ringgit Friday before the budget announcement.

US Crops in Drought Area for Week Ending Oct. 4

The following table shows the percent of US agricultural production within an area that experienced drought for the week ending Oct. 4, according to the USDA’s weekly drought report.

- Corn area experiencing moderate to intense drought up 4 percentage points to 44% in the week

- Soybean drought area rose 3 points to 41%

US Export Sales of Pork and Beef by Country

The following table shows US export sales of pork and beef product by biggest net buyers for week ending Sept. 29, according to data on the USDA’s website.

- Mexico bought 16.8k tons of the 34.3k tons of pork sold in the week

- South Korea led in beef purchases

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |