Today’s Highlights | Corn

Corn closes lower in quiet day.

Corn closed lower today, with March futures finishing 2-3/4 lower at 378-1/2 and the July contract finishing 2-1/2 lower at 389-1/4. The corn market was unable to gather any strength off of higher soybean and wheat markets. Prices have gravitated back to the middle of the range from the last week after touching up to 384-1/2 the last 2 days on the March contract. A number of short term technical indicators are suggesting the market is trying to round the corner higher, but so far corn has been unable to gather any upside momentum. Domestic demand for corn continues to show some improvement. Weekly ethanol grind figures were slightly above the previous week, and were above the amount needed weekly to meet the USDA demand figure for ethanol for the second consecutive week. Basis levels remain firm in general as farmer selling has remained light.

Next Tuesday, the USDA will release their December WASDE report. The USDA typically does not adjust production figures on this report and hold those changes for the final production report in January. Some adjustments to the demand side of the balance sheet will likely be made, but a large shift in the figures is not expected.

Corn | Front Month Continuous

Today’s Highlights | Soybeans

Soybeans finish with gains for second consecutive day.

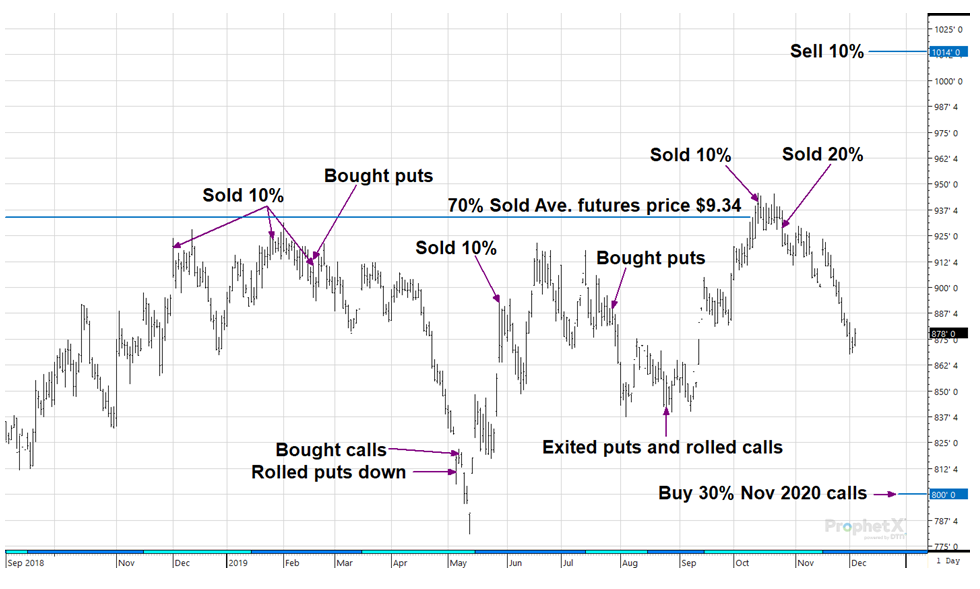

Soybeans showed some signs of life today, with the January contract closing 7 cents higher at 878, and July futures finishing 6 higher at 920. This was the strongest day for the soybean market in nearly a month. Soybeans look to be finding support near the lows of the market from the months of August and September. Short term technical indicators have looked heavily oversold and some indicators have started to curl back higher suggesting the market may be finding a bottom in the near term at least. Soybeans got a boost today on positive talk related to trade talks with China and rumors that Phase 1 of a trade deal is nearly complete. That talk has circulated many times before, so the market may take it with a grain of salt and wait for a more concrete confirmation before getting overly excited about a deal. But if nothing else, it seems to be supporting the market for the time being. A sideways market for the balance of the week would look like a win for soybeans given it’s price direction over the last month and a half.

Weakness in the dollar over the last few days has also aided the soybean market. No major change are expected at this point on next week’s WASDE report. Tomorrow’s export sales report is expected to show soybean sales in the range of 700 thousand to 1.3 million metric tons compared to last week’s report which showed 1.66 million metric tons of sales for the previous week.

Soybeans | Front Month Continuous

Today’s Highlights | Wheat

Wheat moves back higher after Tuesday’s selloff.

Wheat futures closed higher today, with Chicago March finishing 2-1/4 cents higher at 527-1/2, KC March up 3-3/4 at 440-1/2 and Minneapolis up 1-1/2 at 515. The wheat market followed the strength in the soybean market off of optimism that a trade deal with China could be close. Continued weakness in the dollar may have helped the market as well. The market was able to shake off yesterday’s weakness that saw the Chicago market pull back a dime after the market touched new four month highs on Friday. Japan’s parliament approved a US-Japan trade deal that reduces or removes Japan’s tariffs on US wheat. This gives the market some hope for a pick up in export business. Tomorrow’s export sales report is expected to show wheat sales in the range of 300-700 thousand metric tons compared to 612 thousand last week. Earlier this week, Egypt’s GASC purchased 295 thousand metric tons of wheat from Russia, as US prices have remained non-competitive on the world market.

Chicago Wheat | Weekly Front Month Continuous