August 7th, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

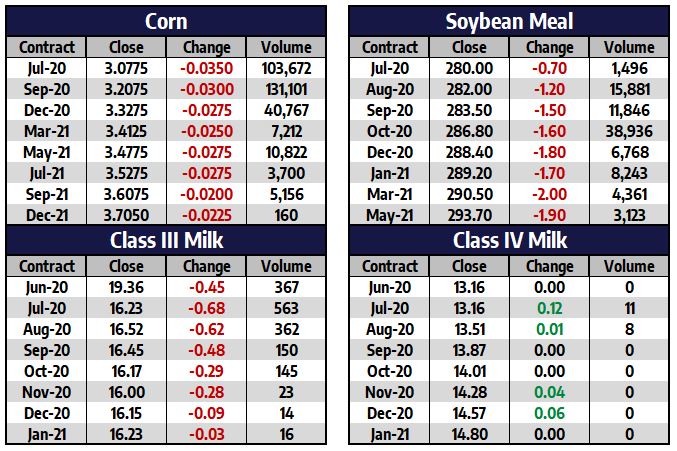

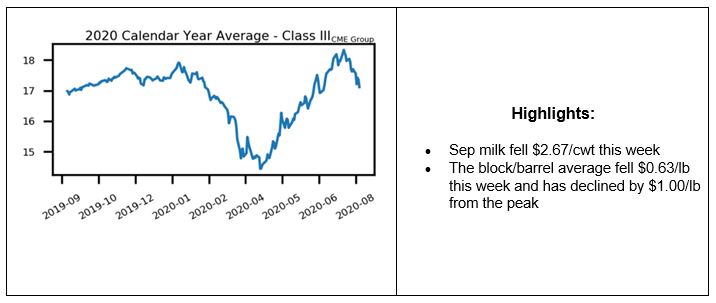

Milk

Sep milk closed lower for a second consecutive week. Last week Sep fell $1.23/cwt and this week it fell $2.67/cwt. This weakness continues to be driven by falling cheese prices. The block/barrel average price has declined for four consecutive weeks, but the bulk of that decline has come the last two with cheese down $0.25/lb last week and down $0.63/lb this week. The cheese market is now down exactly $1.00/lb from it’s highest weekly close of $2.6275. Next major market reports are two weeks out — July Milk Production and Cold Storage.

Corn

Sep corn retested Tuesday’s low of $3.0825 and closed slightly below that level. The market was up three of five days this week, yet Tuesday’s sharp drop of over $0.09/bu resulted in this being the 5th down week in a row. The selloff Tuesday was driven by StoneX’s (formerly FCStone) forecast that pegged the US corn crop at 182.4 bpa. That compares to the current USDA estimate of 178.5 bpa. Their higher yield forecast shouldn’t have been much of a market surprise as current crop condition ratings have most everyone expecting that the USDA is going to increase their yield estimate next Wednesday. And in the past, when the USDA has increased corn yield on the August WASDE report, their average increase has been by over 3 bpa. This next week’s report is the first official NASS crop estimate — meaning it will only be a farmer survey. Corn finished the week down $0.08/bu and has dropped a net of $0.36/bu over the last five weeks.

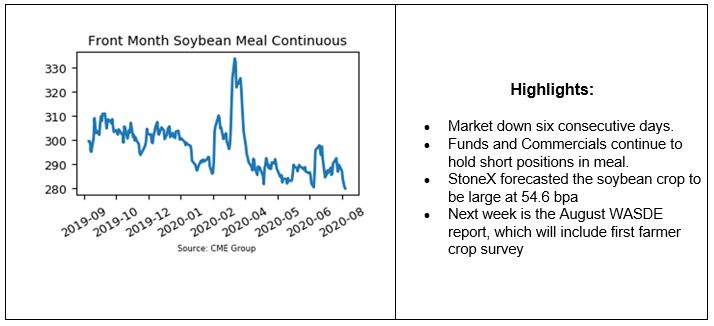

Soybean Meal

Sep meal has declined 6 consecutive trading days and has dropped by a net of $10/ton over that stretch. This week’s decline has the market retesting the May 2020 low of $281.50. Since April the market has been in a sideways grind, largely between $281.00 on the bottom side and $295.00 on the top side. Both the Funds and Commercial traders continue to see a lack of value in the current price range as both trader groups remain net short the market. Part of this week’s weakness was likely attributable to a massive soybean yield projection by StoneX of 54.6 bpa, vs the last USDA forecast of 49.8 bpa. If StoneX ended up being correct on their forecast, it would be over 2 bpa larger than the prior record of 51.9 bpa.

Market Quotes