Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 6 3/4 in SRW, up 6 in HRW, up 1 1/2 in HRS; Corn is up 2 1/2; Soybeans up 12 1/4; Soymeal up $0.44; Soyoil up 0.40.

For the week so far wheat prices are down 11 1/4 in SRW, down 20 1/2 in HRW, down 15 1/4 in HRS; Corn is down 1/2; Soybeans up 29 3/4; Soymeal up $0.34; Soyoil up 1.63.

For the month to date wheat prices are down 111 in SRW, down 81 1/4 in HRW, down 53 3/4 in HRS; Corn is down 24 3/4; Soybeans up 52 1/4; Soymeal down $7.10; Soyoil up 2.77.

Year-To-Date nearby futures are down -1% in SRW, up 13% in HRW, down -4% in HRS; Corn is up 12%; Soybeans up 10%; Soymeal down -1%; Soyoil up 37%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans up 1 yuan; Soymeal up 29; Soyoil up 134; Palm oil up 122; Corn down 26 — Malaysian palm oil prices overnight were up 19 ringgit (+0.45%) at 4238.

There were changes in registrations (308 Corn, -5 Soybeans, 500 Soyoil). Registration total: 3,056 SRW Wheat contracts; 0 Oats; 308 Corn; 121 Soybeans; 539 Soyoil; 278 Soymeal; 5 HRW Wheat.

Preliminary changes in futures Open Interest as of November 29 were: SRW Wheat down 7,089 contracts, HRW Wheat up 573, Corn down 31,715, Soybeans up 3,926, Soymeal down 8,678, Soyoil down 2,292.

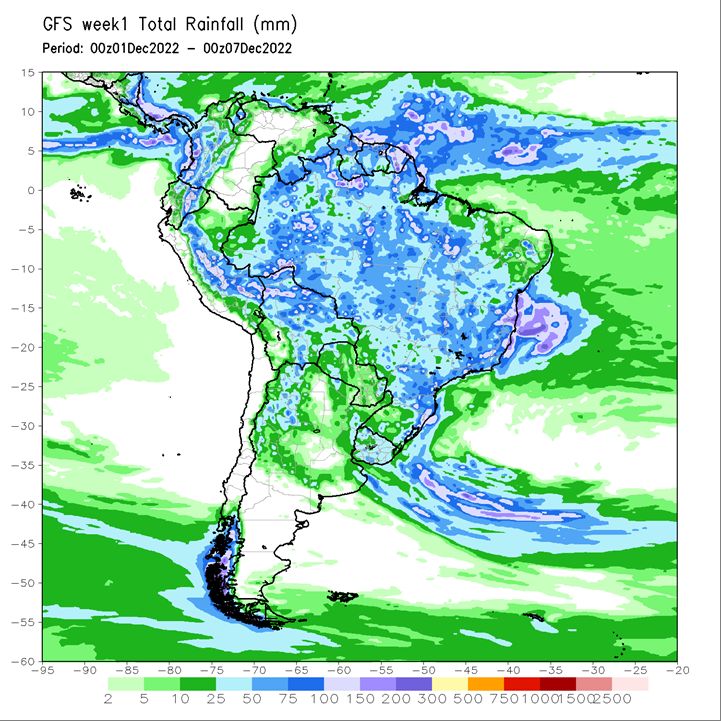

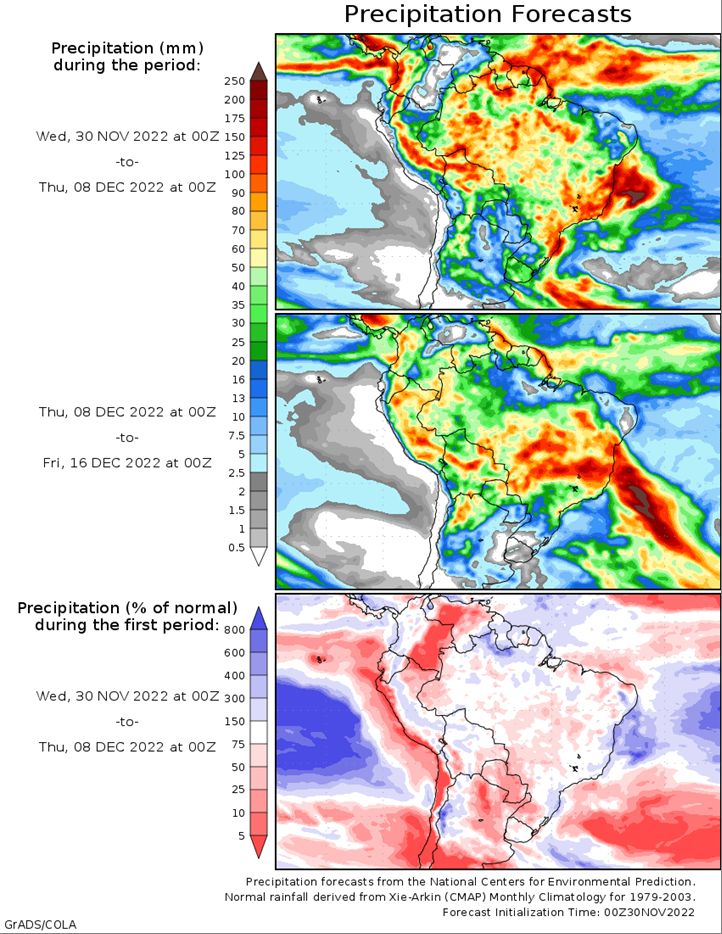

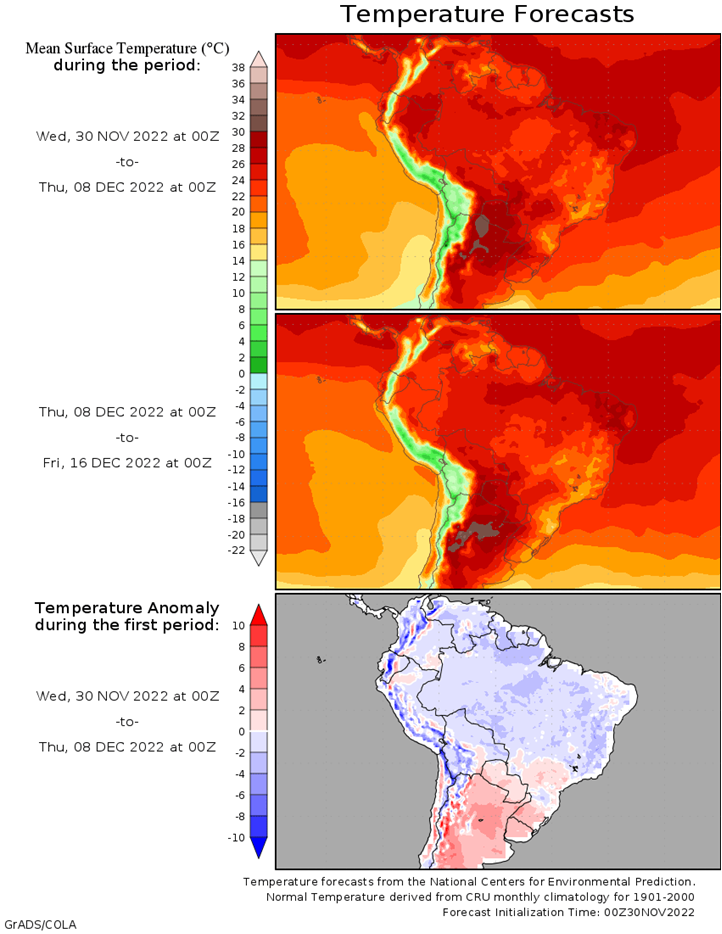

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana Forecast: Isolated showers north through Thursday. Scattered showers Friday-Saturday. Temperatures near to above normal through Saturday. Mato Grosso, MGDS and southern Goias Forecast: Scattered showers through Saturday. Temperatures near normal through Saturday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires Forecast: Isolated showers through Thursday. Mostly dry Friday-Saturday. Temperatures near normal Wednesday-Friday, above normal Saturday. La Pampa, Southern Buenos Aires Forecast: Mostly dry Wednesday-Saturday. Temperatures above to well above normal Tuesday, near normal Wednesday-Friday, above normal Saturday.

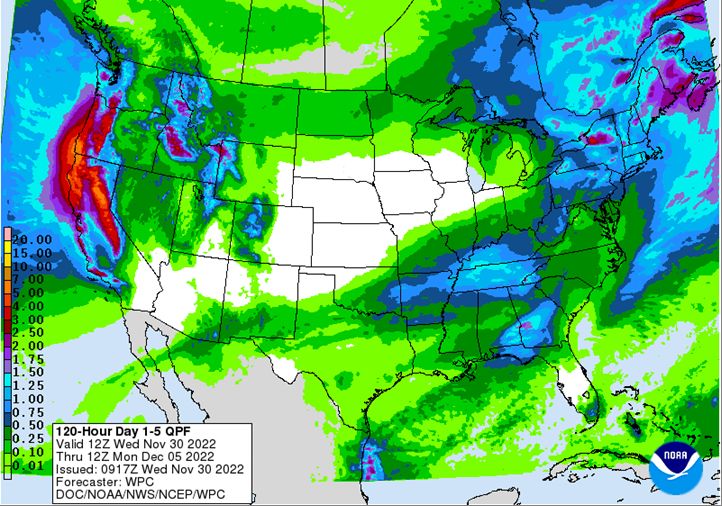

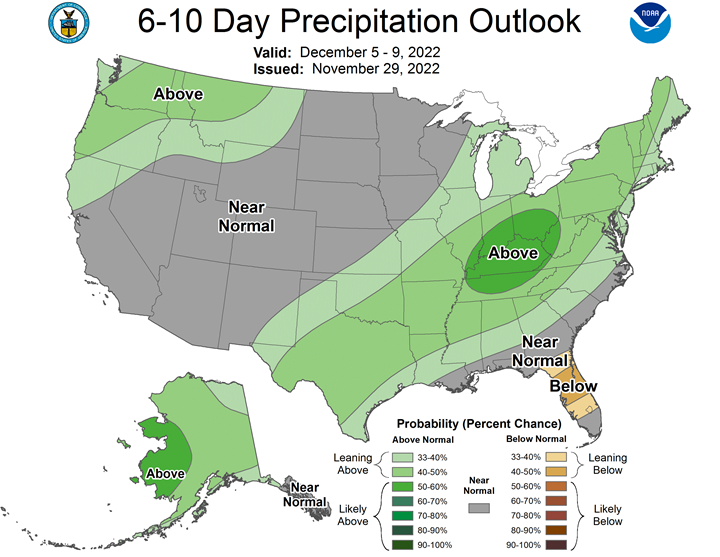

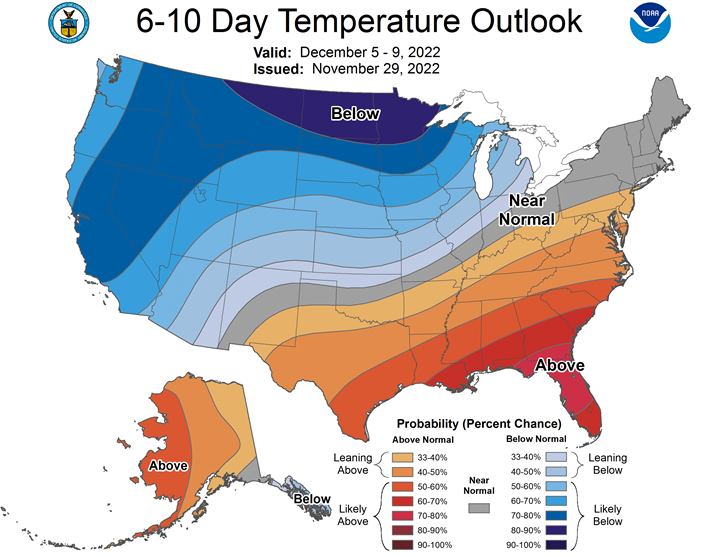

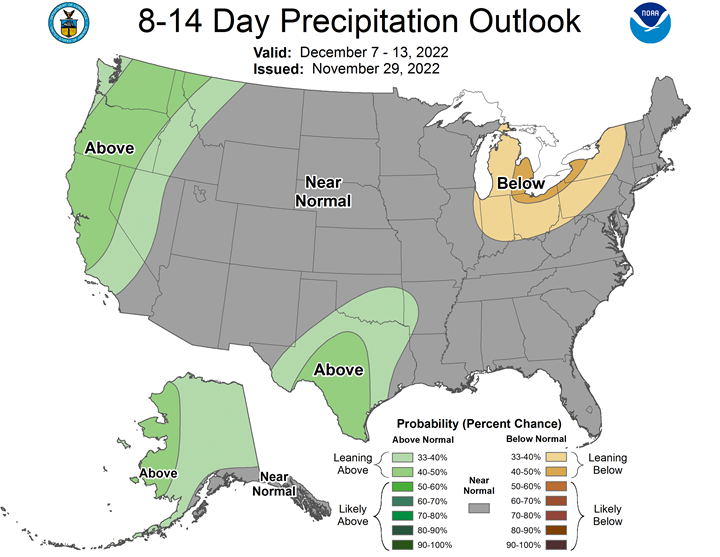

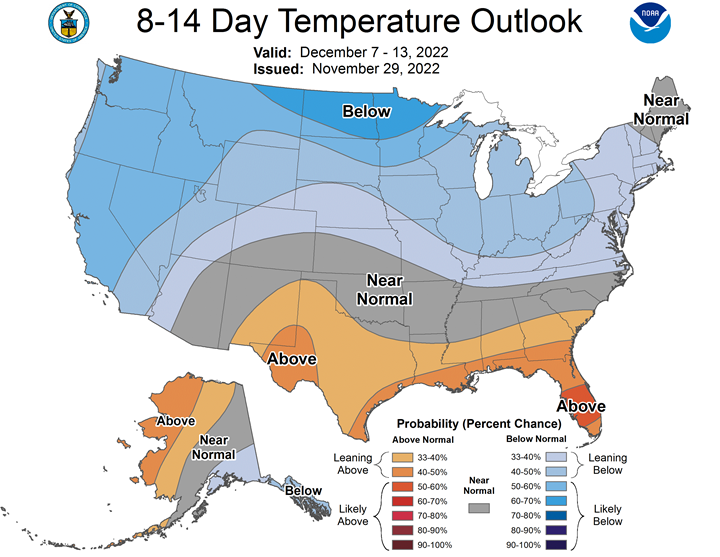

Northern Plains Forecast: Isolated showers Wednesday. Mostly dry Thursday. Scattered snow Friday. Mostly dry Saturday. Temperatures below to well below normal Wednesday, near normal Thursday, near to well below normal Friday-Saturday. Outlook: Mostly dry Sunday. Scattered snow Monday-Wednesday. Mostly dry Thursday. Temperatures near to well below normal Sunday, below to well below normal Monday-Thursday.

Central/Southern Plains Forecast: Mostly dry Wednesday-Friday. Isolated to scattered showers south Saturday. Temperatures below normal Wednesday, near to above normal Thursday, near to above normal Friday-Saturday. Outlook: Isolated to scattered showers Sunday-Monday. Mostly dry Tuesday-Thursday. Temperatures above normal Sunday-Monday, below normal north and above normal south Tuesday, near to below normal Wednesday-Thursday.

Western Midwest Forecast: Mostly dry Wednesday-Thursday. Snow north Friday-Saturday. Temperatures below normal Wednesday-Thursday, above normal Friday, below normal north and above normal south Saturday.

Eastern Midwest Forecast: Scattered showers Wednesday. Mostly dry Thursday-Friday. Isolated showers Saturday. Temperatures near to above normal Wednesday, below normal Thursday, near to above normal Friday-Saturday. Outlook: Scattered showers Sunday-Tuesday. Mostly dry Wednesday-Thursday. Temperatures near to above normal Sunday-Monday, near to below normal Tuesday-Thursday.

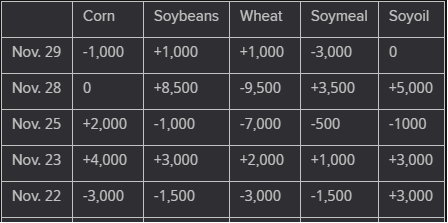

The player sheet for Nov. 29 had funds: net buyers of 1,000 contracts of SRW wheat, sellers of 1,000 corn, buyers of 1,000 soybeans, sellers of 3,000 soymeal.

TENDERS

- WHEAT SALES: Turkey’s state grain board TMO has provisionally purchased an estimated 455,000 tonnes of wheat in an international tender for that volume on Tuesday, with most expected to be sourced from Ukraine

- CORN SALE: South Korea’s Major Feedmill Group (MFG) has purchased an estimated 70,000 tonnes of animal feed corn in an international tender for up to 140,000 tonnes on Tuesday.

- FAILED WHEAT TENDER: Jordan’s state grain buyer is believed to have made no purchase in an international tender to buy 120,000 tonnes of milling wheat which closed on Tuesday.

PENDING TENDERS

- RICE TENDER: Turkey’s state grain board TMO issued an international tender to purchase a total 40,000 tonnes of rice

- WHEAT TENDER: A government agency in Pakistan postponed the deadline for submission of price offers in an international tender to purchase and import 500,000 tonnes of wheat to Nov. 30 from Nov. 28 previously

- BARLEY TENDER: Turkey’s state grain board TMO issued an international tender to purchase an estimated 495,000 tonnes of animal feed barley.

- WHEAT TENDER: Algeria’s state grains agency OAIC has issued an international tender to buy soft milling wheat to be sourced from optional origins.

US BASIS/CASH

- Basis bids for soybeans shipped by barge to U.S. Gulf export terminals were mixed on Tuesday on lower freight costs and moderate spot demand as the peak U.S. export season will be winding down in the coming weeks, traders said.

- Accelerated farmer marketings in Argentina, incentivized by a more generous dollar exchange rate for sales of soybeans, were expected to weaken export prices and trigger additional export sales through the end of the year. U.S. soybean exports are likely to be impacted, traders said.

- CIF corn basis bids were mostly flat on muted demand.

- Easing barge freight rates capped corn and soybean basis gains. Spot freight rates on Midwest rivers were down 25 to 50 points on Tuesday in a second day of moderate declines.

- Rains across the Delta region were forecast to raise water levels on the lower Mississippi River. Low water had restricted barge shipping since September.

- CIF soybean barges loaded in November were bid 146 cents over January, down from trades at 150 cents over on Monday. December barge bids gained 5 cents to 145 cents over futures.

- Export premiums for soybeans shipped in the last half of December shed 5 cents to around 165 cents over futures.

- CIF corn barges loaded in November were bid steady at 130 cents over December. December barges were flat at 122 cents over futures.

- Corn export premiums for late December loadings were steady at 145 cents over December futures.

- Spot basis bids for corn firmed for the second straight day at elevators serving the truck market in the eastern U.S. Midwest on Tuesday, grain dealers said.

- Country movement of corn has been slow in recent weeks, making it hard for dealers to find enough supplies to fill trains.

- Cash bids for corn were steady to firm at the region’s truck elevators, and flat at river terminals and processors.

- Soybean bids were unchanged at river terminals and truck elevators, and steady to weak at processors.

- Farmers were showing little interest in booking deals for crops they have recently put in storage bins, dealers said.

- Spot basis bids for soybeans and corn were steady to firm at elevators along U.S. Midwest rivers early on Tuesday, grain dealers said.

- Cash bids for corn were steady to weak at the region’s interior elevators and ethanol plants, and flat at processors.

- Interior bids for soybeans were steady to weak at processors and unchanged at elevators.

- Farmer sales of both commodities was slow.

- Growers were content to keep recently harvested crops in storage bins and wait to see if prices rise in early 2023, dealers said.

- Spot basis bids for hard red winter wheat held steady at grain elevators across the southern U.S. Plains on Tuesday.

- Country movement was slow.

- Recent weakness in the futures market that has pulled cash prices below $9 a bushel in some areas chilled growers’ interest in booking new deals for their wheat, an Oklahoma dealer said.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City were unchanged for all grades of wheat, according to CME Group data.

- Spot U.S. cash millfeed values were mostly steady to firm on Tuesday, with prices in the southern Plains underpinned by thin supplies following flour mill downtime around the Thanksgiving holiday last week, dealers said.

- Supplies in the Midwest and Eastern U.S. were more ample, which kept a lid on prices, dealers said.

- Prices for millfeed delivered in December were at a $5 to $10 per ton premium to spot values as supplies are due to tighten as mills slow their flour grind during the Christmas and New Year holidays, dealers said.

- Spot basis offers for U.S. soymeal were unchanged at processors in both the truck and rail markets on Tuesday, dealers said.

- On the export front, offers were strong for both soymeal shipped by barge to the U.S. Gulf and for loadings onto ocean-going vessels at export terminals.

- The export market was supported by tight global supplies of soymeal, with uncertainty about the availability of Argentine offerings underpinning the U.S. market, a trader said.

- Domestic demand was strong, with end users finalizing their orders for December shipments, a Minnesota dealer said.

- Livestock and poultry producers often book extra soymeal for December to ensure they have enough supplies on hand during Christmas, when processors are shut down.

- Rail traffic often tends to slow during the holiday season, which can delay delivery of previously booked orders.

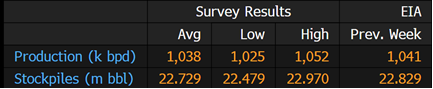

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Nov. 25 are based on four analyst estimates compiled by Bloomberg.

- Production seen slightly lower than last week at 1.038m b/d

- Stockpile avg est. 22.729m bbl vs 22.829m a week ago

USDA October soybean crush seen at 195.9 million bushels

U.S. soybean crushings likely jumped to a 10-month high in October to 5.877 million short tons, or 195.9 million bushels, according to the average forecast of eight analysts surveyed by Reuters ahead of a monthly U.S. Department of Agriculture (USDA) report.

The October crush would be up from a one-year low of 167.6 million bushels in September but below the October 2021 crush of 196.9 million bushels. It would also be the third largest October crush on record and the largest crush for any month since December 2021.

Crush estimates ranged from 194.0 million bushels to 197.1 million bushels, with a median of 196.2 million bushels.

The USDA is scheduled to release its monthly fats and oils report at 2 p.m. CST (2000 GMT) on Thursday.

U.S. soyoil stocks as of Oct. 31 likely rose to 2.107 billion lbs, based on the average of estimates from five analysts. If realized, the supply would be up from a 23-month low of 1.999 billion at the end of September but below stocks of 2.386 billion lbs at the end of October last year.

Estimates for soyoil stocks ranged from 2.060 billion to 2.193 billion lbs, with a median of 2.100 billion lbs.

National Oilseed Processors Association (NOPA) members, which account for about 95% of soybeans processed in the United States, crushed 184.464 million bushels of soybeans last month, up 16.7% from September and up 0.3% from October 2021. Soyoil supplies held by NOPA members as of Oct. 31 rose to 1.528 billion lbs.

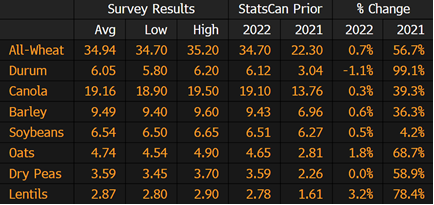

Canada 2022 Crop Production Survey Ahead of StatsCan Report

The following table shows results of a Bloomberg survey of as many as five analysts about 2022 crop production in Canada.

- Statistics Canada in Ottawa is scheduled to release its estimates on Dec. 2 at 8:30am ET

- Analysts see 0.7% more wheat production in 2022 than StatsCan’s previous est., according to the avg in the survey

- Estimates range from 34.7m tons to 35.2m tons

- Canola seen slightly higher than the previous est.

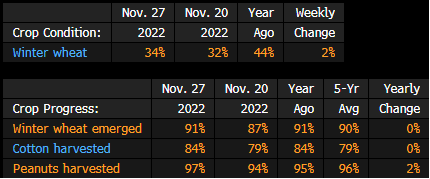

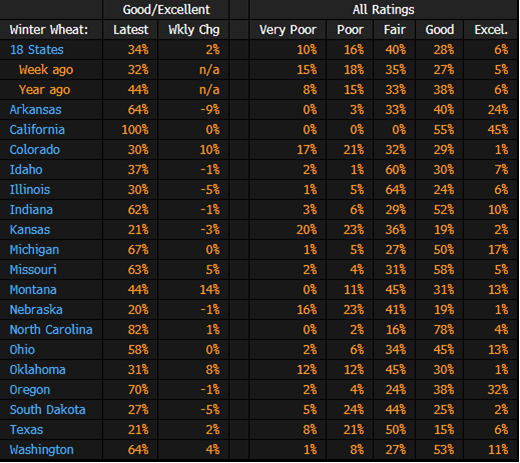

US Crop Progress and Conditions for Nov. 27: Summary

Access to Brazil’s Paranagua port blocked by landslides – authority

Brazil’s Paranagua port authority said on Tuesday that landslides caused by heavy rainfall blocked road and rail access to the port, the second busiest for grain exports in the country.

In a statement, the authority said other port operations are normal as ships continue to unload and load products stored at the port’s warehouses.

Floods Slash Malaysia Palm Oil Output, Plantations Chief Says

Malaysian palm oil output will likely drop by 5% to 8% in November from the previous month after heavy rains and floods disrupted plantation operations, according to United Plantations Bhd.

Rainfall was much higher than usual in October and November, which prevented harvesting and transport of palm fruit in several producing regions, Chief Executive Director Carl Bek-Nielsen said in an interview in Kuala Lumpur.

Supply worries due to floods have sent benchmark palm oil prices to near a four-month high in November. It’s mainly due to a weather pattern known as La Nina, which brings more rains to oil-palm regions in Indonesia and Malaysia, and drier conditions to soybean and corn areas in Argentina and Brazil.

Many oil palm estates had water levels that were several feet high in the first 15 days of November, which will lead to crop losses, Bek-Nielsen said on the sidelines of a conference. The main areas affected include Perak, Pahang and Johor in Malaysia, as well as Kalimantan in Indonesia.

More details from the interview:

Severe labor shortage in Malaysia is being overcome; however the earlier shortages had affected harvesting especially during peak production months

- Malaysia’s total palm oil production is estimated at 18.2 million to 18.4 million tons this year; the second-biggest producer has lost at least 1.2m tons of palm oil in fields, which translates to about 6m tons of fresh fruit bunches

- “Now there’s a lot of new labor coming in, and that is alleviating the problem. Production is not dropping off the cliff because now there are people to harvest the crop,” Bek-Nielsen said.

- “If we had those people four months ago, then production would have been super high.”

Brazil Corn Exports Seen Reaching 5.940 Million Tns In November – Anec

- BRAZIL SOY EXPORTS SEEN REACHING 2.051 MILLION TNS IN NOVEMBER VERSUS 2.268 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.485 MILLION TNS IN NOVEMBER VERSUS 1.553 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 5.940 MILLION TNS IN NOVEMBER VERSUS 6.411 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

EU 2022/23 soft wheat exports up 3% on year at 13.89 mln tonnes

Soft wheat exports from the European Union in the 2022/23 season that started on July 1 had reached 13.89 million tonnes by Nov. 27, up 3% from 13.45 million by the same week in 2021/22, weekly data published by the European Commission showed on Tuesday.

The year-on-year increase has narrowed from 10% two weeks ago, although traders are expecting 2022/23 exports to get a boost in the coming weeks after talk of large French sales to China.

A breakdown of the EU data showed France remained by far the leading EU soft wheat exporting country this season, with 5.65 million tonnes shipped, followed by Romania with 1.81 million tonnes, Germany with 1.57 million tonnes, Latvia with 1.19 million tonnes and Poland with 1.11 million tonnes.

India eyes bumper wheat harvest in 2023 as record prices lead to more sowing

India is expected to harvest a bumper wheat crop in 2023 as high domestic prices and replenished soil moisture help farmers surpass last year’s planting, while an intense heat-wave cut output this year.

Higher wheat output could encourage India, the world’s second biggest producer of the grain, to consider lifting a May ban on exports of the staple and help ease concerns over persistently high retail inflation.

Although the wheat area has almost reached a plateau in India’s traditional grain belts in the northern states such as Punjab, Haryana and Uttar Pradesh, growers are planting the crop on some fallow land in the country’s west where farmers have traditionally grown pulse and oilseeds.

“Wheat prices are very attractive,” Nitin Gupta, vice president at Olam Agro India, told Reuters. “We can see a big jump in states like Gujarat and Rajasthan, where farmers could bring barren land under wheat.”

Domestic wheat prices WHE-ATDEL-NCX have jumped 33% so far in 2022 to a record 29,000 rupees ($355.19) per tonne, far above the government-fixed buying price of 21,250 rupees.

The surge in wheat prices is despite the ban on exports of the grain, indicating a far bigger drop in this year’s output.

India, also the world’s second biggest consumer of wheat, banned exports of the staple after a sharp, sudden rise in temperatures clipped output even as exports picked up to meet the global shortfall triggered by Russia’s invasion of Ukraine.

India grows only one wheat crop in a year, with planting in October and November, and harvests from March.

Farmers have planted wheat on 15.3 million hectares since Oct. 1, when the current sowing season began, up nearly 11% from a year earlier, according to provisional data released by the Ministry of Agriculture & Farmers’ Welfare.

In Punjab and Haryana, India’s bread basket states, a lot of farmers decided to bring forward their planting, believing the early-sown varieties would be ready for harvests before temperatures tend to go up in late March and early April, said Ramandeep Singh Mann, a farmer.

Higher temperatures shrivel the wheat crop.

“In Punjab, farmers have already planted wheat on 2.9 to 3.0 million hectares of its normal area of around 3.5 million hectares,” Mann said.

To cash in on higher prices, farmers are also opting for superior wheat varieties such as Lokwan and Sharbati, the premium grades that fetch higher returns.

“Wheat area has gone up, but the crop will require lower temperatures in the weeks to come, and then the weather needs to remain favourable in March and April when the crop ripens,” said Rajesh Paharia Jain, a New Delhi-based trader.

Ukrainian grain exports via Poland rise by 50%, minister says

Around 450,000 tonnes of Ukrainian grain are being transported via Poland monthly, over 50% more than in the middle of the year, Poland’s infrastructure minister said on Wednesday, as Warsaw helps its neighbour to increase its food exports.

Ukraine is one of the world’s leading grain and oilseed exporters and a Russian blockade of its ports after Moscow invaded the country in February drove a quest for alternative routes.

After an almost six-month blockade, three Ukrainian Black Sea ports were unblocked at the end of July under a deal between Moscow and Kyiv brokered by the United Nations and Turkey.

But Russian support for the pact has wavered in recent weeks to the extent Moscow temporarily withdrew at the end of October, raising questions about the long-term future of the deal that was extended for 120 days in the middle of November.

“Within the so-called solidarity lanes about 452 thousand tonnes of (Ukrainian) grains are currently transported through the territory of Poland, over 50% more than in the middle of the year,” Andrzej Adamczyk said.

“Compared to October last year, the increase in grain transport in the same period of 2022 is over 16 times,” he added.

First shipment of Russian fertilizer heads for Africa, UN says

The first shipment of Russian-produced fertilizer left the Netherlands on Tuesday en route to Malawi under a previously brokered United Nations export deal, a spokesperson for the UN secretary general said in a statement.

The shipment of 20,000 metric tons of fertilizer is the first of a series of exports destined for African countries in the coming months, the spokesperson said, adding that Tuesday’s load will be sent to Malawi via Mozambique.

China’s sow herd up 0.4% in October vs month ago – agriculture ministry

China’s sow herd increased by 0.4% in October from the month before to 43.79 million sows, according to data published by the Ministry of Agriculture and Rural Affairs on Wednesday.

The herd was also 0.7% larger than a year ago, the data showed.

Metals, Coffee, Cotton to See Big Inflows in Index Reweigh: Citi

The annual commodity index reweighing should bring inflows of about $4.3b for industrial metals, led by copper, aluminum and lead, according to Citigroup analysts including Aakash Doshi and Ed Morse.

- Projections use live weights and prices as of late Nov. and assume ~$110b notional assets under management each for Bloomberg Commodity Index and the S&P GSCI

- “The two worst performing commodity sectors this year, industrial and precious metals, should see the largest index rebalancing inflows to bring their weights back in line with the target levels”

- Gold and silver would also see $1.1b and $0.3b of inflows respectively

- Other commodities that may see inflows greater than $1 billion include coffee and cotton

- Bank plans to rerun calculations in early January before scheduled rebalance from 5th to 9th business days of that month

- BCOM 2023 target weights show minimal changes y/y except for the inclusion of lead

- Energy sector should see a tiny gain in target weight, with small increase for Brent offset by decrease of same size for WTI

- Grains and softs should see the total weight unchanged y/y, with gains in coffee, Kansas wheat and bean oil offsetting losses in sugar, corn, CBOT wheat

- For the S&P GSCI Index, the energy sector should see another sizable gain in target weights, offset by lower weights for all other commodity sectors

- Gold should see the biggest drop

Malaysia Nov. Palm Oil Exports +5.6% M/m: Intertek

Following is a summary of Malaysia’s Nov. palm oil exports according to Intertek Testing Services.

- Total exports for Nov. 2022: 1.58m tons

- Crude palm oil exports: 423,475 tons, 26.8% of total

- India & Subcontinent led all destinations for total exports: 415,120 tons

Malaysia Keeps Crude Palm Oil Export Tax at 8% in December

Gazetted price for crude palm oil at 3,847.24 ringgit ($866) a ton, which incurs the maximum export tax of 8%, according to a statement from the customs department posted on the Malaysian Palm Oil Board’s website.

- NOTE: Tax has been kept at 8% since Jan. 2021, following government exemption in July-December 2020

- NOTE: Export duty structure starts at 3% when FOB prices for CPO are in the 2,250-2,400 ringgit per ton range

- Maximum tax rate is 8% when prices are above 3,450 ringgit per ton

Mexico open to deal with U.S. on GMO corn as farmers demand clarity over ban

Mexican President Andres Manuel Lopez Obrador said on Tuesday he is seeking a deal with Washington after the United States threatened legal action over Mexico’s plan to ban genetically modified (GMO) corn in 2024.

After meeting with Mexican officials on Monday, U.S. Secretary of Agriculture Tom Vilsack said Mexico’s decree could violate the United States-Mexico-Canada (USMCA) trade pact.

Lopez Obrador looked to assuage those concerns during a regular news conference on Tuesday, saying the ban was focused on genetically modified yellow corn for human consumption.

“Our position is not closed off,” he said.

Mexico is one of the biggest buyers of U.S. corn with American farmers sending about 17 million tonnes of corn to Mexico annually.

U.S. farmers have been particularly concerned about the threat of a ban on GMO yellow corn for animal feed.

But Lopez Obrador indicated GMO corn for animal feed would continue to be allowed after the decree comes into force, although it remained unclear exactly how that will work or for how long that exception might last. That corn would be subject to an annual permit from Mexico’s health regulator COFEPRIS, he said.

“We offered to extend the term to two years, in the case of yellow corn used for (livestock feed),” Lopez Obrador said without expanding on when that extension would start and end.

Neither did Lopez Obrador specify whether Mexico still planned to reduce overall yellow corn imports by about half in 2024, which a top Mexican official told Reuters last month.

Mexico’s GMO corn ban has been plagued by confusion over how it will be implemented.

Supporters of the ban argue genetically modified corn could contaminate Mexico’s native varieties.

Mexico’s agriculture ministry declined to comment. A spokesperson for the president did not respond to a request for comment.

The United States has called for clarity and warned of severe economic fallout from a ban.

“Since biotech corn accounts for 90% of American-grown corn, blocking any imports using this safe and environmentally friendly technology would not only be a major blow to the Mexican people and the economy, but it would be hard on American farmers and rural communities,” said Jon Doggett, chief executive of the National Corn Growers Association, representing U.S. farmers.

Lopez Obrador added he wanted health authorities in both countries to assess the impact of GMO corn on human health.

Mexico and its northern neighbors are already in dispute resolution talks over Lopez Obrador’s energy policies, which the United States argues violate the trade pact.

Raul Urteaga, a former Mexican official and founder of consulting group Global Agrotrade Advisors, said the meeting with U.S. officials on Monday suggested a trade dispute with Washington over corn might be imminent.

“Why risk another potential trade dispute that looks like Mexico is going to lose?” Urteaga said.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |