Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 13 1/4 in SRW, down 15 1/2 in HRW, down 7 in HRS; Corn is down 4 1/4; Soybeans up 1/2; Soymeal up $0.17; Soyoil down 2.31.

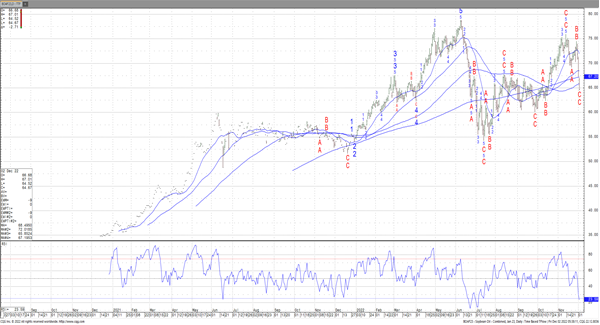

January soyoil futures chart

For the week so far wheat prices are down 26 in SRW, down 36 in HRW, down 19 1/2 in HRS; Corn is down 14 1/4; Soybeans down 9 1/4; Soymeal up $1.56; Soyoil down 6.74.

Year-To-Date nearby futures are down -3% in SRW, up 13% in HRW, down -3% in HRS; Corn is up 9%; Soybeans up 7%; Soymeal up 2%; Soyoil up 20%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (JAN 23) Soybeans down 11 yuan; Soymeal down 2; Soyoil down 168; Palm oil down 194; Corn down 14 — Malaysian palm oil prices overnight were down 120 ringgit (-2.94%) at 3958.

There were changes in registrations (13 Soymeal, 500 HRW Wheat, ). Registration total: 3,056 SRW Wheat contracts; 65 Oats; 308 Corn; 121 Soybeans; 689 Soyoil; 291 Soymeal; 505 HRW Wheat.

Preliminary changes in futures Open Interest as of December 1 were: SRW Wheat up 4,968 contracts, HRW Wheat up 868, Corn up 1,404, Soybeans down 7,001, Soymeal up 2,461, Soyoil down 4,795.

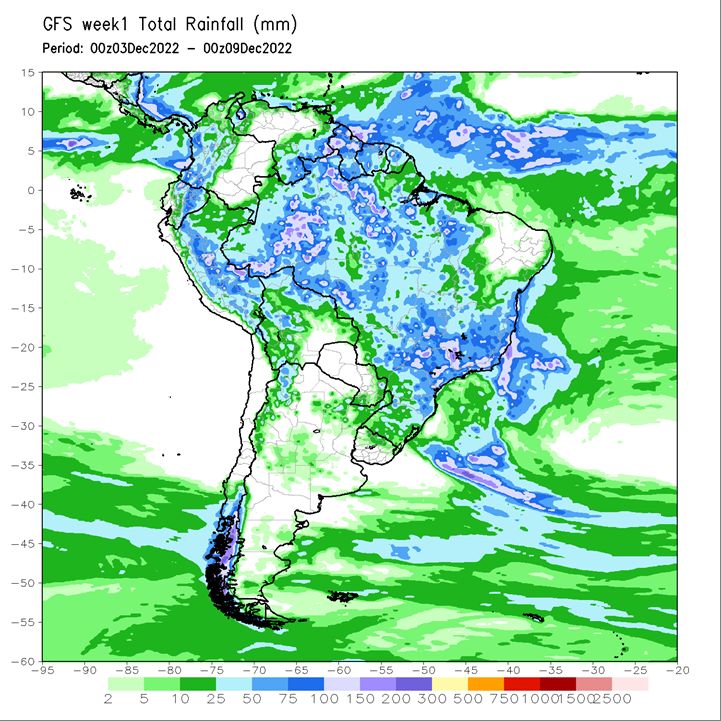

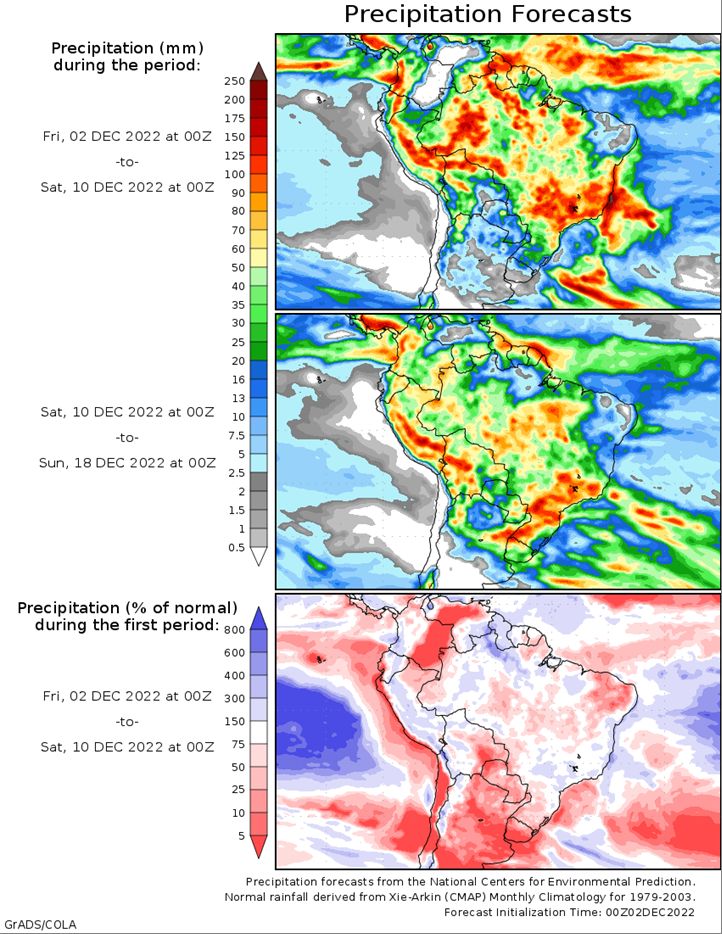

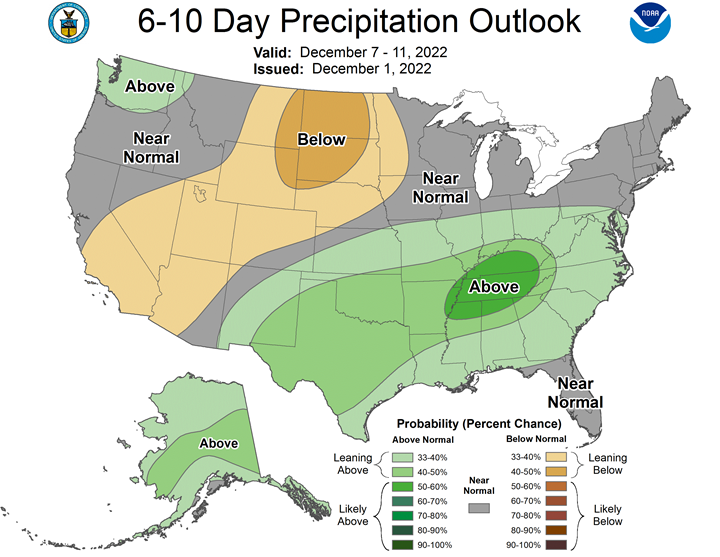

Brazil Grains & Oilseeds Forecast: Scattered showers will continue in central and northern Brazil as is typical for this time of year. Southern Brazil is seeing isolated showers fill back as well. A front will come into southern Brazil on Friday and stall, allowing for more precipitation to accumulate going into next week, which would reverse the recent trend of below-normal rainfall at a crucial time for full-season corn that is nearing pollination. It will be more brief for the state of Rio Grande do Sul, however.

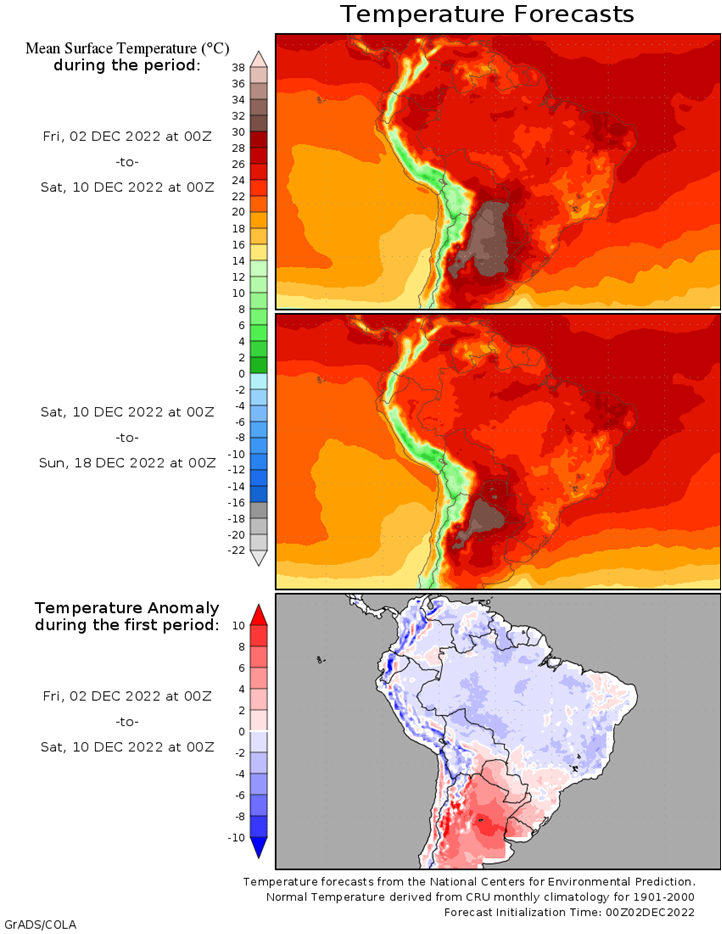

Argentina Grains & Oilseeds Forecast: Isolated showers will be pushed out of Argentina by a cold front on Thursday. Drier conditions follow going into next week along with a return of heat. Dryness and drought continue to be concerns for all crops until showers become more consistent.

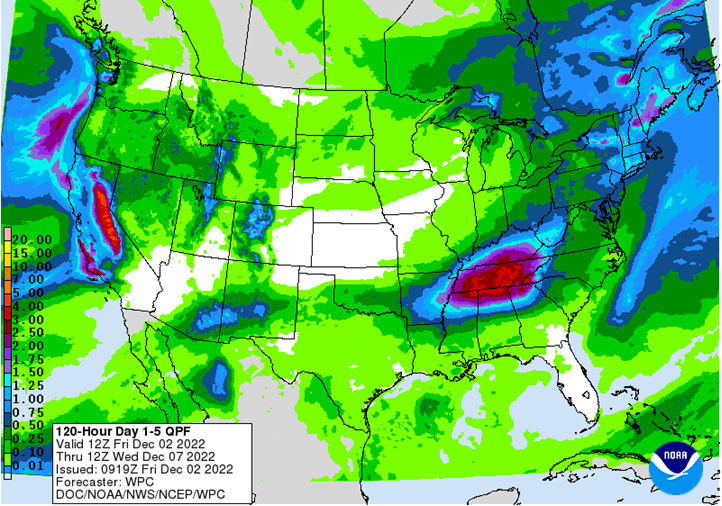

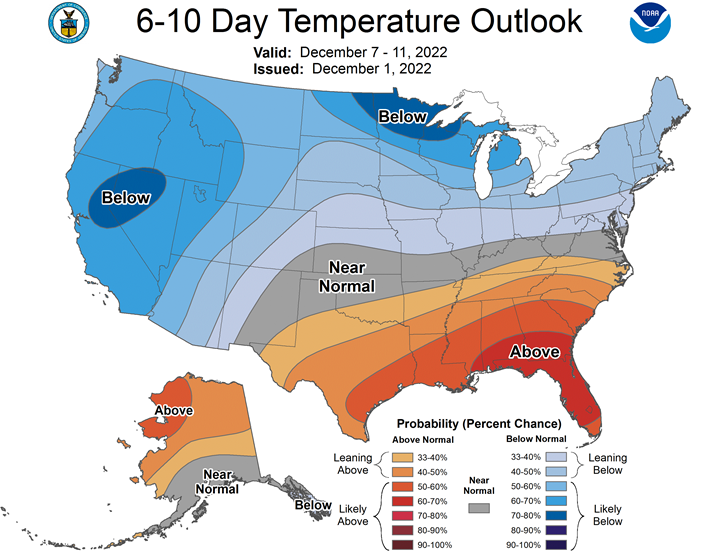

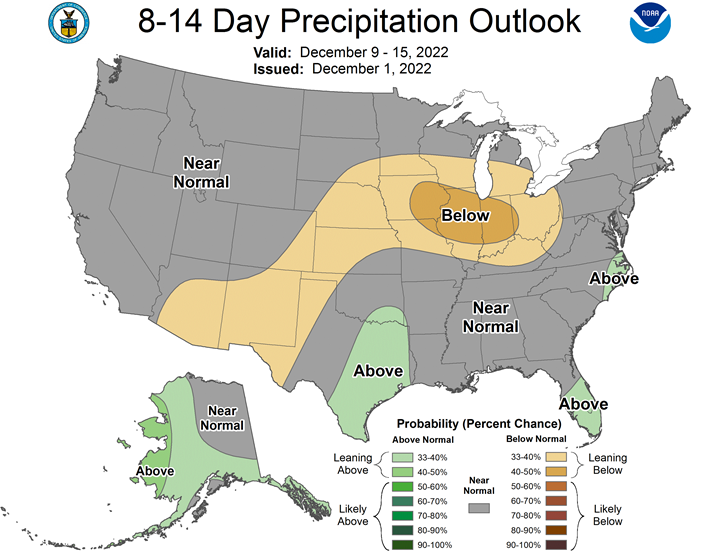

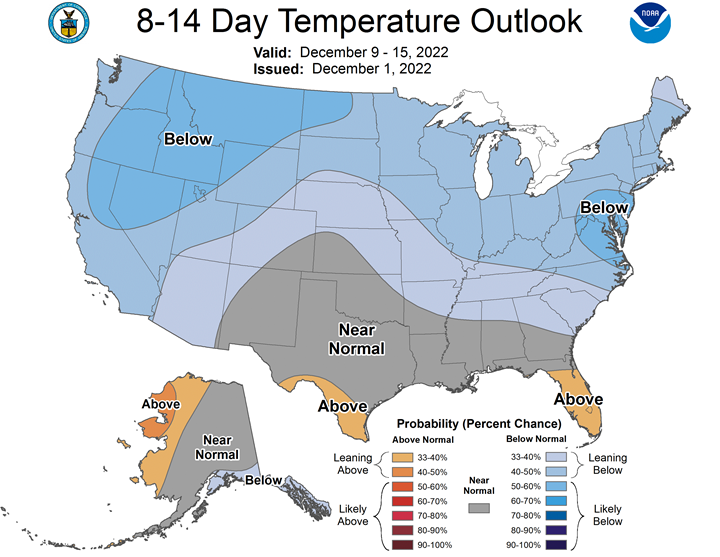

Northern Plains Forecast: Bursts of cold air are coming down from Canada into the Northern Plains over the next couple of weeks. A system will likely bring a round of snow through the region Friday, which may be moderate.

Central/Southern Plains Forecast: Temperatures continue to fluctuate wildly in the Central and Southern Plains for the next week as cold air from Wednesday is being replaced with very warm air Thursday but will fall again behind a front on Friday. Another pop up and down will come through over the following few days. Showers may occur with each front but are likely to miss the drought areas in the west.

Midwest Forecast: Cold temperatures are filling in behind a cold front that moved through on Wednesday. Temperatures will rebound for Friday, only to be put back down over the weekend with another front moving through. That one should have less coverage of precipitation. Another storm system early next week could produce scattered showers as well.

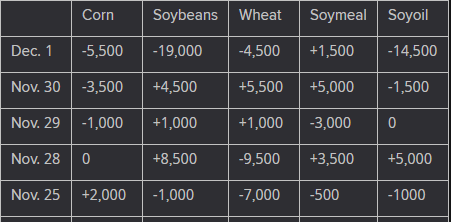

The player sheet for Dec. 1 had funds: net sellers of 4,500 contracts of SRW wheat, sellers of 5,500 corn, sellers of 19,000 soybeans, buyers of 1,500 soymeal, and sellers of 14,500 soyoil.

TENDERS

- CORN SALE: The U.S. Department of Agriculture confirmed private sales of 114,300 tonnes of U.S. corn to Mexico for shipment in the 2022/23 marketing year.

- CORN SALE: The Korea Feed Association (KFA) in South Korea purchased about 65,000 tonnes of animal feed corn expected to be sourced from South America or South Africa in a private deal on Thursday after also buying 68,000 tonnes in an international tender earlier in the day.

- FEED WHEAT SALE: A group of importers in Thailand is believed to have purchased about 123,000 tonnes of animal feed wheat expected to be sourced from Australia, European traders said on Thursday.

- WHEAT SALES UPDATE: Algeria’s state grains agency OAIC is believed to have bought between 450,000 to 500,000 tonnes of milling wheat in an international tender that closed on Wednesday

- WHEAT TENDER UPDATE: More participants in the tender from Pakistan to purchase 500,000 tonnes of wheat, which closed on Wednesday, have agreed to match the lowest price of $372.00 a tonne c&f

- BARLEY SALES: Turkey’s state grain board TMO bought 495,000 tonnes of animal feed barley in an international tender for the same volume on Thursday.

- WHEAT TENDER: The Taiwan Flour Millers’ Association has issued an international tender to purchase 42,750 tonnes of grade 1 milling wheat to be sourced from the United States.

PENDING TENDERS

- RICE TENDER: Turkey’s state grain board TMO issued an international tender to purchase a total 40,000 tonnes of rice.

US BASIS/CASH

- Basis bids for soybeans shipped by barge to U.S. Gulf export terminals were steady to weaker on Thursday on easing freight costs and light to moderate demand, although tumbling futures prices limited basis declines, traders said.

- Corn bids were flat to lower on lower freight rates and weak export demand.

- Spot basis values were anchored by increased supplies in the export pipeline as river elevators received an influx of corn and soybeans previously contracted by farmers for December delivery.

- Stiff competition in global markets kept a lid on Gulf export premiums for grains and soy. The looming South American harvest beginning in early 2023 is expected flood the market with cheaper corn and soybeans, further undercutting demand for U.S. shipments.

- CIF soybean barges loaded in November were bid 135 cents over January futures, down 5 cents from trades on Wednesday. December barges were bid 125 cents over futures, also down 5 cents from prior day trades.

- Export premiums for soybeans shipped in the last half of December were flat at around 165 cents over futures.

- For corn, CIF barges loaded in November were bid 115 cents over December, down 10 cents, while December corn barges were bid 112 cents over futures, down a nickel.

- Corn export premiums for late December loadings were unchanged at around 143 cents over December futures.

- Spot basis bids for soybeans rose at processors and elevators in the eastern half of the U.S. Midwest on Thursday, dealers said.

- Cash bids for soybeans also were strong at the region’s river terminals.

- But the soybean basis weakened at processors west of the Mississippi River.

- Farmers were busy delivering soybeans they had previously agreed to sell, an Ohio dealer said.

- But fresh sales were rare, with a sharp decline in the futures market dulling growers’ interest in booking new deals.

- Corn bids were steady to weak at interior elevators, falling at some facilities west of the Mississippi River.

- Processor bids for corn were steady to firm, with signs of strength noted in the West.

- Spot basis bids for corn rose at U.S. Midwest processors and river elevators on Thursday morning as grain dealers tried to entice farmers to move supplies out of storage bins after weeks of slow sales.

- But country movement of corn remained light, with cash prices below growers’ targets.

- The corn basis was flat at the region’s interior elevators and mixed at ethanol plants, dealers said.

- The soybean basis was weak at interior elevators, particularly in the eastern half of the region, mixed along rivers, and steady to firm at processors.

- Soybean sales slowed after dealers a flurry of deals earlier in the week, an Iowa dealer said.

- Spot basis bids for hard red winter wheat were unchanged at rail and truck elevators across the southern U.S. Plains on Thursday grain dealers said.

- Farmers were showing little interest in booking new deals for their grain, an Oklahoma dealer said.

- Premiums for hard red winter wheat delivered by rail to or through Kansas City fell by 10 cents a bushel for wheat with protein content ranging from ordinary to 12.8%, according to CME Group data.

- Premiums were unchanged for all other protein grades.

- Spot basis offers for soymeal were steady to firm at truck market processors in the western U.S. Midwest on Thursday, dealers said.

- Offers in the rail market were unchanged.

- Demand was routine.

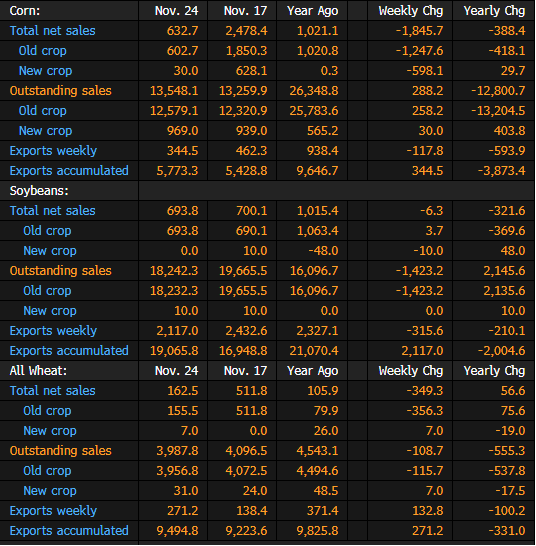

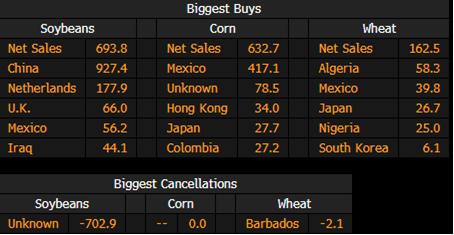

US Agriculture Export Sales for Week Ending Nov. 24

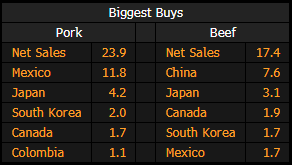

US Export Sales of Pork and Beef by Country

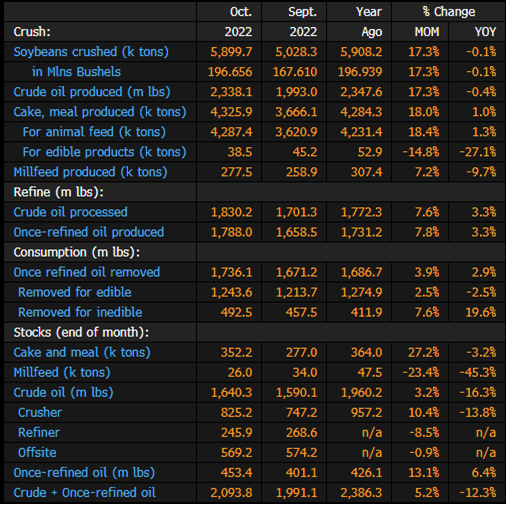

US Soybean Crushings at 197M Bushels in October: USDA

USDA releases monthly oilseed report on website.

- Crushing 0.1% lower than same period last year

- Crude oil production 0.4% lower than same period last year

- Crude and once-refined oil stocks down 12.3% y/y

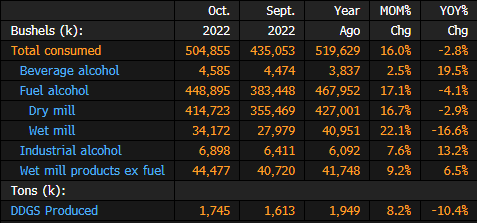

US Corn Used for Ethanol at 448.9M Bu in October

The following table is a summary of US corn consumption for fuel and other products, according to the USDA.

- Corn for ethanol was 4.1% lower than in October 2021

- DDGS production fell to 1.745m tons

Canola Wins US Approval for Use in Renewable Diesel, EPA Says

The Biden administration approves canola oil for use in making renewable diesel and other biofuels, qualifying fuels blended with the oilseed to meet federal standards, the US Environmental Protection Agency said on Thursday.

- EPA’s final rule drew praise from farm trade groups in the US and Canada, the world’s largest canola grower

- NOTE: US renewable diesel production capacity is expected to nearly triple by the end of 2023 as more fossil fuel refineries turn to the lower emitting fuels in a bid to profit from the premium they command in low-carbon energy markets such as California

Cargill Starts Shipping Crops From Ukraine’s 2022 Harvest

Cargill Inc., the world’s largest agricultural commodities trader, has started to export crops from this year’s harvest in Ukraine.

Shipments are flowing well since Russia renewed an agreement to keep export corridors open despite the war, Chief Executive Officer David MacLennan said in an interview. Supplies of everything from wheat to corn and sunflower seeds are smaller this year, and port workers are also facing difficulties including blackouts and having to work at night.

“We are getting new crop out,” he said at Bloomberg headquarters in New York. “Crops are down, but the good news is products are moving. This is one of the bread baskets of the world. We’ve got to have it.”

World food costs jumped to a record in March after Russia’s invasion of Ukraine choked off supplies from one of the world’s top exporters. Prices have since declined after a United Nations-brokered a deal allowing ships to pass safely through the Black Sea. The agreement was renewed in mid November for an additional 120 days.

Ukraine’s harvest is expected to be 60% to 70% compared to previous years, he said.

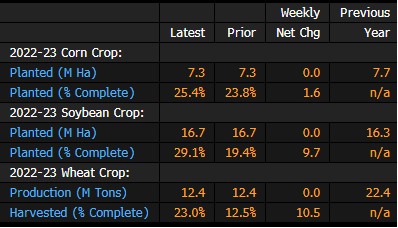

Argentina Dryness, Heat Stops Soy Planting From Gathering Pace

Dry, hot weather in Argentina means many fields remain too parched to plant soybeans, the Buenos Aires Grain Exchange said in a weekly report.

- Planting nationwide is 29% complete, 17 percentage points behind the same stage last year

- Area estimate kept at 16.7m hectares (41.3m acres)

- While some regions have accelerated planting after rains, fieldwork is extremely delayed on a key slither of the crop belt known as zona nucleo

- NOTE: Zona nucleo accounts for more than a quarter of Argentina’s soy area

- CORN, WHEAT:

- Farmers have started planting the late corn crop

- If poorer-than-expected yields reported so far during the wheat harvest continue, the exchange would cut its estimate of 12.4m metric tons

Brazil Soybeans Crop to Rise to 155m Tons: StoneX

Brazil’s 2022-23 soybeans crop estimate was raised to 155m tons, 737,000 tons higher compared to previous estimate from November, StoneX says in report.

- Production seen 22% higher versus the previous season

- Total planted area revised up to 43.4m hectares from 43m hectares in previous estimate

- Outlook for production is positive even as some areas have received lower-than-average rains, analyst Ana Luiza Lodi says

- Corn production in 2022-23 season seen totaling 130.3m tons, up from 123.5m tons in the previous year

- Winter corn production to reach 99.6m tons, up 0.4% from previous estimate

- Estimate for summer corn crop unchanged from November at 28.6m tons

Brazil poised to reap 153.3 mln T of soybeans in 2022/2023 – Datagro

The Brazilian soybean crop, which farmers are finishing sowing, will reach an estimated record of 153.3 million tonnes in the 2022/2023 cycle driven by area growth, agribusiness consultancy Datagro said on Thursday.

If the projection is confirmed, production will rise by almost 21% from the previous season, when a drought spoiled part of the crop, Datagro said.

Farmers are planting an estimated 43.79 million hectares (108.2 million acres) with the oilseed this season, an increase of 762,000 hectares from the forecast in July and a 1.98 million hectare rise from the previous year.

“With this, we have the 16th consecutive year of increase in soybean area,” said Flavio de França Junior, economist and research leader at Datagro Grains. “The increase in area takes place throughout Brazil, but more intensely in the states of the north, northeast and center west.”

Despite the increase in Brazil’s output estimate, Datagro said farmers face concerns in the center-south region due to the La Nina weather phenomenon.

Cargill Cautiously Optimistic About Deal to Avert Rail Strike

World’s largest agricultural commodities trader said it’s “cautiously optimistic” after a bill to avert strike was passed by the house on Wednesday, Cargill’s Chief Executive Officer David MacLennan said in an interview.

- “If the industry or the country thinks things are going to shut down on Dec. 9, they’ll start shutting it down Dec. 5,” he said at Bloomberg headquarters in New York on Thursday.

- “The message we’ve been trying to convey to Washington is don’t wait until Dec. 9.”

- “If you have to, work this weekend to get this bill passed”

- Company isn’t preparing for shutdowns yet, but warned that there isn’t enough truck and barge capacity to replace the amount of crops that move by rail

French Wheat Ratings Steady; Durum Wheat 89% Planted: Agrimer

Soft-wheat plantings in France were 99% complete as of Nov. 28, up from 98% a week earlier, crops office FranceAgriMer said Monday on its website.

- That compares to 98% at the same time last year

- 98% of crop in good or very good condition, same as last week and similar to last year

WINTER BARLEY

- Planting is complete, up from 99% last week

- 97% of the crop is in good or very good condition, compared with 98% a week ago and similar to last year

DURUM WHEAT

- 89% planted, compared to 84% a week ago

- Compares with 87% this time last year

China to auction 500,000 T of imported soybeans on Dec 9 – trade center

China will auction 500,000 tonnes of imported soybeans from the state reserves on Dec. 9, the National Grain Trade Center said on Friday.

USTR Tai: Important to Avoid US Corn Export to Mexico Disruption

US Trade Representative Katherine Tai stressed importance of avoiding any disruption in US corn exports to Mexico, including for both feed and human consumption, according to a statement from her office on Dec. 1.

- In the meeting with Mexican Economy Minister Raquel Buenrostro she also stressed importance of adherence to a science- and risk-based regulatory approval process for all agricultural biotechnology products in Mexico

- Reiterated the importance of the full implementation of the USMCA’s prohibition on the importation of goods made with forced labor

- Underscored the urgency of prompt and meaningful progress in ongoing consultations under the USMCA regarding Mexico’s energy measures and Mexico’s enforcement of its fisheries-related environmental laws

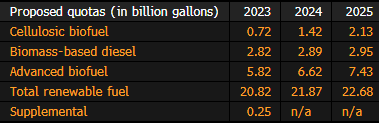

Biden Proposes Biofuel Mandate Overhaul to Boost EV Makers

- EPA aims to boost low-carbon fuels, preserve refining assets

- Automakers could claim biofuel credits under the proposal

The Biden administration is opening the door to a sweeping rewrite of the 17-year-old US biofuel mandate, including a plan to encourage use of renewable natural gas to power electric vehicles, which could benefit Tesla Inc. and other automakers.

An Environmental Protection Agency proposal released Thursday invites public feedback on an array of changes to the Renewable Fuel Standard, initially designed in 2005 to push more ethanol, biodiesel and other plant-based alternatives into vehicles. The plan may spur an overhaul that could shift the program from one narrowly focused on gasoline, diesel and other liquid fuels to an initiative broadly aimed at decarbonizing transportation.

The EPA will also seek public feedback on the best way to promote next-generation low-carbon biofuels, while protecting American oil refining assets after a wave of pandemic-spurred closures and the Russian invasion of Ukraine underscored the strategic importance of these facilities.

Read More: Refinery shortage becomes political liability with no easy fixes

The measure “will set the stage for further growth and development of low-carbon biofuels in the coming years,” the EPA says in its proposal. During the transition, “maintaining stable fuel supplies and refining assets will continue to be important to achieving our nation’s energy and economic goals as well as providing consistent investments in a skilled and growing workforce.”

Biofuel Boost

The agency is proposing to raise the amount of biofuel that must be mixed into gasoline and diesel over the next three years to as much as 22.68 billion gallons in 2025, up from this year’s 20.87 billion gallons. Under the measure, conventional ethanol may be used to fulfill as much as 15.25 billion gallons. But that exceeds what oil refiners call the “blend wall,” or the 10% ceiling on the amount that can be blended into the most commonly available E10 gasoline.

The EPA is asking the public for feedback on whether it should actually set the conventional renewable fuel requirement below the blend wall. It also wants public comment on how the quota plan will affect the “continued viability of domestic oil refining assets,” including so-called merchant refiners with limited blending facilities that can’t easily generate compliance credits.

Administration officials took pains to emphasize their desire to protect oil refining capacity while fostering alternative fuels. EPA Administrator Michael S. Regan said the agency was “focused on strengthening the economics of our critical energy infrastructure” even as it seeks to diversify the nation’s fuel mix. And Energy Secretary Jennifer Granholm cast the proposal as a way to “drive forward fuel innovations while balancing the need to maintain and strengthen critical domestic refining capacity, and support the union workers who operate these facilities.”

Nevertheless, the measure drew criticism from some oil refining supporters as well as biodiesel advocates.

Soybean and corn futures fell in Chicago, with soy oil sliding as much as 6.3%, the biggest decline since early July.

Crop trading giants Archer-Daniels-Midland Co. and Bunge Ltd., both of which have expanded their presence in the market for climate-friendly diesel, saw steep declines on Thursday. Bunge shares dropped as much as 7.7%, their biggest intraday pullback since March 29, while ADM fell as much as 6.4%, the most since September.

Shares of ethanol producers such as Green Plains Inc. swung between gains and losses.

The proposed EPA volumes for crop-based fuels came in below market expectations, StoneX risk management consultant Matt Campbell said. “The market is not taking the news well,” particularly for soybean oil, since “requirements were well short of trade estimates,” Campbell added.

The proposal was also a blow to oil refining champions, who said it would increase the industry’s compliance costs, undermining the economics of some operations. Senator Chris Coons, a Democrat from Delaware, called the proposed quotas “unachievable” and said they foster uncertainty for skilled union workers.

“The cost of complying with the Renewable Fuel Standard is at a record high because the volumes don’t align with what our country can actually produce and consume,” Coons added in an emailed statement.

Refiners prove they have fulfilled annual blending quotas by relinquishing tradeable credits known as “renewable identification numbers” or RINs, which are generated with each gallon of biofuel.

Under a court settlement, the EPA is obligated to finalize the biofuel quotas by June 14 next year. A senior administration official said public feedback could determine the shape of the final rule, prompting the EPA to revise initially proposed blending requirements or even revisit past policy decisions tied to RIN holding thresholds, disclosure requirements and market liquidity.

eRIN Credit

The EPA would also create an eRIN credit awarded when electricity from certain renewable sources — such as natural gas harvested from landfills and at farms — is used as fuel to power EVs. Under the proposal, automakers alone could generate the credit, though its value could be shared with other parties, such as the generators of biogas-powered electricity.

As designed, the eRIN plan would add another incentive for automakers such as Ford Motor Co. and General Motors Co. to produce electric vehicles, building on tax support in the just-enacted Inflation Reduction Act and other air pollution policies.

The plan is likely to set off furious lobbying as charging station operators, biogas producers and utilities vie for a piece of the eRIN credit. Even before the EPA released its proposal, the eRIN concept was opposed by some environmentalists and congressional Democrats who say it would subsidize large industrial livestock operations.

Biodiesel producers also took aim at the proposed quotas, which would offer only a modest boost over the current 2.76-billion-gallon requirement, despite a predicted surge in demand and new production capacity next year. The plan “significantly undercounts existing biomass-based diesel production and fails to provide growth for investments the industry has already made in additional capacity, including for sustainable aviation fuel,” said Kurt Kovarik, vice president of federal affairs at the Clean Fuels trade group.

Brazil November Agriculture Exports by Volume: MDIC

Following is a summary of key Brazilian agriculture exports by volume, from the Brazilian Trade Ministry.

- Corn exports rose 153% in November from a year ago

- Beef exports rose 83% y/y

Food Prices Decline for Eighth Month Easing Inflation Pressures

- Wheat, corn trading lower since Ukraine grain deal renewal

- UN’s index of global food costs falls for an eighth month

Global food prices fell for an eighth month in November, in a sign that inflationary pressures may be easing.

A United Nations gauge of food prices declined 0.1% last month to the lowest since January. The renewal of Ukraine’s grain-export deal sent wheat and corn prices tumbling, while the threat of a global recession is curbing food demand.

Rising food prices have been a major contributor to a broader inflationary spiral that’s fueling a cost-of-living crisis in countries from the UK to Malaysia. Investors and economists are watching closely for signs that inflation has peaked, allowing central banks to slow the pace of monetary tightening.

Food inflation spiked this year after Russia’s invasion of Ukraine, hitting a record in March as a blockade of Black Sea ports hobbled exports of key staples. While shipments from Ukraine resumed in July, prices remain much higher than usual for this time of year. That’s fueling the worst global food shock in more than a decade, according to the International Monetary Fund.

The continued decline may offer some relief to households, but it can take time for commodity price shifts to trickle through to grocery-store shelves. The UN index tracks export prices for raw goods and excludes retail mark-ups.

Obstacles also remain to getting Ukraine’s grain out despite the extension of the deal, and elsewhere high energy prices are pushing some food companies to cut staff.

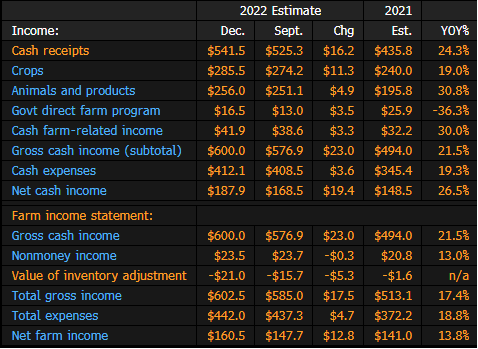

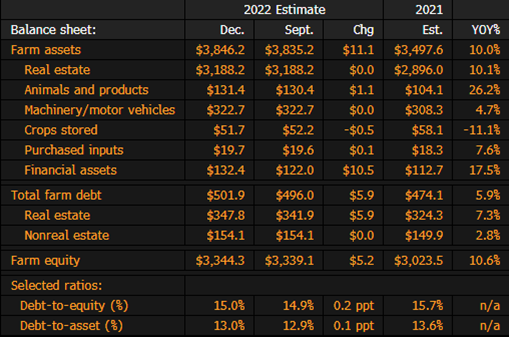

USDA Revises Up US 2022 Net Farm Income Estimate by $13B

The USDA expects farmer profits to be $160.5b in 2022, higher than its previous est. of $147.7b in September, according to the agency’s Farm Income and Financial Forecasts report, released on Thursday.

- This would be 14% higher than 2021 net income

- Gross income est. adjusted upward by $17.5b from September, outweighing a $4.7b upward revision of expenses

- Income from crops and livestock raised by a combined $16.2b

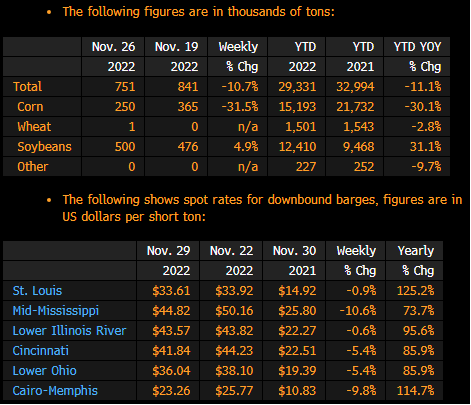

Grain Shipments on Mississippi River Fell 11% Last Week: USDA

Barge shipments down the Mississippi river declined to 751k tons in the week ending Nov. 26 from 841k tons the previous week, according to the USDA’s weekly grain transportation report.

- Barge shipments of corn fell 32% from the previous week

- Soybean shipments up 5% w/w

- St. Louis barge rates were $33.61 per short ton, a decline of $0.31 from the previous week

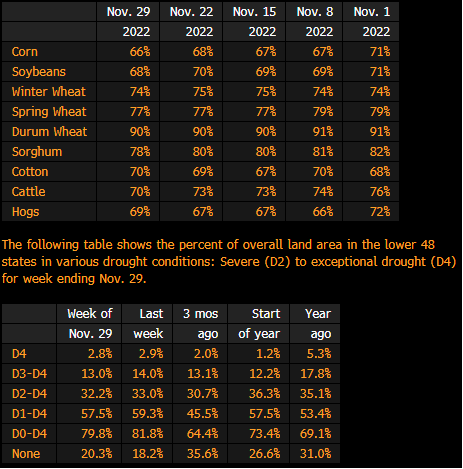

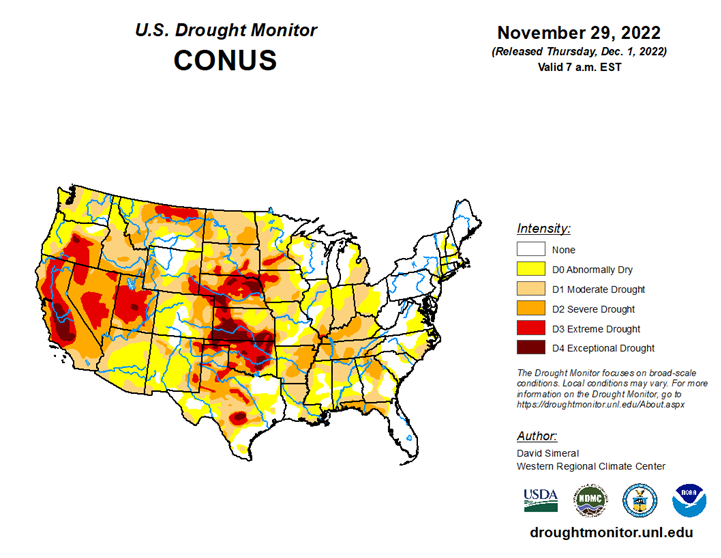

US Crops in Drought Area for Week Ending Nov. 29

The following table shows the percent of US agricultural production within an area that experienced drought for the week ending Nov. 29, according to the USDA’s weekly drought report.

- Winter wheat area experiencing moderate to intense drought fell a point to 74%

- Cattle area dropped to 70% vs 73%

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |