Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 8 3/4 in SRW, down 1 1/2 in HRW, up 5 1/2 in HRS; Corn is down 4 1/2; Soybeans down 12 3/4; Soymeal down $0.14; Soyoil down 0.96.

Markets finished last week with wheat prices down 37 1/2 in SRW, down 16 1/4 in HRW, down 8 1/2 in HRS; Corn is down 23; Soybeans down 13; Soymeal down $1.07; Soyoil down 0.32.

For the month to date wheat prices are down 72 3/4 in SRW, down 31 3/4 in HRW, down 26 in HRS; Corn is down 38 1/4; Soybeans up 17 3/4; Soymeal down $16.90; Soyoil up 2.97.

Year-To-Date nearby futures are up 5% in SRW, up 18% in HRW, down -3% in HRS; Corn is up 10%; Soybeans up 10%; Soymeal down -1%; Soyoil up 35%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 42 yuan; Soymeal down 58; Soyoil down 26; Palm oil up 20; Corn down 10 — Malaysian palm oil prices overnight were down 179 ringgit (-4.18%) at 4108.

There were changes in registrations (-21 SRW Wheat). Registration total: 3,056 SRW Wheat contracts; 0 Oats; 0 Corn; 291 Soybeans; 39 Soyoil; 278 Soymeal; 5 HRW Wheat.

Preliminary changes in futures Open Interest as of November 11 were: SRW Wheat up 1,516 contracts, HRW Wheat up 2,107, Corn down 1,027, Soybeans up 9,729, Soymeal up 987, Soyoil up 5,084.

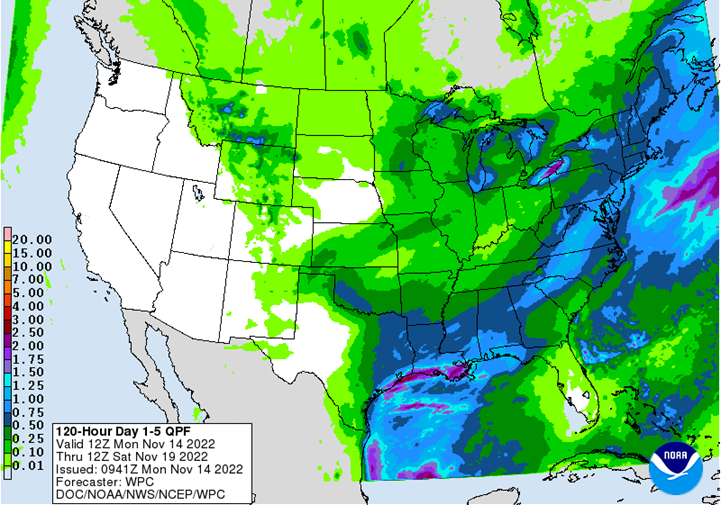

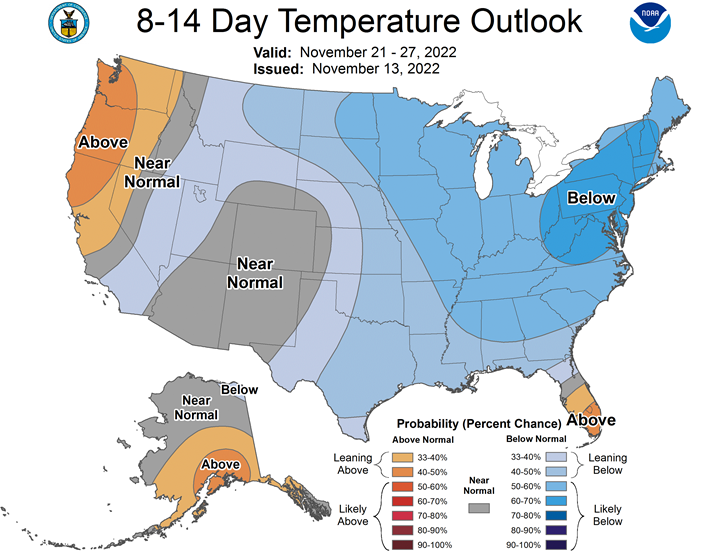

Northern Plains Forecast: Outside of some isolated snows, it was mostly dry over the weekend with bitterly cold temperatures. Light snows may come at times this week as a couple of reinforcing shots of cold air move through. Temperatures will start to moderate next week.

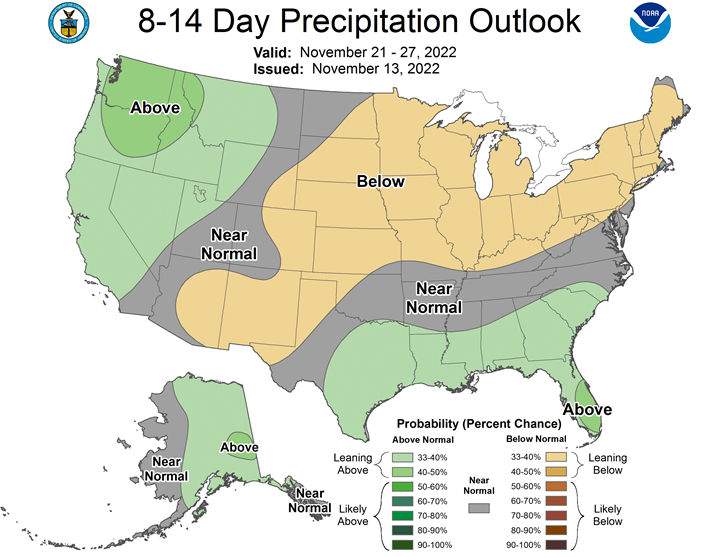

Central/Southern Plains Forecast: Scattered showers fell over southeastern areas on Friday as arctic cold air moved in for the weekend. A storm will develop over Texas on Monday with a mix of scattered showers. Some snow accumulations will be possible in the across wheat country, but will not be much help with temperatures well below normal continuing as a couple of reinforcing shots of cold air move through this week. Temperatures will moderate next week and will go back above normal again. Wheat may be slowly slipping into dormancy in poor condition.

Western Midwest Forecast: A system brought showers to southern areas of the country over the weekend behind the cold front that has brought arctic cold temperatures to the region. A weak system will pass through Monday into Tuesday with scattered showers, mostly in the form of snow. Lake-effect showers will continue afterward. Another push of very cold air will come through late week with more snow showers. Wheat is finding support to go dormant this week.

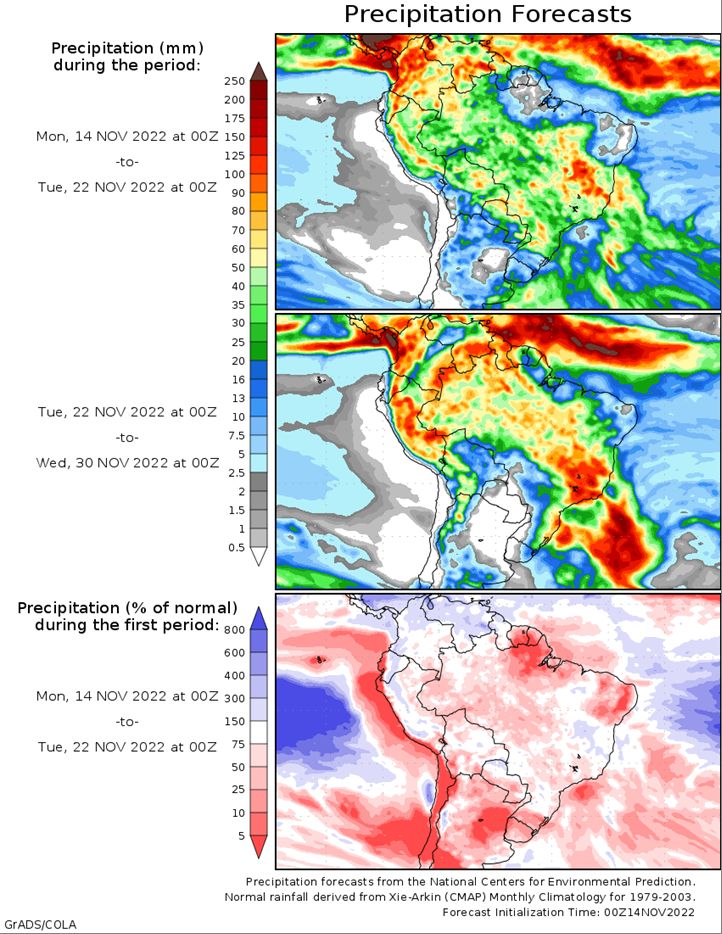

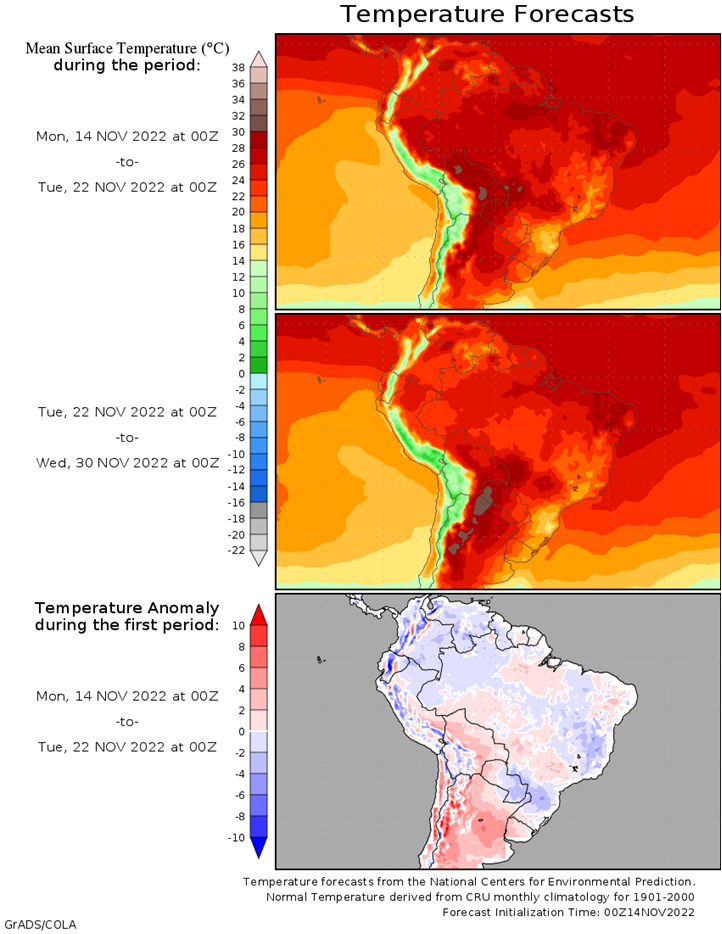

Brazil Grains & Oilseeds Forecast: Scattered showers occurred over southern areas this weekend, which is important since a cold front moving through will leave the region dry after Monday for the following week. Showers will continue over central areas. With good moisture over the weekend, the dryness in the south will not be concerning just yet. More showers are expected next week.

Argentina Grains & Oilseeds Forecast: Scattered showers moved through over the country this weekend, which will help to ease some of the drought concerns, but soil moisture is still well below normal for most areas despite the showers. A front moved through on Sunday which is clearing out the country and leaving it dry for most of the week. A weak front will allow for some isolated showers to return to southern areas late in the week, and fill in again over the weekend. The dryness and drought continue to be concerns until showers become more consistent.

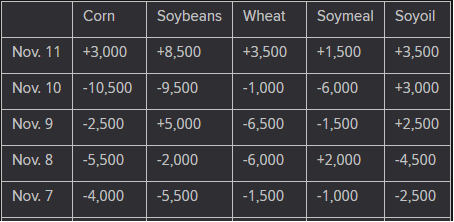

The player sheet for Nov. 11 had funds: net buyers of 3,500 contracts of SRW wheat, buyers of 3,000 corn, buyers of 8,500 soybeans, buyers of 1,500 soymeal, and buyers of 3,500 soyoil.

TENDERS

- WHEAT, BARLEY SALES: Tunisia’s state grains agency is believed to have purchased about 100,000 tonnes of soft wheat, 100,000 tonnes of durum wheat and about 50,000 tonnes of animal feed barley in an international tender on Friday

- WHEAT PURCHASE: Saudi Arabia’s state grains buyer SAGO on Monday said that it had bought about 1 million tonnes of wheat in an international tender for shipment April-June 2023 at an average price of $382.56 a tonne.

- CORN SALE: South Korean animal feed maker Nonghyup Feed Inc. (NOFI) bought an estimated 69,000 tonnes of animal feed corn in an international tender on Friday

- FEED WHEAT SALE: South Korea’s Major Feedmill Group (MFG) purchased about 55,000 tonnes of animal feed wheat expected to be sourced from Australia in a private deal on Friday without issuing an international tender

- WHEAT SALE: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) bought a total of 94,603 tonnes of food-quality wheat from the United States and Canada in regular tenders that closed on Thursday.

- FAILED CORN TENDER: The Korea Feed Association (KFA) is believed to have rejected all offers and made no purchase in a tender on Friday to buy up to 68,000 tonnes of corn

- FAILED WHEAT TENDER: A group of importers in the Philippines is believed to have rejected all offers and made no purchase in a tender for about 60,000 tonnes of animal feed wheat which closed on Thursday

PENDING TENDERS

- RICE TENDER: South Korea’s Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 50,500 tonnes of rice to be sourced from the United States

- MILLING WHEAT TENDER: Jordan’s state grain buyer has issued an international tender to buy 120,000 tonnes of milling wheat that can be sourced from optional origins.

- FEED WHEAT, BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said on Wednesday it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley via a simultaneous buy and sell (SBS) auction that will be held on Nov. 16.

- BARLEY TENDER: Jordan’s state grains buyer issued a new international tender to purchase 120,000 tonnes of animal feed barley.

- WHEAT TENDER: Iraq’s state grains buyer has issued a tender to buy a nominal 50,000 tonnes of milling wheat sourced from the United States only with a limited number of trading companies asked to offer, traders said.

US BASIS/CASH

- Spot basis bids for soybeans shipped by barge to U.S. Gulf export terminals were flat to lower on Friday as freight costs flattened and futures rallied to close out the week, traders said.

- CIF corn barge basis values were mostly flat, capped by sluggish export demand.

- Spot river freight costs leveled out on Friday after good demand for empty barges lifted prices at midweek. However, grain shippers still need barges for this month, brokers said.

- Grain shippers are still unable to load barge to capacity due to low water on southern sections of the Mississippi River. But rains across the Ohio River valley are expected to soon raise water levels on the lower Mississippi River.

- Limited available near-term export loading capacity at Gulf Coast terminals kept FOB basis offers for corn and soybeans inverted.

- Grain traders are monitoring negotiations in Geneva over the Ukrainian Black Sea export corridor deal, which is set to expire at the end of next week.

- CIF soybean barges loaded in November were bid 5 cents lower at 175 cents over January. December barge bids were flat at 155 cents over futures.

- CIF corn barges loaded in November were bid at about 140 cents over December, unchanged from late Thursday.

- Spot corn basis bids were mostly steady to firmer in the U.S. Midwest on Friday, rising at several ethanol plants in the region as the harvest wound down, dealers said.

- The corn basis strengthened by 2 to 11 cents per bushel at ethanol plants at Annawan, Illinois, at Linden and Union City, Indiana, and Council Bluffs, Iowa, reflecting brisk demand for fresh supplies.

- Corn bids were mixed at river locations, firming at Seneca, Illinois, on the Illinois River, and softening at Davenport, Iowa, on the Mississippi. Costs for barge freight moved higher late this week, pressuring grain bids in some locations.

- Soybean basis bids were mostly flat this week after strengthening at several crushing locations this week.

- Spot cash millfeed values were mixed around the United States on Friday on ample supplies in some markets and tight supplies in others, dealers said.

- Improved flour mill run times have boosted millfeed stocks in the Plains and the eastern United States, and spot prices have gradually fallen from peaks posted last month.

- Planned downtime over the next two weeks at a large flour mill in the eastern Midwest elevated millfeed prices in the Central States market.

- Offers for millfeed delivered later this month and beyond were at premiums of $5 to $10 per ton or more as supplies were due to tighten around the year-end holidays. Stronger demand was also anticipated due to colder weather.

- Spot basis bids for hard red winter (HRW) wheat were unchanged in the southern U.S. Plains on Friday while protein premiums were mixed, and producers braced for below-normal temperatures over the next two weeks, dealers said.

- The cooler temperatures should push most of the region’s newly planted HRW wheat into dormancy, space technology company Maxar said in a daily crop weather note.

- Protein premiums for wheat delivered by rail to or through Kansas City fell by 11 to 15 cents a bushel for wheat with 11.6% and 11.8% protein, and fell by 15 to 30 cents for wheat with 13.6% though 14.0% protein. But premiums rose by 5 to 6 cents for wheat with 12.0% through 12.4% protein, and rose by 10 cents for 13.0% through 13.2% protein grades.

- Spot basis offers for soymeal were steady to weaker in the U.S. Midwest on Friday, pressured by ample supplies of the feed ingredient as processors took advantage of strong crush margins, dealers said.

NOPA October U.S. soy crush seen rising to 184.464 million bushels

The U.S. soybean crush likely surged in October to the fourth highest on record for any month as processing plants received a flood of newly harvested beans, analysts said ahead of a monthly National Oilseed Processors Association (NOPA) report due on Tuesday.

NOPA members, which handle about 95% of all soybeans processed in the United States, were estimated to have crushed 184.464 million bushels of soybeans last month, according to the average of estimates from nine analysts.

If realized, the monthly crush would be up 16.7% from the 158.109 million bushels processed by NOPA members in September and up 0.3% from the October 2021 crush of 183.993 million bushels. It would also be the second largest October crush on record, behind only October 2020.

The October estimate implied a daily processing rate of 5.950 million bushels, which would be the highest daily crush pace since December.

Estimates for the October 2022 crush ranged from 175.000 million to 191.343 million bushels, with a median of 185.000 million bushels.

The monthly NOPA report is scheduled for release at 11 a.m. CST (1700 GMT) on Tuesday. NOPA releases crush data on the 15th of each month, or the next business day.

Soyoil supplies held by NOPA members as of Oct. 31 were projected at 1.535 billion pounds, according to the average of estimates gathered from six analysts.

If realized, the soyoil stocks would be up 5.2% from the two-year low of 1.459 billion pounds at the end of September but down 16.3% from the 1.834 billion pounds held by NOPA members at the end of October last year.

Soyoil stocks estimates ranged from 1.425 billion to 1.700 billion pounds, with a median of 1.530 billion pounds.

Brazil 2022/2023 soybean crop seen at 154.5 million tns – Safras & Mercado

BRAZIL 2022/2023 SOYBEAN CROP SEEN AT 154.5 MILLION TNS VERSUS 151.5 MILLION TNS IN PREVIOUS FORECAST – SAFRAS & MERCADO

India’s wheat planting gathers momentum, acreage up nearly 10%

Indian farmers have planted wheat on 4.5 million hectares since Oct. 1, when the current sowing season began, up 9.7% from a year ago, the latest data from the farm ministry showed on Friday.

The Ministry of Agriculture & Farmers’ Welfare will keep updating the provisional crop sowing figures as it gathers more information from state governments.

In India, wheat is mainly produced in the northern states of Punjab, Haryana, Uttar Pradesh and the central state of Madhya Pradesh.

The planting figures are also subject to revision depending on weather conditions.

Late rains in October and November raised soil moisture levels and helped farmers bring in more area under wheat, the main winter crop, growers said.

India grows only one wheat crop in a year, with planting in October and November, and harvests from March.

India, the world’s second-biggest wheat producer, was forced to ban exports of the staple in May this year, after a sudden rise in temperatures in March cut crop yields.

Despite the ban, wheat prices have soared to a record high, prompting the government to weigh measures such as the release of state reserves into the open market while axing the 40% tax on imports to cool prices.

Sowing of rapeseed, the main winter-planted oilseed reached 5.5 million hectares, up from 4.8 million hectares a year ago, according to the farm ministry.

Higher rapeseed output will help India, the world’s biggest cooking oil importer, to cut expensive purchases of edible oils from Malaysia, Indonesia, Brazil, Argentina, Russia and Ukraine.

In the fiscal year to March 31, 2022, New Delhi spent a record $18.99 billion to import vegetable oils, prompting Prime Minister Narendra Modi to voice concerns about India’s rising vegetable oil import bill.

As part of efforts to reduce India’s dependence on edible oil imports, New Delhi has granted environmental clearance for indigenously developed genetically modified mustard seeds, part of the rapeseed family.

CORN/CEPEA: Amid expectations for higher supply, values drop

Corn quotations dropped for one more week in the Brazilian market, pressed down by low liquidity and, majorly, estimates pointing to a high output in 2023. Thus, not even the dollar appreciation against the Real limited corn devaluations in Brazil.

Brazilian purchasers have not been buying large amounts because they are aware of the high expectations for the summer crop and ending stocks. Many sellers have been willing to lower asking prices, due to the need to make room in warehouses. However, the good exports performance may reduce national stocks.

Between November 3 and 10, on the average of the regions surveyed by Cepea, quotations dropped by 0.4% in the wholesale market (deals between processors) and by 0.7% in the over-the-counter market (paid to farmers). In Campinas (SP), the ESALQ/BM&FBovespa Index for corn closed at BRL 84.48 (USD 15.65) per 60-kilo bag on Thursday, 10, 0.3% lower than that on the previous Thursday, 3. The US dollar rose by 5.6% in the last seven days, to BRL 5.394 on Nov. 10th.

ESTIMATES – In a report released on Nov. 9th, Conab estimated the Brazilian output in the 2022/23 season to total 126.39 million tons, 500 thousand tons lower than that previously estimated but still 12% higher than that last crop and a record.

Productions in the first and second crops are both forecast to increase by 12% in 22/23 compared to that in the previous season, to 28.15 million tons and 96.27 million tons. However, the output from the third crop is expected to decrease by 10%, to 1.97 million tons, due to high rainfall in some states and low investments in technology in other areas.

The estimates for Brazilian consumption and exports were kept at 81.75 million tons and 45 million tons compared to that reported in October, however, they are 6% and 17% higher than that in 2021/22. Thus, ending stocks in Jan/24 are forecast at 9.76 million tons, similar to the average of the last five years, of 10.16 million tons.

CROPS – Crops are developing well in Brazil, where sowing of the summer crop in ending. By Nov. 5th, 43% of crop had been sown.

SOYBEAN/CEPEA: Dollar appreciation and higher demand raise liquidity in BR

Liquidity has resumed rising in the Brazilian soybean market this week, reflecting higher demand for the product, majorly from abroad. Added to that, international valuations – including by-products – and the US dollar appreciation against the Real pushed up the domestic prices for soybean, raising the interest of sellers in closing deals. Between November 3 and 10, the American currency rose by 5.6%, to BRL 5.397 on Thursday, 10.

In the same period, the ESALQ/BM&FBovespa Paranaguá (PR) Index rose by 2%, closing at BRL 191.22 (USD 35.43) per 60-kilo bag on Thursday, 10 – the highest since July 29th. The CEPEA/ESALQ Paraná Index increased by 1%, to BRL 184.56 (USD 34.20)/bag, the highest since August 1st. On the average of the regions surveyed by Cepea, prices rose by 0.4% in the over-the-counter market (paid to farmers) and by 0.7% in the wholesale market (deals between processors).

In the market of soy oil, demand increased too, majorly for the production of biodiesel. In the last seven days, quotations rose by 2.8% in São Paulo (with 12% ICMS included), closing at BRL 8,063.22/ton on Thursday – the highest since July 28th. Agents are optimistic about the possible increase in the share of biodiesel in the mandatory blend with diesel oil in 2023, which may raise soybean processing in Brazil.

On the other hand, in the market of soybean meal, liquidity decreased, since national purchasers have stocks for the mid-term. Also, these agents are aware of the possible higher supply of the by-product – it is important to highlight that soybean processing usually increases to meet the demand for oil, since, of each ton of soybean processed, 78% produce meal, and 19%, oil. On the average of the regions surveyed by Cepea, meal values dropped by 1.3% between Nov. 3 and 10.

As for sales of the 2022/23 crop, agents consulted by Cepea have reported farmers’ low interest in sales, due to the preference of trading it in the spot market because of the instability of the dollar. However, soybean FOB prices (based at the port of Paranaguá, PR) indicate lower values for 2023.

SUPPLY AND DEMAND – According to data released by Conab this week, the area allocated to soybean crops in Brazil may be larger than 43.24 million hectares, 4.2% larger than that last season. Crops productivity is forecast at 3.55 tons per hectare, 17.3% up, in the same comparison. Thus, the Brazilian soybean output is estimated to be 22.3% higher than that last season, hitting 153.58 million tons. Conab estimates domestic consumption at 55.32 million tons, and exports at 96.62 million tons.

Still according to Conab, 57.5% of soybean crops had been sown in Brazil by Nov. 5th, against 67.3% in the same period last year.

The USDA estimates the Brazilian production of soybean to total 152 million tons in the 2022/23 season, 19.69% higher than that in the previous season.

Russia to Increase Grain Export Quota in 2023, Deputy PM Says

Russian Agriculture Ministry’s subcommittee on customs and tariff regulation supported the proposal to increase grain export quotas in 2023 to 25.5m tons, Deputy Prime Minister Viktoria Abramchenko says in her Telegram channel.

- Extremely important to use instruments of customs and tariff regulation and reduce barriers for the sale of products on foreign markets

- Quota covers exports of wheat, meslin, rye, barley and corn from Feb. 15 to June 30, 2023

- 2022 quota was 11m tons, according to Interfax

Palm Oil Prices to Stay Buoyant on Floods and Weak Ringgit: MPOC

Palm oil will likely hold above 4,000 ringgit ($872) a ton for the rest of the year, buttressed by a weaker Malaysian ringgit and supply worries due to floods in top producers Indonesia and Malaysia.

Prices are forecast to trade between 4,000 ringgit and 4,400 ringgit a ton until the end of December, according to Malaysian Palm Oil Council CEO Wan Aishah Wan Hamid. Benchmark futures were at about 4,172 ringgit on Monday.

Indonesia and Malaysia are currently experiencing higher rainfall than usual, she said in slides prepared for an online seminar. “This has caused floods in major oil-palm planted areas and has already negatively impacted production.”

Over the whole of 2022, Malaysian output is set for a third straight annual decline as a worker shortage continues to hamper harvesting. Indonesia will see a slight gain in production due to newly matured oil-palm planted areas.

While the current rainy season is causing floods, it’s likely to boost palm oil production in the second to third quarters of 2023, Wan Aishah said. Prices may trade from 3,800 ringgit to 4,300 ringgit in the first half of next year, also driven by more demand, crude oil volatility and geopolitical tensions, she said.

Ahmad Parveez Ghulam Kadir, director general of the Malaysian Palm Oil Board, highlighted in his presentation the various factors that will drive the palm oil market in 2023. He expects prices to stay strong but didn’t provide a forecast.

A persistently weak ringgit will spur demand for Malaysian palm oil. Exports to China may pick up, while an expected resumption of Indonesia’s export levy will likely lift palm oil prices as its discount to soybean oil narrows, he added.

India Oct. Vegetable Oil Imports Fall to 1.4m Tons: SEA

India’s vegetable oil imports fell to 1.4m tons in October from 1.64m tons in September, according to the Solvent Extractors’ Association of India.

- Palm oil imports fell to 886,594 tons from 1.17m tons in September

- Soybean oil imports rose to 334,467 tons from 261,815 tons in September

- Sunflower oil imports fell to 144,934 tons from 159,810 tons in September

Indian Farmers Increase Wheat Plantings, Boost Oilseeds Acreage

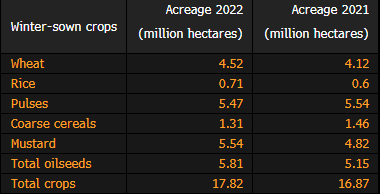

Farmers in the world’s second-biggest wheat grower have planted the crop on 4.52 million hectares (11.2 million acres) of land as of Nov. 11, an increase of 7% from a year earlier, according to the farm ministry.

The area allocated to winter-sown pulses has risen to 5.47 million hectares, from 5.54 million a year earlier, while the planting of oilseeds has increased to 5.81 million hectares from 5.15 million, the ministry said on Friday. Sowing operations are continuing across the country.

Area for major winter crops, sown in October-November and harvested in March-April:

Parched Argentina Farms Set to Get Rains Needed to Plant Soy

Argentina’s Pampas crop belt is forecast to receive rain through Nov. 16, according to maps in a Buenos Aires Grain Exchange weather report.

- “Most parts of the growing area will get abundant rain, except for a dry patch in Entre Rios province”

- Precipitation will on average be 25-50mm (1-2 inches)

- NOTE: Argentine farmers need rain to be able to get soy seeds in the ground, with the bulk of planting done this month and next

- NOTE: In the so-called zona nucleo, a key slither of the Pampas, three quarters of the first soy crop are expected to be planted outside of the optimal planting window, which ends Nov. 15, according to a Rosario Board of Trade report

- Planting of the first soy crop in the zona nucleo is 24% complete vs. 80% at the same stage last year

- “We’ve never seen anything like this in at least the last 12 years”

Shriveled Wheat Crop Wipes $2.2b From Argentine Exports Y/y

With frosts compounding a drought, Argentina is set to export just 7m metric tons of wheat in the 2022-23 trading year, worth $2.4b, the Rosario Board of Trade said in a report.

- Exports in 2021-22 were 14.5m tons, valued at $4.6b

- The forecast for shipments has plunged 30% in both volume and value since September

- Volume estimate in September was 10m tons, value was $3.4b

- NOTE: Wheat export dollars are a key bridge for Argentina’s central bank reserves over the southern hemisphere summer until soy and corn are harvested in 2Q

Indonesia to Double Palm Oil Output to Reach High-Income Status

Indonesia plans to double palm oil output over the next two decades, which will help the country reach high-income status faster, said a senior minister.

“Not by 2050 — By 2035, we can reach that status because we have nickel, tin, bauxite and palm oil,” said Luhut Panjaitan, coordinating minister for investment and maritime affairs, at a BloombergNEF Summit in Bali. He defined high-income as reaching $10,000 per capita gross domestic product.

The country will replant trees to reach 100 million tons of palm oil output in 2045, from about 51 million tons this year. Half of the output will be used for food, while the rest will go toward clean energy that can help Indonesia stop crude oil imports, he said.

UAE bans unapproved price increases for staple goods -state news agency

The United Arab Emirates has forbidden any increase in the prices of nine basic staple goods without prior government approval, state news agency WAM said in a statement.

Those staples, which it said “impact consumer purchasing power”, are cooking oil, eggs, milk, sugar, poultry, legumes, bread and wheat, with the possibility of adding more.

Brazil’s Fertilizer Prices Soften Amid High Inventory

Brazilian phosphate prices were mixed this week, though we believe slow demand until 2Q could further underpin the softening trend. Mosaic flagged expectations for firmer phosphate prices in Brazil, saying supply constraints would apply global pressure. Yet Brazilian phosphate ending stocks are significantly above last year’s record, rising even as yearly imports through 3Q were down 11.5% vs. last year. Rising fertilizer inventory in Brazil pushed phosphate prices down $20/mt on the week. Urea followed, finding liquidity at $580/mt cost-and-freight near week’s end after offers started the week at $620-$630.

Soybean planted area forecasts are growing. Conab raised its 2023 forecast by 0.3 million hectares this week to 43.2 million.

US Pork Production Falls 3.1% This Week, Beef Rises: USDA

US federally inspected pork production falls to 534m pounds for the week ending Nov. 12 from 552m in the previous week, according to USDA estimates published on the agency’s website.

- Hog slaughter down 3.3% from a week ago to 2.492m head

- Beef production up 0.8% from a week ago, cattle slaughter rises 0.6%

- For the year, beef production is 1.5% above last year’s level at this time, and pork is 2.5% below

UNITED STATES

SOUTH AMERICA

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |