Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 1 1/4 in SRW, up 3 3/4 in HRW, up 1 1/2 in HRS; Corn is up 1/2; Soybeans up 6; Soymeal up $0.24; Soyoil up 0.22.

For the week so far wheat prices are up 1/4 in SRW, up 8 in HRW, up 8 3/4 in HRS; Corn is down 1/2; Soybeans up 1; Soymeal down $1.11; Soyoil up 2.85.

For the month to date wheat prices are down 43 3/4 in SRW, down 49 in HRW, down 25 1/2 in HRS; Corn is down 14 1/2; Soybeans up 10 1/4; Soymeal up $35.70; Soyoil down 5.25.

Year-To-Date nearby futures are down -2% in SRW, up 6% in HRW, down -6% in HRS; Corn is up 10%; Soybeans up 12%; Soymeal up 10%; Soyoil up 18%.

Chinese Ag futures (MAR 23) Soybeans down 11 yuan; Soymeal up 49; Soyoil down 38; Palm oil down 42; Corn down 38 — Malaysian palm oil prices overnight were up 91 ringgit (+2.35%) at 3960.

There were changes in registrations (-5 Soymeal). Registration total: 2,795 SRW Wheat contracts; 0 Oats; 154 Corn; 91 Soybeans; 774 Soyoil; 291 Soymeal; 495 HRW Wheat.

Preliminary changes in futures Open Interest as of December 20 were: SRW Wheat up 971 contracts, HRW Wheat down 1,462, Corn down 3,671, Soybeans up 1,294, Soymeal up 2,848, Soyoil down 10,404.

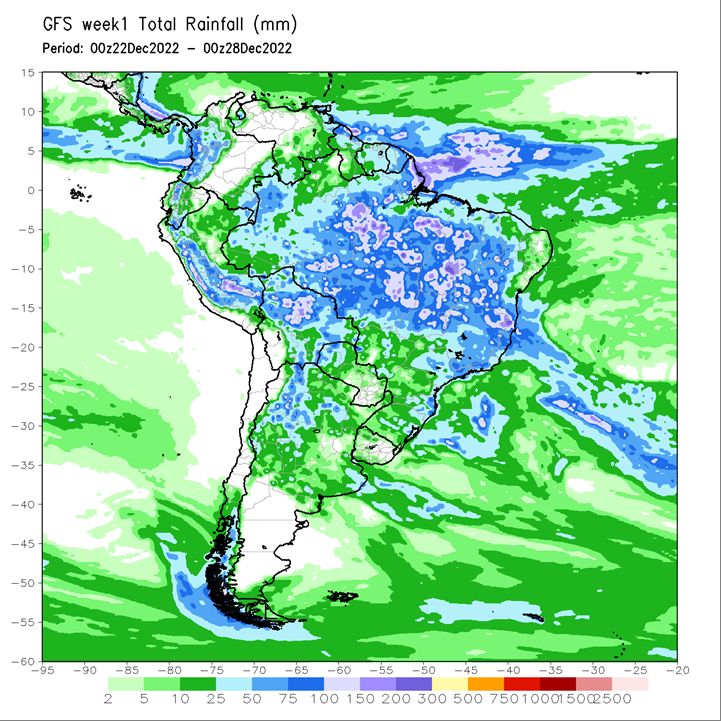

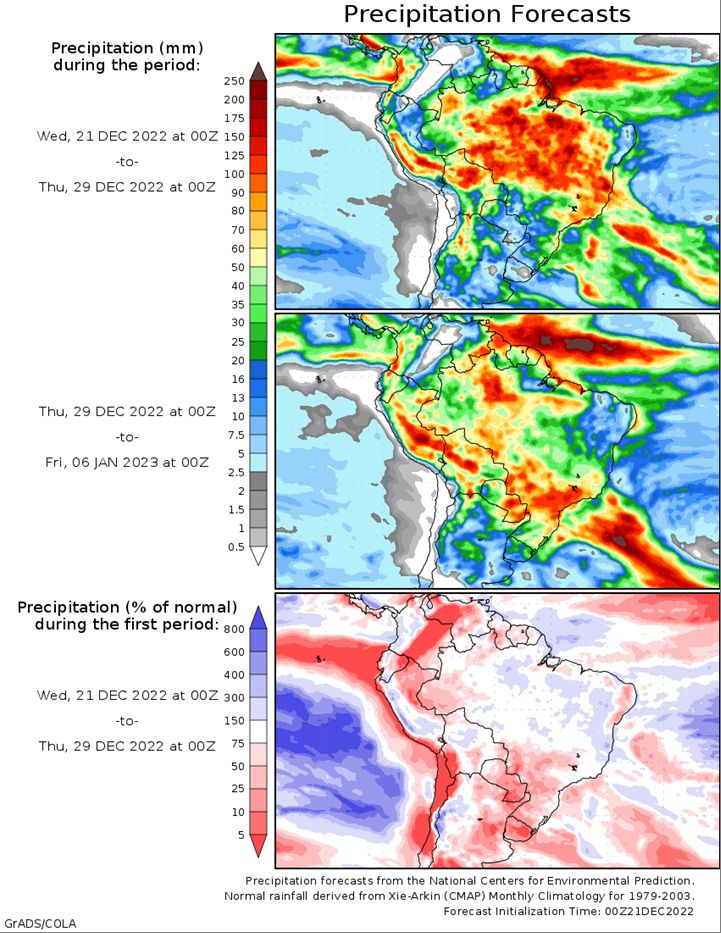

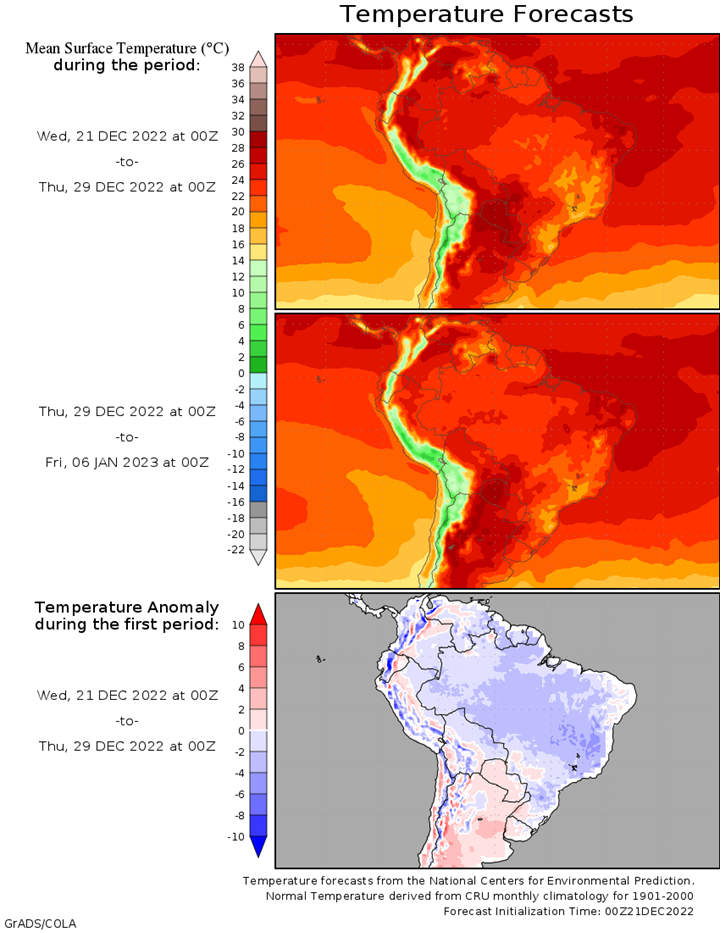

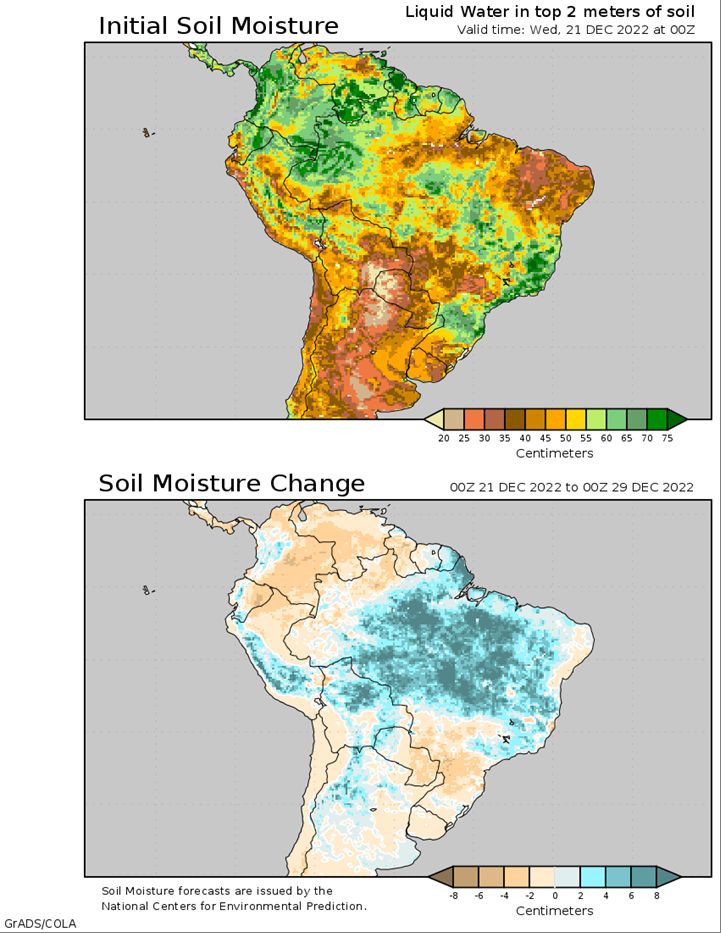

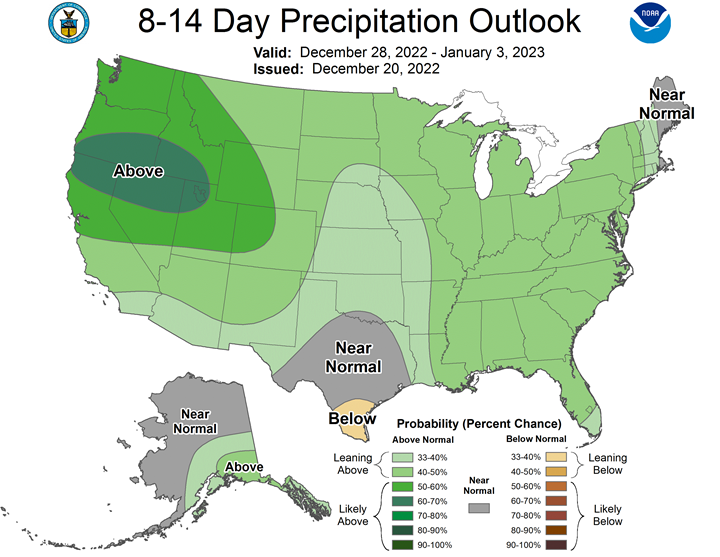

Brazil Grains & Oilseeds Forecast: Rio Grande do Sul and Parana Forecast: Isolated to scattered showers north Wednesday. Mostly dry Thursday-Friday. Isolated showers south Saturday. Temperatures near to below normal Wednesday, below normal north and near to above normal south Thursday-Friday, near to above normal Saturday. Mato Grosso, MGDS and southern Goias Forecast: Scattered showers through Saturday. Temperatures near to below normal through Saturday.

Argentina Grains & Oilseeds Forecast: Cordoba, Santa Fe, Northern Buenos Aires Forecast: Mostly dry Wednesday. Isolated showers Thursday, scattered showers Friday-Saturday. Temperatures near to above normal through Friday, below normal Saturday. La Pampa, Southern Buenos Aires Forecast: Mostly dry Wednesday, isolated to scattered showers Thursday-Friday. Mostly dry Saturday. Temperatures near to above normal through Friday, below normal Saturday.

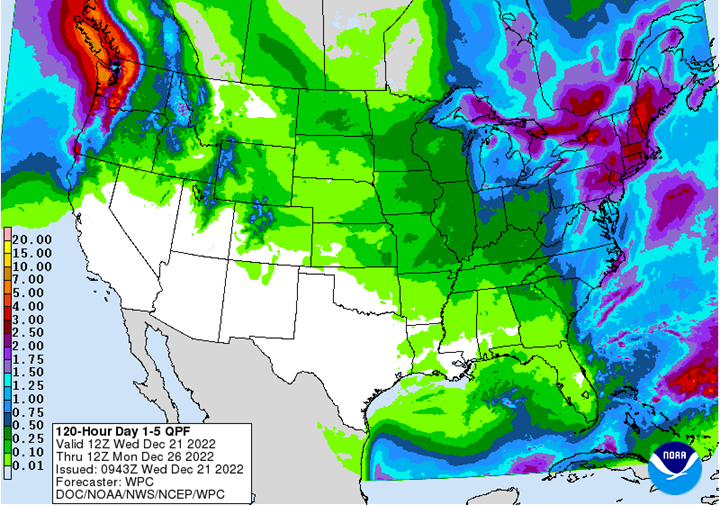

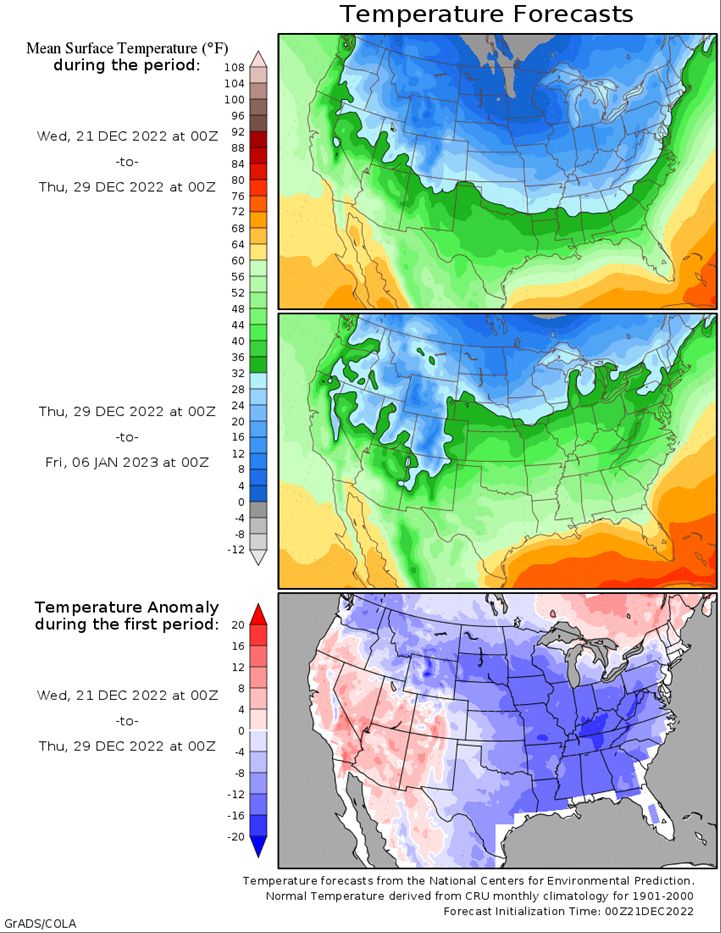

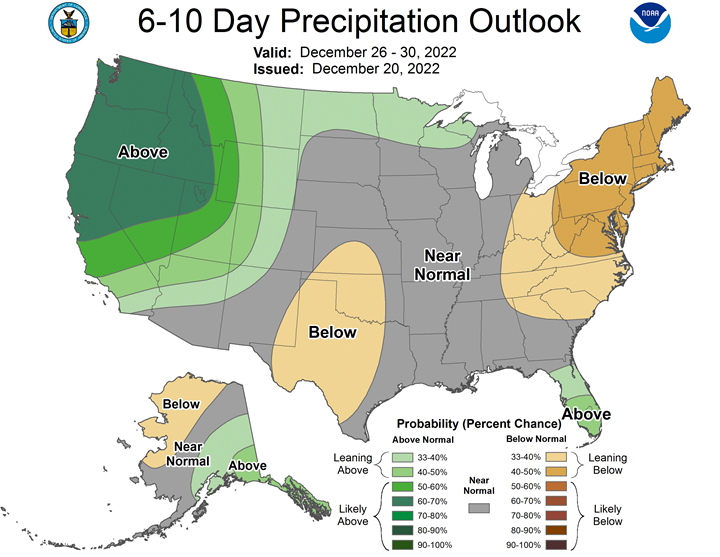

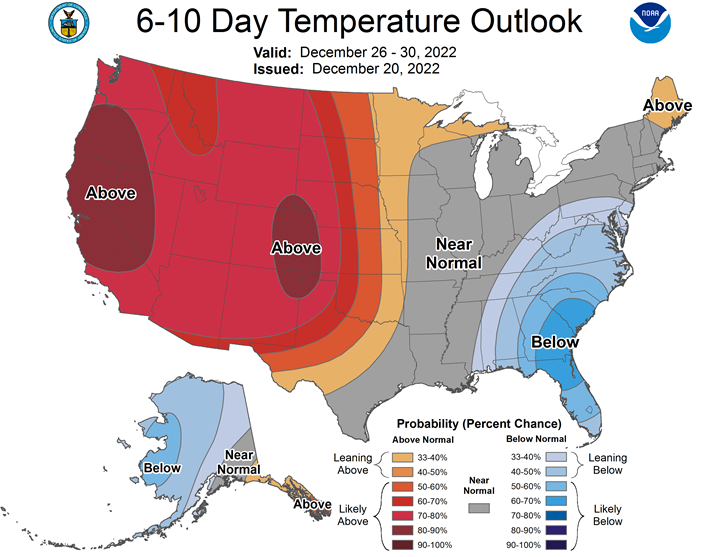

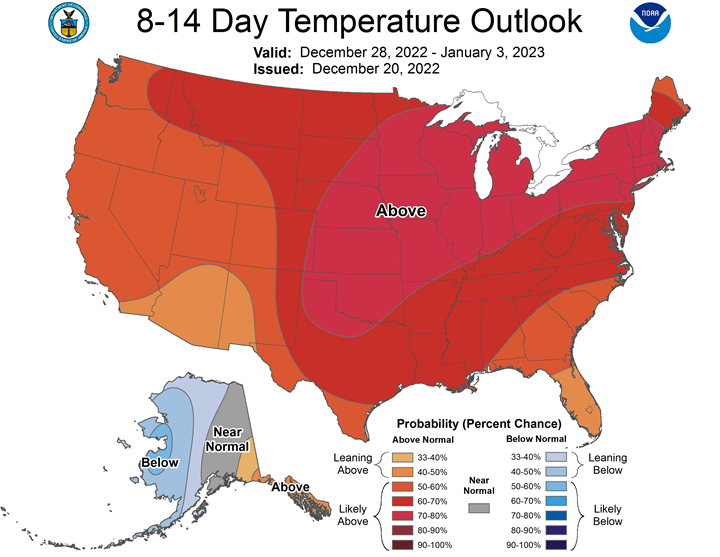

Northern Plains Forecast: Isolated to scattered snow Wednesday. Mostly dry Thursday-Saturday. Temperatures well below normal through Friday, below to well below normal Saturday. Outlook: Isolated to scattered showers Sunday-Thursday. Temperatures above normal west and below normal east Sunday-Monday, near to above normal Tuesday-Thursday.

Central/Southern Plains Forecast: Scattered showers north Wednesday. Isolated to scattered showers Thursday. Mostly dry Friday-Saturday. Temperatures near to well below normal Wednesday, well below normal Thursday-Saturday. Outlook: Isolated showers Sunday-Monday. Mostly dry Tuesday-Thursday. Temperatures near to below normal Sunday-Monday, above normal Tuesday-Thursday.

Western Midwest Forecast: Scattered showers Wednesday-Thursday. Mostly dry Friday-Saturday. Temperatures below to well below normal through Saturday.

Eastern Midwest Forecast: Isolated to scattered showers Wednesday-Saturday. Temperatures below to well below normal through Saturday. Outlook: Mostly dry Sunday. Scattered showers Monday-Thursday. Temperatures below normal Sunday-Tuesday, above normal Wednesday-Thursday.

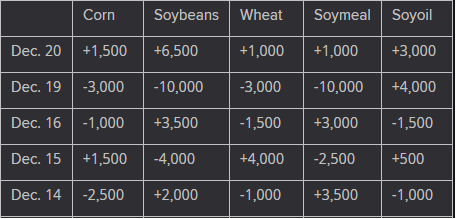

The player sheet for Dec. 20 had funds: net buyers of 1,000 contracts of SRW wheat, buyers of 1,500 corn, buyers of 6,500 soybeans, buyers of 1,000 soymeal, and buyers of 3,000 soyoil.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

TENDERS

- FOOD WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 144,441 tonnes of food-quality wheat from the United States and Canada in a regular tender that will close on Dec. 22.

- U.S. WHEAT TENDER: The Taiwan Flour Millers’ Association has issued an international tender to purchase 56,000 tonnes of grade 1 milling wheat to be sourced from the United States.

PENDING TENDERS

- WHEAT TENDER: Iraq’s state grains buyer has issued a tender to buy a nominal 50,000 tonnes of milling wheat

- CORN TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued new international tenders to purchase around 25,000 tonnes of food-quality soybeans free of genetically modified organisms (GMOs)

- SUNFLOWER OIL TENDER: Turkey’s state grain board TMO has issued an international tender to purchase about 24,000 tonnes of crude sunflower oil

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp has issued an international tender to purchase an estimated 83,672 tonnes of rice to be sourced from the United States

- RICE TENDERS: Bangladesh’s state grains buyer issued an international tender to purchase 50,000 tonnes of rice

US BASIS/CASH

- U.S. spot basis bids for soybeans and corn shipped by barge to U.S. Gulf export terminals rose on Tuesday, with freight rates firming and buyers closely watching forecasts of a serious winter storm, traders said.

- CIF soybean barges loaded in December traded at 150 cents over January futures and were re-bid at 145 cents over futures, up 3 cents from Monday’s last bid.

- CIF soybean barges loaded in January also traded at 140 cents over January futures.

- Export premiums for soybeans shipped in January were steady at about 170 cents over January futures.

- CIF corn barges loaded in December traded at 111 cents and 112 cents over CBOT March SH3 futures; barges loaded in January traded at 111 cents over March futures; and barges loaded in February traded at 109 cents over March futures, traders said.

- CIF corn barges loaded in December were re-bid at 112 cents over futures, up 7 cents from Monday’s last bid.

- Export premiums for January loadings of corn were at about 132 cents over March futures.

- Spot basis bids for soybeans were mixed at processors in the eastern half of the U.S. Midwest on Tuesday.

- Cash bids slipped by 5 cents a bushel at a major soybean processing plant in Decatur, Illinois, but rose by the same amount at a Lafayette, Indiana, processor.

- Processor bids for soybeans were unchanged west of the Mississippi River.

- The soybean basis held steady at interior elevators and river terminals around the region.

- Cash bids for corn were flat at processors, elevators and river terminals in the eastern half of the region.

- In the west, the corn basis was steady to weak at processors, steady to firm at elevators and unchanged along rivers.

- Farmers were showing little interest in booking sales of either corn or soybeans, an Ohio dealer said.

- Spot basis bids for soybeans were steady to firm at interior elevators and processors in the eastern half of the U.S. Midwest and flat in the West on Tuesday morning, grain dealers said.

- Along rivers, the soybean basis was unchanged.

- Farmer sales were slow.

- Dealers were not even bothering to call in to check on prices despite a futures market rally that pushed cash prices for soybeans above $15 a bushel in some areas, an Iowa dealer said.

- Cash bids for corn were steady to firm at interior elevators and ethanol plants, mixed at processors and flat at river terminals.

- Spot basis bids for hard red winter wheat were unchanged at grain elevators across the southern U.S. Plains on Tuesday, dealers said.

- Activity on the cash market was quiet.

- Growers were not showing interest in booking deals for the wheat they have in storage bins, an Oklahoma dealer said.

- Spot basis offers for U.S. soymeal were steady to weak at truck market processors and mixed at rail market processors on Tuesday, dealers said.

- Activity on the cash market was quiet.

- Most end users had already booked enough supplies to last them through Christmas, a rail broker said.

- Livestock and poultry producers often book surplus amounts of soymeal during December to ensure they do not run short when processors are closed during the holiday season.

- The extra soymeal also will help end users get through a major winter storm that is forecast for much of the Plains and Midwest this week that could slow movement along highways and railroads.

- On the export front, the CIF market for river barges and the FOB market for loadings at the U.S. Gulf continued to firm due to limited capacity.

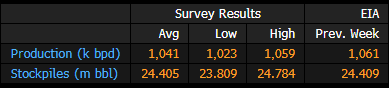

ETHANOL: US Weekly Production Survey Before EIA Report

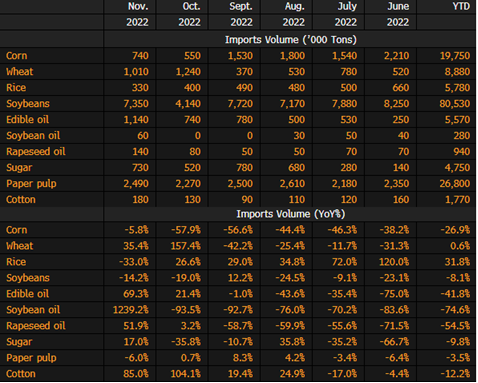

China November Imports

- Soybean imports -14.2% y/y to 7.35M tons

- Corn imports -5.8% y/y to 0.74M tons

- Wheat imports +35.4% y/y to 1.01M tons

Rice imports -33% y/y to 0.33M tons

Brazil Soy Exports Seen Reaching 1.750 Million Tns In December – Anec

- BRAZIL SOY EXPORTS SEEN REACHING 1.750 MILLION TNS IN DECEMBER VERSUS 1.772 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.523 MILLION TNS IN DECEMBER VERSUS 1.599 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 6.579 MILLION TNS IN DECEMBER VERSUS 6.715 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

EU Soft-Wheat Exports Up 5.5% Y/y; Corn Imports More Than Double

EU soft-wheat exports during the season that began July 1 reached 15.7m tons as of Dec. 18, compared with 14.9m tons in a similar period a year earlier, the European Commission said on its website.

- Leading destinations include Morocco (2.13m tons), Algeria (2.12m tons), and Egypt (1.59m tons)

- EU barley exports at 2.78m tons, compared with 4.8m tons a year earlier

- EU corn imports at 13.5m tons, against 6.58m tons a year earlier

China’s November soybean imports from U.S. fall 7%

China’s November soybean imports from the United States fell 6.9% from a year earlier, data showed on Tuesday, after low U.S. river levels slowed shipping of beans to ports for export.

The world’s biggest soybean buyer, China, imported 3.38 million tonnes of the oilseed from the United States last month, down from 3.63 million tonnes a year earlier, according to the General Administration of Customs.

U.S. soybean exports were delayed by low water on the Mississippi River and its tributaries, slowing the flow of grain barges to export terminals on the Gulf Coast.

Imports from Brazil, China’s biggest supplier, fell 32.3% in November to 2.54 million tonnes as high prices and low bean crushing profits eroded appetite for purchases from the South American nation.

Overall soybean imports fell 14% in November from a year earlier to 7.35 million tonnes, data showed this month.

For the first 11 months of the year, China brought in 51.83 million tonnes of Brazilian beans, down from 56.5 million tonnes in the same period of 2021.

Imports from the United States for January-November came in at 23.01 million tonnes, down from 26.2 million tonnes the previous year.

UBS ‘Moderately Overweight’ on Agriculture and Livestock in 2023

“We believe grain prices and positioning don’t adequately reflect the degree of climate and geopolitical risks present through the first quarter or so,” UBS agriculture strategists including Wayne Gordon write in a note.

- UBS projects wheat prices to rise to $8.25 a bushel by end June, and then easing to $7.50 by end-2023

- “We foresee the global wheat market facing a deficit over the next two years,”

- UBS boosts corn forecast to $7.25/bushel by end-June (previously forecast $6.75)

- Forecasts a “mild increase” in sugar prices over 2023 to $0.21 per pound; and a global surplus of 2–3m tons

- Expects coffee prices to “somewhat recover” in 1Q; sees $1.85/lb at end March

- Cuts cocoa outlook to $2,250/ton at end-2023 from $2,700/ton

Indonesia to Announce Another Commodity Export Ban Wednesday

Indonesia will announce another commodity export ban later on Wednesday, President Joko Widodo said in Jakarta.

Jokowi, as the president is known, also flagged that there were potentially more prohibitions on shipments coming in 2023. “Next year, we may announce to stop another one or two raw material exports,” he said in a speech.

It’s unclear what raw material exports will be banned. Aluminum rose 0.5% on the London Metal Exchange as of 11:47 a.m. in Singapore, as Indonesia is a major supplier of bauxite, an ore used to make the metal. Palm oil was up 1.8% amid flooding in major producer Malaysia.

Southeast Asia’s largest economy has been pursuing policies designed to create jobs and revenue by processing more of its natural resources at home, rather than just shipping out raw materials. Jokowi said this month that Indonesia wouldn’t follow a purely open economic model that he blamed for undercutting Latin America’s growth prospects for decades.

The World Trade Organization ruled last month that Indonesia’s ban on nickel ore exports violated international trade rules following a complaint by the European Union. Jakarta is appealing the decision.

India extends suspension on futures trade in key farm commodities by a year

India’s market regulator on Tuesday extended the suspension of trading in derivative contracts of commodities including wheat, paddy and crude palm oil until Dec. 20, 2023.

The Securities and Exchange Board of India (SEBI) had last year ordered a year-long suspension of futures trading in key farm commodities, as the world’s biggest importer of vegetable oils and a major producer of wheat and rice struggled to tame food inflation.

In a notification late on Tuesday, SEBI said the suspension of trading in futures contracts would continue for a year on soybean and its derivatives, crude palm oil, wheat, paddy rice, chickpea, green gram and mustard.

Annual retail inflation eased below the central bank’s upper tolerance level for the first time this year in November amid a softer rise in food prices.

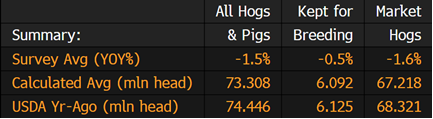

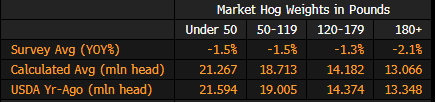

US Hog and Pig Inventory Survey Before USDA Report

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |