Corn Futures Close Higher With Strong Finish to the Week

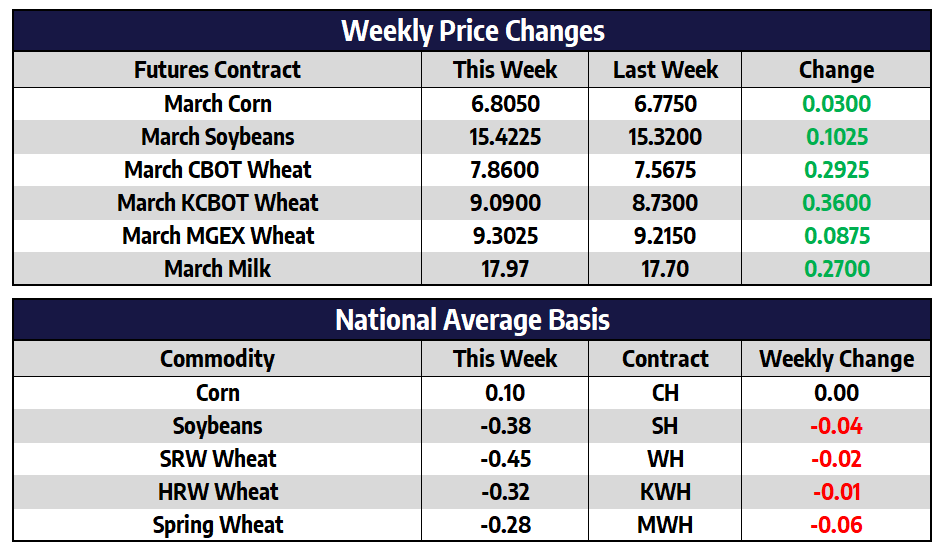

- March CBOT corn futures added 3 cents this week to close at 680-1/2

- New crop December CBOT corn futures were unchanged this week to close at 596

- As of late last week, 12% of Brazil’s safrinha corn had been planted compared to 24% the year before; This represented an advance of 7% compared to the prior week

- CFTC Commitment of Traders data was once again delayed this week, the agency stated it “has not received all the data required”; The report had been delayed last week due to a ransomware attack

- With lack of much new news this week, the corn market looked to the wheat market to end the week for price direction

Soybeans Move Higher on Friday Surge

- March CBOT soybean futures added 10-1/4 cents this week to close at 1542-1/4

- New crop November CBOT soybean futures added 9 cents this week to close at 1378-3/4

- In their February Crop report, Conab increased the 2022/23 soybean production by 0.17 million tons to 152.82 million tons; This would put 2022/23 Brazilian soybean production up 21.8% compared to last year’s drought stricken crop

- Brazilian soybeans were 9% harvested as of late last week compared to 16% last year; This was a four percent jump from last week; Wet weather has slowed the start of soybean harvest

- After a tough start to the week soybean meal futures found buyers on Thursday and Friday and managed to close higher for a third consecutive week

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Fly Higher on Friday

- March CBOT wheat futures added 29-1/4 cents this week to close at 786

- March KCBOT wheat futures added 36 cents this week to close at 909

- March MGEX spring wheat futures added 8-3/4 cents this week to close at 930-1/4

- Russia has reportedly intensified their offensive attacks on Ukraine and will continue to do so in the coming week; This spooked wheat markets higher to end the week

- With managed money funds (likely) still holding a very sizable net short position in wheat, today’s price action could be the start of more short covering to come

2023 Dairy Prices In the Green

Milk prices for 2023 were solidly in the green this week. The 2023 average for Class III rebounded after three down weeks with 26 gains and the Class IV average climbed for the second straight week with 41 cent gains added to last week’s 40-cent gains. Much of those gains can be attributed to gains in the second month contracts where Class III rose 24 cents on the week, while Class IV second month rose 33 cents. Besides cheese, the spot markets found gains with whey, powder, and butter all continuing to climb after hitting recent lows. Cheese, conversely, continues to work lower as waning exports and building inventories loom over the market.