Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 13 1/4 in SRW, down 12 1/4 in HRW, down 10 3/4 in HRS; Corn is down 1; Soybeans down 3 1/2; Soymeal down $0.06; Soyoil down 1.08.

For the week so far wheat prices are up 44 1/2 in SRW, up 43 1/4 in HRW, up 35 1/2 in HRS; Corn is up 14; Soybeans up 3 1/2; Soymeal up $0.44; Soyoil down 1.62.

For the month to date wheat prices are up 3 1/4 in SRW, up 20 1/2 in HRW, up 21 1/2 in HRS; Corn is up 19 3/4; Soybeans up 5 3/4; Soymeal up $2.10; Soyoil up 3.42.

Year-To-Date nearby futures are up 20% in SRW, up 26% in HRW, up 2% in HRS; Corn is up 18%; Soybeans up 3%; Soymeal down 0%; Soyoil up 24%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 31 yuan; Soymeal down 46; Soyoil up 46; Palm oil up 70; Corn up 40 — Malaysian palm oil prices overnight were down 144 ringgit (-3.75%) at 3693.

There were no changes in registrations. Registration total: 3,084 SRW Wheat contracts; 0 Oats; 0 Corn; 5 Soybeans; 39 Soyoil; 247 Soymeal; 40 HRW Wheat.

Preliminary changes in futures Open Interest as of October 10 were: SRW Wheat up 4,760 contracts, HRW Wheat up 3,183, Corn up 10,411, Soybeans up 14,824, Soymeal down 725, Soyoil down 6,338.

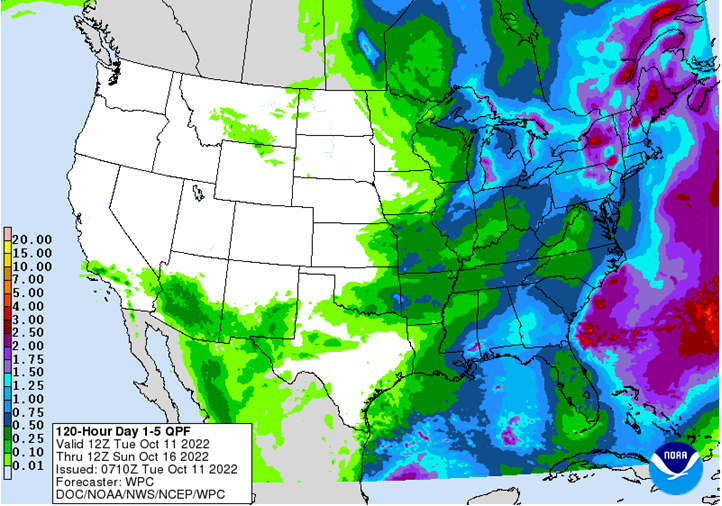

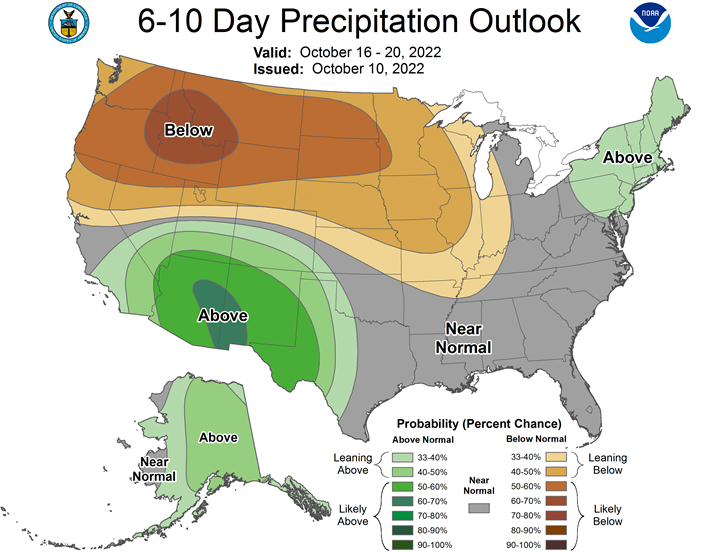

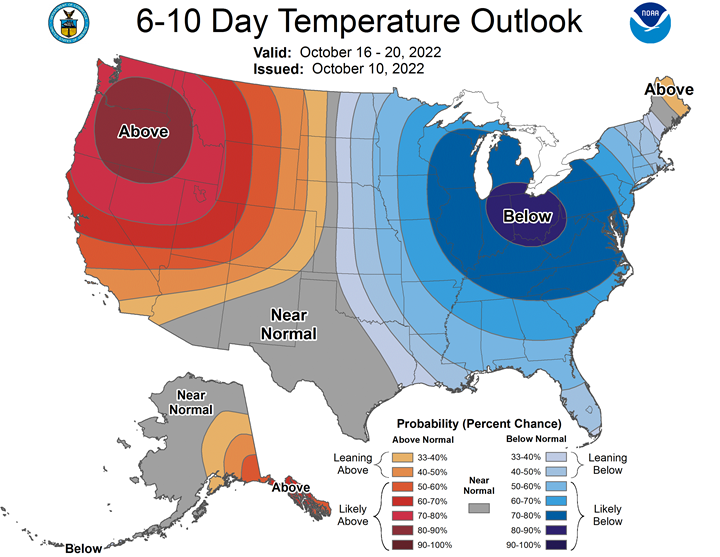

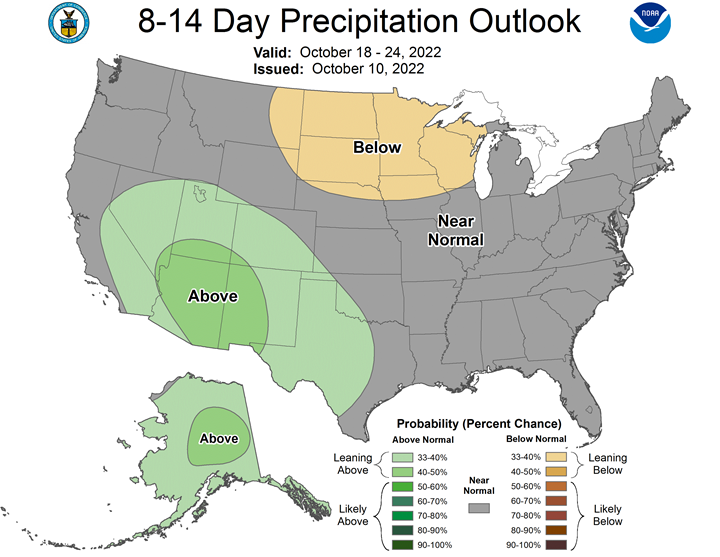

Northern Plains Forecast: Isolated to scattered showers Tuesday-Wednesday. Mostly dry Thursday-Friday. Temperatures above normal Tuesday, near normal Wednesday-Thursday, near to above normal Friday. Outlook: Mostly dry Saturday-Wednesday. Temperatures near to above normal Saturday, near to below normal Sunday-Monday, near to above normal Tuesday-Wednesday.

Central/Southern Plains Forecast: Isolated showers Tuesday-Wednesday. Mostly dry Thursday-Friday. Temperatures near to above normal through Friday. Outlook: Mostly dry Saturday. Isolated showers Sunday-Wednesday. Temperatures near to above normal Saturday-Sunday, near to below normal Monday-Tuesday, near normal Wednesday.

Western Midwest Forecast: Scattered showers Tuesday-Wednesday. Mostly dry Thursday-Friday. Temperatures above normal through Wednesday, near to below normal Thursday-Friday.

Eastern Midwest Forecast: Scattered showers Tuesday-Wednesday. Isolated showers north Thursday. Mostly dry Friday. Temperatures above normal Tuesday-Wednesday, below normal Thursday-Friday. Outlook: Scattered showers Saturday-Sunday. Lake-effect showers Monday. Mostly dry Tuesday-Wednesday. Temperatures near normal Saturday, below normal Sunday-Wednesday.

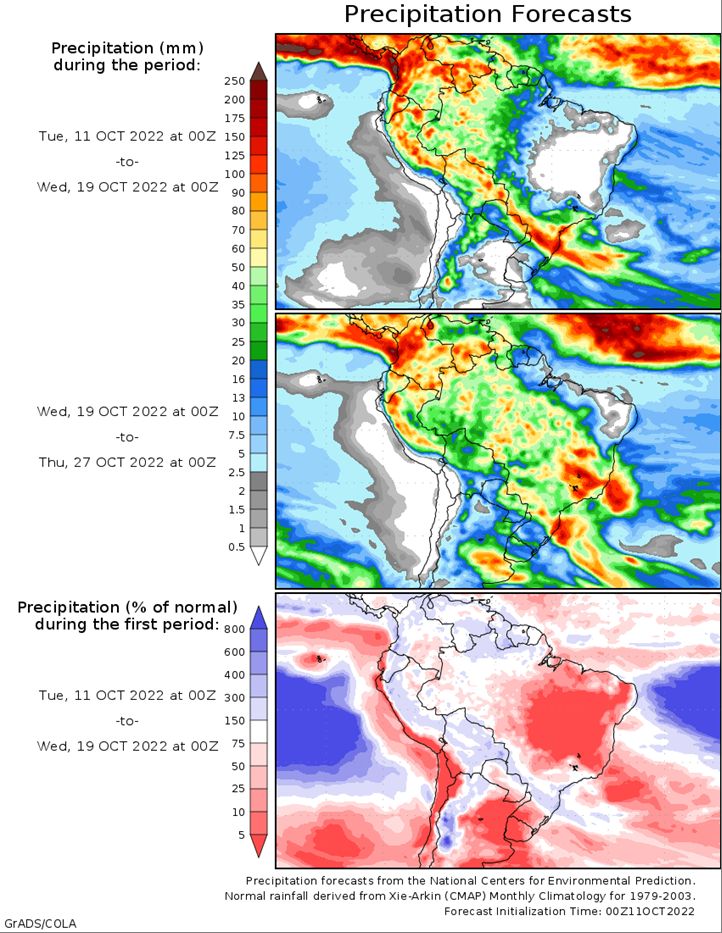

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana Forecast: Scattered showers through Friday, mostly north. Temperatures near to below normal through Friday. Mato Grosso, MGDS and southern Goias Forecast: Scattered showers through Friday. Temperatures near to below normal through Friday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires Forecast: Mostly dry through Friday. Temperatures near to above normal Tuesday-Friday. La Pampa, Southern Buenos Aires Forecast: Mostly dry through Friday. Temperatures near to above normal Tuesday-Friday.

The player sheet for Oct. 10 had funds: net buyers of 19,500 contracts of SRW wheat, buyers of 11,000 corn, buyers of 4,500 soybeans, buyers of 2,000 soymeal, and sellers of 1,000 soyoil.

TENDERS

- WHEAT TENDER: Algeria’s state grains agency OAIC issued an international tender to buy soft milling wheat to be sourced from optional origins, European traders said on Sunday. The tender sought a nominal 50,000 tonnes, but Algeria often buys considerably more in its tenders than the nominal volume sought. The deadline for submission of price offers in the tender is Oct. 11, with offers having to remain valid until Oct. 12.

- VEGETABLE OILS TENDER: A Tunisian state agency issued an international tender to purchase up to 9,000 tonnes of vegetable oils, European traders said. Either crude degummed soyoil or crude degummed rapeseed oil is sought. The deadline for submissions of price offers in the tender is Oct. 11. The oils can be sourced from optional origins. Delivery is sought in one consignment between Nov. 21 and Dec. 5.

PENDING TENDERS

- CORN TENDER: Taiwan’s MFIG purchasing group has issued an international tender to buy up to 65,000 tonnes of animal feed corn which can be sourced from the United States, Brazil, Argentina or South Africa, European traders said on Tuesday.

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 94,140 tonnes of food-quality wheat from the United States, Canada and Australia in regular tenders that will close on Thursday.

- WHEAT TENDER: The World Food Programme, a United Nations agency, issued an international tender to purchase about 100,000 tonnes of milling wheat, European traders said. The deadline for submission of price offers in the tender was Sept. 28, with an award expected on Sept. 30.

- BARLEY TENDER: Turkey’s state grain board TMO issued an international tender to purchase and import a total of 495,000 tonnes of animal feed barley, European traders said. The deadline for submission of price offers in the tender is Oct. 11, they said.

- WHEAT TENDER: Jordan is seeking 120,000 tonnes of wheat in an international purchasing tender with a deadline for offers on Oct. 11, a government source told Reuters.

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 90,100 tonnes of rice sourced from the United States, Vietnam and other origins, European traders said. The deadline for submissions of price offers in the tender is Oct. 19, they said.

US BASIS/CASH

- Basis bids for corn and soybeans shipped by barge to the U.S. Gulf Coast marched higher on Monday, reflecting persistent river shipping delays due to low water on the southern Mississippi River, traders said.

- Two stretches of Mississippi River were reopened to commercial traffic over the weekend after dredging operations deepened the shipping channel near Memphis, Tennessee, and near Stack Island, Mississippi, the U.S. Coast Guard said.

- A southbound queue of 22 tow boats hauling 392 barges was still waiting to pass a section of river near Stack Island on Monday morning, but the northbound queue had been cleared, a Coast Guard spokesman said. There were no vessels waiting to pass near Memphis, he said.

- Low water is expected to remain a problem for barge shippers amid mostly dry weather in the near term forecast.

- Costs for barge freight remained historically high. Barges for this week on Memphis-to Cairo, Illinois, segment of the Mississippi River traded at 3,000% of tariff, barge sources said, compared with October offers a month ago near 875% of tariff.

- Basis bids for corn barges loaded in October jumped 30 cents to 225 cents over December, with barges loaded in first-half October bid at 230 cents over futures.

- FOB basis offers for corn shipped in the first half of November held at around 270 cents over futures while last-half November loadings were 220 cents over futures.

- For soybeans, barges loaded this month were bid at 205 cents over November, up 5 cents from Friday.

- FOB basis offers for soybeans shipped in first-half November were offered around 250 cents over November futures and last-half shipments were quoted around 230 cents over futures, both steady with Friday.

- China set its tariff rate quota for wheat, corn and rice imports in 2023 at the same volumes as the previous year. The Tariff Rate Quota (TRQ) for wheat imports in 2023 was set at 9.636 million tonnes, according to a notice published on the website of the National Development and Reform Commission. Import quotas for corn and rice were set respectively at 7.2 million tonnes and 5.32 million tonnes.

- Spot basis bids for corn were mixed at locations around the U.S. Midwest on Monday, rising at processors and falling at elevators.

- The basis was strong at plants as dealers at those locations sought supplies to boost the pace of processing due to strong profit margins.

- But slow movement of barges along rivers and potential railroad snarls was making it hard to move supplies delivered to elevators, cutting into demand at those locations.

- Cash bids for soybeans were mixed at processors and river terminals, and flat at truck elevators.

- Farmer sales of both corn and soybeans were slow, although growers were making heavy deliveries of both commodities to fill contracts they had previously booked, an Ohio dealer said.

- A sharp rally in the futures market spurred a round of soft red winter wheat sales, with farmers locking in prices for crops they will harvest in 2023.

- Spot basis bids for soybeans fell at U.S. Midwest processors, elevators and river terminals on Monday, with the basis under pressure from a glut of deliveries of newly harvested supplies, dealers said.

- The corn basis was steady to weak at elevators and ethanol plants, flat at river terminals and steady to firm at processors.

- Fresh sales on the cash market were slow, an Iowa dealer said.

- But country movement was heavy as farmers brought corn and soybeans they had previously agreed to sell to the region’s elevators and processors.

- Dry weather across much of the region allowed growers to make good progress in the fields during the weekend.

- Spot basis bids for hard red winter wheat were steady to sharply lower at truck terminals in Oklahoma on Monday, grain dealers said.

- The basis was flat in Kansas and at rail terminals that ship supplies to the U.S. Gulf.

- Farmer sales were slow despite a sharp rally in the futures market that pulled cash prices lower even in areas where the basis fell.

- Dryness across broad swaths of the southern U.S. Plains was deterring farmers from booking new deals because they were concerned about how big their harvest will be next summer, an Oklahoma dealer said.

- Spot cash millfeed values were steady to weaker in U.S. regional markets on Monday, pressured by reduced demand in some areas as animal feed mixers reformulated their rations with cheaper alternatives, dealers said.

- Spot truck offers fell $20 per ton compared to last week in the Buffalo, New York, market, a reflection of feed mixers cutting back on their use of millfeeds.

- Nearby supplies remained tight after one of Buffalo’s mills did not operate during the weekend, one broker said.

- Bids and offers were steady elsewhere. Flour mills were operating about half a day less than last week on average across the eastern Midwest and Northeast, the same broker said, curbing millfeed supplies and keeping a floor under prices.

- Firm prices for corn, a competing feed ingredient, also helped underpin millfeeds values.

- Spot basis offers for U.S. soymeal were steady to weak at both rail and truck market processors on Monday, dealers said.

- Rising supplies pressured basis levels.

- Heavy deliveries of newly harvested soybeans allowed processors around the Midwest to boost their pace of crushing.

- Demand was routine, with many end users waiting to see if the increased supply base cuts into prices even further in the coming weeks, dealers said.

TODAY

Ukraine Grain Exports Top 6.4 Million Tons, But Backlog Persists

Ukraine has shipped more than 6.4 million tons of grain and foodstuffs from Black Sea ports through an export corridor that opened in early August, but the number of ships awaiting inspections remains high.

Outbound vessels need to be inspected in Istanbul under terms of the export deal, and more than 80 ships still need to be cleared there, according to the latest lineup posted by the United Nations. That equates to about a quarter of the total ships that have departed Ukraine so far.

The Joint Coordination Centre in Turkey said late Friday that it’s working to improve capacity. The wait for inspections has increased to an average of nine days from the time ships arrive in Istanbul, and the center urged shipowners to follow procedures to ready for the process. The congestion has helped support benchmark Chicago wheat futures.

“The JCC hopes that this congestion will soon be eased with the cooperation of the shipping industry,” it said.

The agreement that formed the corridor was signed in late July and is due to expire in mid-November, unless the parties renew it.

Some Ukrainian ports remain blocked by Russia’s invasion. The nation’s total grain exports for the 2022-23 season are running 37% below last year, government data show.

Monday Strikes Haven’t Impacted Ukraine Grain Shipments: UN

“We have observed no impact of the strikes on the operations of the Black Sea Grain Initiative,” Ismini Palla, a UN spokesperson for the initiative, says by email.

- “Ships have moved as per normal schedule today”

Brazil 2022/23 Soy Planting 9.6% Done as of Oct. 6: AgRural

Compares with 3.8% a week earlier, and 10.1% a year before, according to an emailed report from consulting firm AgRural.

- Summer corn seeding was 38.8% complete, vs 34.1% a week earlier and 37.9% a year before

Brazil Soybean Planting Advances Amid Irregular Rain

Brazilian farmers moved ahead with their soybean planting work for the 2022-2023 growing season amid irregular rain in the key state of Mato Grosso, say analysts at AgRural in a research note. The area planted with the oilseeds grew to 9.6% as of Oct. 6, up from 3.8% a week earlier but behind the 10.1% planted on the same date a year earlier, AgRural says. Low soil moisture in Mato Grosso is limiting the pace of planting in that state, while constant rain and high soil moisture levels in the states of Parana, Santa Catarina and Mato Grosso do Sul are slowing planting in those states, AgRural says.

WHEAT/CEPEA: Harvesting advances in BR; production is forecast to set a record

Despite the recent rains in many wheat-producing regions in Brazil, the harvesting is in progress, and the national output is estimated to set a record. This scenario led Conab (Brazil’s National Company for Food Supply) to raise the estimates for wheat exports and reduce imports estimates.

As for prices, Cepea surveys show that quotations followed opposite directions in the over-the-counter market (paid to farmers) and the wholesale market (deals between processors). While the values paid to farmers have been influenced by the expectations for a record harvest in Brazil, in the wholesale market, quotations have increased slightly, pushed up by the rains, which hampered crop activities in some areas.

ESTIMATES – In a report released this month, Conab has estimated the Brazilian wheat output in the 2022/23 season at 9.35 million tons, a slight 0.1% down from that reported in September but 21.9% up from that in 2021/22 and a record. Productivity estimates were also revised down (slightly) compared to that forecast in September but is still expected to hit 3.08 tons/hectare, 10.2% higher than that in 2021/22. The area allocated to wheat crops continued estimated at 3.03 million hectares, 10.6% up from that last season.

Thus, Conab has reduced imports estimates by 200 thousand tons compared to that forecast in September, to 6.1 million tons between Aug/22 and Jul/23, volume 0.3% higher than that last crop. The domestic availability is expected to total 16.18 million tons, and domestic consumption, 12.28 million tons. Exports are forecast at 2.7 million tons between Aug/22 and Jul/23. Thus, the estimates for ending stocks have been revised down to 1.19 million tons by July/23.

CROPS – In Paraná, 42% of the wheat crop had been harvested by October 3rd, according to Deral/Seab. Of the crops still developing, 73% are in good conditions; 23%, are in average conditions; and 4%, in bad conditions.

In Rio Grande do Sul, crops are currently in good conditions. According to Emater/RS, 3% of the wheat crops had been harvested in RS by October 6, the same as that in the same period last crop and within the average of the last five years.

PRICES – Between Sept. 30 and October 7, the prices paid to wheat farmers in Santa Catarina dropped by 2.66%; in Rio Grande do Sul, by 1.3%; and in Paraná, by 0.09%. In the wholesale market, values rose by 0.96% in Paraná, 0.74% in Santa Catarina, 0.56% in São Paulo, and 0.27% in Rio Grande do Sul. In the same period, the US dollar decreased by 2.86%, closing at BRL 5.225 on Friday, 7.

EXPORTS AND IMPORTS – According to Secex, Brazil exported 369.78 tons of wheat in September. In the last 12 months, 3.14 million tons were exported, and this year, 2.6 million tons have been shipped. As for wheat imports, last month, Brazil imported 373.39 thousand tons, 30.4% less than that from August and 16.6% down from that in September last year. Last month, most of the wheat imported (80.62% of the total) came from Argentina, at the average import value of BRL 2,281.45/ton. In the last 12 months, imports totaled 5.95 million tons.

Kazakhstan Grain Harvest at 21.6m Tons: Agriculture Minister

About 99.5% of the planted area, or 15.9m hectares, has been harvested, the Agriculture Minister Yerbol Karashukeev tells government meeting, according to his presentation.

- Average grain yield is 13.5 centners/hectare

- Kazakhstan may harvest more than 19m tons of grain in net weight, Interfax reports, citing agriculture ministry

Indonesia’s Aug palm oil exports at 4.33 mln T- association

Indonesia exported 4.33 million tonnes of palm oil products in August, data from industry group the Indonesian Palm Oil Association (GAPKI) showed on Tuesday, up from 2.71 million tonnes in July.

Crop Giant Cargill Sees Developing Nations Cutting Grain Demand

- Strong US dollar, high prices, rates drive decline in trade

- Barge backup at Mississippi River adds to US export woes

A combination of a strong US dollar, high commodity prices and rising interest rates are creating a mix that’s driving a “demand destruction” in crops, according to the head of Cargill Inc.’s World Trading Group.

Developing countries in parts of North Africa, Middle East and southeast Asia are struggling with access to dollars that are needed for importing commodities, said Alex Sanfeliu, world trading head for Cargill in Geneva. That means in the upcoming months global trade flows may be reduced by 5% to 6% for wheat and 2% to 3% for corn and soybean meal, he said.

“We are seeing a fair amount of demand destruction in parts of the world,” Sanfeliu said in a video interview. “High interest rates, dollar appreciating and high prices in commodities — that is a really bad combination for many of these governments.”

Commodities traded in world markets are typically priced in the greenback, which has rallied 18% this year to a record against a basket of currencies. At the same time, agricultural commodities have resumed their rally amid the escalation of conflict in Ukraine and the uncertainty regarding shipments from the Black Sea region.

In July, an international deal was brokered with the help of the United Nations and Turkey to keep grain flowing out of Ukraine. Concern is mounting over whether the deal will be renewed next month.

The question of how much the Black Sea region can export will help guide the short term, Sanfeliu said, but fundamentally the market is different.

“I don’t think you’re gonna make the same kind of highs,” should the Ukraine deal fall through. “I don‘t think we are going to reach $13.50 a bushel of wheat like we had before,” Sanfeliu said.

On global demand for US goods, the low water levels in the Mississippi river, although improving, will also trim US exports in October 20% to 30%, he estimated.

“Then the question is: Are you gonna be able to catch up in November, December before Brazil harvest?,” Sanfeliu said.

Malaysia Sept. Palm Stockpiles +10.5% M/m to 2.32M Tons: MPOB

Palm oil stockpiles in Malaysia, the world’s second-largest producer, rose 10.5% to 2.32 million tons in September from a month earlier, Malaysian Palm Oil Board says in statement today.

- Palm oil exports +9.3% m/m to 1.42m tons

- Crude palm oil stock: +24.8% to 1.28m tons

- Crude palm oil production +2.6% m/m to 1.77m tons

Malaysia Sept. Palm Oil Exports to India -21% M/m: Details

Malaysia’s palm oil exports to India fell 21% to 0.19 million tons in Sept. from a month earlier, the Malaysian Palm Oil Board posted on its website.

- Exports to India -21% m/m to 185,061 tons, -50.4% y/y

- Exports to China +108.5% m/m to 264,089 tons, +12.7% y/y

- Exports to EU -36% m/m to 83,386 tons, -38.6% y/y

France Cuts Outlook for 2022 Corn, Sugar and Wheat Harvests

This year’s French corn harvest is now seen at 11.4m tons, down from a September outlook for 11.6m tons, its agriculture ministry said Tuesday in a report.

- Average yield of corn raised for grain is likely to be the lowest since 2005, after summer heat and drought damaged fields

- Sugar beet crop estimate cut to 32.9m tons, from 33.3m tons

- Soft-wheat crop estimate cut to 33.7m tons, from 34.1m tons

- Barley crop estimate kept steady at 11.4m tons

- Rapeseed crop estimate also steady at from 4.5m tons

Brazil unusually re-exports fertilizer amid storage shortage – port authority

Brazil, which normally relies on fertilizer imports to boost crop yields, is re-exporting cargoes as there is nowhere to store them following a surge in inbound shipments earlier this year, according to the port authority of Antonina on Monday.

In an unexpected turn of events, an importer will re-route 24,700 tonnes of DAP fertilizer that had arrived from Jordan but will now be shipped to Turkey over the next few days, the authority said.

The move follows the re-export last month of a 17,000-tonne phosphate fertilizer cargo that had sat at an Antonina customs storage facility for two months coming from Egypt.

The Egyptian consignment was re-routed from Antonina, a port located in southern Brazil, to the United States on Sept. 22, a situation the authority described as unprecedented.

“Four to five months ago we were talking about a possible fertilizer shortage,” said Jeferson Souza, an analyst with Agrinvest. “Now we have nowhere to put product.”

The rare fertilizer re-exporting deals expose Brazil’s logistics woes at a time of ample supplies and slow farmer buying.

No taxes will apply on re-exported cargos as these remained at the port’s customs area, Antonina said.

The threat of fertilizer shortages escalated after the war in Ukraine, which sparked sanctions against major supplier Russia and caused prices to surge earlier this year. Prices have since abated some.

Brazil’s import rush during the first months of 2022 rose port storage costs and demurrage, a penalty cargo vessel operators pay when facing unloading issues, Antonina said.

The nation, which relies on imports for 85% of its fertilizer needs, brought in some 30.77 million tonnes of in the nine months through September, a record.

Nationwide, Brazilian ports are “full” of fertilizer imports that have not been moved internally, trade group Anda told Reuters last week.

Anda also confirmed expectations that fertilizer deliveries to farmers could fall between 5% and 7% in 2022 as farmers either delayed or decided not to buy after prices jumped.

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |