Information produced by ADM Investor Services, Inc. and distributed by Stewart-Peterson Inc.

Wheat prices overnight are up 1/2 in SRW, up 2 1/2 in HRW, up 1/4 in HRS; Corn is unchanged; Soybeans up 1/4; Soymeal up $0.33; Soyoil down 0.29.

For the week so far wheat prices are down 11 1/2 in SRW, down 14 3/4 in HRW, down 10 3/4 in HRS; Corn is down 2 1/4; Soybeans up 11; Soymeal up $1.62; Soyoil down 1.12.

For the month to date wheat prices are down 9 3/4 in SRW, down 12 1/2 in HRW, down 3 3/4 in HRS; Corn is up 6 3/4; Soybeans up 50 1/4; Soymeal up $29.60; Soyoil up 0.12.

Year-To-Date nearby futures are down 13.8% in SRW, down 9.5% in HRW, down 8.5% in HRS; Corn is down 4.9%; Soybeans up 1.4%; Soymeal up 6.1%; Soyoil down 6.2%.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Chinese Ag futures (MAY 23) Soybeans down 34 yuan; Soymeal up 30; Soyoil down 100; Palm oil down 106; Corn up 2 — Malaysian palm oil prices overnight were down 77 ringgit (-1.80%) at 4206.

There were changes in registrations (-77 Corn, -6 Soybeans, -16 Soyoil). Registration total: 2,587 SRW Wheat contracts; 43 Oats; 95 Corn; 228 Soybeans; 701 Soyoil; 0 Soymeal; 352 HRW Wheat.

Preliminary changes in futures Open Interest as of March 6 were: SRW Wheat up 4,246 contracts, HRW Wheat up 2,169, Corn down 1,278, Soybeans up 3,429, Soymeal up 6,789, Soyoil up 2,105.

Brazil Grains & Oilseeds Forecast: Scattered showers continue for much of Brazil’s growing regions for the next week outside of Minas Gerais and Rio Grande do Sul, where showers will be more limited. Despite recent rains, many areas have made significant progress with regard to soybean harvest and corn planting. However, some areas are behind, somewhat significantly, and will expose more of the corn crop to the dry season which is forecast start in April. Corn already in the ground will benefit from good soil moisture.

Argentina Grains & Oilseeds Forecast: Dry conditions continue to be a concern for immature corn and soybeans moving forward. Any showers will be limited for at least the next week, though far southern areas could see more widespread showers through the weekend. Heat that developed last week continues for the next week. The heat and dryness are keeping stresses high for both crops in various stages of growth.

Northern Plains Forecast: A system moved into the Northern Plains over the weekend and continued on Monday with areas of snow. Additional waves of snow will press through the region throughout the week, adding up to some hefty amounts for a lot of the region. Colder air will also be in place for a while, with higher inputs than normal required for livestock.

Central/Southern Plains Forecast: A front will slide south through the Central and Southern Plains over the next couple of days, with some scattered showers and falling temperatures. Near- to below-normal temperatures should be in place going into next week as well. Precipitation continues to be limited for southwestern areas where drought remains in control.

Midwest Forecast: A system is bringing precipitation across the Midwest Monday and will be followed by additional waves of precipitation throughout the rest of the week, especially across the west. Cooler temperatures will replace the recent warmth but won’t be extremely cold.

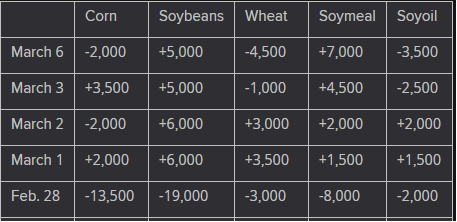

The player sheet for 3/6 had funds: net sellers of 4,500 contracts of SRW wheat, sellers of 2,000 corn, sellers of 5,000 soybeans, buyers of 7,000 soymeal, and sellers of 3,500 soyoil.

TENDERS

- CORN SALES: The U.S. Department of Agriculture confirmed private sales of 182,400 tonnes of U.S. corn to unknown destinations and another 110,000 tonnes to Japan, all for delivery in the 2022/23 marketing year that began Sept. 1, 2022.

- WHEAT TENDER: Algeria’s state grains agency OAIC issued an international tender to purchase a nominal 50,000 tonnes of durum wheat.

PENDING TENDERS

- WHEAT TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking a total of 80,570 tonnes of food-quality wheat from the United States and Canada in a regular tender that will close on Thursday.

- WHEAT TENDER: Jordan’s state grain buyer issued an international tender to buy up to 120,000 tonnes of milling wheat which can be sourced from optional origins

- FEED WHEAT AND BARLEY TENDER: Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) said it will seek 70,000 tonnes of feed wheat and 40,000 tonnes of feed barley to be loaded by June 30 and arrive in Japan by Aug. 31, via a simultaneous buy and sell (SBS) auction that will be held on March 8.

- FEED BARLEY TENDER: Jordan’s state grains buyer issued an international tender to purchase up to 120,000 tonnes of animal feed barley.

- CORN TENDER: Taiwan’s MFIG purchasing group issued an international tender to buy up to 65,000 tonnes of animal feed corn, which can be sourced from the United States, Brazil, Argentina or South Africa.

US BASIS/CASH

- Basis values for corn and soybeans shipped by barge to the U.S. Gulf Coast eased a bit on Monday in subdued trade, brokers said.

- Barge loadings were resuming in some locations on the mid-Mississippi River after seasonal winter closures, traders said. Temperatures were mild on Monday from St. Louis to Davenport, Iowa, although storms were expected later this week that could bring snow to the Davenport area, the National Weather Service said.

- CIF corn barges loaded in March were bid at 77 cents over March, down 2 cents from Friday.

- FOB basis offers for March corn shipments were around 90 cents over May futures, unchanged from Friday.

- For soybeans, CIF barges loaded in March traded at 88 cents over March, down a penny from Friday’s trades. March soy barges were offered at 104 cents over May.

- FOB offers for March soybean shipments held at around 110 cents over May.

- Spot basis bids for soybeans were mixed at U.S. Midwest processors on Monday, dealers said.

- The soy basis was unchanged at river terminals and elevators around the interior of the region.

- Cash bids for corn held steady at processors, elevators and river terminals.

- Some growers were locking in prices for soybeans they had kept in storage at commercial elevators since the harvest in 2022, an Ohio dealer said.

- Sales of corn were slow.

- Spot basis bids for soybeans were flat at processors and river terminals around the U.S. Midwest on Monday morning, dealers said.

- The soy basis was steady to weak at the region’s interior elevators, falling by 2 cents a bushel in Cincinnati, Ohio.

- Farmer sales of soybeans were slow despite a surprise rally in the futures market that pulled cash prices higher, an Iowa dealer said.

- Growers were focused on preparing their equipment and finalizing plans for spring planting, the dealer added.

- Cash bids for corn were steady to weak at processors, steady to firm along rivers and flat at interior elevators and ethanol plants.

- Spot basis bids for hard red winter wheat were steady to slightly weaker for supplies delivered by rail to the U.S. Gulf on Monday, grain dealers said.

- The cash basis was flat at truck market elevators across the southern U.S. Plains.

- Farmers were showing little interest in booking deals for their wheat, an Oklahoma dealer said.

- Poor overseas demand for U.S. supplies has limited the amount of supplies needed by exporters at the U.S. Gulf.

- Protein premiums for hard red winter wheat delivered by rail to or through Kansas City fell by 4 cents a bushel for wheat with ordinary protein content, according to the latest CME Group data. Premiums were unchanged for wheat with protein content ranging from 11% to 14%.

- Spot basis offers for U.S. soymeal held steady at most processors in both the rail and truck markets on Monday, dealers said.

- Winter storms across much of the northern U.S. Midwest in recent weeks has slowed movement of supplies and many dealers were busy working to ensure that previously booked orders were being delivered.

- Demand from end users was steady, a Minnesota dealer said.

- Although the basis was mostly steady, offers fell by $10 per ton in Mankato, Minnesota.

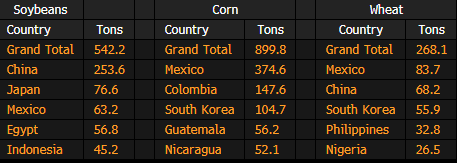

US Inspected 900k Tons of Corn for Export, 542k of Soybean

In week ending March 2, according to the USDA’s weekly inspections report.

- Wheat: 268k tons vs 653k the previous wk, 403k a yr ago

- Corn: 900k tons vs 649k the previous wk, 1,582k a yr ago

- Soybeans: 542k tons vs 765k the previous wk, 772k a yr ago

US Corn, Soybean, Wheat Inspections by Country: March 2

Following is a summary of USDA inspections for week ending March 2 of corn, soybeans and wheat for export, from the Grain Inspection, Packers and Stockyards Administration, known as GIPSA.

- Soybeans for China-bound shipments made up 254k tons of the 542k total inspected

- Mexico was the top destination for corn inspections, and also led in wheat

U.S. Winter Wheat Crop Conditions by State for March 5: USDA

The following table shows the most current winter wheat conditions for selected states as of March 5, according to the USDA’s state crop progress and conditions reports.

- Kansas good/excellent rating dropped by 2 percentage points in the week ending March 5 vs the previous week

- Oklahoma conditions rose to 39% good/excellent vs 36%

- Texas conditions remained at 19% good/excellent

China’s Jan-Feb Imports

China Jan.-Feb. Soybean Imports 16.173m Tons: Customs

General Administration of Customs says on website.

- Edible vegetable oil imports in Jan.-Feb. 1.381m tons

- Rubber imports in Jan.-Feb. 1.322m tons

- Meat (including offal) imports in Jan.-Feb. 1.298m tons

- Fertilizer exports in Jan.-Feb. 3.586m tons

Uruguay 2023 Soy Crop Seen Falling 36% y/y to 2.1M Tons: Exante

Uruguay’s soy harvest could shrink about 36% y/y to 2.1m metric tons this year due to a deep drought affecting the South American country, consulting firm Exante said in a report.

- That would be the worst soy harvest since the 2m tons produced in 2021, which was also a drought year

- Yields are expected to hit a five-year low of 1,800 kilograms per hectare

- Production costs rose an estimated 29% y/y to a record $941 per hectare owing to higher fertilizer, fuel, chemical and seed prices

- Low yields, higher costs mean soy farmers will see zero or even negative margins on that crop even before paying rent on the land

- Exante forecasts rape seed and carinata production doubling y/y to a record 587,321 tons

- Even so, farmers will probably have negative margins on those crops due to high costs and lower prices, yields

Brazil’s Soy Crop Is So Big Farmers Are Running Out of Storage

Brazil — the world’s largest exporter of soybeans — is running out of places to store its record harvest, forcing farmers to speed up sales and move cargoes at a rare discount.

Usually sold at a premium to futures prices in Chicago, soybeans offered at Brazil’s Paranagua port are now almost 18 cents a bushel below the benchmark. That’s the biggest discount since June 2021.

Unlike in the US, where most farmers own their own silos, many small and medium-sized Brazilian producers harvest and immediately deliver their grains because they lack independent storage. The South American nation is expected to harvest an all-time high of 153 million tons of soybeans this year due to higher yields and more acreage, plus 124 million tons of corn. However, it has a grain storage capacity of just 186.6 million tons total, with only 15% of that capacity located at farms, according to the national supply company Conab.

Brazilian producers often sell a portion of their output in advance to fund crop expenses, but farmer selling has lagged previous years because producers are more flush with cash after a profitable crop last year. That led more farmers to initially hold out for higher prices, worsening the storage crunch. Now, many are selling at once. Brazil’s soybean harvest is almost 50% complete.

“Now they need to sell because harvest has accelerated and they don’t have enough bins to store it,” said Luiz Fernando Roque, an analyst at Safras & Mercado. That’s likely to keep Brazilian premiums negative in the coming weeks as soy reaping enters its final stage, possibly pressuring Chicago futures down, he added.

Brazil 2022/23 Corn Harvest 35.4% Done as of March 3: Safras

Compares with 44.8% last year and a five-year average of 33.5%, according to an emailed report from consulting firm Safras & Mercado.

Winter corn planting in Brazil’s Center-South region is at 57%, compared to a five-year average of 65.2%

WHEAT/CEPEA: Sales are low in PR and slightly higher in RS; quotations drop

Wheat sales have been low in Paraná, where farmers are currently focused on the harvesting of soybean and the summer crop of corn. In Rio Grande do Sul, liquidity has been slightly higher, due to the higher supply of wheat in the spot market – it is worth to mention that, in 2022, the harvesting of wheat set a record in RS.

Quotations are fading this month, in both the Brazilian and the international markets. Cepea surveys show that, between February 24 and March 3, the prices paid to wheat farmers (over-the-counter market) dropped 0.7% in Santa Catarina and 0.23% in Paraná but rose a slight 0.14% in Rio Grande do Sul. In the wholesale market (deals between processors), values decreased 1.36% in SC, 0.92% in PR and 0.53% in São Paulo but remained stable in RS. In the same period, the US dollar depreciated 0.15%, to BRL 5.198 on March 3rd.

EXPORTS AND IMPORTS – According to data from Secex, in the 18 working days of February, Brazil imported 291.6 thousand tons of wheat, against 498.7 thousand tons in Feb/22. Exports totaled 536.7 thousand tons, against 820.2 thousand tons in Feb/22.

Cargill Is Optimistic Ukraine Grain-Export Deal Will Be Renewed

- Shipments climbed after the pact, which runs until March 18

- February exports were just below December’s high, data show

Cargill Inc., the world’s top agricultural commodities trader, said rising grain exports from Ukraine are sparking optimism that a deal to keep ships sailing via the Black Sea will be renewed.

The increase in Ukraine’s shipments of corn, wheat and barley is helping push down world food costs after they jumped to a record in 2022, giving Cargill Chairman David MacLennan confidence that last year’s landmark UN-brokered export pact — which is up renewal March 18 — will remain in force.

The Black Sea has become a major breadbasket for the world, with Ukraine exporting about 10% of the world’s corn and 7% of its wheat. That’s made the former Soviet Union nation key supplier to some of the world’s biggest buyers, including China and Egypt.

“There is political support from around the world to keep the corridor open,” MacLennan said in an interview at Cargill’s headquarters in Minnesota last week. “As long as that is the case, we will continue to help farmers and help product out of the country.”

In a separate interview from Cargill’s trading floor, Michael Ricks, vice president and trading and merchandising manager, said the company’s exports had picked up in the past two weeks, a reversal from the “tremendous” delays inspecting boats just after the opening of the corridor.

“In the very, very short term — and this is probably the last two weeks — the corridor is probably working better than it ever has,” Ricks said. “We’ve gotten more boats passed in the last 10 days that we’ve had in the last two months.”

Renewing the export pact is a priority for China, which listed that goal as number 9 in its 12-point plan to resolve the war in Ukraine. While the UN-brokered grain corridor deal has boosted shipments, Ukrainian traders and authorities have said that Russia is purposefully slowing the pace by delaying required ship inspections.

Total Ukrainian shipments of corn, wheat and barley can reach 4 to 6 million tons per month with the corridor open, compared with just 2 million by rail, Cargill said. Grain exports hit 4.908 million tons in February via all means of transport, government data show. That’s just below the nearly 5 million shipped in December, the highest since the war began.

Ricks added that the company’s export facilities — which earlier faced electricity shortages — are now back to operating three shifts, instead of just one. Traders also have a better handle on how to ship grain over land.

“The movement by a barge, rail and truck to Constanta has become much more efficient too,” he said, referring to Romania’s main grain export port.

Australia hikes 2022/23 wheat crop estimate to new record 39.2 mln T

The Australian Bureau of Agricultural and Resource Economics (ABARES) has increased its estimate of 2022/23 wheat production in major exporter Australia to a new record of 39.2 million tonnes.

That compared with ABARES’ previous estimate of 36.6 million tonnes in December, which was already a record level.

For the 2023/24 season, wheat production was projected to fall to 28.2 million tonnes, on the assumption that less favourable drier conditions will develop, it said in a crop report.

Uruguay 2023 Soy Crop Seen Falling 36% y/y to 2.1M Tons: Exante

Uruguay’s soy harvest could shrink about 36% y/y to 2.1m metric tons this year due to a deep drought affecting the South American country, consulting firm Exante said in a report.

- That would be the worst soy harvest since the 2m tons produced in 2021, which was also a drought year

- Yields are expected to hit a five-year low of 1,800 kilograms per hectare

- Production costs rose an estimated 29% y/y to a record $941 per hectare owing to higher fertilizer, fuel, chemical and seed prices

- Low yields, higher costs mean soy farmers will see zero or even negative margins on that crop even before paying rent on the land

- Exante forecasts rape seed and carinata production doubling y/y to a record 587,321 tons

- Even so, farmers will probably have negative margins on those crops due to high costs and lower prices, yields

Japan to Take Measures to Keep Down Imported Wheat Prices: NHK

Japan’s agriculture ministry plans to take measures to keep the rise in imported wheat prices at ~5%, public broadcaster NHK reports without attribution.

- Considering using prices during most recent 6 months to calculate what to charge domestic flour mills, rather than the usual 1 year

- Without the change, imported wheat prices would increase ~13%

- NOTE: Japan imports ~90% of its wheat, with the government buying in bulk before selling on to domestic flour mills; government revises prices every April and Oct.

India Mulling Raising Palm Oil Tax to Aid Rapeseed Farmers: Rtrs

India is considering to raise import duty on palm oil to help support local farmers reeling from a crash in domestic rapeseed prices, Reuters reported citing government and industry officials it didn’t name.

- The increase in the tax on palm oil could lift local prices, making the tropical oil a little less competitive than rival soyoil and sunflower oil

- NOTE:India Will Import More Edible Oils as Consumption Jumps: Group

India’s Food Corp Asked to Ensure Grains Storage For Hot Weather

Prime Minister Narendra Modi has asked Food Corporation of India to ensure optimal storage of grains as the country gears up for hot weather in the coming summer, according to a press release issued by Press Information Bureau.

- Modi chaired a high-level meeting Monday to review the preparedness for hot weather in summer

- He instructed India Meteorological Department to issue daily weather forecasts in a manner which can be easily interpreted and disseminated

- Modi instructed that availability of fodder and of water in reservoirs should be tracked

- He stressed on the need for detailed fire audits of all hospitals

- NOTE: India Forecasts Heat Waves After Hottest February Since 1901

- Separately, India’s chief economic adviser, V Anantha Nageswaran, said that if the heat wave forecast turned out to be true, it could hurt farm produce

India’s palm oil imports could jump to 4-year high on lower prices – industry official

India’s palm oil imports could jump 16% in 2022/23 to a four-year high of 9.17 million tonnes, as consumption is set to jump after two years of contraction due to COVID-led lockdowns, a senior industry official told Reuters on Tuesday.

Higher purchases by the world’s biggest importer of vegetable oils could lend further support to palm oil futures, which are trading near their highest level in four months.

“Consumption fell for two straight years because of the pandemic. This year, it would rebound by about 5% as restrictions have eased and prices have fallen,” said Sudhakar Desai, president of the Indian Vegetable Oil Producers’ Association.

The consumption growth would be fulfilled by higher imports of palm oil, which has been trading at a discount to rival soyoil and sunflower oil, he said.

India’s palm oil imports in the first four months of the 2022/23 marketing year that started on Nov. 1 jumped 74% from a year ago to 3.67 million tonnes, traders estimate.

India buys palm oil mainly from Indonesia, Malaysia and Thailand. It imports soybean and sunflower oil from Argentina, Brazil, Russia and Ukraine.

The country’s total vegetable oil imports could rise to 14.38 million tonnes in the current year from 14.07 million tonnes a year ago, Desai said.

Soybean oil imports could fall to 3.16 million tonnes from 4.05 million tonnes, while sunflower oil imports could rise to 2 million tonnes from 1.93 million tonnes, he said.

Palm Oil Prices Seen Trading Above 4,000 Ringgit to June: IOI

Palm oil prices will likely trade above 4,000 ringgit a ton in the next two to three months on supply tightness caused by heavy rain and limited exports from Indonesia, according to IOI Corporation Bhd., one of the world’s biggest producers.

- Major flooding in parts of Malaysia will not have a significant impact on the planter’s palm oil production, and may only affect less than 5% of its annual output, Chief Executive Lee Yeow Chor said in an interview on Tuesday

- Malaysian total production may not increase substantially this year, as unexpected heavy rainfall will curb growth in yields

- Labor shortages at plantations likely to normalize by mid-year

- Biodiesel boom and growing demand for soybean oil have resulted in a vacuum in vegetable oil supply in the US and rest of the world

Russia Has Exported 40M Tons of Grain in 2022-23 Season: IFX

Russia has shipped 40m tons of grain abroad since July 1, Roman Nekrasov, director of the crop production department at the country’s agriculture ministry, said at a meeting Tuesday, according to Interfax.

NOTE: That means the country already has met at least two-thirds of the ministry’s 55m-60m ton grain-export forecast for the season

Australia Sees Wheat Exports Plunging 20% on Drier Climate

- Australian cargoes have helped keep global prices in check

- Canola and barley supplies also set to drop in coming year

Australia, the world’s second-largest wheat exporting country, is likely to see shipments slump 20% from record levels in the coming financial year as production tumbles because of a shift to a drier climate pattern.

Exports will probably fall to 22.5 million tons in 2023-24 from an all-time high of 28 million tons a year earlier, while output is set to decrease to 28.2 million tons from 39.2 million tons, government forecaster Abares said. The figure for the harvest just completed is up from 36.6 million tons estimated in December. Planting for the coming crop only gets under way in April.

Supplies of the food staple from Australia have helped to cap global prices in the past year after Russia’s invasion of Ukraine choked shipments and sent the grain to a record. Production in Australia was boosted by plentiful rains from the La Nina weather event, and a return to less favorable, drier conditions is expected in the coming months, the agency said in a report.

More from Abares:

- The agricultural sector will be “affected by a flip into El Nino or positive IOD led drought-like conditions” in 2023–24, according to assumptions based on statistical analysis and climate modeling.

- The Indian Ocean Dipole refers to a pattern of changes in sea surface temperatures in the western and eastern tropical Indian Ocean.

- “Our expectation is that the climate’s going to shift towards a dry pattern,” Abares Executive Director Jared Greenville said in an interview. “We’ve had a run of three really wet years and that’s really unusual in the historical record.”

- But given factors such as levels of water storage and soil moisture, production should still remain at about an average level, he said. Winter rainfall is a key uncertainty in terms of climate change.

- Canola production in Australia is expected to decline by 35% to 5.4 million tons in 2023–24 on expectations of drier conditions.

- Barley output is likely to shrink 30% to 9.9 million tons in 2023-24, while sorghum production is forecast to contract 28%.

- The value of crop production is likely to fall to A$46 billion ($31 billion) in 2023-24 from a record A$54 billion, largely driven by a drop of about a third in the value of wheat, barley and canola output

- Livestock production will remain relatively steady at A$35 billion

- In 2023–24, the value of agricultural exports is forecast to fall to A$64 billion from A$75 billion a year earlier.

Malaysia’s 2023 biodiesel exports to fall to six-year low, association says

Malaysia’s biodiesel exports in 2023 are expected to fall to a six-year low of 300,000 tonnes due to the European Union’s decarbonisation plans, the Malaysian Biodiesel Association (MBA) said on Tuesday.

The European Union’s demand for palm oil is expected to decline significantly over the next 10 years due to a renewable-energy directive that requires the phasing out of palm-based transportation fuels by 2030 over allegations of deforestation.

Malaysia’s biodiesel exports to the bloc are forecast to decline for a fourth consecutive year, MBA president U.R. Unnithan said at a palm oil industry conference.

The EU in December agreed on another deforestation regulation that requires companies to produce a due diligence statement showing when and where their commodities were produced and provide “verifiable” information that they were not grown on land deforested after 2020, or risk hefty fines.

“The new EUDR (European Union Deforestation Regulation) will open up new opportunities and challenges for the biodiesel market,” Unnithan said.

He expected crude palm oil prices to range between 3,800 and 4,200 ringgit a tonnne in the next three months, supported by Indonesia’s biodiesel programme.

Prices will average 3,900 ringgit in 2023, Unnithan said.

USDA attache sees China pork production, imports growing in 2023

Following are selected highlights from a report issued by the U.S. Department of Agriculture’s (USDA) Foreign Agricultural Service post in Beijing:

“The People’s Republic of China (PRC) decision to end its zero-COVID policy restrictions is expected to improve demand for both pork and beef products in 2023. However, Brazil’s decision to suspend beef exports to China at the end of February following a suspected bovine spongiform encephalitis (BSE) detection could impact supply as alternative origin suppliers may not fully bridge the potential supply gap in 2023. Pork production and imports, and beef production are all forecast to grow in 2023. Hong Kong remains the PRC’s primary export market for pork and beef.”

Iowa, Nebraska Threaten to Sue EPA Over Ethanol Rule Start Date

US farm states tell EPA they’re prepared to sue within 60 days if the Biden administration doesn’t allow sales of higher ethanol E15 blends this summer.

- EPA’s proposal aimed at encouraging year-round sales of E15 is flawed because it doesn’t start until April 2024, attorneys general for Iowa and Nebraska tell EPA Administrator Michael Regan in letter

- “At best, this delay is arbitrary and capricious, at worst it is plainly unlawful”: letter

- AGs demand emergency action to allow sales this year if EPA can’t issue timely rule

- Ethanol industry praised move by the states

- “The marketplace finds itself in between a rock and hard place because of the administration’s inaction, and consumers are at risk of losing access to low-cost, lower-carbon E15 in a few short months,” Renewable Fuels Association President Geoff Cooper said in a statement

SOUTH AMERICA

UNITED STATES

This commentary is provided by ADM Investor Services, a futures brokerage firm and wholly owned subsidiary of ADM Company. ADMIS has provided expert market analysis and price risk management strategies to commercial, institutional and individual traders for more than 50 years. Please visit us at www.admis.com or contact us at sales@admis.com to learn more.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by Archer Daniels Midland Company. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS.

| CONFIDENTIALITY NOTICE

This message may contain confidential or privileged information, or information that is otherwise exempt from disclosure. If you are not the intended recipient, you should promptly delete it and should not disclose, copy or distribute it to others. |