December 9, 2022

Dairy Under Pressure All Week

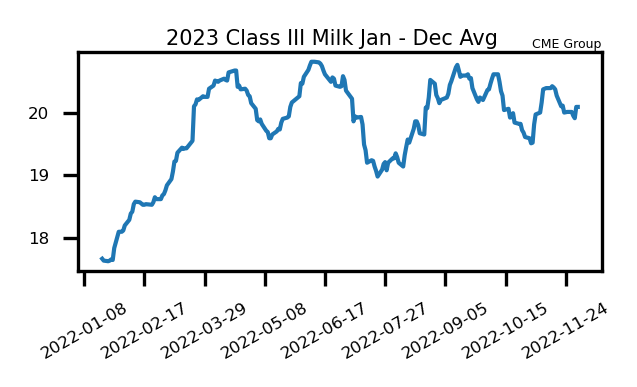

For nearly all of the dairy market, this week concluded in losses. Both Class III and Class IV futures lost value in the first half of 2023, with January contracts in both classes down for the fourth straight week. The spot markets were all lower besides cheese, which gained just over 2 cents per pound, while powder, butter, and whey were all in the red. Butter was extremely volatile this week with a 20-cent drop in the spot market Thursday and a 12.75 cent recovery in Friday’s trade. Volume in both cheese and butter spot markets was good this week with 21 and 18 loads traded, respectively. Regional butter reports have shown production and demand as steady, while inventories continue to be well short of recent history and regional cheese reports show similar sentiment for production and demand but large inventories continue for cheese. Opportunity maintains for US dairy products shown in this week’s reporting of October Dairy Exports and Global Dairy Trade event. It will be a quiet week for fundamentals coming up with no reports on the release docket.

- GDT Auction event Tuesday was up 0.60% to 1,101, up from a 22-month low in early November of 1,069 points

- US spot butter prices continue at a large premium to GDT pricing; a near 70 cent gap remains between the two

- The cheese market has been choppy in recent months. It was able to find bidding this week that took it back over the $2.00/lb level

Corn Market Stabilizes

- The corn trade found support this week after dropping 25c during last week’s trade

- March 2023 corn futures closed the week down just 2.25c to $6.44 per bushel

- The USDA made few changes in Friday’s December WASDE report. The USDA estimated the World corn crop at 1,161.8 mmt versus 1,216.8 mmt last year

- The USDA lowered Ukraine’s corn crop to 27.0 versus 42.1 last year. Argentina is at 55.0 versus 51.5 last year

- The Buenos Aires Grain exchange said 18% of the Argentina corn crop is rated good to excellent with 33% planted

- Total US corn export commitments are down 48% from last year

Soybean Meal Up 8 Days in a Row

- The soybean meal market surged higher this week as January futures jumped $47.50 per ton to $471.60

- January soybean meal hit new contract highs consistently this week

- Rain is needed in South America. Over the last 48 hours, Argentina received scattered showers though

- The Buenos Aires Grain Exchange said 11% of Argentina’s soybean crop is rated good to excellent, with 37% planted

- The USDA estimated the World soybean crop at 391.10 mmt versus 355.60 last year

Friday’s Market Quotes