Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are down 1/2 in SRW, down 1 1/2 in HRW, down 3 in HRS; Corn is down 1/4; Soybeans up 12 1/4; Soymeal up $0.40; Soyoil down 0.13.

For the week so far wheat prices are down 2 3/4 in SRW, up 1 3/4 in HRW, up 3/4 in HRS; Corn is up 7 1/2; Soybeans up 16 1/2; Soymeal up $0.13; Soyoil up 1.60.

For the month to date wheat prices are down 21 1/2 in SRW, down 22 in HRW, down 11 3/4 in HRS; Corn is up 7 1/2; Soybeans up 25 3/4; Soymeal up $35.80; Soyoil down 4.02.

Year-To-Date nearby futures are up 0% in SRW, up 9% in HRW, down -5% in HRS; Corn is up 14%; Soybeans up 13%; Soymeal up 11%; Soyoil up 20%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAR 23) Soybeans up 33 yuan; Soymeal down 48; Soyoil up 116; Palm oil up 96; Corn up 27 — Malaysian palm oil prices overnight were down 13 ringgit (-0.32%) at 4087.

There were changes in registrations (-55 Soymeal). Registration total: 2,788 SRW Wheat contracts; 0 Oats; 154 Corn; 91 Soybeans; 774 Soyoil; 235 Soymeal; 410 HRW Wheat.

Preliminary changes in futures Open Interest as of December 27 were: SRW Wheat down 3,071 contracts, HRW Wheat up 140, Corn up 2,152, Soybeans down 9,409, Soymeal down 4,684, Soyoil down 3,210.

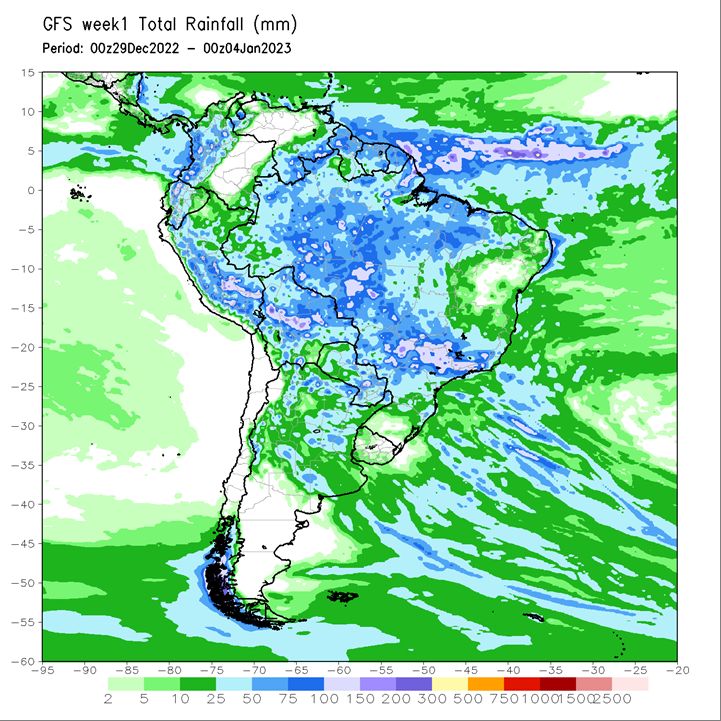

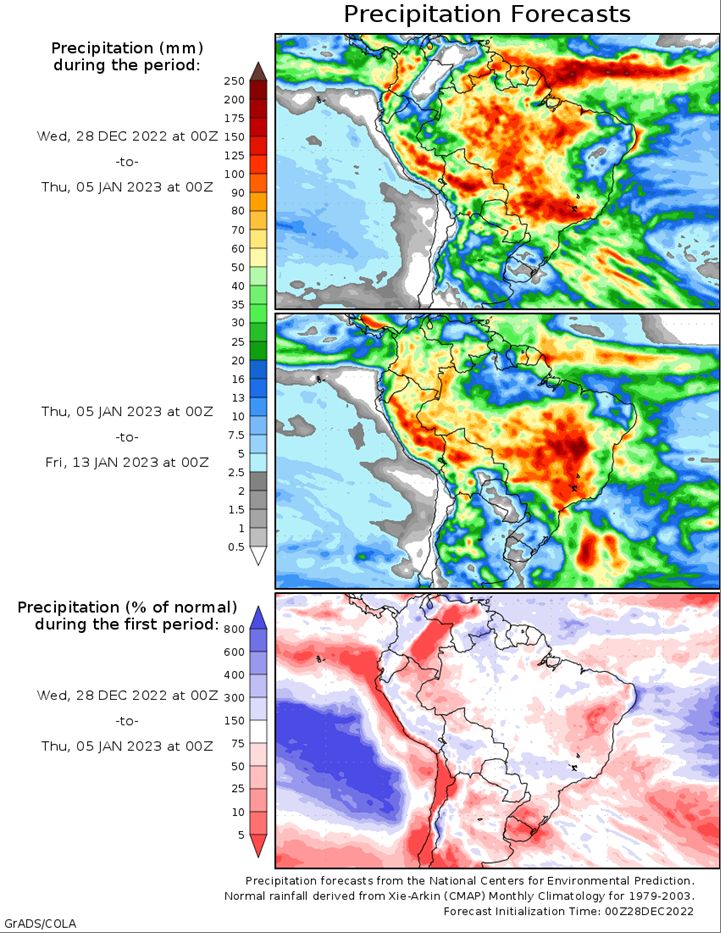

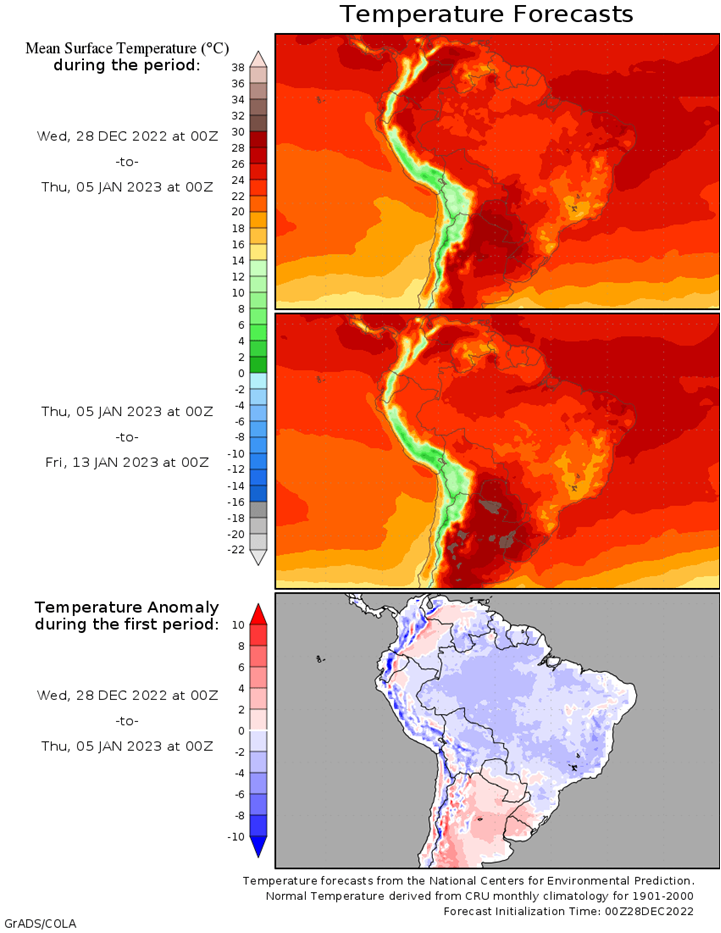

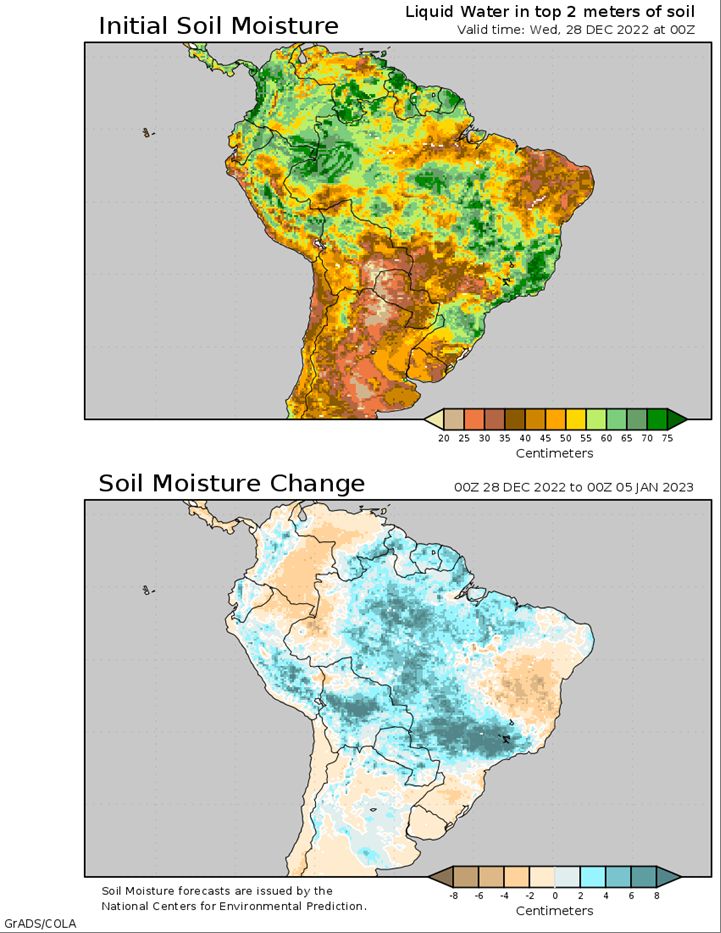

Brazil Grains & Oilseeds Forecast: Scattered showers will continue in central and northern Brazil for at least the next two weeks, as is typical for this time of year. Soybeans remain in mostly favorable condition, though dryness across the far south is a little concerning for both corn and soybeans that are in reproductive stages. A cold front will move into the south with a brief period of showers Tuesday into Wednesday, but the front will move north of Rio Grande do Sul and dry out behind it. Rio Grande do Sul and eventually Parana will dry out and some concern over crop conditions continues in these states.

Argentina Grains & Oilseeds Forecast: A front brought widespread showers to Argentina on Friday, but it has gotten dry behind it yet again, with dry conditions continuing through most of the week. Another shot of showers will move through this weekend, but it will get dry behind that front as well. Showers are not coming at a consistent enough clip to reduce drought or turn around crop conditions for corn and soybeans that have been significantly harmed by heat and drought this season. Planting on both remains well behind the normal pace as well.

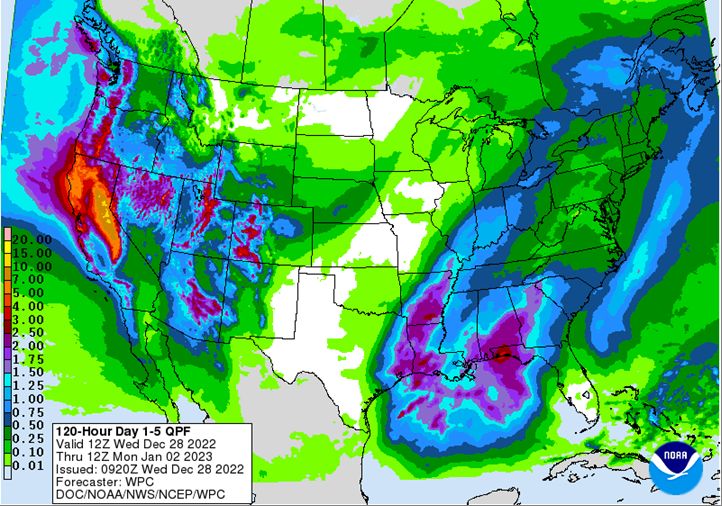

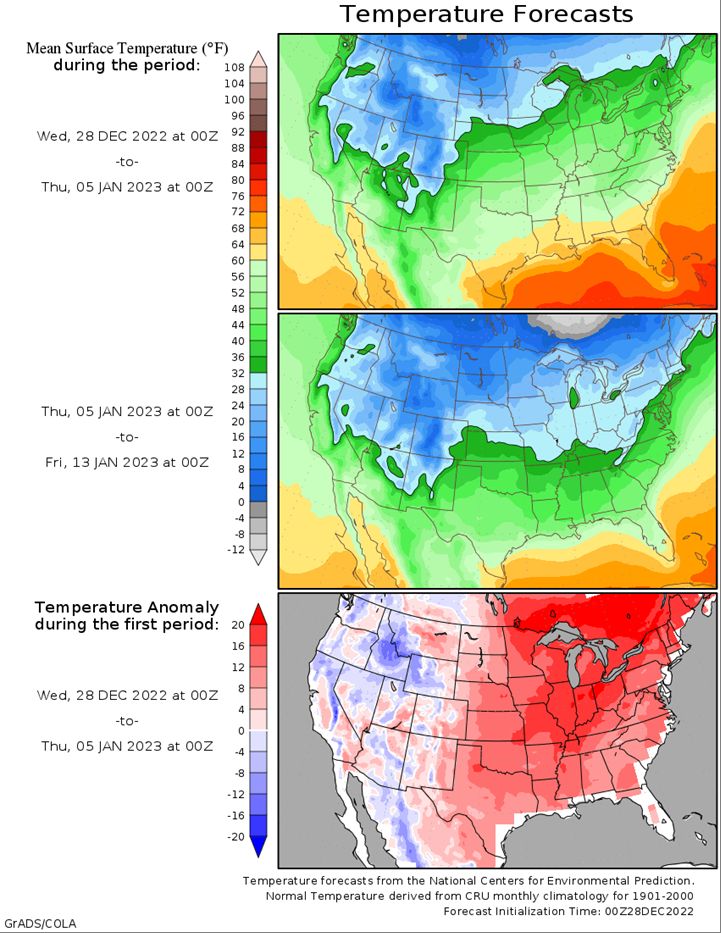

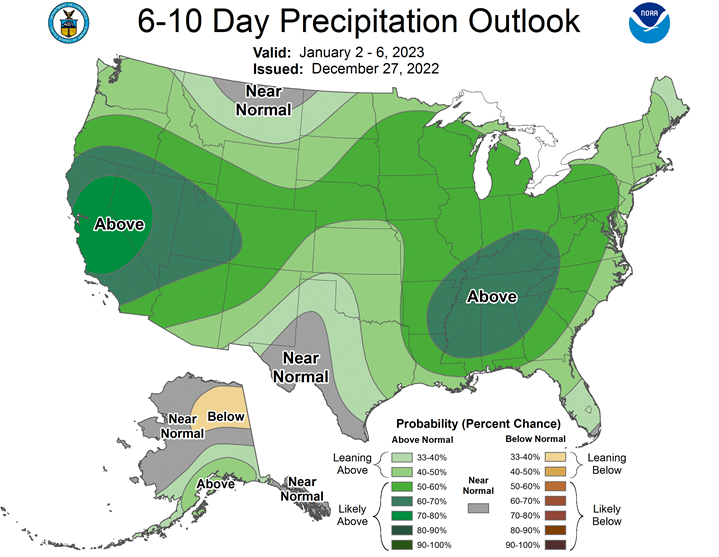

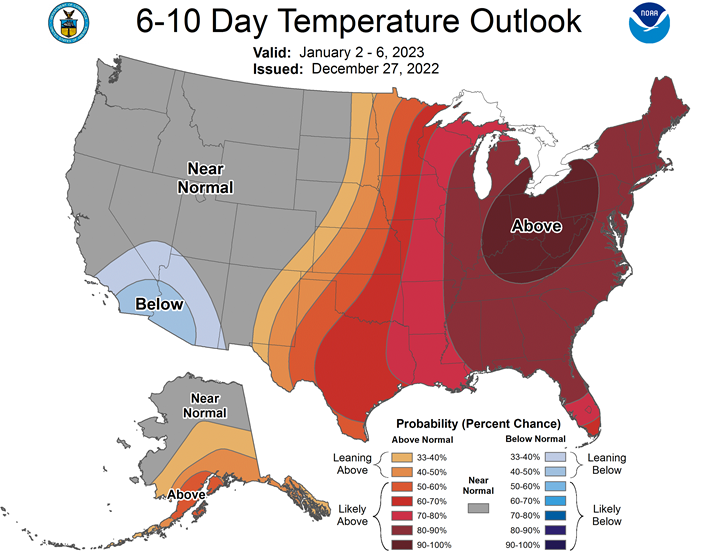

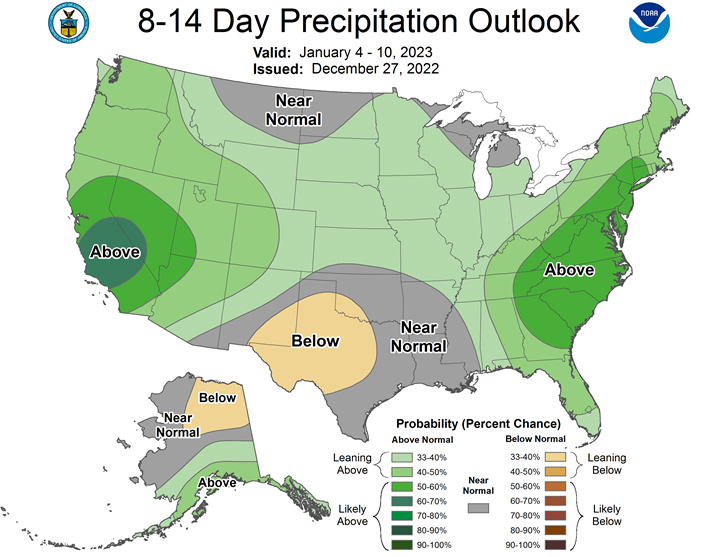

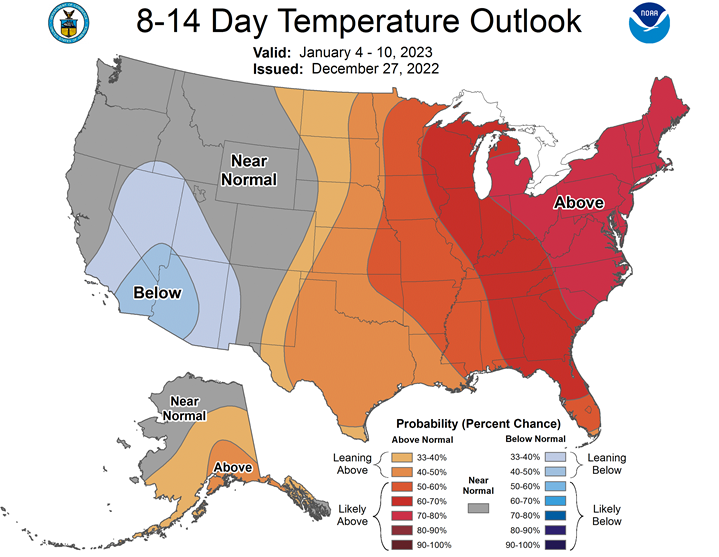

Northern Plains Forecast: The arctic air is moving out of the Northern Plains and temperatures are rising above normal. Any threat to below-normal temperatures is well off in time. A couple of systems may move through, however, and bring periods of rain and snow for the next week.

Central/Southern Plains Forecast: Temperatures are rising above normal in the Central and Southern Plains as arctic air is moving out of the region. Several storm systems and disturbances will move through over the next week, but precipitation is going to be limited and more likely for northern areas than anywhere else. This will likely be a mix of rain and snow. Precipitation is not forecast to be very heavy or help with the drought situation.

Midwest Forecast: In the Midwest, very cold temperatures from the polar vortex are shifting eastward this week, being replaced by some very warm air. Snowfall that came for Christmas will be melting quite a bit. In addition, scattered rain showers are expected later this week and weekend with a couple of disturbances moving through, mostly along the Ohio Valley.

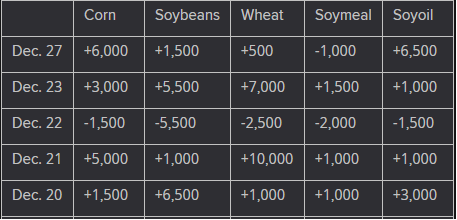

The player sheet for Dec. 27 had funds: net buyers of 500 contracts of SRW wheat, buyers of 6,000 corn, buyers of 1,500 soybeans, sellers of 1,000 soymeal, and buyers of 6,500 soyoil.

TENDERS

- CORN SALE: Private exporters reported the sale of 177,500 tonnes of corn to Japan, the U.S. Agriculture Department said on Tuesday morning. Of the total, 7,500 tonnes was for delivery in the 2022/23 marketing year and 170,000 tonnes for 2023/24 delivery.

- WHEAT SALE: The Betagro group in Thailand is believed to have purchased about 63,000 tonnes of animal feed wheat expected to be sourced from Australia from GrainCorp. Price was estimated at $340 a tonne c&f liner out for shipment in June 2023.

- SUNFLOWER OIL SALE: Turkey’s state grain board TMO has provisionally purchased about 24,000 tonnes of crude sunflower oil in a tender for the same volume.

- WHEAT TENDER UPDATE: Egypt’s state grains buyer, the General Authority for Supply Commodities, is believed to be awaiting approval from the World Bank for a possible wheat tender purchase.

- RICE TENDER UPDATE: The lowest price offered in a tender from Bangladesh’s state grains buyer to purchase 50,000 tonnes of rice was assessed at $397.03 a tonne CIF liner out. No purchase has been made yet.

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp. issued an international tender to purchase an estimated 113,460 tonnes of rice to be sourced from the United States.

PENDING TENDERS

- CORN TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued new international tenders to purchase around 25,000 tonnes of food-quality soybeans free of genetically modified organisms (GMOs).

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp has issued an international tender to purchase an estimated 83,672 tonnes of rice to be sourced from the United States.

US BASIS/CASH

- Bids for soybeans shipped down river by barge to the U.S. Gulf firmed on Tuesday, with the market underpinned by hopes that export demand for U.S. supplies will remain strong until the South American harvest.

- CIF bids for corn and wheat were steady.

- CIF soybean barges loaded in December were bid at 147 cents over January futures, 3 cents higher than Friday.

- FOB offers for soybeans loaded at the U.S. Gulf in January were steady at about 165 cents over January futures.

- CIF corn barges loaded in December were bid at 111 cents over the March futures, unchanged from Friday.

- Export premiums for January loadings of corn also held steady, at about 135 cents over March futures.

- The wheat market was steady, with CIF bids for soft red winter wheat loaded in December reported 120 cents over futures WH3, while January export premiums were offered at 155 cents over.

- CIF bids for hard red winter wheat loaded in were unchanged at 157 cents over futures and FOB offers for January were unchanged at 180 over futures.

- Spot basis bids for soybeans and corn were little changed in the U.S. Midwest on Tuesday but brokers reported moderate farmer sales of both crops as corn futures hit a six-week high and soybean futures set a six-month top, dealers said.

- The soy basis fell by 10 cents at a crushing facility in Des Moines, Iowa.

- The spot corn basis held steady at Blair, Nebraska, after tumbling by 23 cents on Friday.

- U.S. spot cash millfeed values held steady on Tuesday, dealers said.

- Activity was quiet, as most end users had enough supplies on hand to meet their immediate needs.

- Mills were re-starting after closing for a long Christmas weekend, a broker said.

- Spot basis bids for corn were mixed at U.S. Midwest processing sites on Tuesday, with the basis dropping sharply compared to last week at one site in Blair, Nebraska, dealers said.

- The corn basis fell by 25 cents per bushel at Blair, but bids firmed by a nickel at Cedar Rapids, Iowa, as business resumed after the Christmas holiday and last week’s winter storm.

- Basis bids for soybeans were mostly unchanged to start the week.

- Spot basis bids for hard red winter (HRW) wheat were mixed on Tuesday, with the basis easing by 2 cents a bushel at the U.S. Gulf and firming by a nickel at Catoosa, Oklahoma, but farmer grain sales were thin even as March HRW wheat neared $9 a bushel for the first time since Dec. 1, dealers said.

- Railroads were trying to get caught up after last week’s massive winter storm crossed the region.

- Frigid temperatures over the Christmas holiday weekend may have damaged winter wheat in portions of the HRW crop belt, including central Nebraska, western Kansas, east-central and southeast Colorado, northwest Oklahoma and far northwest Texas, space technology company Maxar said in a daily crop weather note.

- However, damage will be difficult to evaluate until the spring, analysts noted.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City fell by 5 cents a bushel on Tuesday for wheat with 12.0% through 14.0% protein, while premiums for lower-protein grades were unchanged.

- Spot basis offers for soymeal were mixed at U.S. Midwest rail and truck points on Tuesday as ingredient brokers worked on delivery logistics following last week’s winter storms, dealers said.

- The spot basis for soymeal was unquoted in Sioux City, Iowa, where the crushing plant was closed for part of last week for maintenance due to the cold.

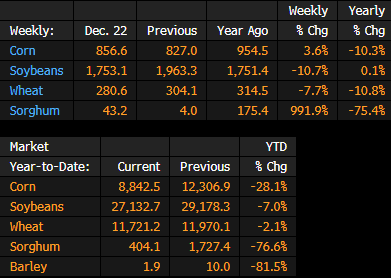

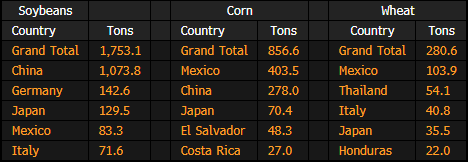

US Corn, Soybean, Wheat Inspections by Country: Dec. 22

Following is a summary of USDA inspections for week ending Dec. 22 of corn, soybeans and wheat for export, from the Grain Inspection, Packers and Stockyards Administration, known as GIPSA.

- Soybeans for China-bound shipments made up 1.07m tons of the 1.75m total inspected

- Mexico was the top destination for corn inspections, and also led in wheat

Brazil Exempts US Ethanol From Import Tax Through March 2023

Brazil’s federal government extended the import tariff exemption on US ethanol through March 2023, according to a decision from the Economy Ministry published in the official gazette on Monday.

- “This is a positive first step toward a permanent resolution and it sends a favorable signal to the marketplace,” Geoff Cooper, CEO of the US Renewable Fuels Association, says in a note

- The group expects to work with incoming President Luiz Inacio Lula da Silva to restore free ethanol trade between both nations, he says

- Brazil government also granted import tariff exemption to dozens of products, according to the resolution

Brazil Soy Exports Seen Reaching 1.715 Million Tns In December – Anec

- BRAZIL SOY EXPORTS SEEN REACHING 1.715 MILLION TNS IN DECEMBER VERSUS 1.750 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.504 MILLION TNS IN DECEMBER VERSUS 1.523 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 6.191 MILLION TNS IN DECEMBER VERSUS 6.579 MILLION TNS FORECAST IN PREVIOUS WEEK – ANEC

Cargill Soy Crush Plant in Ohio Operational Following Fire

Cargill’s soy processing plant in Sidney, Ohio, reopened Sunday after a “small mechanical fire” broke out, according to a statement from the world’s largest agricultural commodities trader.

- There was minimal damage and no injuries, Cargill spokesperson says in emailed statement

- All company crushing plants in the US are running; Sidney plant was operational as of Sunday

- Local media say fire started early Sunday

- “While there was some slowdown in production due to the frigid temperatures, the warmer temps this week have allowed us to resume our normal production”

- Cargill invested about $225 million in 2019 to expand the facility to increase the crude soybean oil production

Brazil Exempts US Ethanol From Import Tax Through March 2023

Brazil’s federal government extended the import tariff exemption on US ethanol through March 2023, according to a decision from the Economy Ministry published in the official gazette on Monday.

- “This is a positive first step toward a permanent resolution and it sends a favorable signal to the marketplace,” Geoff Cooper, CEO of the US Renewable Fuels Association, says in a note

- The group expects to work with incoming President Luiz Inacio Lula da Silva to restore free ethanol trade between both nations, he says

- Brazil government also granted import tariff exemption to dozens of products, according to the resolution

Ukraine’s Grain Exports Drop 30% Y/y in Season So Far

Ukrainian grain exports in the season that began July 1 totaled 22m tons as of Dec. 28, down 30% y/y, according to the Agriculture Ministry.

- Total comprises:

- 8.2m tons of wheat, down 48% y/y

- 1.6m tons of barley, down 69% y/y

- 12.2m tons of corn, up 18% y/y

Palm Oil Prices to Avg. Lower in 2023, Despite Strong 1H: Fitch

Malaysian benchmark crude palm oil spot prices will average $850/t in 2023, significantly lower than $1,175/t in 2022, Fitch says in report.

- Benchmark prices have rebounded to more than $850/t in 4Q from the end-Sept. level of around $700/t

- Expect prices to strengthen further in 1H to more than $900/t

- The outlook for demand growth boosted by Indonesia’s decision in Dec. to increase share of palm-oil based fuel in diesel

- Expect supply to increase from 2Q, and cause prices to drop in 2H

Malaysia Keeps Crude Palm Oil Export Tax at 8% in January

Gazetted price for crude palm oil at 3,889.52 ringgit a ton, which incurs the maximum export tax of 8%, according to a statement from the customs department posted on the Malaysian Palm Oil Board’s website.

- NOTE: Tax has been kept at 8% since Jan. 2021, following government exemption in July-December 2020

- NOTE: Export duty structure starts at 3% when FOB prices for CPO are in the 2,250-2,400 ringgit per ton range

- Maximum tax rate is 8% when prices are above 3,450 ringgit per ton

Argentina’s GDM to focus on U.S. soy and European sunflower seed improvement

Argentine plant genetics company GDM is entering the European sunflower research business through acquisitions while boosting its soy improvement program in the United States as part of a five-year expansion plan, a senior executive told Reuters.

Santiago De Stefano, global director of business, on Tuesday also reaffirmed in an interview in Buenos Aires its decision to focus on improving corn seeds for the Brazilian market – where it already derives most of its revenue based on its soy products offerings.

The focus on corn seed research for Brazilian farmers and enhancement of sunflower plants for European clients reflects potential limitations to genomic research for soybean enhancement, Stefano said.

“We want GDM to continue to grow, but we aim to make it more sustainable in the future,” Stefano said. “For this sales have to be a bit more balanced between crops and territories.”

In relation to growing GDM’s soy business in the United States, Stefano said it is currently smaller compared with Argentina’s and Brazil’s.

GDM researches, develops, and sells genetically improved plant products that can help farmers boost yields.

This year, GDM got approval in Brazil for two new soy varieties obtained through “genetic editing,” a process that unlike genetic modification does not entail introduction of an extraneous gene from another organism.

One of the approvals was for a low-sugar soy designed to help animal digestion that could be launched in 2024/2025. The other is a drought-tolerant soy which requires further testing and may be commercially launched in 2026/2027, Stefano said.

GDM estimates more than doubling its total sales in 2022 to $700 million, thanks mainly to a soy price spike, the company said publicly for the first time.

The firm, which gets around 80% of revenues in Brazil, owns the world’s biggest and most diversified genetics bank to improve soy and other crops, doing research in 15 countries.

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |