Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 1/2 in SRW, up 1/4 in HRW, up 1 3/4 in HRS; Corn is down 1/4; Soybeans up 3 1/4; Soymeal up $0.22; Soyoil down 0.39.

For the week so far wheat prices are down 20 1/2 in SRW, down 7 1/4 in HRW, down 1 1/4 in HRS; Corn is down 13 3/4; Soybeans down 12 1/2; Soymeal up $0.11; Soyoil down 2.53.

For the month to date wheat prices are down 55 in SRW, down 32 3/4 in HRW, down 24 1/2 in HRS; Corn is down 24 1/4; Soybeans up 30 1/4; Soymeal down $6.60; Soyoil up 1.43.

Year-To-Date nearby futures are up 7% in SRW, up 18% in HRW, down -3% in HRS; Corn is up 12%; Soybeans up 9%; Soymeal up 2%; Soyoil up 33%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans up 8 yuan; Soymeal down 1; Soyoil down 150; Palm oil down 90; Corn down 11 — Malaysian palm oil prices overnight were down 163 ringgit (-3.74%) at 4198.

There were changes in registrations (-66 Soybeans, ). Registration total: 3,077 SRW Wheat contracts; 0 Oats; 0 Corn; 335 Soybeans; 39 Soyoil; 278 Soymeal; 5 HRW Wheat.

Preliminary changes in futures Open Interest as of November 8 were: SRW Wheat up 2,019 contracts, HRW Wheat down 2,169, Corn down 7,512, Soybeans up 7,074, Soymeal down 3,635, Soyoil up 1,794.

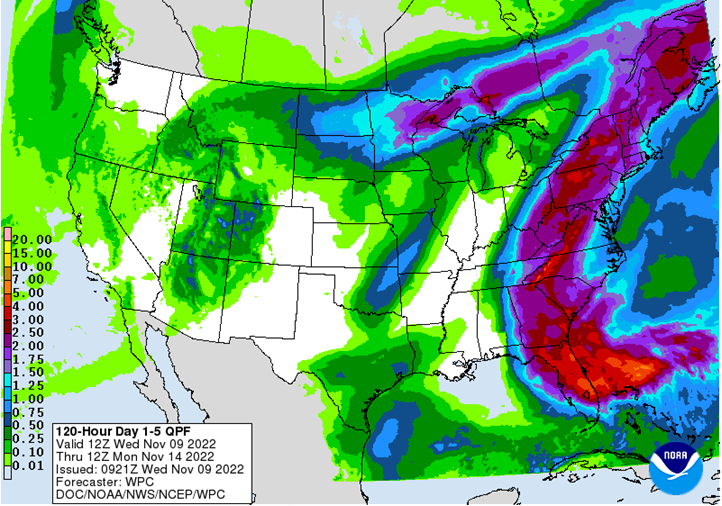

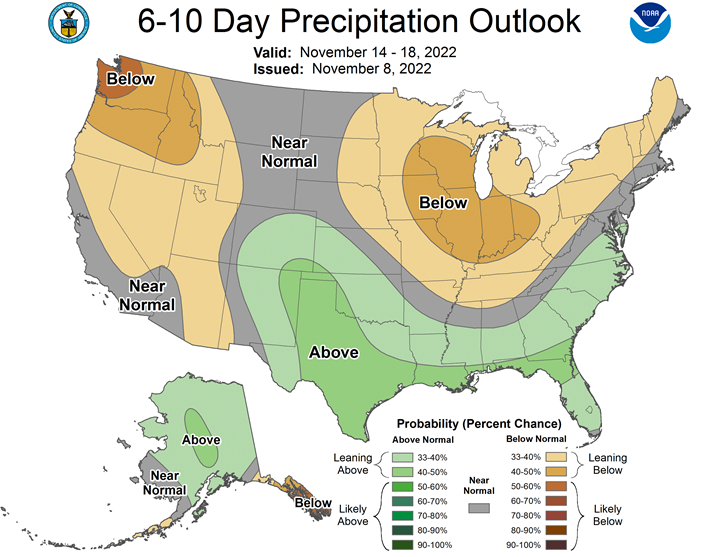

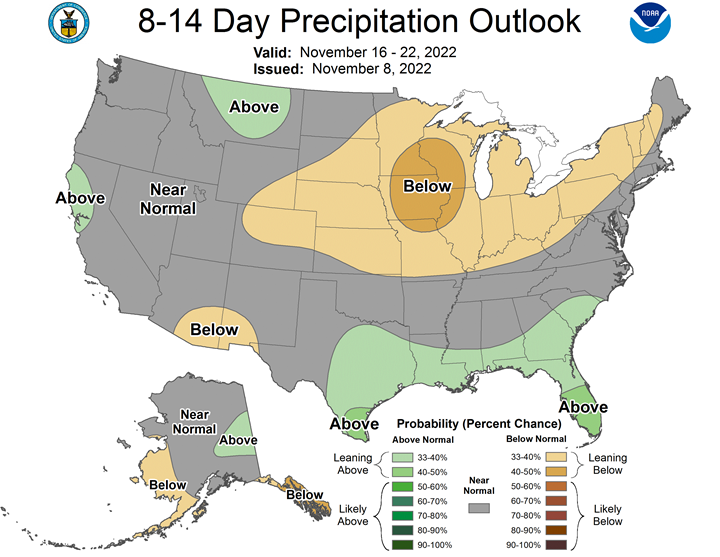

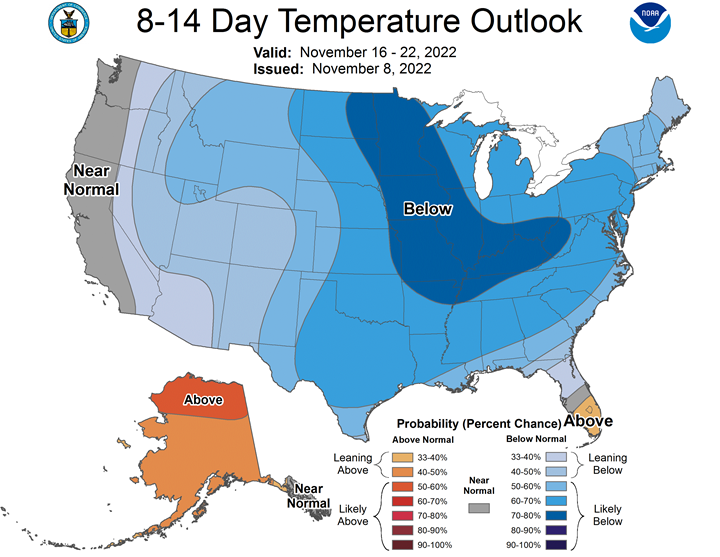

Northern Plains Forecast: A low-pressure system is pushing a cold front through the Northern Plains on Tuesday. A stronger low center will develop on the front Wednesday night which will bring much more widespread and heavier precipitation through the region, with any rain turning over to heavy accumulating snow. Some areas are likely to see over 12 inches of accumulation in the Dakotas. With strong winds developing, blizzard conditions will be possible Thursday into Friday. Very cold air will follow behind the system, lasting through next week with a couple of reinforcing shots of arctic air and some light snow.

Central/Southern Plains Forecast: The Central and Southern Plains will see some isolated showers Wednesday, but a stronger storm will develop Wednesday night. Most of the precipitation will occur north of the region, but there could be a line of stronger storms developing for eastern areas Thursday. Strong winds will develop with the system as well, which continues to dry out soils. Much colder air follows the system, with colder air lasting through most of next week. A cold front will push through in the middle of next week with some additional showers and potential for accumulating snow. There is some limited potential for precipitation over southwestern areas, but this will likely leave this region dry, as wheat may start to go dormant in poor condition.

Midwest Forecast: Scattered showers went through the middle of the Midwest over the weekend, with moderate to heavy rain for Missouri up through Wisconsin and northwestern Michigan, which may help river levels on the Lower Mississippi. A front will bring rain to northwestern areas through Wednesday, but a stronger storm will push through Thursday and Friday with strong winds and potential for heavier showers across the north and a push of colder air. Some snow will be possible in Minnesota. The colder air will last through next week with a couple of reinforcing shots that may also bring some isolated showers, mostly in the form of snow.

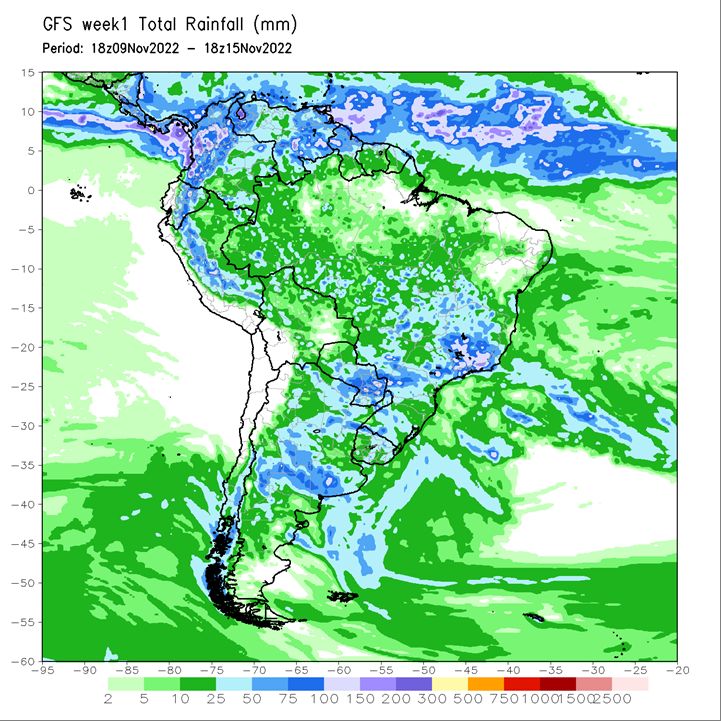

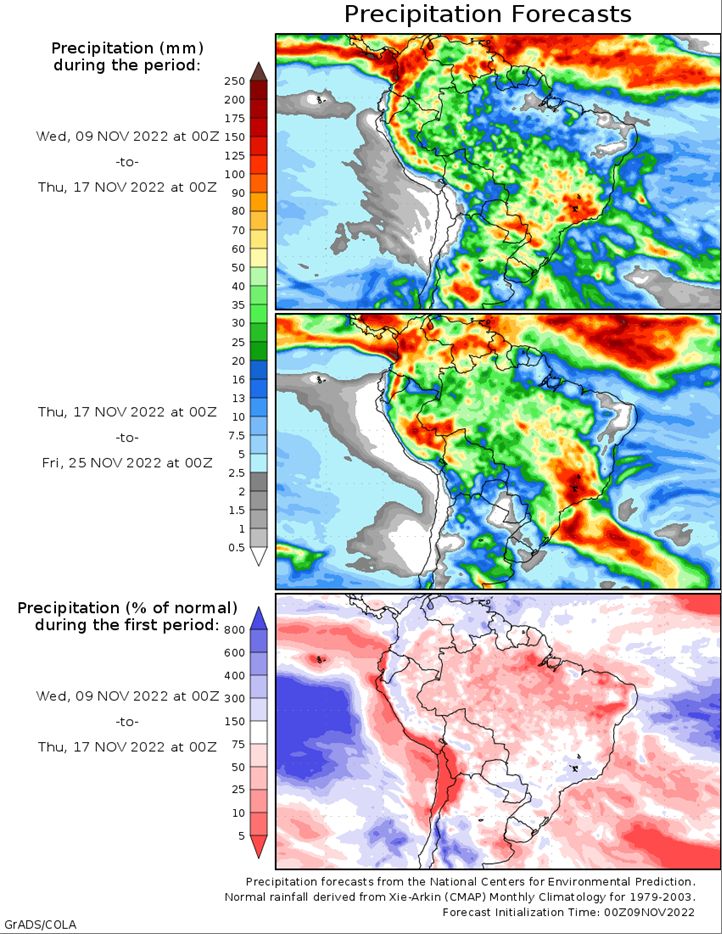

Brazil Grains & Oilseeds Forecast: Isolated showers will start to return to central Brazil on Wednesday while it will take until Friday to get into southern Brazil. The showers will not last long over southern areas as another front clears out the area on Monday. If showers disappoint, soil moisture in southern areas will decline, starting to impact corn and to a lesser extent, soybeans. Showers next week may still be possible for southern areas, but unlikely. Central areas should fare better with showers continuing.

Argentina Grains & Oilseeds Forecast: Isolated showers will move into Argentina on Wednesday but will be cleared out of the country on Sunday. A long period of dryness has had a significant effect on filling wheat as well as corn and soybean planting and establishment. Showers may still go through next week with a couple of weaker cold fronts but will likely be isolated. If showers disappoint this week, the drought will likely start to damage corn and soybeans, as well as push back planting even further.

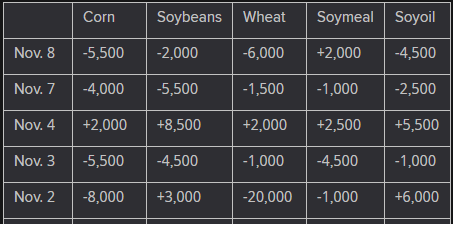

The player sheet for Nov. 8 had funds: net sellers of 6,000 contracts of SRW wheat, sellers of 5,500 corn, sellers of 2,000 soybeans, buyers of 2,000 soymeal, and sellers of 4,500 soyoil.

TENDERS

- SOYBEAN, CORN SALES: The U.S. Department of Agriculture confirmed private U.S. soybean sales totaling 138,700 tonnes to China, 144,000 tonnes of Mexico and 132,000 tonnes to unknown destinations. The agency also confirmed 338,600 tonnes in U.S. corn sales to Mexico. All were for shipment in the 2022/23 marketing year.

- WHEAT PURCHASE: Taiwan’s MFIG purchasing group has bought about 65,000 tonnes of animal feed corn expected to be sourced from Brazil in an international tender that closed on Wednesday

- WHEAT SALE: Algeria’s state grains agency OAIC has bought about 400,000 tonnes of milling wheat in an international tender which closed on Tuesday

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 94,603 tonnes of food-quality wheat from the United States and Canada in regular tenders that will close on Thursday.

PENDING TENDERS

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 50,500 tonnes of rice to be sourced from the United States

- MILLING WHEAT TENDER: Jordan’s state grain buyer has issued an international tender to buy 120,000 tonnes of milling wheat that can be sourced from optional origins

- BARLEY TENDER: Jordan’s state grains buyer issued a new international tender to purchase 120,000 tonnes of animal feed barley

- WHEAT TENDER: Iraq’s state grains buyer has issued a tender to buy a nominal 50,000 tonnes of milling wheat sourced from the United States only with a limited number of trading companies asked to offer

US BASIS/CASH

- Spot basis bids for corn shipped by barge to U.S. Gulf export terminals were mostly lower on Tuesday, while soybean basis values were steady to firm in a rebound from a recent sharp decline, traders said.

- Barge basis values remain anchored by falling freight costs and moderately improved shipping conditions on the Mississippi River.

- Water levels on the river, which had fallen to record lows in some southern areas, have increased, allowing more barges to be hauled to the Gulf. Barges, however, continue to be loaded with less grain so that they do not get stuck on the river bottom.

- Spot barge freight rates on Midwest rivers are down more than 1,000 points of tariff from a week ago.

- FOB export premiums for corn and soy remain inverted following recent supply disruptions due to river shipping woes. Nearby offers, however, have shed some of their recent premium as supplies available to Gulf exporters have increased.

- CIF corn barges loaded in November were bid at about 137 cents over December, down 3 cents from late Monday. Barges loaded in December were bid 15 cents lower at around 125 cents over futures.

- CIF soybean barges loaded in November traded at 165 cents over January, up 5 cents from bids on Monday. November barges were then re-bid at 170 cents over futures.

- Spot basis bids for soybeans were steady to firm in the U.S. Midwest on Tuesday as the harvest of the 2022 oilseed crop wound down and farmers grew reluctant to book additional sales, dealers said.

- The spot soy basis firmed by a nickel at a Chicago elevator, while the basis at Davenport, Iowa, on the Mississippi River, jumped by 20 cents.

- Barge freight costs have been declining this week as Midwest river levels improve slightly, helping to support grain bids at river elevators. BG/US GRA/F

- Corn basis bids were mixed, with a firmer tone in the western Midwest. The basis firmed at Blair, Nebraska, site of a large processor, and at an elevator in Council Bluffs, Iowa. But the corn basis fell by a nickel at Toledo, Ohio.

- Spot basis bids for hard red winter wheat held steady in the southern U.S. Plains on Tuesday as producers finished up planting the 2023 crop in dry conditions.

- K.C. December hard red winter wheat futures remained below recent peaks, encouraging farmers to hold on to grain kept in storage in case of shortfalls with the newly planted crop, dealers said.

- Protein premiums for wheat delivered by rail to or through Kansas City rose by 9 cents a bushel for wheat 11.4% protein content, by 20 cents for 11.6% and 11.8% protein wheat and by 4 cents for wheat with 12.0% through 12.8% protein. Premiums for “ordinary” wheat with less than 11% protein fell by 5 cents.

- Spot basis bids for corn were mixed at elevators and processors around the U.S. Midwest on Tuesday as the harvest wound down, dealers said.

- Spot basis bids for soybeans were steady to higher.

- U.S. spot cash millfeed values were mostly unchanged on Tuesday on adequate supplies and light to moderate demand, dealers said.

- A recent uptick in flour mill operations boosted supplies of millfeed in the marketplace.

- Demand for millfeed has slowed seasonally while a recent rise in prices prompted change among some feed mixers to cheaper feed alternatives, a dealer said.

- Spot basis offers for soymeal were steady to weaker in the U.S. Midwest on Tuesday as strong crush margins encouraged processors to churn out ample supplies of the feed ingredient, dealers said.

- Basis offers were steady to $3 per ton weaker at Midwest rail points and steady to down $5 in truck markets. CIF and FOB offers for soymeal at the U.S. Gulf declined as well.

- Demand from domestic feed mixers was subdued this week, one broker said.

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Nov. 4 are based on five analyst estimates compiled by Bloomberg.

- Production seen slightly lower than last week at 1.039m b/d

Stockpile avg est. 22.257m bbl vs 22.232m a week ago

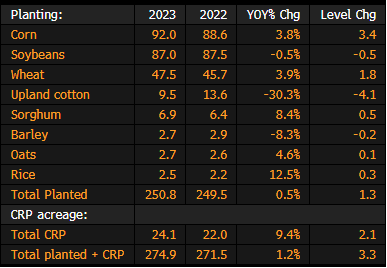

USDA Baseline Projections for US 2023 Crop Acreage

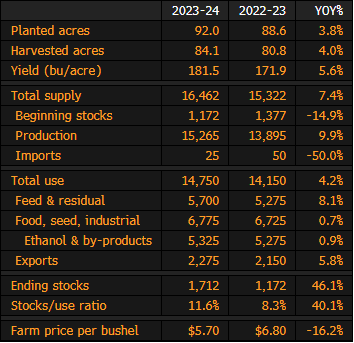

USDA Baseline Projections for US Corn Crop

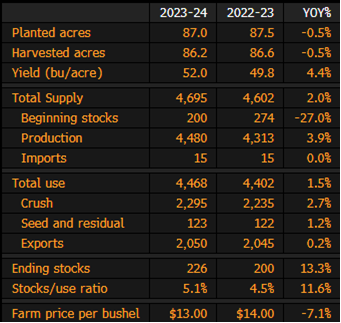

USDA Baseline Projections for US Soybean Crop

USDA Baseline Projections for US Wheat Crop

China Cuts Cotton Import Forecast Due to Sluggish Demand: CASDE

China cuts estimate for 2022-23 cotton imports to 1.85 million tons, down 200,000 tons from a previous forecast, according to the latest China Agricultural Supply & Demand Estimates.

- Consumption of textile products remains weak due to tightening of monetary policies in Western economies and Covid situation in China

- Forecast for 2022-23 cotton consumption also reduced to 7.7 million tons, down 150,000 tons from earlier estimate

- For corn, domestic supply has increased as harvest hits the market

- Consumption of corn for animal feed has risen as hog farming margins improve

- Domestic production of soybean likely increased; global soybean supply is expected to loosen

- CASDE cuts estimate for 2022-23 edible oils output by 40,000 tons to 29.21 million tons due to a fall in peanut production

French Wheat Exports Seen Easing, Bolstering Stockpiles: AgriMer

French soft-wheat exports outside the EU are now seen at 10m tons in the 2022-23 season, crops office FranceAgriMer said in a report Wednesday.

- That’s down from an October outlook for 10.1m tons

- Total exports seen at 17.1m tons, down from 17.3m tons

- Stockpiles estimate boosted to 2.56m, from 2.13m tons

BARLEY

- Non-EU exports seen at 2.4m tons, versus 2.5m tons

- Total exports seen at 5.49m, versus 5.44m tons

- Stockpiles estimate raised to 1.81m tons, from 1.77m tons

CORN

- Stockpiles for 2022-23 season are seen at 2.04m tons, versus 2.01m tons

Argentina’s farmers notch sales of more than 70% of soybean crop

Argentine farmers sold as of last week about 72% of the current soybean harvest, government data showed on Tuesday, a key crop especially important since it helps generate much-needed hard currency for the country’s cash-strapped government.

During the same time last season, farmers sold a little over 73% of the soybean harvest.

Argentina’s powerhouse agricultural sector is one of the world’s top soybean, corn and wheat exporters, but has recently been hit by drought and untimely cold snaps expected to undermine grains output.

Total soy production from the 2021/2022 harvest is seen at 44 million tonnes, according to agriculture ministry data.

Farmers sold about 248,000 tonnes from Oct. 27 to Nov. 2, down by half compared to the same week during the previous 2020/2021 season, the data showed.

In September, farmers sold 13.3 million tonnes of soybeans, nearly three times more than the historical average for the month, boosted by a government-authorized one-month preferential exchange rate designed to incentivize sales.

Meanwhile, Argentine farmers have sold 70% of the 59-million-tonne 2021/2022 corn crop, according to the ministry, about two percentage points down from sales notched during the same period in the previous season.

The 2022/2023 season’s corn plantings, which kicked off in September, were delayed by extended drought which forced farmers to cut the area planted with corn to its lowest level in six years, according to data from the Rosario grains exchange.

Since last week, 2022/2023 wheat sales total 5.6 million tonnes, or about 41% of the expected crop.

Due largely to dry weather, the exchange recently lowered its wheat production forecast to 13.7 million tonnes.

Argentina Reaches Deal to Boost Grain, Oilseed Transport Rate

Argentina’s transport ministry mediated talks that led to an agreement to increase by 35% the reference rate per kilometer to transport grain and oilseed products and their derivatives, according to a govt statement.

Cargo providers, grain collectors and the Argentine Rural Society participated in the talks, according to the statement

Canada Railway Parks More Trains as Rain Hampers Grain Shipments

10 trains loaded with grain that were destined for Vancouver’s north shore were parked in the week ended Nov. 5, Canadian Pacific Railway says Tuesday in a report.

- Railway continues to call on the federal government to find a safe solution for loading grain in Vancouver during periods of inclement weather

- “Winter weather is creating challenging conditions for the grain supply chains across the Prairies, including provincial road closures, poor driving conditions, and impacts at grain customer facilities that are lowering loading efficiency and performance”

- There were 31 ships waiting for grain to be loaded in Vancouver as of Monday, down one from a week ago, according to Quorum Corp., a company hired by the federal government to monitor the nation’s grain-transportation system

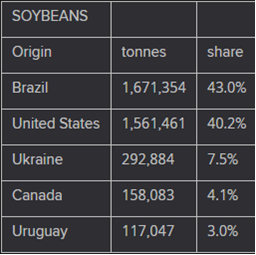

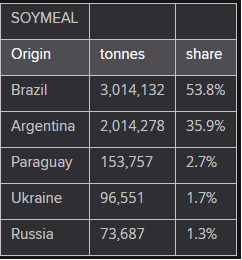

EU 2022/23 soybean imports at 3.88 mln T, rapeseed 2.49 mln T

European Union soybean imports in the 2022/23 season that started on July 1 had reached 3.88 million tonnes by Nov. 6, against 4.29 million by the same week in the previous season, data published by the European Commission showed on Tuesday.

EU rapeseed imports had reached 2.49 million tonnes, compared with 1.76 million tonnes a year earlier.

EU soymeal imports over the same period totalled 5.60 million tonnes, unchanged from the prior season, while palm oil imports stood at 1.21 million tonnes versus 2.10 million in 2021/22.

Brazil Soy Exports Seen Reaching 2.43 Million Tns In November – Anec

BRAZIL SOYMEAL (NOT CORN) EXPORTS SEEN REACHING 1.45 MILLION TNS IN NOVEMBER – ANEC

BRAZIL SOY EXPORTS SEEN REACHING 2.43 MILLION TNS IN NOVEMBER – ANEC

Philippines 3Q Farm Output +1.8% Y/y, Rice Production +1.0%

Agricultural production rose 1.8% from a year ago in the third quarter, Philippine Statistics Authority says on website.

- Rough rice production +1.0% y/y to 3.79m metric tons

- Corn production +2.5% y/y to 2.35m metric tons

- Crops +1.8% y/y, accounts for 53.9% share of total agricultural production

- Livestock, which accounted for 15.6%, +4.0% y/y

- Prices received by farmers +2.40% y/y

Biodiesel Margins Turn Negative on High Corn Oil Prices

- Corn oil prices skyrocketed 78% in 2Q 2022

- Corn oil used for bio-based diesel fell 10% in California

Corn oil prices skyrocketed 78% to $3,400/MT in June 2022, causing the gross profit margin for renewable diesel produced from 100% corn oil to fall to -$4.18 per gallon, according to BNEF estimates. As a result, the use of corn oil to make bio-based diesel in California fell 10% quarter-on-quarter, with producers instead turning to alternate feedstocks such as used cooking oil and tallow.

Drought in South America and Indonesia’s brief ban on palm oil exports have tightened the global vegetable oil market, including corn oil. Fortunately, most bio-based diesel plants can utilize a variety of feedstocks, so the use of corn oil to make bio-based diesel in California fell 10% in 2Q, with used cooking oil and tallow gaining market share.

The US is the largest corn oil producer in the world due to its massive corn ethanol industry, of which corn oil is a byproduct. Yet it is increasingly in competition with waste feedstocks due to their lower carbon intensity. This price spike is further exacerbating that trend.

Global Fertilizer Availability Grows Scarcer

Even with easing prices in recent months, it has become harder to get fertilizer around the globe, says Gro Intelligence. In a partnership with the Gates Foundation, the International Fertilizer Association, and the CRU Group, the agencies forecast that fertilizer shortages may cause anywhere from 143 trillion calories to 216 trillion calories less of food to be produced. Ukraine looks to see the biggest drop-off in food production, with the amount of calories grown there expected to fall anywhere from 22% to 42%. In its latest assessment, DTN says that retail fertilizer prices are mostly trending lower in the US, although they remain at historically high levels.

Vessel Carrying Sunflower Oil Leaves Ukraine Port for China: JCC

The Champion Pula vessel carrying 43k tons of sunflower oil for China left the port of Yuzhny/Pivdennyi under the Black Sea Grain Initiative, according to a statement Tuesday from the Joint Coordination Centre that facilitates the pact.

- Six inbound vessels also moved through the humanitarian corridor toward Ukrainian ports

- Ten vessels were inspected with another 80 waiting to move into Ukraine port while 13 loaded ships waited for inspections in Turkish territorial waters

- Four inspections were planned for Wednesday

Ukraine wants grain deal expanded, eyes decision next week

Ukraine wants the Black Sea grain export deal expanded to include more ports and goods, and hopes a decision to extend the agreement for at least a year will be taken next week, Ukraine’s deputy infrastructure minister said on Tuesday.

The deal, which eased a global food crisis by unblocking three major Ukrainian ports during Russia’s invasion, expires on Nov. 19 and briefly appeared imperilled last month when Moscow suspended its participation in the deal before rejoining again.

“(We) are already very late (giving) clear information to the market about the extension (of the agreement),” Yuriy Vaskov, the deputy minister, told Reuters in an interview.

“We hope that no later than next week from our partners Turkey and the UN we will have an understanding and the whole market will also have a clear signal about the further functioning and continuation of the initiative,” he said.

The deal has allowed about 10.5 million tonnes of Ukrainian food, mainly grain, to be delivered to foreign markets since it was agreed in July under the mediation of Turkey and the United Nations.

Vaskov said Ukraine had offered an extension of at least one year to Turkey and UN, as well as a broadening of the deal to include the ports of the southern Mykolaiv region, which provided 35% of Ukrainian food exports before Russia’s invasion.

Kyiv has also demanded that mandatory inspections of ships that are involved in food transportation be “streamlined”, as Kyiv believes Russia is deliberately slowing down inspections to reduce the speed of exports, he said.

“We are already … demanding inspections be streamlined or inspections of departed (ships) be cancelled, because it makes no sense. Or else increase the number of inspection teams,” Vaskov said.

He noted that exports under the agreement could amount to 15 million tonnes, if Russia did not delay the inspection of ships.

Vaskov said that inspectors of the Joint Center that oversees the deal conducted only 12 inspections per day, but that it was necessary to make 25-30 inspections.

“When Turkey and the UN did their own inspections, they proved it was possible to carry out more than 40 inspections a day. Now that Russia has returned … we again have a total of 12 inspections per day,” he said.

“They do not explain (the reason for the delays), but they also do not hide that they are doing this in order to complicate the work of the corridor,” said Vaskov.

FERTILIZERS, GUARANTEES

Vaskov said neither the UN nor Turkey had informed Kyiv about the conditions for extending the agreement put forward by Russia.

Moscow has said it has received guarantees the grain corridor will not be used for military purposes. The UN has said that it would continue working on easier conditions for the export of the Russian fertilisers.

Vaskov said Kyiv advocated the exclusively peaceful use of the grain corridor, and that the current agreement involved the export of fertilizers.

However, he said that so far there had not been a single application from ships wishing to transport ammonia from Ukrainian ports.

“Ukraine has confirmed and confirms now that the grain corridor is only for ships that take part in the initiative – both in the past and in the future,” the deputy minister said.

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |