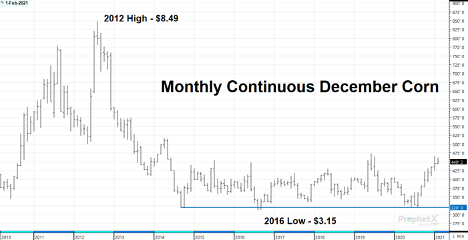

The corn market has seen a jump in volatility in the last 12 months. Only 365 days ago, front-month corn futures prices were hanging around $3.80 per bushel with no idea what was on the horizon. A bearish March 2020 planting intentions report and the onset of COVID-19 sent prices spiraling lower from February of 2020 into the summer months. The idea of sub $3 corn come harvest seemed inevitable as the calendar turned to August and prices continued to fall. The August 10 Derecho and ensuing massive Chinese purchases turned the market higher as prices rallied through harvest and into the beginning of 2021. The wild roller coaster ride of corn prices in the last year has left some market participants scarred, while others continue to lick their chops, eyeing higher prices.

Protecting the most profitable levels we have seen since 2014 for new crop corn (excluding a small clip of higher prices during the planting delays of 2019) should be of high priority for producers. If the seemingly parabolic rally in the market since August has left you gun-shy to forward contract grain, a put option could be your next best tool to capitalize on these higher prices. While volatility and uncertainty remain high, a December put will provide protection against falling prices from now until harvest.

Many view a put option much like any other type of insurance. No one plans to collect on an insurance policy when it is purchased. If needed, you are sure glad you had the insurance to protect you. One could view a put in the same light. Though you do not want to have to cash in on this put, if prices fall throughout the year, you will be glad you had the protection purchased when profitable levels were presented. The mental hurdle of purchasing something in hopes it expires worthless can be difficult to process. Don’t let greed cloud your judgment now, when opportunity presents itself.

Visit with your advisor to determine the best strategy for your operation.

© 2021 Total Farm Marketing

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC, all part of the Total Farm Marketing family of companies. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association; Stewart-Peterson Inc. is a publishing company; SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The data presented is believed to be accurate, and cannot be guaranteed.