Corn trades sideways, demand looks to be improving

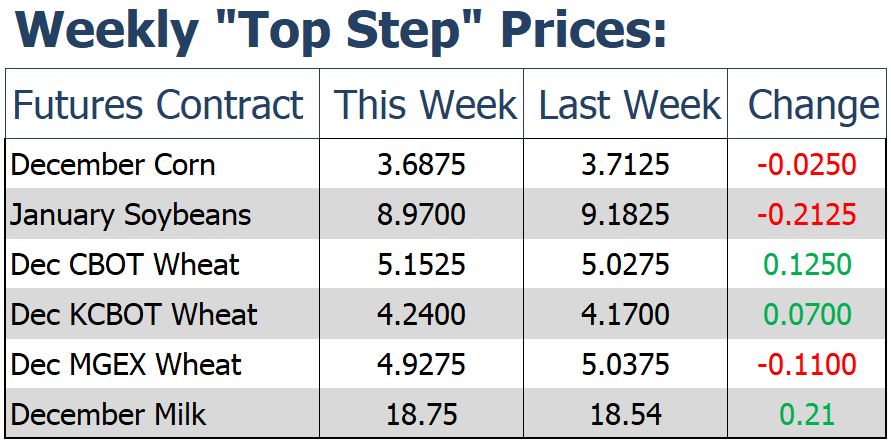

The corn market had a rather quiet week, trading within a six-cent range all week. December corn lost 2-1/2 cents this week to close at 368-3/4. July corn closed at 388-3/4 off 3-3/4 cents this week. Corn exports were rather strong for the week ending November 14, coming in over 30 million bushels. This was a nine-week high for corn exports. Mexico was the top destination, buying nearly half the total with 15.2 million bushels. Domestically, feed demand looks to be in a significant up trend with the release of today’s cattle on feed numbers. Cattle placements in feedlots were up 10% from last October, totaling 2.48 million head. With the market being in an extremely oversold condition any sort of non-bearish news should attract some buyers.

Corn harvest remains behind pace across the country, with 76% harvested vs the five-year average of 92%. The harvest of 2019 is now the third slowest harvest on record and is only quicker than the harvests of 2009 and 1992. Propane shortages across the corn belt continue to hinder harvest progress. Eight states have declared emergencies related to propane.

Soybean market has its worst week since July

The soybean market traded lower for a third straight week, posting a 21-1/4 cent loss in the nearby January contract at 897. July soybeans were down 15-1/2 cents this week to close at 937. Selling pressure in recent weeks has pushed front month soybeans below the $9 mark. The market has spent a majority of the trade war below this point. Lack of any positive news in the last week and a half on the trade front has caused speculative buyers to back out of long positions. Managed Money funds are estimated to be long about 10,000 contracts currently. This is more than 60,000 contracts smaller than their most recent large net long position from the last week of October. Also adding pressure to the soybean market is favorable weather in South America. Worries of drought have been eased and soybean planting has moved at a rather impressive pace in both Brazil and Argentina, the worlds #1 and #3 soybeans producers respectively.

Wheat turns higher

December Chicago wheat was up 12-1/2 cents this week to close at 515-1/4. December Kansas City wheat was up 7 cents closing at 424 while Minneapolis spring wheat was down 11 cents this week to close below the 5-dollar mark at 492-3/4. Wheat export sales were near the upper end of estimates for the week ending last Thursday totaling 16.1 million bushels. Week over week export sales were 83% higher and 29% above the four-week average. A stronger US dollar this week could add pressure moving forward.

Class III 2020 Average Finishes the Week Strong

Today’s spot trade was lower in every category other than cheese, which was unchanged. Butter prices finished the day down 1.5 cents on 6 loads traded. This is a new low for the spot market in 2019. The primary pressure for butter appears to be coming from the fact that global prices are over 20 cents cheaper per pound than U.S. butter. Non-fat powder was down 0.5 cents on a whopping 15 loads traded. This is somewhat disappointing given GDT powder traded at $1.37/lb. Non-fat did make new highs for 2019 earlier in the week but have since backed off of those levels. Whey prices closed above the resistance of $0.35/lb yesterday but broke back down below it today. If we see further downside in the whey market next week it could indicate that the recent push higher was a false move. Cheddar blocks and barrels had no loads traded today closing the week just above $2.01/lb.

2020 class III milk futures contracts continue to add premium as contracts work their way up to new highs. The 2020 calendar year average for class III made a new high again today trading to $0.03 cents higher to $17.56. It is extremely supportive to see strength in 2020 contracts despite spot cheese prices being down for multiple weeks in a row. The November contract finished the week at $20.36 with a short week of trading next week left to go it looks like November will be the highest contract settlement since November of 2014. The sales closing date for Q1 D-RP insurance is December 15th. As we approach that time horizon we will be heavily considering getting protection in place given the relative strength and cost of Q1 of 2020 insurance.