Happy Thanksgiving from all of us at Total Farm Marketing!

Thursday, November 24, 2022: The CME and Total Farm Marketing offices are closed.

Friday, November 25, 2022: The CME closes at noon, and the Total Farm Marketing office closes at 1:00.

Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 1 in SRW, down 3/4 in HRW, down 1 1/4 in HRS; Corn is down 1/4; Soybeans down 3; Soymeal down $0.16; Soyoil up 0.64.

For the week so far wheat prices are down 4 3/4 in SRW, down 1 3/4 in HRW, down 6 1/4 in HRS; Corn is down 6 3/4; Soybeans up 5 1/2; Soymeal up $0.03; Soyoil up 0.76.

For the month to date wheat prices are down 82 in SRW, down 52 1/4 in HRW, down 37 1/4 in HRS; Corn is down 33 1/2; Soybeans up 14 1/4; Soymeal down $12.70; Soyoil up 0.76.

Year-To-Date nearby futures are up 4% in SRW, up 16% in HRW, down -4% in HRS; Corn is up 11%; Soybeans up 8%; Soymeal down 0%; Soyoil up 31%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 32 yuan; Soymeal up 36; Soyoil down 62; Palm oil up 60; Corn up 12 — Malaysian palm oil prices overnight were up 149 ringgit (+3.87%) at 4004.

There were no changes in registrations. Registration total: 3,056 SRW Wheat contracts; 0 Oats; 0 Corn; 126 Soybeans; 39 Soyoil; 278 Soymeal; 5 HRW Wheat.

Preliminary changes in futures Open Interest as of November 21 were: SRW Wheat up 3,112 contracts, HRW Wheat down 2,344, Corn down 30,172, Soybeans up 966, Soymeal down 5,074, Soyoil up 2,067.

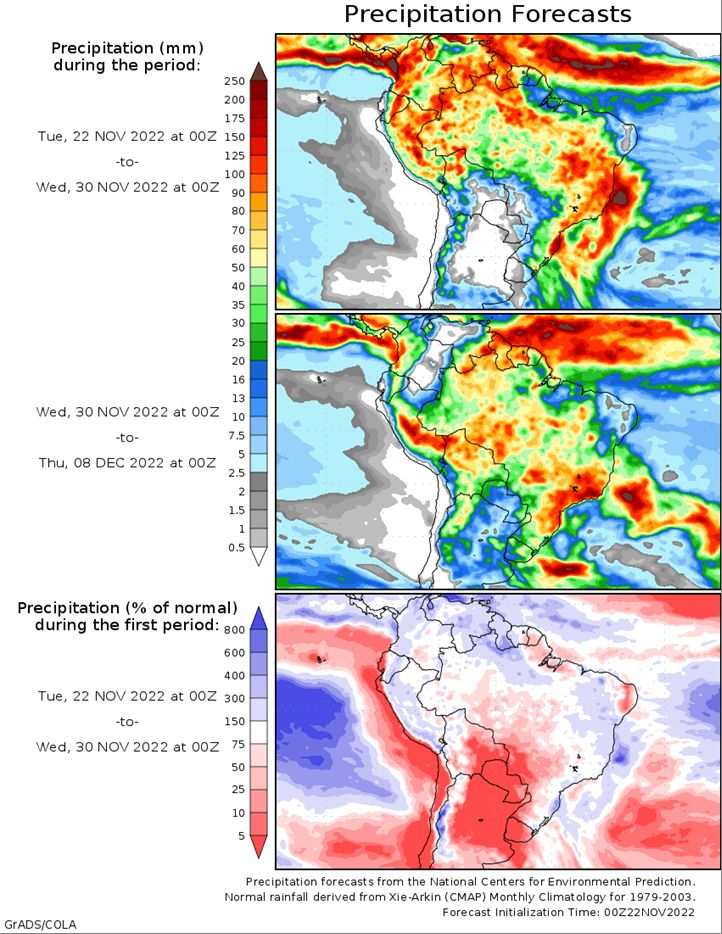

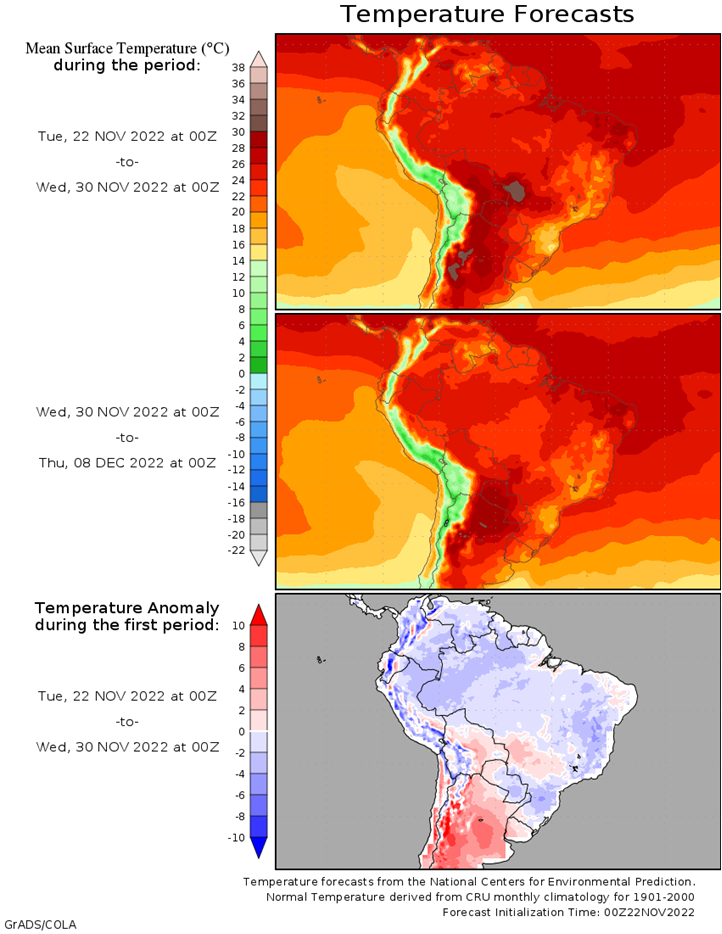

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Scattered showers Tuesday. Mostly dry Wednesday-Friday. Temperatures near to above normal Tuesday, near to below normal Wednesday-Friday. Mato Grosso, MGDS and southern Goias: Scattered showers through Friday. Temperatures near normal through Friday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Mostly dry through Friday. Temperatures below normal Tuesday, above normal Wednesday-Friday. La Pampa, Southern Buenos Aires: Mostly dry through Friday. Temperatures below normal Tuesday, above normal Wednesday-Friday.

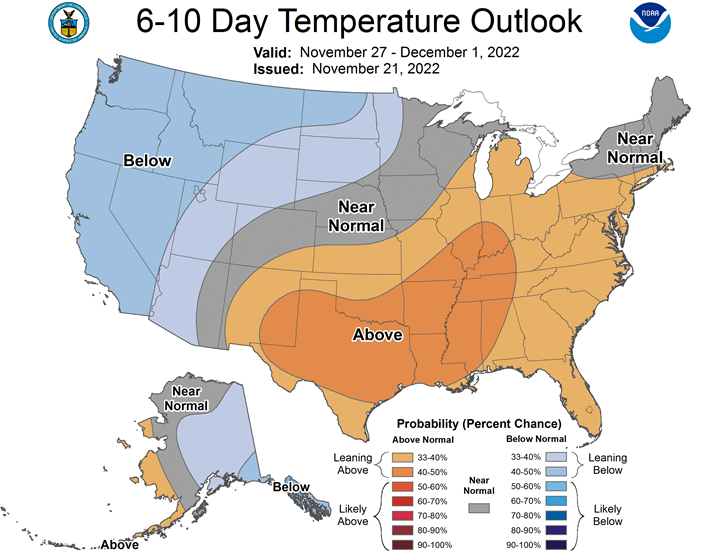

Northern Plains Forecast: Mostly dry Tuesday. Isolated showers Wednesday-Thursday. Mostly dry Friday. Temperatures near to below normal Tuesday, near to above normal Wednesday-Friday. Outlook: Mostly dry Saturday-Sunday. Scattered snow Monday-Wednesday. Temperatures near to above normal Saturday-Sunday, near to below normal Monday-Wednesday.

Central/Southern Plains Forecast: Mostly dry Tuesday. Isolated showers east Wednesday night-Thursday. Mostly dry Friday. Temperatures near to below normal Tuesday, near to above normal Wednesday-Friday. Outlook: Mostly dry Saturday-Monday. Isolated showers Tuesday-Wednesday. Temperatures above normal Saturday-Monday, near to above normal Tuesday-Wednesday.

Western Midwest Forecast: Mostly dry through Wednesday. Scattered showers Thursday, south Friday. Temperatures near to below normal Tuesday, near to above normal Wednesday-Friday.

Eastern Midwest Forecast: Mostly dry through Wednesday. Scattered showers Thursday-Friday. Temperatures below normal Tuesday, near to below normal Wednesday, near to above normal Thursday-Friday. Outlook: Isolated showers east Saturday. Mostly dry Sunday-Monday. Isolated to scattered showers Tuesday-Wednesday. Temperatures near to above normal Saturday-Wednesday.

The player sheet for Nov. 21 had funds: net sellers of 2,500 contracts of SRW wheat, sellers of 6,000 corn, sellers of 4,000 soybeans, buyers of 1,500 soymeal, and buyers of 1,000 soyoil.

TENDERS

- WHEAT PURCHASE: The Taiwan Flour Millers’ Association purchased an estimated 43,400 tonnes of milling wheat to be sourced from the United States in a tender late last week

- WHEAT TENDER: Jordan’s state grain buyer has issued an international tender to buy 120,000 tonnes of milling wheat which can be sourced from optional origins.

- BARLEY TENDER: Jordan’s state grains buyer has issued a new international tender to purchase 120,000 tonnes of animal feed barley.

- DURUM WHEAT TENDER: Algeria’s state grains agency OAIC has issued an international tender to purchase a nominal 50,000 tonnes of durum wheat

- VEGOILS TENDER: Egypt’s state grains buyer said it was seeking vegetable oils in an international purchasing tender for arrival Jan. 10-31, 2023. The deadline for offers is Nov. 22.

- RICE TENDER: Turkey’s state grain board TMO has issued an international tender to purchase a total 40,000 tonnes of rice.

PENDING TENDERS

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 94,687 tonnes of food-quality wheat from the United States and Canada in regular tenders that closed on Nov. 17.

- WHEAT TENDER: A government agency in Pakistan has issued a new international tender to purchase and import 500,000 tonnes of wheat.

US BASIS/CASH

- Spot basis bids for corn and soybeans shipped by barge to U.S. Gulf export terminals were weaker on Monday on muted demand and weaker freight costs, traders said.

- Cash market activity was minimal on Monday in a quiet start to the U.S. Thanksgiving holiday week. Although futures markets will be open on Friday, many traders are expected to be out for the last half of the week.

- Barge freight rates eased on Monday as shipping conditions have improved significantly on the lower Mississippi River. Low water have restricted barge loadings and barge tow sizes since September. BG/US

- Soybean export demand was moderate as Chinese buyers are still in need of U.S. shipments for late December through at least February. Brazilian new-crop supplies are expected to displace U.S. soy into China after February.

- CIF soybean barges loaded in November were bid 3 cents lower at 148 cents over January. December barge bids were down 4 cents at about 138 cents over futures.

- Export premiums for soybeans shipped in the first half of December were quoted at around 200 cents over futures, down 15 cents from late last week. Last-half December offers held steady at 195 cents over futures.

- CIF corn barges loaded in November were bid 4 cents lower at 127 cents over December futures.

- Corn export premiums for early December loadings were quoted 10 cents lower at 170 cents over December futures. Late-December export premiums were 5 cents lower at 155 cents over futures.

- Spot basis bids for corn were steady to higher in the U.S. Midwest on Monday, firming at one Chicago processing site and at Midwest river elevators, while soy basis bids were mixed, dealers said.

- The corn basis firmed at Chicago and at Davenport, Iowa, on the Mississippi River, as well as Morris, Illinois, on the Illinois River.

- Cheaper barge freight costs helped support river basis bids. Barge costs have softened as shipping conditions have improved with slightly higher river levels. BG/US

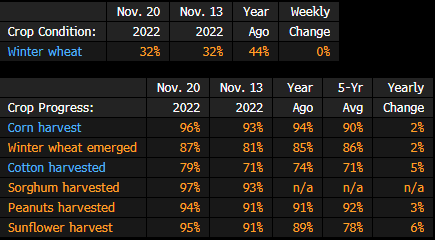

- Country movement of corn and soy has slowed in recent weeks as farmers wrapped up their harvest of those crops. The U.S. Department of Agriculture late Monday said the U.S. corn harvest was 96% complete, ahead of the five-year average of 90%. Soybeans were 96% harvested as of Nov. 13.

- The soybean basis firmed at an elevator in Council Bluffs, Iowa, but weakened at a crushing plant in Sioux City, Iowa, as well as at Morris, Illinois.

- Spot basis bids for soybeans and corn were steady to firmer at processing sites in the U.S. Midwest on Monday as farmer selling slowed following the conclusion of the harvest in most areas, grain dealers said.

- Spot basis bids for hard red winter wheat shipped by rail to the U.S. Gulf softened on Monday while the basis held steady at elevators in the southern Plains, dealers said.

- Poor export demand for U.S. wheat weighed on the Gulf basis while the dollar strengthened, making U.S. grains less competitive globally.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City were unchanged on Monday.

- Spot basis offers for U.S. soymeal were steady to weaker in U.S. rail and truck markets on Monday, pressured by ample supplies of the feed ingredient as strong crush margins encouraged processor output, dealers said.

- Spot basis offers were quoted $5 a ton lower in the Kansas City rail market and $10 lower in the Mankato, Minnesota, truck market. Basis offers were unchanged elsewhere.

- Demand for soymeal from livestock producers and feed mixers was relatively light ahead of the U.S. Thanksgiving holiday on Thursday because many users have already booked enough to cover their needs, one broker said.

US Crop Progress and Conditions for Nov. 20: Summary

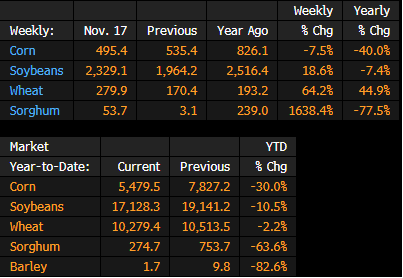

US Inspected 495k Tons of Corn for Export, 2.329m of Soybean

In week ending Nov. 17, according to the USDA’s weekly inspections report.

- Wheat: 280k tons vs 170k the previous wk, 193k a yr ago

- Soybeans: 2,329k tons vs 1,964k the previous wk, 2,516k a yr ago

- Corn: 495k tons vs 535k the previous wk, 826k a yr ago

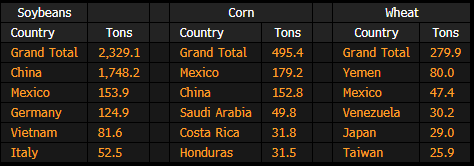

US Corn, Soybean, Wheat Inspections by Country: Nov. 17

Following is a summary of USDA inspections for week ending Nov. 17 of corn, soybeans and wheat for export, from the Grain Inspection, Packers and Stockyards Administration, known as GIPSA.

- Soybeans for China-bound shipments made up 1.75m tons of the 2.33m total inspected

- Mexico was the top destination for corn inspections, Yemen led in wheat

Warmest October on Record Aids European Winter Crops: MARS

In most of Europe, the Oct. 1-Nov. 10 period was the warmest in data going back to 1991, the EU’s Monitoring Agricultural Resources unit said Monday in a note.

- The exceptional warmth, coupled with adequate moisture, aided emergence and establishment of winter-crops

- Negative effects of the heat, like a lack of frost tolerance and increased pest pressure, “are not yet alarming”

- However, much of southern Europe is lacking precipitation

- That delayed sowing in countries such as Spain, Italy, Romania and Bulgaria

- “Drought conditions in the Maghreb region raise serious concerns for the coming sowing campaign”

Brazil 2022/23 Soybean Planting at 80% as of Nov. 17: AgRural

Compares with 69% a week earlier, and 86% a year before, according to an emailed report from consulting firm AgRural.

- The works are now concentrated in the later calendar states of the South and North/Northeast

- In Center-West region, where sowing is nearing the end, irregularity of the rains concerns the producers, even after the improvement in the registered rainfall, AgRural says

Ukrainian Farmers Sow Winter Grain on 94% of Planting Area

Ukraine has sown winter grains, mainly wheat, across 4.4m hectares, or 94% of the planting area, the Agriculture Ministry said on its website.

- Wheat accounted for 3.8m hectares, barley 613,000 hectares and rye 79,200 hectares

India’s Ethanol Output Set to Hit Record High in 2023: ISO

India’s ethanol production will reach a record 4.5 billion liters (1.2 billion gallons) next year as the government sets more ambitious gasoline blending targets, according to Pedro Arruda, an economist at the International Sugar Organization.

- Sugar industry has already supplied 86% of ethanol that mills have been contracted to supply, Arruda says at conference in London

- Nearly 90% of the ethanol is supplied by the sugar sector

- Government aiming for 12% ethanol-gasoline blending next year, compared with 10% this year

- US ethanol production, consumption and exports expected to fall in 2023

- Premium over gasoline prices sends negative incentive to blend

- Ethanol production in Brazil will continue to recover in 2023 with improved cane production and greater use of corn

Pro-Bolsonaro demonstrations slow corn transport in Brazil’s Mato Grosso

Truckers and other demonstrators protesting the electoral defeat of President Jair Bolsonaro are hampering the transport of corn in Mato Grasso state, the heart of Brazil’s farm country, two farmers said on Monday.

Mato Grosso highway police reported 11 demonstrations on Monday morning, with roads blocked or partially blocked on four federal highways near farmers and grain processing facilities.

Brazil’s top public prosecutor authorized the governor of Mato Grosso to mobilize police to clear highways of protesters.

The protests have hampered transport of some corn from farmers to ports and storage facilities, but the quantities could not be determined. The slowdown could have knock-on effects as warehouses need to be emptied ahead of a January soy harvest.

“It’s actually a race against time. Clean the corn warehouses so you can start reaping soybeans,” Mato Grasso farmer Evandro Lermen told Reuters.

The blockades are also delaying deliveries of farm inputs needed for planting of Brazil’s second corn crop early next year, he added.

While farmer Cayron Giacomelli supports the protesters’ cause, he said the blockades have prevented him from moving his corn, and he will not receive payment until he delivers it.

“We give full support to protesters, but we are being harmed,” Giacomelli said.

Demonstrations by truckers and other Bolsonaro supporters started after leftist President-elect Luiz Inacio Lula da Silva won the Oct. 30 election. He takes office on Jan. 1.

Brazil’s farmers have been a key constituency for Bolsonaro, but not all back continued demonstrations.

Global companies like Cargill, Bunge and Cofco operate in Mato Grosso.

At the southern port of Paranagua in Parana state, a blockade on an access road that backed up trucks on Sunday night was lifted on Monday, according to a port agent and an association representing firms that operate at Paranagua.

They said that there was little disruption to the flow of goods. Authorities are also trying to curtail demonstrations in the states of Santa Catarina, Para and Rondonia.

Farmer Endrigo Dalcin said there was little corn and soybeans left to move in Mato Grosso but said storage of the next soy crop may be complicated if protests continue.

Brazil to keep 10% biodiesel mandate until March -CNPE

– Brazil’s National Energy Policy Council (CNPE) decided the mandatory blend of biodiesel in diesel will be kept at 10% until Mar. 31, 2023, the Mines and Energy Ministry said on Monday.

From April on, the mix requirement will be increased to 15%, the ministry said in a statement, pointing out that Brazil’s next government which takes office in January could change the decision.

CNPE also decided that biodiesel produced by “any technological route of production” may be part of the mixture, which could include Petrobras’ PETR4.SA R5 diesel, a fuel co-processed with vegetable oil in a 95%-5% ratio.

Brazil’s oil, gas and biofuel regulator ANP would first have to approve the biodiesel used in the blend.

Around 70% of the country’s biodiesel is produced from soy oil, which is obtained after grain crushers process the beans.

With a 15% mandate being adopted as of April, the total soybean demanded for biodiesel would rise to about 30 million tonnes in 2023.

The decisions sparked protests from biodiesel producers, as Petrobras’ R5 could be a competitor, hurting the biofuel industry which says it should not be eligible for blending.

“It is not biofuel,” said Donizete Tokarski, managing director at industry group Ubrabio, referring to Petrobras’ diesel.

Petrobras did not comment immediately, but has previously said its product is efficient, reduces emissions because it has renewable content and has a chemical composition similar to diesel derived from petroleum.

Tokarski also said he is confident that Brazil can adopt a 15% mandate in April, but that ideally the change will not be so abrupt.

For Francisco Turra, chairman of the board at producers association Aprobio, keeping the mandate at 10% and allowing the use of co-processed diesel for blending could represent “a death blow to the entire sector and to the entire biodiesel production chain”.

“The unlikely inclusion of co-processed diesel is another issue that lacks technical support, since the regulator ANP itself does not consider the product a biofuel,” Turra said.

Big Oil joins farmers, biofuel groups to tout more ethanol in U.S. fuel

A group of oil, renewable fuel and farm trade organizations have joined together for the first time to voice support for U.S. legislation that would expand nationwide of E15, a higher ethanol-gasoline blend, according to a letter from the group.

Organizations including the American Petroleum Institute (API), Renewable Fuels Association and the National Farmers Union wrote to congressional leaders to urge them to adopt legislation that would effectively lift restrictions on E15 sales.

API’s support is a win for the biofuel and farm groups because the oil industry has at times resisted efforts to expand the market for ethanol.

U.S. Environmental Protection Agency (EPA) anti-smog regulations restrict summertime sales of E15, even though research has shown the higher percentage blend may not increase smog relative to the 10% blend called E10 that is now sold year-round.

Reuters reported this month that API began cooperating with the biofuels trade group after governors from major corn-producing Midwestern states requested the EPA allow for expanded sales of E15 in their states. The governors’ proposal raised oil industry concerns about fuel regulations differing from state to state.

“By ensuring uniformity across the nation’s fuel supply chain, federal legislation will provide more flexibility and result in more consistent outcomes than a state-by-state regulatory landscape,” the groups said in a letter dated Monday.

Expanding national sales of E15 would also resolve long-standing differences among the groups about the fuel regulations, the letter said.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |