Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 4 1/4 in SRW, down 1 1/4 in HRW, up 1 1/4 in HRS; Corn is down 1; Soybeans down 6 1/2; Soymeal up $0.03; Soyoil down 0.49.

For the week so far wheat prices are down 6 in SRW, up 2 3/4 in HRW, up 7 in HRS; Corn is down 5 3/4; Soybeans down 18 1/2; Soymeal down $0.11; Soyoil down 1.33.

For the month to date wheat prices are down 40 3/4 in SRW, down 22 3/4 in HRW, down 19 3/4 in HRS; Corn is down 16 3/4; Soybeans up 24 1/4; Soymeal down $8.80; Soyoil up 2.63.

Year-To-Date nearby futures are up 9% in SRW, up 19% in HRW, down -2% in HRS; Corn is up 14%; Soybeans up 8%; Soymeal up 2%; Soyoil up 35%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 22 yuan; Soymeal up 49; Soyoil down 70; Palm oil up 12; Corn up 14 — Malaysian palm oil prices overnight were down 72 ringgit (-1.62%) at 4361.

There were no changes in registrations. Registration total: 3,077 SRW Wheat contracts; 0 Oats; 0 Corn; 401 Soybeans; 39 Soyoil; 278 Soymeal; 5 HRW Wheat.

Preliminary changes in futures Open Interest as of November 7 were: SRW Wheat up 3,750 contracts, HRW Wheat up 648, Corn up 439, Soybeans up 5,383, Soymeal up 10,811, Soyoil up 3,763.

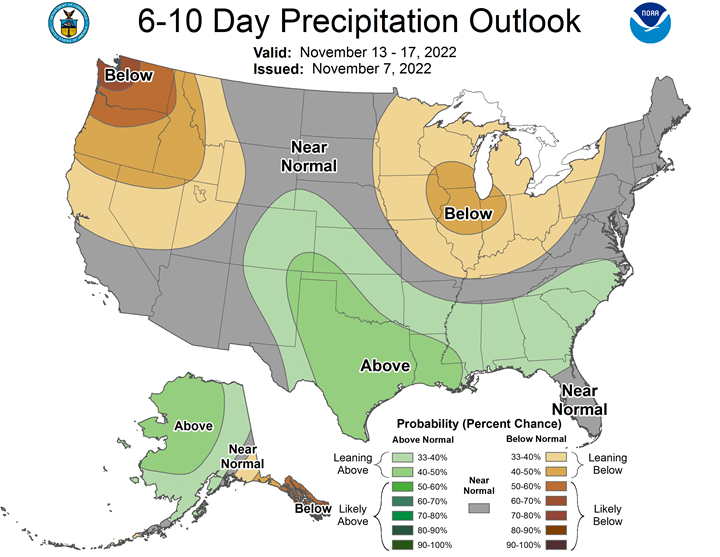

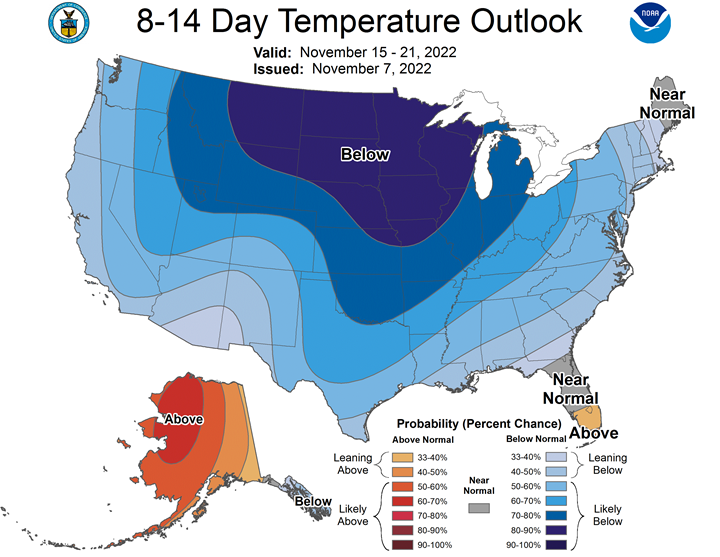

Northern Plains Forecast: Isolated to scattered showers through Wednesday. Scattered showers changing to snow Thursday-Friday. Temperatures below normal west and above normal east Tuesday-Wednesday, below to well below normal Thursday-Friday. Outlook: Isolated snow Saturday-Wednesday. Temperatures below to well below normal Saturday-Wednesday.

Central/Southern Plains Forecast: Isolated showers through Thursday. Mostly dry Friday. Temperatures above to well above normal Tuesday-Thursday, below normal Friday. Outlook: Mostly dry Saturday-Sunday. Isolated showers Monday-Tuesday. Mostly dry Wednesday. Temperatures below to well below normal Saturday-Wednesday.

Western Midwest Forecast: Isolated showers Tuesday. Scattered showers north Wednesday. Scattered showers Thursday. Snow north Friday. Temperatures above to well above normal Tuesday-Thursday, below normal Friday.

Eastern Midwest Forecast: Mostly dry through Thursday. Isolated to scattered showers Friday. Temperatures near to above normal Tuesday, above to well above normal Wednesday-Thursday, near to above normal Friday. Outlook: Isolated showers Saturday. Mostly dry Sunday-Monday. Scattered showers Tuesday-Wednesday. Temperatures below to well below normal Saturday-Wednesday.

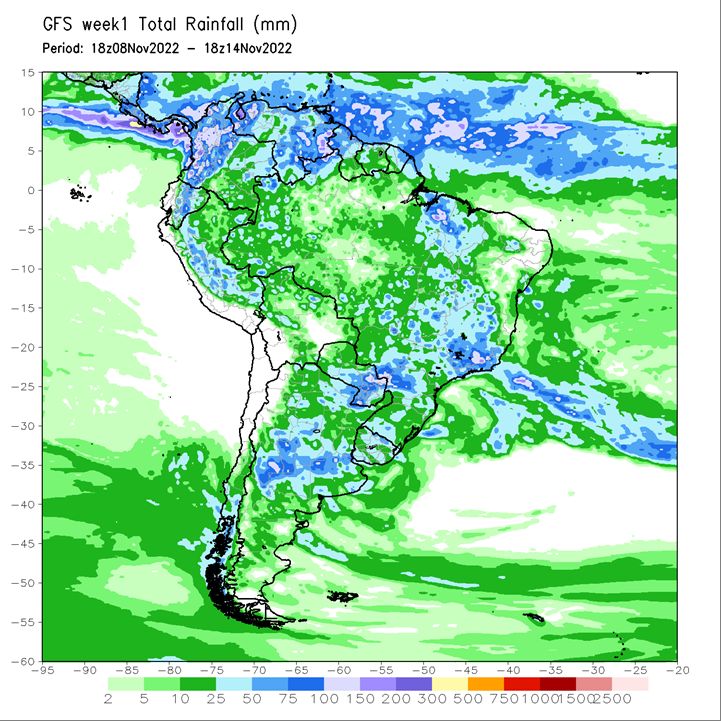

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Mostly dry through Thursday. Scattered showers Friday. Temperatures below normal through Wednesday, near to above normal Thursday-Friday. Mato Grosso, MGDS and southern Goias: Mostly dry through Tuesday. Isolated to scattered showers Wednesday-Friday. Temperatures near to below normal Monday-Tuesday, near to above normal Wednesday-Friday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Mostly dry Tuesday. Scattered showers Wednesday-Friday. Temperatures above normal through Wednesday, near to above normal Thursday-Friday. La Pampa, Southern Buenos Aires: Mostly dry Tuesday. Scattered showers Wednesday-Friday. Temperatures above normal through Wednesday, near to above normal Thursday-Friday.

The player sheet for Nov. 7 had funds: net sellers of 1,500 contracts of SRW wheat, sellers of 4,000 corn, sellers of 5,500 soybeans, sellers of 1,000 soymeal, and sellers of 2,500 soyoil.

TENDERS

- WHEAT TENDER: Iraq’s state grains buyer has issued a tender to buy a nominal 50,000 tonnes of milling wheat sourced from the United States only with a limited number of trading companies asked to offer.

- WHEAT TENDER: Algeria’s state grains agency OAIC has issued an international tender to buy soft milling wheat to be sourced from optional origins

- FAILED WHEAT TENDER: Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC), said on Monday it had canceled an international purchasing tender for wheat for shipment Dec. 15-30 and/or Jan. 1-15, 2023. It added that prices offered on FOB and C&F basis were higher than estimated prices.

PENDING TENDERS

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 50,500 tonnes of rice to be sourced from the United States.

- MILLING WHEAT TENDER: Jordan’s state grain buyer has issued an international tender to buy 120,000 tonnes of milling wheat that can be sourced from optional origins.

- BARLEY TENDER: Jordan’s state grains buyer issued a new international tender to purchase 120,000 tonnes of animal feed barley.

US BASIS/CASH

- Spot basis bids for corn and soybeans shipped by barge to U.S. Gulf export terminals fell on Monday as freight costs declined on improved Mississippi River shipping conditions, traders said.

- River levels on the lower Mississippi River have risen slightly after recent rains, allowing a backlog of barges to transit to Gulf terminals with fewer delays.

- Spot barge freight dropped by 200 points of tariff on the Illinois River and the Mississippi River at St. Louis on Monday, while spot rates fell by 300 points on the lower Ohio River. Rates fell by 300 to 400 points late last week.

- FOB export premiums for corn and soy remain inverted following recent supply disruptions due to river shipping woes.

- New export demand was limited as South American corn and soybeans can be purchased at cheaper prices, traders said. Soy demand from top buyer China is also lackluster as COVID restrictions there are blunting consumption.

- China’s imports of soybeans fell 19% in October from a year earlier, hitting their lowest for any month since 2014, customs data showed.

- CIF corn barges loaded in November were bid at about 140 cents over December, down 20 cents from late Friday. Barges loaded in December were bid 15 cents lower at around 140 cents over futures.

- CIF soybean barges loaded in November were bid at about 160 cents over January, down from 205 cents over November futures on Friday.

- Spot basis bids for corn were steady to weak at elevators in the eastern half of the U.S. Midwest on Monday, grain dealers said.

- Corn bids were flat at the region’s processors and river terminals.

- Most grain terminals had ample stocks of corn on hand as growers have been delivering supplies to fill contracts they had booked before harvest.

- Spot corn sales on the cash market have been slow throughout the fall, but low demand on the export market has pressured basis levels.

- Cash bids for soybeans were unchanged at elevators, processors and river terminals around the Midwest.

- Spot basis bids for corn were steady to firm at processors, grain elevators and ethanol plants around the interior U.S. Midwest on Monday morning.

- Dealers were trying to entice farmers to sell their corn rather than putting it in storage bins as they near the tail end of harvest.

- Once farmers put grain in storage, they are unlikely to sell it until 2023, dealers said.

- Although the interior corn basis was steady to firm, bids were steady to weak along rivers. Weak export prospects cut into demand from dealers who load barges with grain and send them to shipping hubs at the U.S. Gulf.

- Soybean bids were flat at processors and river terminals, and steady to firm at interior elevators.

- Spot basis bids for hard red winter wheat were unchanged at rail and truck market elevators across the southern U.S. Plains on Monday.

- Activity on the cash market was light despite gains in the futures market that pulled cash prices higher.

- But prices remained below recent peaks, and farmers wanted to hold onto crops they had in storage in case of crop shortfalls in 2023, dealers said.

- U.S. spot cash millfeed values held mostly steady on Monday, capped by adequate supplies following a recent increase in flour mill operations in some areas, dealers said.

- Demand for millfeed has slowed seasonally while a recent rise in prices prompted change among some feed mixers to cheaper feed alternatives, a dealer said.

- Spot basis offers for soymeal were steady to weak at U.S. Midwest truck market processors on Monday, dealers said.

- The soymeal basis was flat in the rail market.

- On the export front, the CIF market for soymeal barges shipped down U.S. rivers and the FOB market for supplies load onto ocean-going vessels at the U.S. Gulf both were steady.

- Activity was quiet on Monday morning, an Indiana dealer said.

- Most end users had enough supplies on hand and prices were too high to spark any interest in booking surplus loads, dealers said.

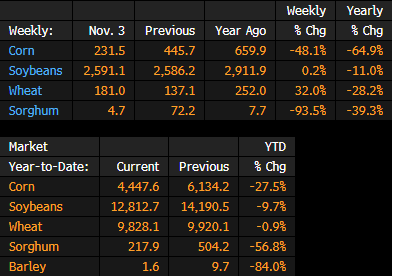

US Inspected 231k Tons of Corn for Export, 2.591m of Soybean

US Corn, Soybean, Wheat Inspections by Country: Nov. 3

US Crop Progress and Conditions for Nov. 6: Summary

U.S. farmers to seed more corn and wheat, less soy for 2023/24 -USDA

U.S. farmers are likely to expand plantings of corn and wheat while reducing seedings of soybeans for the upcoming marketing year, the U.S. Agriculture Department said on Monday.

The USDA forecast that farmers will seed 92.0 million acres of corn this spring for the 2023/24 crop year, up from 88.6 million in 2022/23. Corn is planted in April and May in the United States, the world’s biggest exporter.

The USDA’s preliminary “baseline” projections , based on conditions as of October and generally used for budgeting, come at a time of tightened world grain supplies due to drought in key production areas as well as war in Ukraine that has disrupted shipments from the Black Sea.

The USDA projected corn production for 2023/24 at 15.265 billion bushels, based on an average yield of 181.5 bushels per acre (bpa). That compares to the 13.895 billion-bushel 2022/23 crop that farmers are currently harvesting for 2022/23, with an average yield of 171.9 bpa.

For soybeans, U.S. acreage is projected to dip to 87.0 million acres in 2023/24, from 87.5 million. But the government projected a crop of 4.480 billion bushels with an average yield of 52.0 bpa, up from the ongoing 2022/23 harvest estimated at 4.313 billion bushels, with an average yield of 49.8 bpa. The United States is the No. 2 global soybean supplier after Brazil.

The USDA projected total U.S. wheat plantings for 2023/24 at 47.5 million acres, up from 45.7 million acres in 2022/23. Roughly 70% of U.S. wheat acres are seeded to winter wheat each autumn, with the remainder planted the following spring. U.S. farmers have nearly finished planting winter wheat for the 2023/24 marketing year.

The crop projections issued on Monday are part of the USDA’s annual 10-year outlook for the agricultural sector. The government will release a complete report on its outlook to the year 2032 in February. The USDA typically releases its first official plantings forecasts based on a survey of farmers in late March.

SovEcon Raises Russia Wheat Export Estimate on ‘Rapid’ Sales

Russian wheat exports in the 2022-23 season are now seen at 43.7m tons, up 0.3m tons from a prior outlook, due to the current “rapid” pace, analyst SovEcon says in an emailed note.

- Exports during October likely totaled 4.3m tons, about 1m tons above the same month in 2021

- “This is the first month in the current season when exports were higher y/y and above the average. Exports are supported by good margins for traders and strong demand from importers,” the report says

- Russia has enough supply to “easily” ship 50m tons of wheat this season, but shipments have been limited by weak initial pace, a strong ruble and export taxes

- There is also a lengthy wait for grain rail cars

- “Things could improve if/when we see a truce in Ukraine, as it could put less pressure on railroad infrastructure”

Brazil 2022/23 Soybean Seeding 57% Done as of Nov. 3: Agrural

This compares with 46% a week earlier, and 67% a year before, according to an emailed report from consulting firm AgRural.

- Despite the maintenance of delay in relation to the previous crop, sowing progressed well in the week, favored by the record of rains in areas that were dry in Mato Grosso, Goias, Minas Gerais states, AgRural said

- Summer corn seeding is 63% complete, compared with 56% a week earlier and 75% a year before

Ukraine Crop Shipments Top 10 Million Tons, But Inspections Slow

- Just two outbound cargoes cleared in Istanbul over the weekend

- Russia briefly withdrew from deal, before returning last week

Ukraine’s crop-corridor exports have surpassed 10 million tons, although inspections of outbound cargoes are reversing a brief boom.

Some 10.07 million tons of grain and foodstuffs have departed Ukrainian ports since the corridor began operating in early August, the Joint Coordination Centre that facilitates the Ukraine grain-export deal said late Sunday. More than 40% of the total amount has been corn and 28% has been wheat, data show.

Vessel inspections sped up dramatically for a couple of days last week after Russia temporarily withdrew from the grains deal — pulling out its own inspectors — but have slowed again since Moscow returned.

Only two outbound cargoes over the weekend were cleared in Istanbul, where they are required to be checked, with others being halted for fumigation issues and “various grounds,” the JCC said. That compares with more than 80 outbound cargoes that cleared last Monday and Tuesday.

It remains unclear if the crop corridor will be extended beyond Nov. 19, when the initial deal comes up for renewal. Inbound vessels continue to head into Ukraine, the JCC said, meaning more exports are likely in coming days.

Ukraine Ports Receiving Grain at ‘Very Slow Pace’: UAC

Ukrainian ports have resumed receiving grain after the temporary disruption to the crop-export deal last week, but at “very slow pace,” analyst UkrAgroConsult said in a report.

- NOTE: Russia temporarily suspended its involvement in the pact, before resuming it last week

- Still, the deal is up for renewal in less than two weeks and officials have yet to verify an extension

- There is “virtually no demand” from importers for fresh seaborne grain shipments, and exporters aren’t in a rush to buy from farmers

- Ukraine’s agriculture exports typically peak in November to December, but will likely decrease this year due to logistics risks

More Crop Ships Head to Ukraine, Two Outbound Ships Halted: JCC

Eight inbound ships transited the Ukraine crop corridor on Monday, heading to ports for loading under the Black Sea Grain Initiative, according to a statement from the Joint Coordination Centre that facilitates the pact.

- Eight inbound vessels cleared inspection Monday in Istanbul

- Two outbound crop-laden vessels were also cleared, while inspections on two more were halted due to fumigation issues

- 77 ships are currently waiting to head to Ukraine ports, and there is a queue of 15 loaded vessels waiting to clear inspection

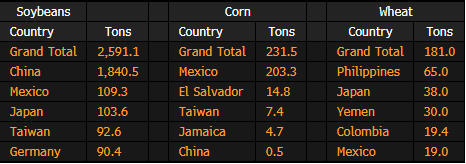

Brazil Soybean, Corn Crop Survey Before Conab’s Report

The following table shows results of a Bloomberg News survey of as many as eight analysts for Brazil’s soybean and corn crops. Conab, the Brazilian national supply company, is scheduled to release its latest estimates on Nov. 9 at 9am local time.

- Planted area in millions of hectares, production in millions of tons, yields in thousands of kilograms per hectare:

3tentos Cuts 2022 Est. Soybean Meal Sale to 690,000 mt

3tentos has cut its sales projections for soybean meal in 2022 to 690,000 from 713,000 tons and biodiesel to 180,000m³ from 213,000 m³, the company says in a securities filing.

- Estimated CBIOs issuance for 2022 went to 180,000 from 200,000

- Lower efficiency in the Industry due to the origination of lower quality soybeans and economic viability deterioration due to the bases for soybean strengthened against the bases for soybean meal were highlighted as reasons behind the company’s revisions, according to the statement

WHEAT/CEPEA: Harvesting advances in RS and presses down quotations; production decreases by 40% in AR

The progress of the wheat harvesting in Rio Grande do Sul is pressing down quotations in that state. Cepea collaborators reported deals for delivery in Paraná because of the higher quality of the cereal from RS.

According to Emater, 12% of the wheat crop had been harvested in RS by Nov. 3rd. In Santa Catarina, 8% had been harvested by October 29th, and in Brazil, 40%, according to data from Conab.

In Paraná, 72% had been harvested by Oct. 31st. Of the crops still developing, 64% were in good conditions; 31%, in average conditions; and 5%, in bad conditions, a better scenario than that in the previous week.

Thus, Cepea surveys show that, between October 28th and November 4th, the prices paid to the wheat farmers in Rio Grande do Sul dropped by 2%, while in Santa Catarina, they rose by 0.62%, and in Paraná, by 0.44%. In the wholesale market, quotations decreased by 3.06% in RS, 0.85% in SC and 0.15% in PR, but increased by 0.32% in São Paulo. In the same period, the US dollar dropped by 2.7%, to BRL 5.034 on Friday, 4.

The dollar depreciation against the Real reduced the import parity value, favoring imports. However, In Argentina, Brazil’s number one wheat supplier in the world, the Bolsa de Cereales (Buenos Aires Stock Exchange) revised down the national production by 1.2 million tons compared to that in the previous report, to 14 million tons. Compared to last season, whose production totaled 22.4 million tons, Argentina’s output is forecast to be 37.5% lower. Considering all wheat crops in Argentina, 54% are in bad conditions; 37%, in regular conditions; and a slight 9%, in good/excellent conditions. This scenario is worse than that in the previous week, due to frosts.

IMPORTS AND EXPORTS – According to data from Secex, Brazil imported 297.6 thousand tons of wheat in October, 20.3% less than that imported in September and 42.5% down from that in Oct/21. The average import value closed at BRL 2,187.18/ton, 4.1% lower in the monthly comparison but 42.5% higher in the annual comparison. In the last 12 months, imports totaled 5.73 million tons.

As for exports, Brazil shipped 399.58 tons of wheat last month. Between Nov/21 and Oct/22, exports totaled 3.14 million tons. And this year, 2.6 million tons have been exported.

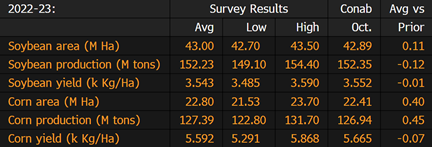

Mississippi River Barge Prices Plunged in the Last Week

Thanks to a mix of improving weather conditions and general seasonality, the price to move grain down the Mississippi River has fallen by about a third during the last week.

For the last several months, a severe drought in the Midwest has lowered the water levels on the Mississippi River to their worst depth since the 1980s, which had the effect of constraining the flow of barges carrying grains and other goods. As discussed on a recent episode of the Odd Lots podcast, this had caused the spot price of barge transport to explode roughly 10 times above normal levels.

However, according to Ben Scholl, president of specialty grain buyer Osterbur & Associates, a confluence of factors have pushed down the prices dramatically in just the past week. One of those factors is simply seasonality. The harvest is coming to an end, and so demand is starting to wane.

But more importantly, the area is finally starting to get some rain. According to Scholl, all the major segments of the river saw rain over the weekend and more is on the horizon. There’s also a tropical storm coming up to Florida that could possibly result in more rain in the Midwest, depending on its ultimate trajectory.

Greater water depth allows for more goods to be put in barges, pushing them deeper into the water. There are also some larger towboats, which can push more barges, that had been put out of commission due to their depth, and the rain may allow for more these boats to come back into the rotation.

Barge pricing is quoted as a percentage of the so-called tariff. The tariff from St. Louis to New Orleans is $3.99 and the spot rate on Friday, Oct. 28 was 2,200%, meaning $87.78 per short ton of grain, according to quotes that Scholl has received.

By the following Friday, (Nov. 4) the same spot barge price had fallen to a bid/ask of about 1,200%-1300% of the tariff (or roughly $47.88 — $51.87).

This is still well above normal pricing, which is usually below $20 per short ton. But hopefully this is the beginning of sustained rain and an improvement in water depth.

France Lowers Corn Harvest Outlook Another 0.4M Tons, Sugar Cut

This year’s French corn crop is now seen at 11m tons, down from an October outlook for 11.4m tons, its agriculture ministry said Tuesday in a report.

- That’s 29% lower y/y and 21% below the prior five-year average, after drought gripped fields during summer

- NOTE: The harvest was nearly done as of Oct. 31

- Sugar beet crop estimate cut to 31.9m tons, from 32.9m tons

- Soft-wheat crop estimate steady at 33.7m tons; barley and rapeseed also flat

French 2022 sunseed crop fell to about 1.7 mln T – institute

France’s sunflower seed harvest fell to around 1.7 million tonnes this year due to dry summer weather and despite a sharp rise in sowings, French oilseed technical institute Terres Inovia said on Monday.

The estimate, based on an area of over 840,000 hectares and an average yield of 2.05 tonnes per hectare (t/ha), was lower than the latest one issued by France’s agriculture ministry last month at 1.83 million tonnes, based on a yield of 2.13 t/ha.

The institute stressed that despite the fall from last year the harvest remained above the five-year average of 1.5 million tonnes.

“This production will enable the industrial units to crush even more French sunflower seeds and ensure better supplies of oil and meal needs,” it said.

Terres Inovia expects French farmers to continue increasing the harvestable area for the 2023 harvest, pegging it at 900,000 hectares.

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |