Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 55 in SRW, down 43 in HRW, down 36 in HRS; Corn is down 26; Soybeans down 23; Soymeal down $3.60; Soyoil down 0.47.

Chinese Ag futures (JAN 23) Soybeans up 35 yuan; Soymeal up 52; Soyoil up 264; Palm oil up 236; Corn up 1 — Malaysian Palm is up 161. Malaysian palm oil prices overnight were up 161 ringgit (+3.80%) at 4394.

There were no changes in registrations. Registration total: 3,077 SRW Wheat contracts; 0 Oats; 0 Corn; 445 Soybeans; 39 Soyoil; 288 Soymeal; 5 HRW Wheat.

Preliminary changes in futures Open Interest as of November 1 were: SRW Wheat up 4,186 contracts, HRW Wheat up 1,502, Corn down 229, Soybeans up 12,765, Soymeal down 3,594, Soyoil up 487.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

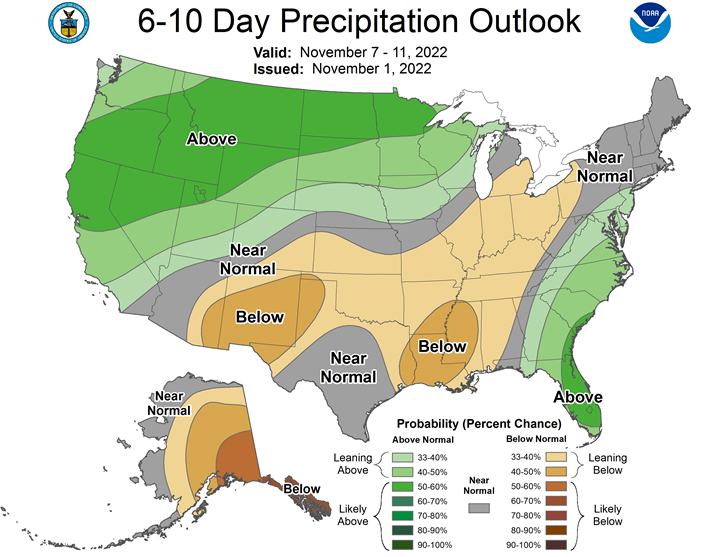

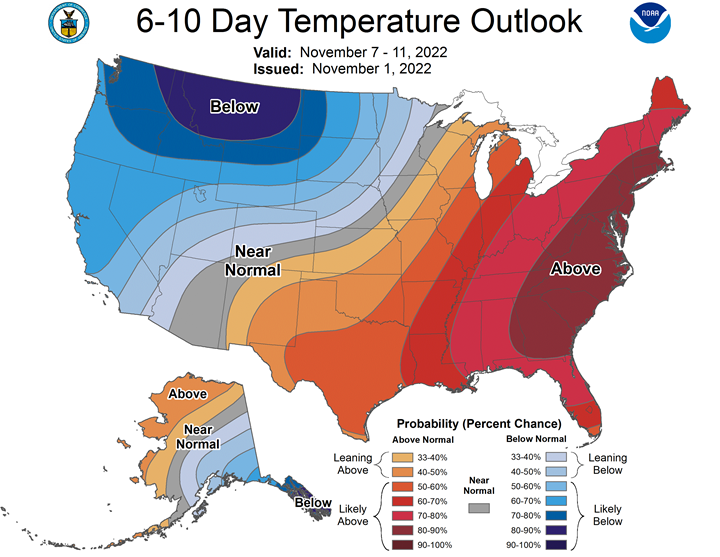

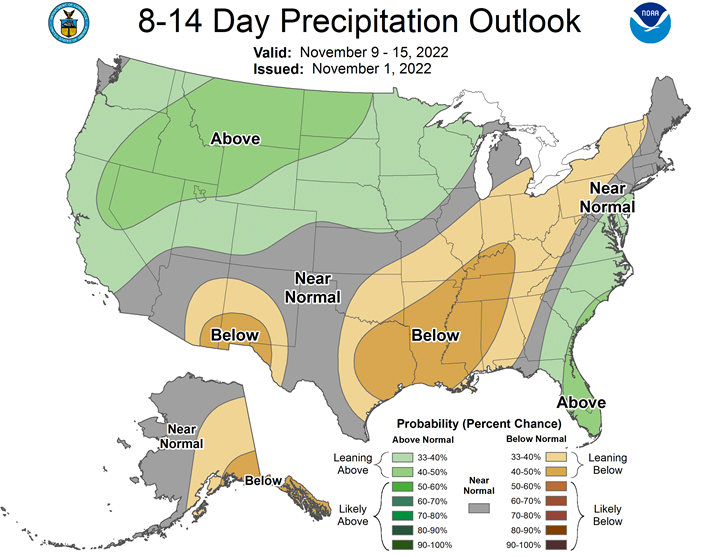

Northern Plains Forecast: Mostly dry Wednesday. Isolated showers Thursday-Saturday. Temperatures above to well above normal Wednesday, below normal west and above normal east Thursday, near to below normal Friday, near to above normal Saturday. Outlook: Isolated to scattered showers Sunday-Thursday. Temperatures near to below normal Sunday, below to well below normal Monday-Thursday.

Central/Southern Plains Forecast: Mostly dry Wednesday. Scattered showers Thursday-Saturday. Temperatures above to well above normal through Thursday, near to below normal west and above normal east Friday, near to above normal Saturday. Outlook: Mostly dry Sunday-Monday. Isolated showers Tuesday-Thursday. Temperatures near to above normal Sunday-Tuesday, near to below normal Wednesday, near to above normal Thursday.

Western Midwest Forecast: Mostly dry Wednesday. Scattered showers Thursday-Saturday. Temperatures above to well above normal through Saturday.

Eastern Midwest Forecast: Mostly dry through Friday. Scattered showers Saturday. Temperatures above to well above normal through Saturday. Outlook: Scattered showers Sunday-Tuesday. Mostly dry Wednesday-Thursday. Temperatures above to well above normal Sunday-Tuesday, near to below normal Wednesday-Thursday.

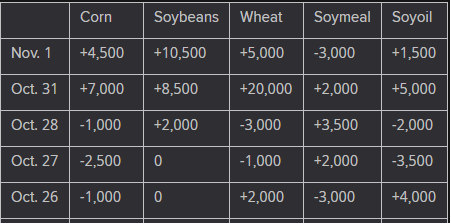

The player sheet for Nov. 1 had funds: net buyers of 5,000 contracts of SRW wheat, buyers of 4,500 corn, buyers of 10,500 soybeans, sellers of 3,000 soymeal, and buyers of 1,500 soyoil.

TENDERS

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 50,500 tonnes of rice to be sourced from the United States

- FEED WHEAT PURCHASE: Leading South Korean animal feed maker Nonghyup Feed Inc (NOFI) is believed to have purchased an estimated 63,000 tonnes of animal feed wheat expected to be sourced from the U.S. Pacific Northwest coast in an international tender

- CORN PURCHASE: The Korea Feed Association (KFA) in South Korea purchased about 65,000 tonnes of animal feed corn in a private deal late last week without issuing an international tender

- NO PURCHASE IN CORN, SOYMEAL TENDER: South Korea’s Major Feedmill Group (MFG) is believed to have rejected all offers and made no purchase in an international tender to buy up to 58,000 tonnes of corn and 8,000 tonnes of soymeal from South America

- NO PURCHASE IN WHEAT TENDER: Jordan’s state grain buyer made no purchase in an international tender to buy 120,000 tonnes of milling wheat

- PRICE OFFERS IN WHEAT TENDER: The lowest price offer submitted in the tender from Iraq’s state grains board to buy a nominal 50,000 tonnes of wheat was believed to be $469 a tonne c&f for wheat to be sourced from Romania.

PENDING TENDERS

- BARLEY TENDER: Jordan’s state grains buyer issued an international tender to purchase 120,000 tonnes of animal feed barley, an official source said. The deadline for submission of price offers is Nov. 2.

US BASIS/CASH

- Spot basis bids for soybeans and corn shipped by barge to U.S. Gulf export terminals were steady to lower on Tuesday on the potential for low Mississippi River water levels to rise, traders said.

- Water levels remain well below normal across the lower Mississippi River despite some rainfall over the past week, weather firm Maxar said. Only minor improvements in water levels are expected from further rains this week, the company said.

- Still, hopes for river conditions to improve put some pressure on the barge freight market, Ceres Barge Line said in a note.

- Spot barges on the lower Ohio River were offered at 2,200% of tariff, down from 2,400% on Monday.

- CIF corn barges loaded in October were bid around 210 cents over December futures, unchanged from Monday. November corn barges were bid at 178 cents over, which was also steady.

- First-half December corn export premiums were nominally quoted around 260 cents over futures, up 35 cents. January loadings were around 170 cents over futures, up 5 cents.

- CIF soybean barges loaded in November were bid at 218 cents over November, down 7 cents.

- Export premiums for soybeans shipped in last-half December were offered at around 260 cents over November, which was unchanged. Premiums for January shipments rose by 10 cents to about 225 cents over futures.

- Traders are also monitoring grain shipments from Ukraine after Russia suspended its participation in a U.N.-brokered export deal for the Black Sea.

- Russia could consider resuming the deal only after completion of an investigation of drone attacks on the Crimean naval port of Sevastopol, President Vladimir Putin told his Turkish counterpart.

- Spot basis bids for soybeans were steady to weak at elevators in the eastern half of the U.S. Midwest on Tuesday, grain dealers said.

- Cash bids for soybeans held steady at the region’s river terminals.

- The corn basis was flat at elevators and river terminals around the region, but steady to firm at processors in the western half of the Midwest.

- Farmer sales of corn have been slow in that area throughout harvest as dry conditions this summer limited growers’ yields.

- Most farmers have been storing bushels they had not previously contracted to sell instead of making fresh deals on the cash market.

- Some farmers were booking sales of soybeans to take advantage of four straight days of gains in the futures market that pushed cash prices higher, an Ohio dealer said.

- But most growers already had enough cash on hand to meet their immediate needs so were delaying payment on the contracts until 2023.

- Bids for soft red winter wheat strengthened in Illinois as farmers have been reluctant to sell due to crop shortfalls in 2022 and concerns about dry soils curtailing the size of the 2023 harvest.

- Spot basis bids for soybeans delivered to terminals along U.S. Midwest rivers rose sharply early on Tuesday, with the market underpinned by strong export demand, grain dealers said.

- But fresh farmer sales were scarce.

- Growers were looking for cash prices of at least $15 a bushel before booking new deals for their recently harvested soybeans, an Iowa dealer said.

- Soybean bids were flat at interior processors and elevators.

- Cash bids for corn were mixed at processors, steady to firm at river terminals, steady to weak at ethanol plants and unchanged at interior elevators.

- Spot basis bids for hard red winter wheat were steady to firm at truck market elevators in the southern U.S. Plains on Tuesday.

- The basis was flat at the region’s rail terminals.

- Country movement of hard red winter wheat was light, with most farmers unwilling to book deals for supplies they had in storage bins.

- A few growers who were looking to guard against potential price declines were booking sales for crops they will harvest next year, an Oklahoma dealer said.

- The new deals were only for small amounts, the dealer added.

- U.S. spot cash millfeed values were flat on Tuesday, dealers said, amid expectations for strong run-times at flour mills.

- Spot basis offers for soymeal were unchanged at truck market processors around the U.S. Midwest on Tuesday, dealers said.

- Offers also held steady in the rail market, a broker said.

- But offers fell for barges loaded with soymeal and shipped down Midwest rivers to the U.S. Gulf.

- The CIF barge offers remained much higher than current bids, keeping activity on that market quiet.

- Most end users and dealers were focused on ensuring that previously booked soymeal was delivered on time.

- Shipments were moving smoothly on trucks and trains, dealers said.

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Oct. 28 are based on six analyst estimates compiled by Bloomberg.

- Production seen higher than last week at 1.038m b/d

- Would be the fifth straight weekly increase after falling to a 19-month low in mid-September

- Stockpile avg est. 22.342m bbl vs 22.291m a week ago

The EIA in Washington is scheduled to release the report at 10:30am Wednesday

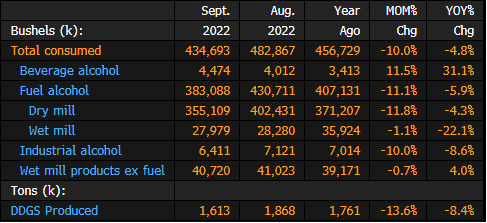

US Corn Used for Ethanol at 383.1M Bu in September

The following table is a summary of US corn consumption for fuel and other products, according to the USDA.

- Corn for ethanol was 5.9% lower than in September 2021

- DDGS production fell to 1.613m tons

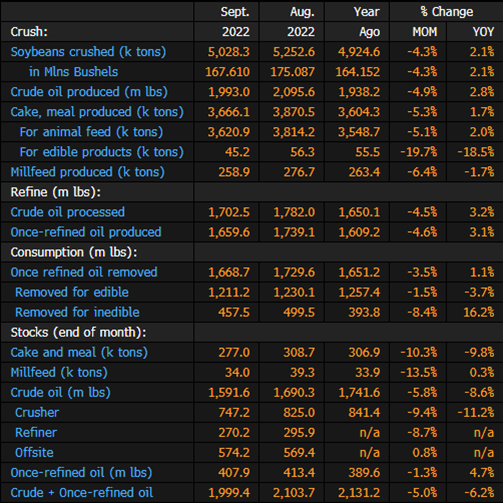

US Soybean Crushings at 168M Bushels in September: USDA

USDA releases monthly oilseed report on website.

- Crushing 2.1% higher than same period last year

- Crude oil production 2.8% higher than same period last year

- Crude and once-refined oil stocks down 6.2% y/y

Ukraine Grain Exports to Transit Black Sea Corridor Thursday

- UN says loaded vessels will move again Thursday on corridor

- Ukraine, Turkey, UN made earlier decision to halt ships

The United Nations said vessels loaded with grains are expected to move through Ukraine’s crop-export corridor on Thursday.

The UN said earlier that ships would be halted on Wednesday, without giving an explanation. The halt was announced after Russia warned that vessels weren’t safe using the route. Wheat prices rose on news of the disruption.

Russia suspended its role in the crucial Black Sea export pact over the weekend. The agreement — signed in July — guaranteed the safe passage of Ukraine crop exports, which are badly needed by food importers amid surging prices and a global cost-of-living crisis.

“We expect loaded ships to sail on Thursday,” the UN coordinator for the Black Sea Grain Initiative said in a tweet. No movements are planned for November 2 under the initiative, he added.

Grain vessels continued to leave Ukraine on Monday and Tuesday, even after Moscow withdrew its support for the deal. The UN said Tuesday those movements were “temporary and extraordinary.”

Ukraine is one of the world’s top grain and vegetable-oil suppliers, and US President Joe Biden has said Russia’s pullback from the deal will increase global hunger. Ukraine’s farmers are in the midst of autumn harvests and may have to redirect crops along costlier and lengthier export routes by rail, road and river if the disruption to vessel traffic lasts.

“Russia should clearly know that it will receive a tough response from the world to any steps that disrupt our food exports. This is literally a matter of life for tens of millions of people,” Ukrainian President Volodymyr Zelenskiy said Tuesday in his night address to the nation. “Pressure on Russia for the sake of guarantees of food security is now needed from everyone.”

Wheat futures in Chicago rose 2%, reversing earlier losses. Prices surged more than 6% the prior session. Corn also traded higher, and the Paris wheat contract reached a two-week high.

There are 110 cargo ships awaiting inspection in Istanbul to travel through to the Black Sea and load Ukrainian grain, said Yuriy Vaskov, Ukraine’s deputy infrastructure minister. He remained optimistic on the prospects of the grain accord even after Russia’s suspension, he said in an interview before the UN announcement.

Still, Kyiv is preparing contingency plans, Vaskov said. The nation has managed to boost logistics capacities of its three Danube River ports near the Romanian border by at least five times and railway capacities as much as twofold, he said.

The UN will issue another update on the status for the crop corridor on Wednesday, a spokesperson for the secretary-general said. The agency is “exerting all efforts” to resume full participation in the grain deal, a statement said.

Ukraine’s Grain Exports Down 32% Y/Y Since July 1: Ministry

Ukraine’s grain exports fell by 32% to 13.4m tons as of Nov. 2, country’s Agriculture Ministry says on its website.

- Total includes:

- 5.1m tons of wheat, down 60% y/y

- 1.1m tons of barley, down 75% y/y

- 7.1m tons of corn, almost triple from last year

- NOTE: Data may include grain that is aimed for exports, but hasn’t left the country yet

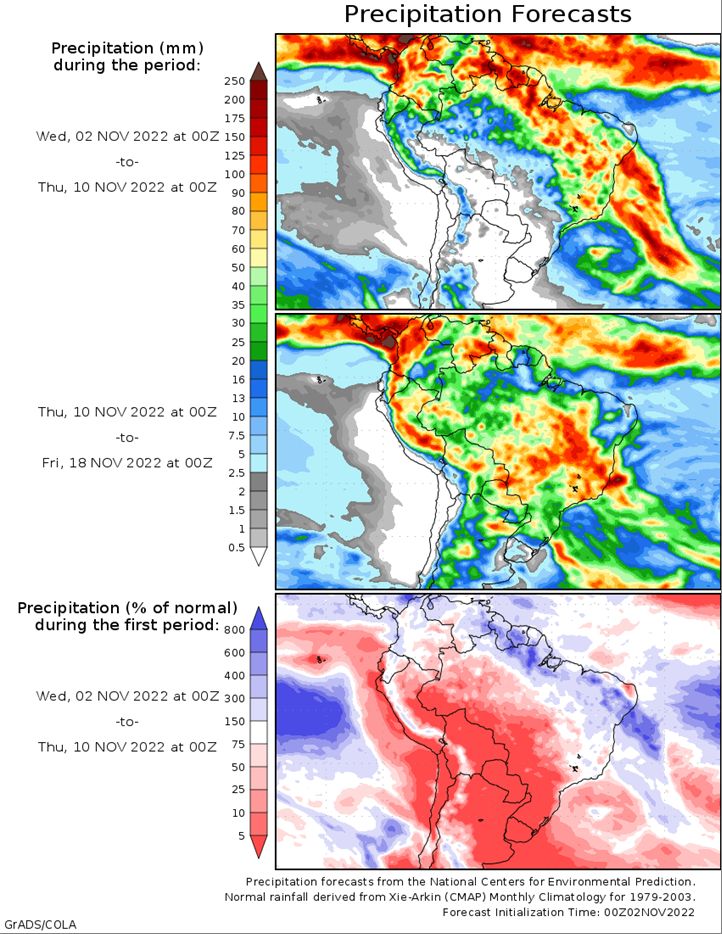

Brazil 2022/2023 Soy Export Forecast Cut to 96 mln T due to China- Stonex

- BRAZIL 2022/2023 SOYBEAN CROP SEEN AT 154.35 MILLION TNS VERSUS 153.8 MILLION TNS IN PREVIOUS FORECAST – STONEX

- BRAZIL 2022/2023 TOTAL CORN CROP SEEN AT 129.9 MILLION TNS VERSUS 126.3 MILLION TNS IN PREVIOUS FORECAST – STONEX

- BRAZIL 2022/2023 SOYBEAN EXPORT VIEW CUT BY 4 MILLION TONNES TO 96 MILLION TONNES DUE TO WORRIES REGARDING CHINESE DEMAND – STONEX

India exempts wholesalers and big retailers from stockholding limits on edible oils and oilseeds

The Indian government said on Tuesday that it would exempt wholesalers and big chain retailers of oilseeds and edible oils from the current stock limit order, according to a statement.

India is the world’s biggest importer of edible oils such as palm oil, soyoil and sunflower oil.

Brazil Truckers Block Access to Paranagua; Santos Halts on Rain

The main road providing access to Paranagua Port, in Parana state, is blocked by protesters, affecting truck reception in one of the main Brazilian export ports, the Paranagua port authority says in a note.

- Shipments operate normally so far

- Only 54 trucks were able to unload from 2pm Monday through 9am Tuesday

- In Santos Port, the largest in Latin America, the main navigation channel has been halted since 4am local time due to persistent rain and heavy winds, a press official from the port authority says by message

- Inland operations at Santos port, including receiving trucks, are normal despite protests from truck drivers on several Brazilian roads

- Loading and unloading operations continue as normal

- NOTE: Brazil Protesters Clog Roads, Airport as Bolsonaro Stays Silent

- Continued rains on the coast left sugar port terminals “crowded” and halted shipments, according to traders

- Sugarcane crushing is already delayed as harvesting machines haven’t been able to reach fields in Center-South amid soaked soil

- Mills operations should not be disrupted by road blockages as most of the transportation relies on private roads that have not been affected, according to Antonio de Padua Rodrigues, a consultant for industry group Unica

- NOTE: Rains at Ports Could Affect Sugar Shipments

Brazil Protests Hamper Shipments of Food, Fuel, Fertilizer

Protests that have blocked roads following Brazil’s presidential election are threatening to upend the country’s massive agriculture industry.

The protests are hampering road shipments of grain, meat and fertilizer around the country, while disruptions to feed distribution put chicken and pork production at risk, according to people familiar with the matter, who asked not to be named for safety reasons. The Paranagua port authority said in a note early Tuesday that the main road giving access to the port was blocked, delaying truck deliveries to one of Brazil’s main export sites.

Truck drivers have led protests by backers of incumbent President Jair Bolsonaro following his defeat in Sunday’s election to Luiz Inacio Lula da Silva. Protests that have spread across the country are a consequence of dissatisfaction with the election, Bolsonaro said in his first speech after the ballot outcome. The president vowed to follow the constitution, but didn’t formally concede. While defending peaceful demonstrations, he didn’t directly ask protesters to end the blockades.

An extended blockade of trade routes would cripple the ability of the world’s biggest crop exporter to move soybeans, corn and coffee to ports, and threaten to leave shelves empty at supermarkets around the country. Supermarket group Abras has reported shortages of some products, according to Valor newspaper.

Brazil’s Federal Road Police has dismissed 339 blockades in Brazilian roads as of 3 pm local time, while dozens of protests were still reported in all regions, according to its official Twitter account.

Crop Shipments

Transportation of agricultural products is down by almost one-third as of the start of protests Monday compared to the previous week, according to a provider of road freight in the country. Of that, the number of trucks loaded with soybeans fell by almost half, corn dropped by 40% and fertilizer by 18%.

Not only have shipments of live animals, feed and refrigerated meat been disrupted, production in some meatpacking plants has started to slow, according to one of the people.

Soy-processing plants, which turn the beans into meal for animal feed and oil used in everything from cooking to cosmetics, also are struggling to receive and send cargoes to ports, said another person. Biodiesel production has been the most affected so far.

Orange juice production is nearly halted, as truck drivers are refusing to take cargoes as they want to avoid protesters, another person said.

The situation is beginning to hit the fuel sector, with fewer orders reported at distributors due to concern that deliveries would not reach clients on time, while supply issues are more prominent at smaller ethanol distributors, mainly in the south of the country. The National Oil Agency (ANP) said it’s in contact with distributors to prevent fuel shortages.

The Brazilian Petroleum and Gas Institute (IBP), which represents Big Oil in the country, said in a statement that it’s worried about potential fuel shortages if protests linger, especially given blockages in Santa Catarina, Parana and Sao Paulo states.

A Petroleo Brasileiro SA spokesperson said there is no impact on refinery operations, as the fuel is distributed mainly through pipelines.

Groups representing chicken, pork producers, soybean crushers and exporters haven’t replied to requests for comment

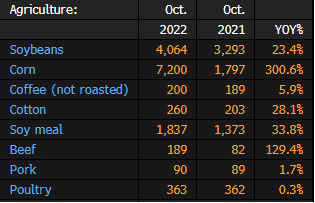

Brazil October Agriculture, Mining Exports by Volume: MDIC

Following is a summary of key Brazilian agriculture and mining exports by volume, from the Brazilian Trade Ministry.

- Corn exports rose 301% in October from a year ago

- Beef exports rose 129% y/y

India’s Southern States to Get Above-Normal Rains in November

India’s southern peninsula, including parts of Tamil Nadu, Karnataka and Andhra Pradesh, is expected to receive above-normal rains in November, according to the country’s weather bureau.

- Rains in the area are expected to be more than 123% of the long-term average this month, Mrutyunjay Mohapatra, director general of the India Meteorological Department, said at an online briefing on Tuesday

- Normal to above-normal rainfall likely over most parts of India

- However, some areas of southern peninsula, and northwestern and northeastern India may get below-normal showers

- NOTE: Rains would benefit crops such as wheat and oilseeds that will be sown later this month, after harvesting of monsoon-sown crops such as rice and soybeans

- Normal to above-normal minimum temperatures seen in most parts of the country, except some areas of northwestern states and the foothills of Himalayas

CBH to Invest A$4b Over 10 Years to Boost Grain Export Capacity

CBH Group, Australia’s biggest grain exporter, will invest A$4 billion ($2.6b) over the next 10 years to help increase its exports, the company said on Wednesday.

- Co. aims to reach a monthly export capacity of 3 million tons by 2033

- Financial commitment equates to annual investment of A$350m-A$450m

- Range is “significant increase” on previous years’ investment, which averaged A$240m per year over past 5 years

- Last year’s record crop reinforced need to invest in export infrastructure, Chief Operations Officer Mick Daw said

- “Increasing the capacity of our network is critical to maximizing the value of growers’ grain in international markets, and sustainably creating value for WA growers, both current and future,” Daw said

- Projects for 2023 include site expansions, storage refurbishments, temporary storage builds, accommodation, throughput enhancements, receival equipment upgrades and rapid rail outloading facilities

- Co. is also unlocking supply chain capacity in the Kwinana Zones, and is in the process of purchasing new rail rolling stock

- Temporary storage and rail investment will be important features in network infrastructure moving forward

US Agriculture Sentiment Fell in October: Purdue Univ.

The Purdue University/CME Group’s agricultural sentiment index fell to 102 points in Oct. from 112 in Sept., according to a survey of 400 agricultural producers.

- Current conditions component declined by 8 points from Sept.

- Future expectations down by 11 points

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |