Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 9 3/4 in SRW, up 10 in HRW, up 8 1/2 in HRS; Corn is up 2 1/2; Soybeans up 5 1/2; Soymeal up $0.39; Soyoil up 0.31.

For the week so far wheat prices are down 8 3/4 in SRW, down 1/2 in HRW, up 7 3/4 in HRS; Corn is down 9; Soybeans down 5 3/4; Soymeal down $0.55; Soyoil up 5.65.

For the month to date wheat prices are down 70 1/2 in SRW, down 39 3/4 in HRW, down 20 in HRS; Corn is up 3 1/4; Soybeans up 13 1/4; Soymeal up $2.60; Soyoil up 9.39.

Year-To-Date nearby futures are up 10% in SRW, up 19% in HRW, down -2% in HRS; Corn is up 15%; Soybeans up 4%; Soymeal down -1%; Soyoil up 26%.

Chinese Ag futures (JAN 23) Soybeans down 92 yuan; Soymeal up 17; Soyoil up 62; Palm oil up 138; Corn down 3 — Malaysian palm oil prices overnight were down 18 ringgit (-0.44%) at 4100.

There were changes in registrations (-4 SRW Wheat). Registration total: 3,080 SRW Wheat contracts; 0 Oats; 0 Corn; 5 Soybeans; 106 Soyoil; 296 Soymeal; 40 HRW Wheat.

Preliminary changes in futures Open Interest as of October 19 were: SRW Wheat up 94 contracts, HRW Wheat up 1,073, Corn down 5,082, Soybeans up 475, Soymeal down 509, Soyoil up 1,458.

Northern Plains Forecast: Mostly dry through Friday. Isolated to scattered showers Saturday-Sunday. Temperatures above normal Thursday-Saturday, below normal west and above normal east Sunday. Outlook: Isolated to scattered showers Monday-Thursday. Mostly dry Friday. Temperatures near to below normal Monday-Friday.

Central/Southern Plains Forecast: Mostly dry through Saturday. Isolated to scattered showers Sunday. Temperatures near to above normal Thursday, above to well above normal Friday-Sunday. Outlook: Isolated showers Monday. Mostly dry Tuesday-Wednesday. Scattered showers Thursday-Friday. Temperatures near to above normal Monday-Tuesday, near to below normal Wednesday, near to above normal Thursday, near to below normal Friday.

Western Midwest Forecast: Mostly dry through Saturday. Scattered showers Sunday night. Temperatures near to below normal Thursday, above to well above normal Friday-Sunday.

Eastern Midwest Forecast: Scattered lake-effect showers Thursday, some snows possible. Mostly dry Friday-Sunday. Temperatures below to well below normal Thursday, near to above normal Friday, above to well above normal Saturday-Sunday. Outlook: Isolated to scattered showers Monday-Tuesday. Mostly dry Wednesday-Thursday. Scattered showers Friday. Temperatures above to well-above normal Monday-Tuesday, near to above normal Wednesday-Friday.

The player sheet for Oct. 19 had funds: net sellers of 3,000 contracts of SRW wheat, sellers of 4,000 corn, unchanged soybeans and soymeal, and buyers of 5,500 soyoil.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

TENDERS

- BARLEY SALE: Leading South Korean animal feed maker Nonghyup Feed Inc (NOFI) purchased about 30,000 tonnes of animal feed barley in an international tender for up to 60,000 tonnes which closed on Wednesday, European traders said.

- WHEAT SALE: A group of South Korean flour mills led by the miller SPC bought around 30,000 tonnes of milling wheat to be sourced from the United States on Wednesday, European traders said.

- WHEAT TENDER: A government agency in Pakistan has issued a new international tender to purchase and import 500,000 tonnes of wheat, European traders said. The deadline for submission of price offers in the tender from the Trading Corporation of Pakistan is Oct. 26.

- WHEAT TENDER: Iraq’s state grains buyer has issued a tender to buy a nominal 50,000 tonnes of hard milling wheat, European traders said. The deadline for submission of price offers in the tender is believed to be Oct. 24 with traders saying offers to remain valid until Oct. 27.

- BARLEY TENDER: Jordan’s state grain buyer is seeking 120,000 tonnes of barley in an international tender with the deadline set for Oct. 26, a government source said.

- FAILED FEED WHEAT TENDER: Leading South Korean animal feedmaker Nonghyup Feed Inc is believed to have rejected all offers and made no purchase in an international tender for up to 95,000 tonnes of feed wheat on Wednesday, European traders said.

- FAILED FEED GRAIN TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries said it received no offers for feed-quality wheat or barley in a simultaneous buy and sell (SBS) auction that closed late.

- FAILED WHEAT PURCHASE TALKS: Egypt’s state grains buyer, the General Authority for Supply Commodities, held private talks on Tuesday to directly purchase wheat, three traders said. No purchase was made, with one trader adding that GASC believed prices were too high.

PENDING TENDERS

- WHEAT TENDER: Saudi Arabia’s state grains buyer SAGO has set a tender to purchase 535,000 tonnes of wheat for shipment March-April 2023, it said on its official Twitter feed.

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 90,100 tonnes of rice sourced from the United States, Vietnam and other origins, European traders said. The deadline for submissions of price offers in the tender is Oct. 19, they said.

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 97,482 tonnes of food-quality wheat from the United States, Canada and Australia in regular tenders that will close on Oct. 20.

- WHEAT TENDER: Turkey’s state grain board TMO has issued an international tender to purchase about 495,000 tonnes of milling wheat, European traders said. The deadline for submission of price offers in the wheat tender is Oct. 21.

- WHEAT TENDER: Jordan’s state grain buyer has issued an international tender to buy 120,000 tonnes of milling wheat, an official source said. The deadline for submission of price offers in the tender is Oct. 25.

US BASIS/CASH

- Basis bids for corn and soybeans shipped by barge to U.S. Gulf export terminals were steady to mostly higher on Wednesday, supported by tight nearby supplies and high freight costs, traders said.

- Export demand for Gulf shipments was slow as high prices triggered by barge shipping delays discouraged buying.

- Historically low water on the lower Mississippi River has largely choked off the flow of grain to Gulf export terminals. Per-bushel barge shipping costs have soared amid various river closures for dredging and reduced barge drafts and tow sizes.

- Many exporters are unwilling to post offers for shipments this month and parts of next month as they are unsure if supplies will be available. Some Gulf exporters are sourcing grain by rail to fill immediate loading commitments for moving shipments from other ports such as the Galveston, Texas, or via Pacific Northwest terminals.

- Waterways are expected to remain difficult to navigate through at least the end of the month amid mostly dry weather in the near-term forecast.

- Soybean barges loaded in October were bid 225 cents over November, up 25 cents from Tuesday. November barges were bid 20 cents higher at 190 cents over futures.

- Cost, insurance, and freight (CIF) corn basis bids for October loadings were 10 cents higher at 205 cents over December. November corn barges were bid steady at 160 cents over.

- Export premiums for soybeans shipped in first-half November were up 10 cents at around 275 cents over November futures, and last-half shipments were nominally quoted around 250 cents over futures, up 10 cents.

- Export premiums for corn shipped in the first half of November were nominally quoted around 280 cents over futures, while last-half November loadings were 230 cents over, up 5 cents.

- Spot basis bids for soybeans were mostly steady to firmer in the U.S. Midwest on Wednesday, rising at two Iowa processing plants as strong soy crush margins encouraged processors to bid up for soybeans even as the Midwest harvest progressed, traders said.

- The soy basis jumped by 25 cents per bushel at a crushing plant in Sioux City, Iowa, and by 13 cents at Des Moines, Iowa.

- However, the soy basis fell by 5 cents at Morris, Illinois, on the Illinois River.

- Corn basis bids were mostly steady, although the Morris, Illinois, corn basis firmed by a nickel.

- Low water on the Mississippi River continued to curb barge traffic and force shippers to reduce the size of their loads.

- Spot basis bids for corn and soybeans were mostly steady to higher in the U.S. Midwest on Wednesday as processor needs outweighed farmer offerings even as the harvest of both crops progressed, dealers said.

- The corn basis firmed by 18 cents at a Cincinnati, Ohio, terminal, by 5 cents at Burns Harbor, Indiana, and by 1 cent at an ethanol plant in Council Bluffs, Iowa. But the basis fell by a nickel at Cedar Rapids, site of a corn processing plant.

- For soybeans, the basis firmed by 17 cents at Cincinnati, by 5 cents at Burns Harbor and by 2 cents at a soy crushing plant in Decatur, Indiana. But the bean basis dropped by 15 cents at Seneca, Illinois, on the Illinois River.

- Dealers continued to monitor low water levels on the Mississippi River that have been impeding the movement of grain barges to export terminals at the U.S. Gulf, and raising freight costs.

- Spot basis bids for hard red winter wheat were steady to firmer at elevators in the southern U.S. Plains on Wednesday and protein premiums were unchanged while producers focused on harvesting fall crops and planting the 2023 winter wheat crop in abnormally dry conditions.

- The spot basis firmed by 2 cents at Newton, Kansas.

- Rain showers over the next two weeks should be limited to far northern and far southeastern areas of the southern Plains HRW wheat belt, the Commodity Weather Group said in a note, leaving newly seeded wheat struggling to emerge from the ground in about half of the region.

- Spot basis offers for soymeal were mostly flat to weaker in the U.S. Midwest on Wednesday as the advancing U.S. fall harvest replenished soy crushing plants with soybeans, dealers said.

- Also, the spread of bird flu in U.S. chicken and turkey flocks has curbed demand for soymeal, a key ingredient in poultry feed, one broker said.

- Basis offers for truckloads of soymeal fell by $4 per ton at Decatur, Indiana, and by $2 at Mankato, Minnesota.

- Market players were monitoring low water levels on the Mississippi River that have slowed the movement of grain barges moving to the U.S. Gulf Coast.

- At the Gulf, CIF basis offers for soymeal for October were up $3 per ton but offers for November and December fell by $2.

TODAY

DOE: US Ethanol Stocks Fall 0.1% to 21.844M Bbl

According to the US Department of Energy’s weekly petroleum report.

- Analysts were expecting 21.948 mln bbl

- Plant production at 1.016m b/d, compared to survey avg of 0.962m

GRAIN EXPORT SURVEY: Corn, Soy, Wheat Sales Before USDA Report

Estimate ranges are based on a Bloomberg survey of six analysts; the USDA is scheduled to release its export sales report on Thursday for week ending Oct. 13.

- Corn est. range 250k – 700k tons, with avg of 433k

- Soybean est. range 1,700k – 2,500k tons, with avg of 2,005k

Russia’s 2023 Wheat Crop Will Retreat on Plantings Cut: SovEcon

Russian farmers are expected to substantially lower winter-grain plantings, which are currently under way, compared with the prior season, consultant SovEcon said in an emailed note.

- That’s due to heavy rains in recent weeks and historically low wheat prices, amid the strong ruble and government export tax

- Winter-grain area is forecast at 18.8m hectares, from 19.5m hectares a year ago; majority is wheat

- The 2023 wheat harvest is estimated at 84.8m tons, SovEcon says in initial estimate

- Compares with the firm’s outlook for 100.6m tons this year

- NOTE: USDA estimates Russia’s 2022 wheat harvest at 91m tons

Brazil Soybean Production, Exports Higher in 2022-23, USDA Says

Brazilian production seen rising to 148.5 million metric tons in 2022-23 from 144m tons earlier this year based on expanded planted area and improved yields, according to the US Department of Agriculture’s Brasilia post report.

- The record crop, if confirmed, would be 17% higher compared to 126.6m tons in 2021/22, after adverse weather hurt yields last year

- Exports are now pegged at 95.7m tons, up from 92m tons

- 2021/22 exports are currently estimated at 77m tons

- Crushing should be a record at 50m tons, “based on strong demand for Brazilian soybean products, especially oil,” said the report

- The agency’s Brasilia post now estimates a yield of 3.50 metric tons per hectare, up from an August forecast of 3.39 MT/HA: report

- Soybean planted area forecast at 42.8 million HA, up from 42.5m HA

- USDA’s export marketing year for 2022/23 goes from February 2023 to January 2024

SIPEF Says 2022 Palm Oil Production Could Reach Growth Of Over 4% – Reuters

- PALM OIL PRODUCTION OVER 2022 COULD REACH THE PROJECTED GROWTH OF OVER 4%, BARRING EXCEPTIONAL WEATHER CONDITIONS

- FOR THE THIRD QUARTER, THE GROUP’S PALM OIL PRODUCTION GREW BY 11.7% AGAINST LAST YEAR’S THIRD QUARTER

- IS MOVING TOWARD A POSITIVE NET FINANCIAL POSITION, DESPITE CONTINUING THE PLANNED EXPANSION IN SOUTH SUMATRA

- REALISED 9M NET SALES PRICES MORE THAN 50% ABOVE THE LEVEL OF THE FIRST NINE MONTHS OF 2021

- PALM OIL PRICES REMAIN HISTORICALLY HIGH WITH QUOTATIONS AGAIN AROUND USD 1 000 CIF ROTTERDAM PER TONNE

- WITH 88% OF EXPECTED PALM OIL PRODUCTION SOLD AND PROSPECT OF CONTINUED FAVOURABLE MARKET PRICES, GROUP’S RECURRING ANNUAL RESULTS COULD EXCEED RECORD USD 100 MILLION, BARRING UNFAVOURABLE CHANGES IN EXPORT TAXES AND LEVIES IMPOSED BY INDONESIAN GOVERNMENT

- PRICE EXPECTATIONS FOR 2023 ALSO REMAIN POSITIVE FOR THE PALM OIL MARKET

- NET CASH FLOW IS LIKELY TO ALSO REMAIN POSITIVE IN Q4, DUE TO FAVOURABLE FORECASTS FOR PRODUCTION AND SALES PRICES

- GROUP PRODUCTION IN Q3: PALM OIL 111,681 TONNES; RUBBER 594 TONNES; BANANAS 7,749

- TOTAL NINE-MONTH FRUIT HARVEST WAS 5.0% HIGHER THAN THAT AS ON 30 SEPTEMBER 2021

- AVERAGE MARKET PRICES YTD Q3: PALM OIL CIF ROTTERDAM $1,441/TONNE; RUBBER RSS3 FOB SINGAPORE $1,918/TONNE; BANANAS CFR EUROPE $745/TONNE

Argentina grains exchange cuts wheat harvest forecast to 15 mln T

Argentina’s Rosario grains exchange cut its 2022/23 wheat harvest forecast to 15 million tonnes, down from 16 million tonnes estimated last week, it said on Wednesday, after a late frost hit crops already damaged by drought.

The projected wheat harvest – which would make this year the worst in seven years – is “very critical and could still get worse,” the exchange said in its monthly report.

Argentina produced a record 23 million tonnes of wheat in the last growing season.

The country is a major grains exporter, but this crop year has been hit by a drought that dates back to May, exacerbating the impact of low temperatures during the southern hemisphere spring, when many wheat fields were in key development stages.

The Rosario exchange maintained its projections for the 2022/23 corn harvest at 56 million tonnes and its 2022/23 soybean harvest at 48 million tonnes. Producers are beginning to plant corn, and soybean planting will start in coming weeks.

The exchange said that due to the drought farmers may opt to plant more land in soybeans, a hardier crop than corn, estimating that the planting area for the oilseed could reach 17 million hectares (42 million acres).

The exchange said producers so far have planted only 12% of the 8 million hectares forecast for corn, 15 percentage points behind the planting rate at the same time last season.

China to auction 40,200 tonnes of wheat from state reserves on Oct 26

China will sell 40,200 tonnes of wheat from its state reserves on Oct. 26, the National Grain Trade Center said on Thursday.

The country sold 41,359 tonnes of wheat at an auction of its reserves held on Oct. 12

Mandatory conciliation stalls Argentinean union grain strike

The Argentine province of Buenos Aires issued a mandatory conciliation late on Tuesday in the dispute involving Argentina’s grain inspectors’ union, URGARA, which has threatened to disrupt the critical grain exports sector.

As part of a dispute between the union and food exporting company Desdelsur SA, the union said that “we will comply with the conciliation but we will continue to be on alert and mobilise until the situation of the workers in the dispute is resolved”.

On Tuesday, the union threated the possibility of an abrupt walkout at the country’s ports.

As a result of the dispute, the local government “issued a five-day extension of the previous compulsory conciliation. Meanwhile the employer cannot retaliate against the workers, (and) URGARA must lift the strike”, the union added on its Facebook page.

URGARA is an association of grain technicians who analyse grains held in storehouses and loaded on ships, so their strike could affect the country’s grain trade.

Argentina is the world’s leading exporter of soybean oil and meal, and the third-largest exporter of corn.

Argentina’s economy is highly dependent on foreign exchange generated by its powerful agro-export sector. However, October is a slower month for the country’s ports.

Malaysia Oct. 1-20 Palm Oil Exports to China 210,541 Tons: SGS

- China imported 210,541 tons; +27.9% m/m

- EU imported 190,440 tons; +2.6% m/m

- India imported 93,700 tons; -27.9% m/m

Russia May Raise Quota on Grain Exports So High It Won’t Matter

- Agriculture ministry proposes increase to 25.5 million tons

- Nation is expecting a record wheat harvest this season

Russia’s agriculture ministry wants to effectively remove limits on grain exports in the second half of this season after a bumper harvest and a slow start to shipments left wheat piling up at home.

Minister Dmitry Patrushev said Russia “tentatively” plans a grains quota of 25.5 million tons from February to June, according to Tass. The proposal was sent to the economy ministry, Patrushev said.

“It’s a very generous quota that won’t limit exports,” said Andrey Sizov, head of consultancy SovEcon. “It’s impossible to export more than 5.5 million tons each month between February and June because river navigation is closed during some of that period due to ice.”

Patrushev’s comments come a week after a deputy prime minister said Russia was considering canceling the quota. Exports of wheat, corn and barley are expected to reach 52 million tons this season, the US Department of Agriculture estimates, and the quota typically only covers about a third of the season.

The wheat harvest could reach a record 100 million tons this season, according to SovEcon.

In recent years, Russia limited shipments between February and June to protect domestic supplies. Its wheat and meslin export quota the year before was 8 million tons.

Russia traditionally exports more before those months, but shipments have been slower this season because its wheat wasn’t price-competitive and sanctions caused logistical problems.

Russia’s total exports of agricultural products from July to September this year were 11.8 million tons, compared with 15 million tons a year ago, according to data from AgFlow.

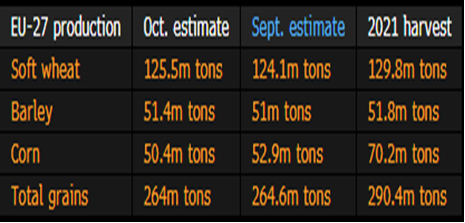

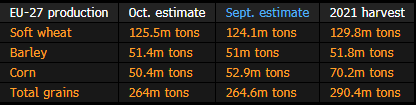

EU Corn Harvest ‘Calamitously Low’ After Drought: Strategie

The EU will only collect about 50m tons of corn this year, a “calamitously low” level, analysts at Strategie Grains said in a report.

- Users have imported massive amounts from Ukraine and Brazil to offset the anticipated shortfall, allowing the market “some breathing space”

- Even if the Ukraine grain-export deal is not expanded past mid-November, the country will likely continue corn shipments to the EU by rail, road and river

- The EU is also bringing in some wheat from Ukraine, and domestic stockpiles are now expected to be “very comfortable”

Germany’s DRV Expects Corn Harvest a Fifth Below Last Year

This year’s corn harvest in Germany is estimated at 3.54m tons, 20% below the prior season, agricultural cooperatives group DRV said Wednesday in a report.

- The crop suffered from severe drought and heat in July and August, the group says

- Plants were stressed by the conditions and high-yielding corn cobs were rarely formed

- Output will be lower than 2018, another year when Germany suffered widespread drought

- The sector is also grappling with expensive costs to dry grain after harvest, which is typically done with gas

Fertilizer Giant Yara Cuts European Ammonia Output on Gas Crunch

- Company lowers production to 57% of capacity in third quarter

- Tight global nitrogen market boosted Yara’s profit for period

Yara International ASA cut its European ammonia output to just 57% of capacity in the third quarter as the fertilizer giant struggles with swings in natural gas prices.

Russia’s squeeze on gas shipments following its invasion of Ukraine is hurting industries across Europe. Fertilizer companies are especially vulnerable because gas is both a key feedstock and a source of power.

Production fell from 81% in the previous quarter, Oslo-based Yara said on Thursday. The company warned in August that it will take output down to just 35% of capacity in Europe as a result of record gas prices.

“Yara will where possible continue to use its global sourcing and production system to supply customers, but cannot produce at negative margins,” it said on Thursday. It has curtailed annual capacity of about 1.7 million tons of ammonia and 900,000 tons of finished fertilizer.

While the fertilizer maker is seeking to protect its margins in Europe, the tight global nitrogen market boosted profits in the Americas, Africa and Asia. Yara proposed an additional dividend as third-quarter net income of $400 million beat analyst estimates.

ADM sees Brazilian soybean exports up 11% for 2022/23 crop

Grain trader Archer-Daniels-Midland Co ADM.N projects to grow its soybean exports from Brazil’s 2022/23 crop-year by 11%, amid record production forecasts, Luciano Souza, the company’s sourcing director for Latin America said on Wednesday.

Brazil’s soybean output is estimated at a record 152.4 million tonnes in the 2022/23 season, a 21% increase over last year’s drought-hit cycle.

The bigger harvest should be reflected in exports from Brazil, which is already the largest global soy producer and exporter.

Brazil’s food supply agency Conab expects exports in the 2022/23 season nationwide to reach 95.87 million tonnes, up 22.5% from last cycle.

ADM did not disclose the volume of its planned shipments.

The company said it is particularly optimistic about the current soybean crop in Brazil’s top producing state of Mato Grosso, where it estimates output will rise 6% compared to the previous crop, reaching 42.1 million tonnes.

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |