Happy Thanksgiving from all of us at Total Farm Marketing!

Friday, November 25, 2022: The CME closes at noon, and the Total Farm Marketing office closes at 1:00.

Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Grain calls are mixed. SF is near 14.36. SMF is near 407.4. BOF is near 72.20. CH is near 6.66. WH is near 8.13. KWH is near 9.19. MWH is near 9.52. US stocks are higher. US Dollar is lower. Crude is higher. Gold, silver, copper, coffee, cocoa and sugar are higher.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

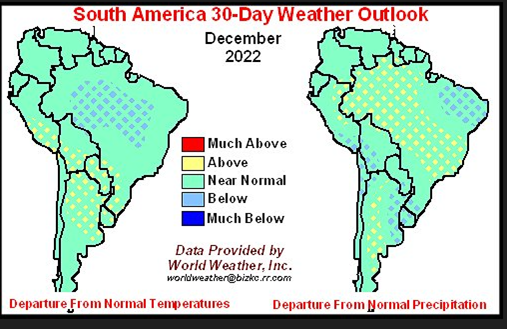

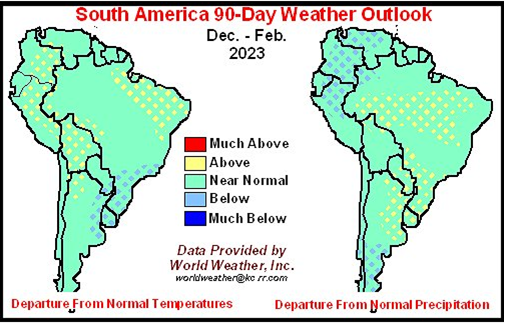

Those who are bearish corn are looking at cheaper SOAM and Ukraine premiums versus US, continued problems on the Mississippi River, and the growing potential for a US rail strike. Those who are bullish US corn remind us of dryness in Argentina, the rally in DCE corn suggesting all is not well for the Chinese corn balance sheet, and the recent massive missile bombing of Ukraine leaving almost 50% of the country without power. It remains unclear for how long power outages will leave Ukraine ports inoperable.

Daily COVID cases in China soared above 30,000, bringing in talk of more shutdowns and lockdowns. Not a positive for the Chinese and world economy.

As expected, Brazilian President Bolsonaro has officially challenged election results, leading to more road blockades. All slowing or halting grain movement in Mato Grosso. This was followed by the head of the Superior Electoral Tribunal, ruling the Liberal Party’s request for a re-count and throwing out certain voting machines was absolutely false. The Tribunal said the request from Bolsonaro and the Liberal Party was aimed at “encouraging criminal and anti-democratic movements” by Bolsonaro supporters seeking to fight the election result. The Brazilian Real settled higher on this news.

The State of Parana is expected to announce an increase in production taxes on Ag products, including corn and soybeans. Parana produces over 20 mmt of both corn and beans.

So far this week the Brazilian farmer has sold 600,000 tonnes of soybeans and 300,000 tonnes of corn. Bean premiums are mostly unchanged, meal $1 to $2 firmer, soyoil steady, and corn up 3-5 cents. On the week China has bot 2-3 FM Brazil and 8-9 DJ USG soybean cargos.

The November Brazilian export lineup for soybeans is 2.442 mmt (1.579 mmt loaded), for soymeal 1.500 mmt (1.115 mmt loaded), for soyoil 188,000 tonnes (137k loaded), for corn 7.198 mmt (3.938 mmt loaded), and for wheat 153,000 tonnes (none loaded).

So far on the week the Argentine farmer has sold zero soybeans and 70,000 tonnes of corn. Bean premiums on the week are steady, soymeal up $2 to $3, soyoil steady, and the corn market dead quiet.

The November export lineup for Argentine soybeans is 954,000 tonnes (867k loaded), for soymeal 2.581 mmt (1.710 mmt loaded), for soyoil 456,000 tonnes (380k loaded), for corn 2.056 mmt (1.396 mmt loaded), and for wheat 211,000 tonnes (92k loaded).

The PBoC lowered the reserve requirement ratio for cash held at Chinese banks by 25 basis points. There was talk yesterday it might have been as big as 50 basis points. This will free up over $70 billion for banks to lend. The rate cut will take effect on December 5th. It also follows a heavy dose of government actions to aid the Chinese economy, specifically a rescue package for the beleaguered property sector. The last time the PboC cut the RRR was April, another 25 basis point cut.

All at a time when Chinese local government burdens are swelling, maybe becoming unsustainable. Reports suggests the 31 provincial governments in China have a debt to GDP ratio just under 120% of income. The central government in Beijing has set 120% as the threshold for debt to income. Over the next 5 years there is over $2.1 trillion in bonds coming due for these 31 provinces, about 40% of their total outstanding debt. The major cause of this potential financial squeeze, property markets. Revenues from land sales in China’s provinces make up 30% of total government revenue. This as more and more Yuan, reported to be trillions of Yuan per year, are doled out to companies in the form of tax breaks. This is not being done to give Chinese companies the ability to expand, but to merely operate on a daily basis. We may be at a juncture in time when the Chinese central government will be forced to take on this swelling local debt. Or local governments will be forced to slow down or halt investment into projects, cut public spending, and/or sell assets. None of this is sustainable, all of this will need to be addressed by Beijing.

The minutes from the November FOMC minutes were released on Wednesday. This FOMC meeting concluded it would soon be appropriate for the Fed to slow the pace of rate increases. This is a clear signal the Fed will go with a 50 basis point rate hike on December 14. At the same time several officials suggested the ultimate level of Fed funds necessary to achieve the committee’s inflation goals was somewhat higher than they had previously expected. Thus leaving the door open for the Fed fund target rate to move towards 6% versus the talked about 5% level. It was just 3 months ago Fed officials were talking about a Fed funds target of 4.4% by the end of 2022 and 4.6% in 2023.

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |