Happy Thanksgiving from all of us at Total Farm Marketing!

Thursday, November 24, 2022: The CME and Total Farm Marketing offices are closed.

Friday, November 25, 2022: The CME closes at noon, and the Total Farm Marketing office closes at 1:00.

Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 2 1/2 in SRW, down 3 1/2 in HRW, down 1 3/4 in HRS; Corn is up 2; Soybeans up 1 3/4; Soymeal up $0.05; Soyoil down 0.17.

For the week so far wheat prices are down 14 in SRW, down 15 1/4 in HRW, down 10 1/4 in HRS; Corn is down 8 3/4; Soybeans up 3 1/4; Soymeal down $0.06; Soyoil up 0.69.

For the month to date wheat prices are down 91 1/4 in SRW, down 65 3/4 in HRW, down 41 1/4 in HRS; Corn is down 35 1/2; Soybeans up 12; Soymeal down $13.60; Soyoil up 0.66.

Year-To-Date nearby futures are up 2% in SRW, up 15% in HRW, down -4% in HRS; Corn is up 11%; Soybeans up 8%; Soymeal down -1%; Soyoil up 31%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 10 yuan; Soymeal up 29; Soyoil up 44; Palm oil up 128; Corn up 17 — Malaysian palm oil prices overnight were up 100 ringgit (+2.50%) at 4104.

There were no changes in registrations. Registration total: 3,056 SRW Wheat contracts; 0 Oats; 0 Corn; 126 Soybeans; 39 Soyoil; 278 Soymeal; 5 HRW Wheat.

Preliminary changes in futures Open Interest as of November 22 were: SRW Wheat up 1,149 contracts, HRW Wheat down 1,029, Corn down 4,753, Soybeans down 1,675, Soymeal up 3,729, Soyoil up 3,530.

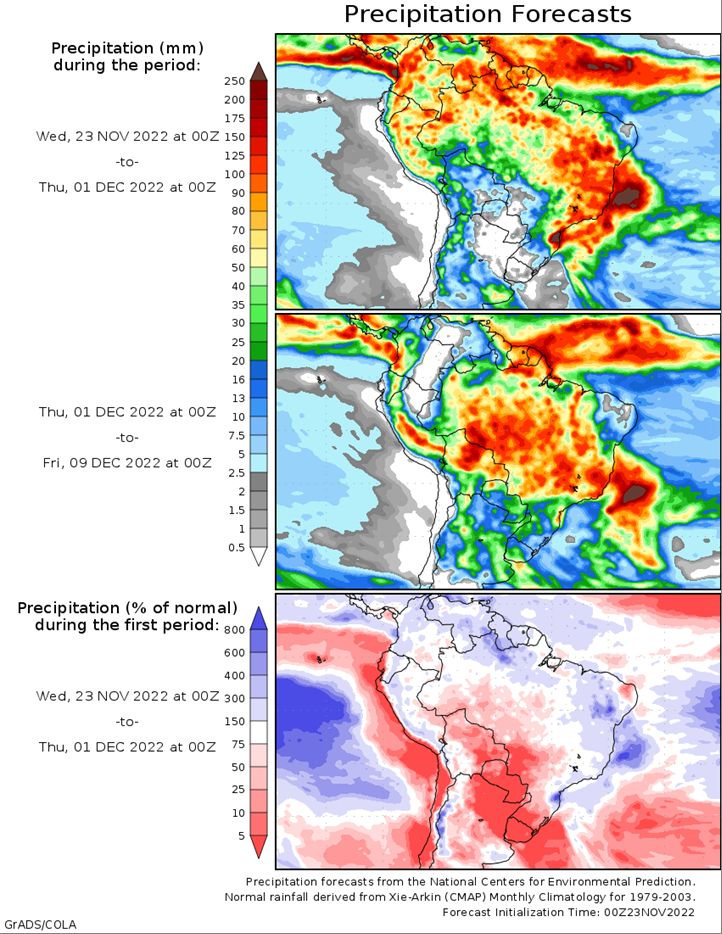

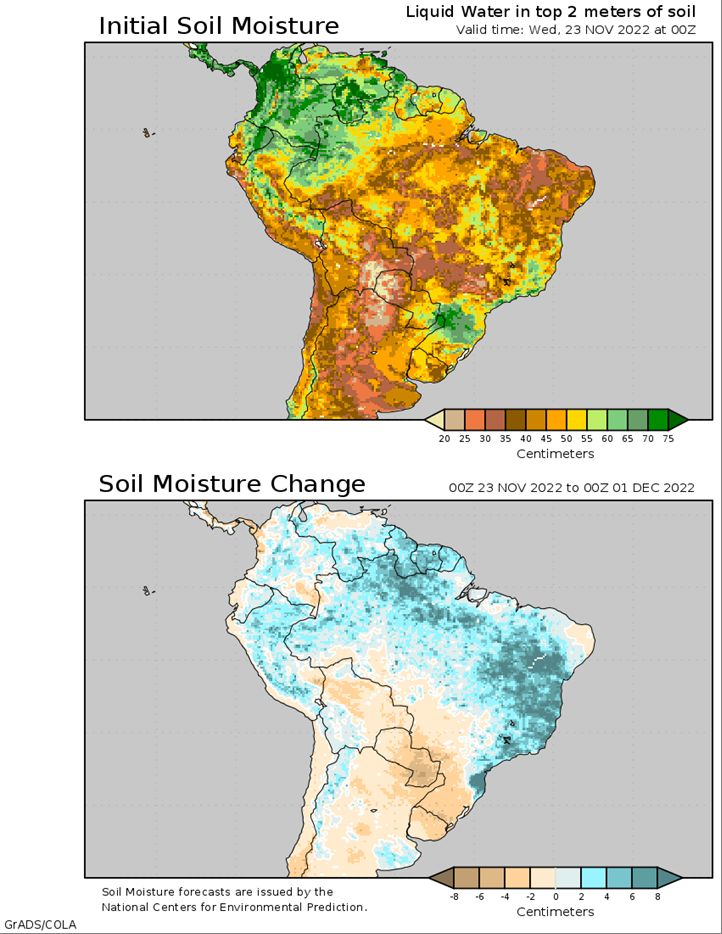

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana: Mostly dry Wednesday-Saturday. Temperatures near to below normal through Saturday. Mato Grosso, MGDS and southern Goias: Scattered showers through Saturday. Temperatures near normal through Saturday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires: Mostly dry through Saturday. Temperatures above normal Wednesday-Saturday. La Pampa, Southern Buenos Aires: Mostly dry through Friday. Isolated showers Saturday. Temperatures above normal Wednesday-Saturday.

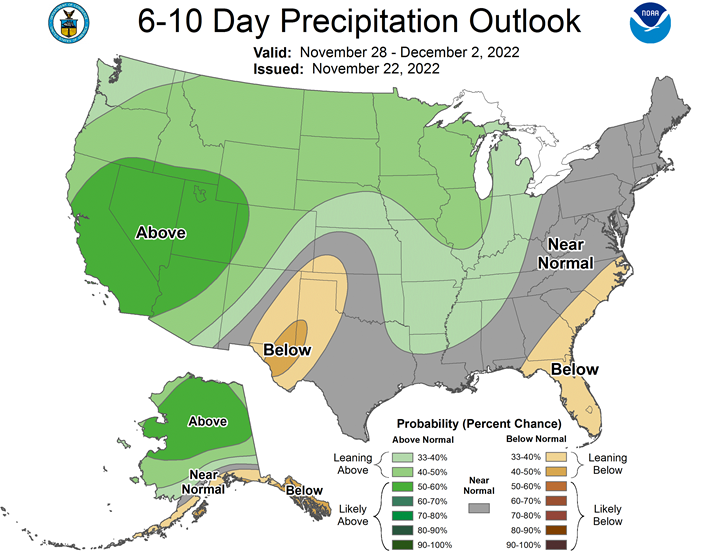

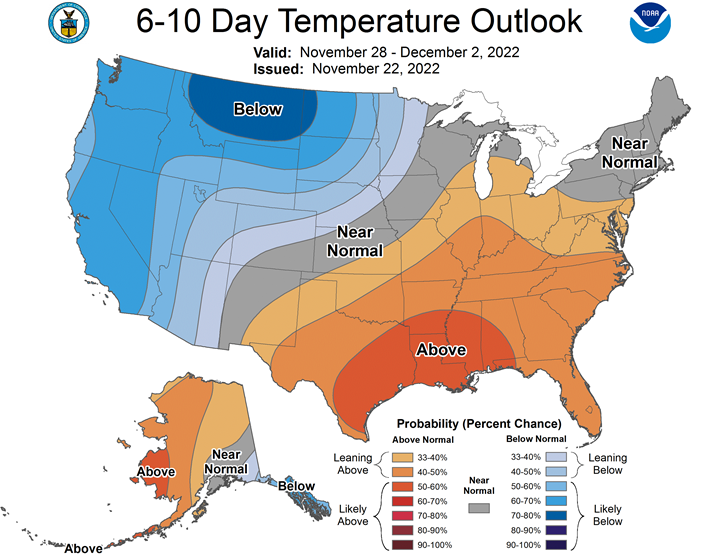

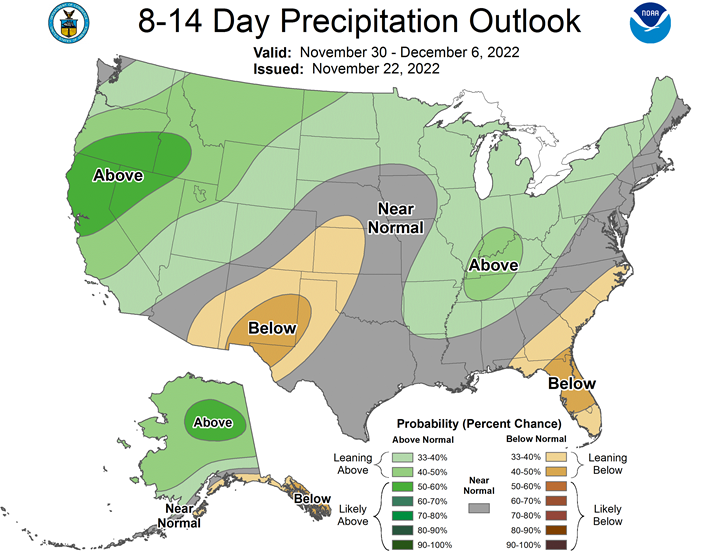

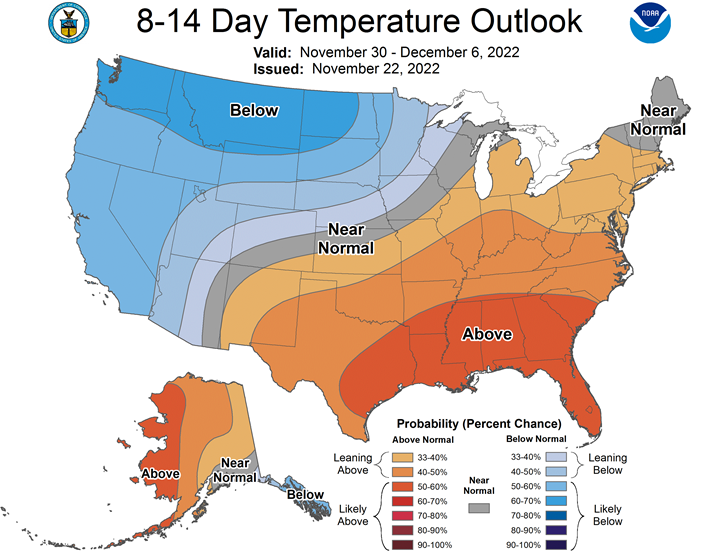

Northern Plains Forecast: Isolated showers Wednesday. Mostly dry Thursday-Saturday. Temperatures near to above normal Wednesday-Saturday. Outlook: Isolated to scattered snow Sunday-Thursday. Temperatures near to below normal Sunday-Tuesday, below normal Wednesday-Thursday. Central/Southern Plains wheat and livestock highlights… Isolated showers far southeast. Temperatures near to below normal.

Central/Southern Plains Forecast: Isolated to scattered showers Wednesday night-Saturday. Temperatures near to above normal Wednesday-Thursday, above normal north and near to below normal south Friday-Saturday. Outlook: Mostly dry Sunday-Monday. Isolated showers Tuesday-Wednesday. Mostly dry Thursday. Temperatures near normal Sunday-Monday, near to above normal Tuesday-Wednesday, near to below normal Thursday.

Western Midwest Forecast: Mostly dry Wednesday. Isolated showers Thursday. Mostly dry Friday. Scattered showers south Saturday. Temperatures near to above normal Wednesday-Saturday.

Eastern Midwest Forecast: Isolated showers Thursday-Friday. Scattered showers Saturday night. Temperatures near to above normal Wednesday-Saturday. Outlook: Scattered showers Sunday. Isolated showers Monday. Mostly dry Tuesday. Scattered showers Wednesday-Thursday. Temperatures near to above normal Sunday-Wednesday, near to below normal Thursday.

The player sheet for Nov. 22 had funds: net sellers of 3,000 contracts of SRW wheat, sellers of 3,000 corn, sellers of 1,500 soybeans, sellers of 1,500 soymeal, and buyers of 3,000 soyoil.

TENDERS

- WHEAT SALE: The Taiwan Flour Millers’ Association purchased an estimated 43,400 tonnes of milling wheat to be sourced from the United States in a tender late last week, European traders said on Tuesday.

- VEGOIL SALE: Egypt’s state grains buyer GASC said on Tuesday it had bought 65,750 tonnes of vegetable oils in an international tender. The purchase was comprised of 35,000 tonnes of soyoil and 30,750 tonnes of sunflower oil, the state buyer added.

- FAILED RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp rejected all offers and made no purchase in an international tender for an estimated 50,500 tonnes of rice to be sourced from the United States which closed earlier in November.

PENDING TENDERS

- BARLEY TENDER: Jordan’s state grains buyer has issued a new international tender to purchase 120,000 tonnes of animal feed barley

- DURUM WHEAT TENDER: Algeria’s state grains agency OAIC has issued an international tender to purchase a nominal 50,000 tonnes of durum wheat

- RICE TENDER: Turkey’s state grain board TMO has issued an international tender to purchase a total 40,000 tonnes of rice

- WHEAT TENDER: A government agency in Pakistan has issued a new international tender to purchase and import 500,000 tonnes of wheat

- WHEAT TENDER: Jordan’s state grain buyer has issued an international tender to buy 120,000 tonnes of milling wheat which can be sourced from optional origins

US BASIS/CASH

- Spot basis bids for corn and soybeans shipped by barge to U.S. Gulf export terminals were steady to firmer on Tuesday as values stabilized after a recent slide, traders said.

- Concerns about receding river levels and only limited precipitation in the forecast underpinned the market. A rise in water levels on the lower Mississippi River last week allowed shippers to clear a backlog of heavy-loaded barges that had been stalled for weeks due to low water.

- Spot barge freight rates held steady on Midwest rivers on Tuesday. Values, however, remain supported by tight supplies of empty vessels, brokers said.

- Cash market activity was light on Tuesday. Soybean traders reported little fresh buying interest from China. Buyers there are still in need of U.S. shipments for late December through at least February, traders said.

- CIF soybean barges loaded in November were bid 2 cents higher at 150 cents over January. December barge bids were up 2 cents at 140 cents over futures.

- Export premiums for soybeans shipped in the first half of December were flat at around 200 cents over futures. Last-half December offers held at 195 cents over futures.

- CIF corn barges loaded in November were bid 3 cents higher at 130 cents over December.

- Corn export premiums for early December loadings were steady at 170 cents over December. Late-December export premiums were also unchanged at 155 cents over futures.

- Spot basis bids for corn softened in a few locations in the western Midwest on Tuesday while soybean basis bids were mostly unchanged in thin trade ahead of the U.S. Thanksgiving holiday weekend, dealers said.

- The corn basis fell by 10 cents at Blair, Nebraska, site of a large processing plant, where the basis had been firming in recent weeks.

- The rail corn basis fell by 5 cents at Hereford Texas, as well.

- Country movement of corn and soy has slowed in recent weeks as farmers wrapped up their harvest of those crops.

- Spot basis bids for hard red winter (HRW) wheat firmed sharply at an Oklahoma elevator on Tuesday, reflecting a lack of farmer grain offerings, but protein premiums declined in thin trade ahead of the U.S. Thanksgiving holiday, dealers said.

- The basis firmed by 35 cents at Catoosa, Oklahoma, to 50 cents over the K.C. December KWZ2 HRW wheat futures contract.

- Yet protein premiums for hard red winter wheat delivered by rail to or through Kansas City fell by 10 cents a bushel for all wheat grades, a possible sign of softening demand from domestic flour mills.

- Meanwhile, market talk swirled of U.S. millers booking European wheat, possibly of Polish or German origin, shipped into the U.S. East Coast at c&f prices at least $50 to $75 a tonne cheaper than U.S. hard red winter wheat. “Today the talk is that Polish wheat can be shipped to Florida in a range between $360 and $370 a tonne c&f,” a Polish trader said.

- Spot cash millfeed values were mostly steady to firm around the United States on Tuesday, underpinned by tightening supplies as flour mills are due halt operations over the U.S. Thanksgiving holiday, dealers said.

- Limited millfeed demand kept a lid on prices, however, as many end users stocked up on feed ahead of the holiday, dealers said.

- Spot offers in the Buffalo, New York, market were unquoted following heavy snow over the weekend.

- Spot basis offers for soymeal were steady to softer at the U.S. Gulf export terminal on Tuesday, following declines in the interior Midwest a day earlier as robust margins encouraged processors to maintain a strong crush pace, bolstering supplies of the feed ingredient, dealers said.

- Cash trade was subdued ahead of Thursday’s U.S. Thanksgiving holiday.

- CIF bids and offers for soymeal shipped to the Gulf were steady to down $5 per ton and FOB offers were down $3 to $8.

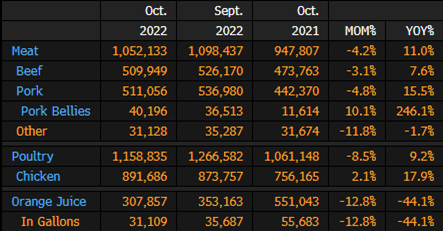

US Stocks of Beef, Pork and Chicken in Cold Storage

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Nov. 18 are based on six analyst estimates compiled by Bloomberg.

- Production seen higher than last week at 1.022m b/d

- Stockpile avg est. 21.304m bbl vs 21.298m a week ago

Brazil to Keep 10% Biodiesel Blend Through March, Hike in April

Brazil’s mandatory blend of biodiesel in diesel will be kept at 10% until March 31, according to a government statement that cited a decision by the National Energy Policy Council.

- Mandatory blend will increase to 15% from April

- NOTE: The incoming government may review levels after it takes office in January

- While most biodiesel in Brazil is produced from soybean oil, the council decided that “any technological route of production” may be part of the blend

Brazil Crushers Say Biodiesel Mandate May Curb Soy Processing

Brazil’s decision to maintain a 10% mandatory biofuel blend in diesel through March will discourage soybean processors from increasing the crush next year, potentially leading to higher bean exports, says Andre Nassar, head of crushing group Abiove.

- Soy crushing is seen steady in 2023, after falling 12% this year due to successive cuts in the biodiesel mandate, Nassar says by phone

- NOTE: Previous biodiesel rule set a 10% biodiesel blend through the end of the current year, rising to 14% from January and 15% from March

- A group of lawmakers linked to biodiesel producers said they’ll try to overturn the decision, which “limits biodiesel output expansion,” according to an emailed statement

- Lawmakers will also challenge a new rule allowing “any technological route of production” to be part of the blend

- That means Petrobras’ R5, a renewable diesel with a 5% blend of vegetable oil, may be used to meet the mandate

- Competition between biodiesel, which in Brazil is mostly made from soy oil, and the co-processed diesel is unfair: lawmakers

Pro-Bolsonaro Protests Halt Corn Traffic in Brazil’s Mato Grosso

Protesters block traffic on key roads for grains transportation from Mato Grosso, Brazil’s top growing state, to export ports in north Brazil, says Edeon Vaz Ferreira, head of the logistics branch at farmer group Aprosoja.

- Around 8am local time, blockades were reported in the cities of Lucas do Rio Verde, Primavera do Leste, Sapezal, Sorriso and Campos de Julio, the Road Federal Police said in a twitter post

- Protesters, including truckers, demonstrate against the defeat of President Jair Bolsonaro in the presidential election

- That means traffic on two major export corridors through northern ports is halted, including roads BR-163 and BR-364

- Blockades may delay shipments as grain trucks can’t reach terminals, Ferreira says

- NOTE: BR-163 is the path to reach the Miritituba river terminal, where barges are loaded to head to Barcarena and Santarem ports

- NOTE: BR-364 gives access to Porto Velho port

Bolstered by China, Brazil’s 2023 corn exports could reach up to 50 mln T -Anec

In the event Brazilian farmers harvest a full corn crop in 2023, exports of the agricultural commodity could reach up to 50 million tonnes next year, with a new trade protocol with China helping to bolster sales, a trade group said on Tuesday.

Sergio Mendes, director general at grain exporters group Anec, told Reuters in an interview Brazil could export as much as 5 million tonnes of corn to China alone in 2023. That would make Brazil a key supplier of corn to China alongside the United States, he said.

Brazil’s 2023 corn exports could get big boost from China

Brazilian corn exports could jump exponentially next year if farmers harvest a full crop and Chinese demand is strong, Brazil’s National Association of Grain Exporters said on Tuesday.

Brazil is poised to export 40 million tonnes to 50 million tonnes of corn next year, boosted by a new trade protocol with China and a potential bumper crop, said Sergio Mendes, director general of the group, known as Anec, in an interview.

Brazil could export as much as 5 million tonnes of corn to China alone in 2023, making it a key supplier to the country alongside the United States. China’s import demand is 18 million tonnes for the 2022/2023 cycle, according to the U.S. Department of Agriculture.

Brazilian corn exports to China of around 62,000 tonnes in the year through October were likely limited by a strict old protocol, Mendes said, citing Brazilian trade data.

Brazil’s overall export volumes could reach a record high after Beijing authorized a number of Brazilian corn exporters under the new protocol, he added.

At least three vessels were named to ship Brazilian corn to China, Agrinvest analyst Eduardo Vanin wrote in a note to clients, citing shipping schedules data. He said he expected more in coming weeks.

Traders in Asia have talked about six to eight vessels named to take Brazil’s corn to China as well, Vanin added.

Chinese customs updated its list of approved Brazilian corn exporters earlier this month, a move the Brasilia government said could jumpstart sales to the world’s second-largest economy.

On Tuesday, Anec projected 38.3 million tonnes of corn exports through end-November.

For full-year 2021, Brazilian exported 20.6 million tonnes of corn, reduced by a drought that spoiled part of the crop, Anec data showed.

First Brazilian Corn Shipment Is Heading to China This Week

- Vessel Star Iris is set to sail Wednesday from Santos

- Move was to diversify suppliers due to surging corn and dollar

The first vessel carrying Brazilian corn to China is set to sail Wednesday after a deal earlier this year between the two nations.

The Star Iris is moored in Santos port, loaded with about 68,000 metric tons of grain for Chinese trader Cofco Corp., according to the shipping agency Alphamar.

China made the decision to start buying Brazilian grains back in May in part to reduce dependence on the US and replace supplies from Ukraine cut off by the Russian invasion. In October, China approved over 130 facilities for export. The US accounted for about 70% of Chinese purchases in the 2020-2021 season.

Read more: China is set to import Brazilian corn as it looks to diversify from US supply

The market was expecting imports to start in December, since the US just finished harvesting a crop. But because US corn is the most expensive in the world, not only are the first exports happening ahead of the expected pace, but the total imports might be higher as well.

According to Alphamar, three more vessels are scheduled to leave in November, which could put the total shipments for this month close to 200,000 tons. There’s also another ship expected to sail in the first days of December.

Mexico Signals It May Allow Exceptions to US Corn-Import Ban

- Mexican president says considering yellow corn for livestock

- Mexico is second-largest export market for US corn producers

Mexican President Andres Manuel Lopez Obrador signaled he’s softening his stance on a planned ban of a type of US corn amid pressure from the US government.

AMLO, as he’s also known, said Tuesday that he’s considering allowing imports of genetically-modified yellow corn for livestock feed. That’s a change in tone from previous government statements to phase out GMO corn by early 2024.

“Yes, there is pressure from foreign companies, from foreign governments,” Lopez Obrador said at his morning news conference on Tuesday. “We are looking at yellow corn for animal feed.” Most US corn exports to Mexico are yellow corn, primarily used as livestock feed, while Mexico grows its own white corn, used for tortillas and other dishes.

If Mexico follows through with AMLO’s latest comments on the corn dispute, it would provide relief for US farmers, as Mexico is their second-largest export market. The issue has mobilized President Joe Biden’s administration, as well as policymakers in key corn-growing states, including Senators Chuck Grassley and Joni Ernst from Iowa.

The US Department of Agriculture “will continue to engage in conversations with Mexican officials about the critical importance of the bilateral trade relationship,” a spokesperson said. USTR didn’t immediately respond to requests for comment on Lopez Obrador’s remarks.

US officials have flagged concern about the yellow corn ban across a series of meetings in recent months, including a meeting between US Trade Representative Katherine Tai and her Mexican counterpart earlier this month.

Along with cuts to US corn exports, the planned ban could increase the price of groceries in Mexico at a time when food inflation is running at 14%, the fastest in more than two decades, said Kenneth Smith Ramos, a longtime Mexico trade and agricultural negotiator. It also further strains the US-Mexico relationship, he said.

“Trying to restrict imports of GMO corn — it’s really Mexico shooting itself in the foot,” said Smith Ramos, partner at consulting firm AGON, who previously led technical talks for the US Mexico Canada Agreement on trade under former president Enrique Pena Nieto.

Mexico Agriculture Minister Victor Villalobos has shown openness to finding a solution, according to people familiar with the talks, who asked not to be identified because they don’t have permission to speak publicly.

Meanwhile, Lopez Obrador has sent conflicting signals, saying as recently as last month that GMO yellow corn must be stopped to protect the health of the Mexican people. More broadly, he’s pushed to make Mexico self-sufficient in food and gasoline, a goal that he reiterated on Tuesday.

Slowing Ship Checks Hit Ukraine Crop Exports After Deal Renewal

- More than 100 vessels are awaiting inspection in Istanbul

- The pace of checks has slowed in November from previous months

Logistical hurdles continue to slow grain flows from Ukraine, even after a critical crop-export pact was renewed.

The Black Sea grain-export deal was extended last week for an additional 120-day run, aiding global food supplies. Inspections by the Joint Coordination Centre in Istanbul of all vessels heading in and out of Ukraine’s ports are a key condition of the agreement.

Unfavorable weather has held up checks for six days over the past week, according to daily JCC updates. Fumigation issues and vessels that were “not fully prepared” also delayed checks in that span, it said.

Some 109 vessels were waiting in Turkish waters as of Monday, mainly headed to Ukraine ports, the JCC said. Dmitry Timotin at shipping agent Inzernoexport GmbH Agency in Odesa said he doesn’t expect much demand for new vessels to transit the corridor until the queue eases.

Ten vessels, destined for its terminal, are waiting at Istanbul, including three that have been waiting for a month or more, Timotin said. “We need to load these ships first,” he said.

The center is staffed by Ukraine, Russia, Turkey and the United Nations — the four parties to the grain deal. The delegations are “discussing ways to increase the number of successful inspections conducted,” it said Monday.

Ukraine has cleared almost 12 million tons of crops since the corridor opened, and flows from farms to ports have picked up following the deal’s extension, Roman Slaston, head of the Ukrainian Agribusiness Club, said by phone.

Still, the bottlenecks have been persistent, and Ukraine’s president in October accused Russia of deliberately slowing exports.

Inspections briefly surged when Russia temporarily suspended its participation in the grain deal late last month, leaving Turkey and the UN to check ships on their own. Excluding that two-day spike, an average of just 2.5 outbound ships have been cleared daily so far in November, down from 4.9 in October and 4.2 in September, JCC data show.

EU 2022/23 soft wheat exports up 4% on year at 13.63 mln T

Soft wheat exports from the European Union in the 2022/23 season that started on July 1 had reached 13.63 million tonnes by Nov. 20, data published by the European Commission showed on Tuesday.

The total so far this season was 4% above the 13.09 million tonnes shipped by the same week in 2021/22, the data showed.

The year-on-year increase had narrowed from 10% in the Commission’s previous weekly data. However, traders are expecting 2022/23 exports to accelerate in the coming weeks after talk of large sales to countries including China.

A breakdown of the EU data showed France remained the leading EU soft wheat exporting country this season, with 5.58 million tonnes shipped, followed by Romania with 1.75 million tonnes, Germany with 1.57 million tonnes, Latvia with 1.16 million tonnes and Poland with 1.08 million tonnes.

Mexico to Use GMO Yellow Corn Just for Animal Fodder: AMLO

Mexico continues to analyze its corn policies and is facing pressure from external groups, said President Andres Manuel Lopez Obrador in a press briefing on Tuesday.

- Mexico won’t use GMO yellow corn for human consumption but exclusively for animal fodder, said AMLO, as the president is known

- Mexico will continue to use non-GMO white corn for human consumption

- Mexico plans to eliminate use of the herbicide glyphosate, because it has been shown to have adverse health effects

China to auction 40,000 tonnes of wheat from state reserves on Nov 30 – trade center

China will sell 40,000 tonnes of wheat from state reserves on Nov.30, the National Grain Trade Center said on Wednesday.

Putin promises further efforts to unblock more Russian fertiliser exports

President Vladimir Putin said on Wednesday Russian officials would work to unblock Russian fertilisers stuck in European ports and to resume ammonia exports via a pipeline through Ukraine.

At a meeting with Russian businessman Dmitry Mazepin, who gave up control of fertiliser producer Uralchem-Uralkali after he was hit by EU sanctions in March, Putin said Russia was ready to increase its fertiliser exports.

“The main problem was probably the fact that quite a lot of fertiliser was frozen in European ports,” Mazepin said at the meeting, which was shown on state TV.

There are 262,000 tonnes of Uralchem’s fertiliser frozen in ports of Estonia, Latvia, Belgium and the Netherlands, he said. Other producers, Acron and Eurochem, have 52,000 tonnes and almost 100,000 tonnes of their fertiliser stuck in Europe, respectively.

The cargoes are stranded because of the EU sanctions on the companies’ former owners, including Mazepin. Uralchem said on Nov. 12 it had agreed with the Netherlands, Estonia and Belgium to ship the fertiliser to African countries for free.

Putin said, however, that even these proposed donations were being blocked. He agreed to ask Russian officials to help, saying he had been contacted by several African leaders on the issue.

“All the time we are talking about the need to help the poorest countries and on issues completely unrelated to food security these supplies, even donations, are blocked,” Putin said. “It is totally unacceptable, but it is happening.”

Mazepin also asked for Putin’s further help with resumption of Russian ammonia exports via a pipeline running from Russia through Ukraine to the Black Sea.

The export of ammonia, used in fertiliser, was not part of last week’s renewal of the Black Sea deal allowing Ukraine’s grain shipments, though the United Nations has been optimistic Russia and Ukraine could agree on terms for the pipeline.

“We had hoped that when there was a continuation of the grain deal, which was recently made, this issue would also be resolved. But I would like to report to you that the Ukrainian side puts forward a number of political issues that are outside our competence,” Mazepin said.

Putin answered: “We will also work with the U.N., with our colleagues from the organisation. We will see what comes of it.”

Ukrainian President Volodymyr Zelenskiy said in September he would only back the resumption of ammonia exports via Ukraine if Moscow handed back prisoners of war, an idea the Kremlin rejected.

India Soaks Up Urea and Traders Ask for More

Lower prices and higher volume in India’s urea tender show a softening market. Traders expected India to purchase nearly 1 million metric tons of urea, but the offtake was 1.4 million mt, suggesting lengthy global supply. With the additional tonnage, India could defer its next tender until late December. Urea prices seasonally rise in 4Q on Indian and Brazilian buying, but Brazilian import demand has softened 7% vs. last year, making way for India to buy up the nutrient. India will bring two urea plants online this winter, adding 2.6 million mt of domestic capacity to the world’s largest importer. Awards for the most recent tender were $578.77 per mt East Coast cost-and-freight (CFR), down $76.23 CFR from the last done on Oct. 24.

CF, Yara and Nutrien are the largest publicly traded nitrogen producers.

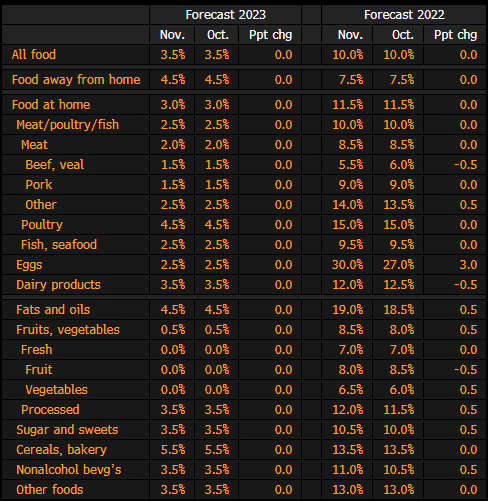

USDA Retail Food-Inflation Forecasts for 2022 and 2023

Egypt Commodities Exchange to Begin Operation Nov. 27

General Authority for Supply Commodities will begin offering wheat twice weekly to private mills on the new exchange, the Supply Ministry says in a statement.

- First offering will be on Nov. 27

- Wheat offered to come from country’s strategic reserves

U.S. farm agency to collect data on hemp, precision farming in census

The U.S. Department of Agriculture will for the first time collect data on farmers growing hemp and using technology to guide their farming decisions in the 2022 census of agriculture, which the agency launched on Tuesday.

The census, an effort to count and gather information about every farm and ranch in the country that is conducted every five years, is critical to USDA’s funding and policy decisions, said Donald Buysse, chief of the census planning branch at the National Agricultural Statistics Service (NASS), an agency of USDA that administers the survey.

“In terms of the comprehensive nature of the census, there’s not anything that comes close to it,” Buysse said.

USDA began regulating hemp production in 2021 and this census will be the first to publish data on hemp producers, who grow the crop for fabric, food products, and cannabidiol (CBD). And the agency will be identifying farmers who use “precision agriculture,” data-collection technology that guides planting decisions.

NASS will make a particular effort to collect data from farmers of color, Buysse said, as they have historically been underrepresented in the census. Regional and state offices will work with community organizations to reach Black farmers in the Southeast, among other groups, Buysse said.

About 70% of the nation’s 2.2 million farms responded to the 2017 census, Buysse said, and response rates have been trending downward. Farmers are required by law to fill out the survey, but NASS has no enforcement mechanism, he said.

“The incentive [is] the idea that you’re providing data as a useful tool for your community,” he said.

USDA will collect responses until Feb. 6 and plans to publish the data in February 2024, said Buysse.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |