New crop corn higher for sixth week in a row

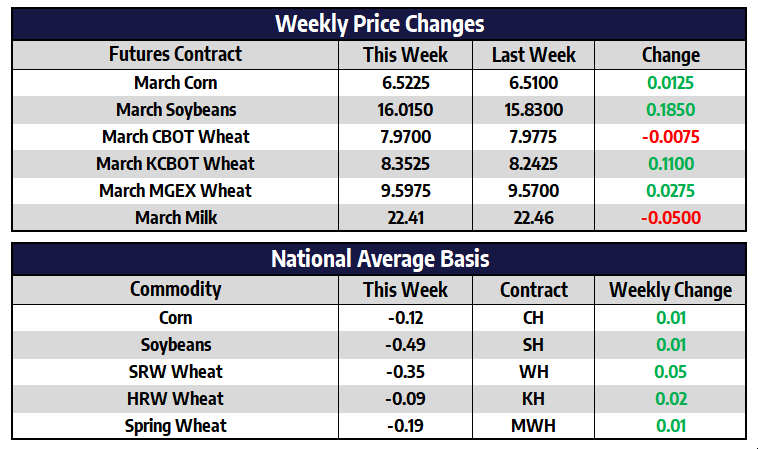

March corn futures added 3-1/4 cents this week to close at 654-1/4. New crop December corn futures added 3 cents this week to close at 597-3/4. New crop corn continued higher once again this week marking its sixth consecutive week of higher highs and higher lows. After more than a $30 per barrel rally in front-month crude oil, prices turned lower this week for the first time in 2022. The risk of conflict between Russia and Ukraine remains at the front of mind for the crude oil, corn, and wheat markets. Headlines have whipsawed commodity markets in recent weeks.

A Reuter’s poll this week pegged the Brazilian corn crop at 113.05 million tons as compared with the current USDA estimate of 114 million tons. These initial estimates, if realized, would be nearly a 30% jump from last year’s crop, much of which was planted later than expected due to wet weather. Bigger corn acres are expected to offset the risks to the second crop corn which is already off to a great start. Nationwide, Brazilian farmers have planted 42% of their second crop corn as of late last week, this compares with the just 11% planted last year in this same week. The safrinha crop represents approximately 75% of Brazil’s total corn production.

Soybeans close above $16 this week

March soybean futures added 18-1/2 cents this week to close at 1601-1/2. New crop November soybean futures added 19-3/4 cents this week to close at 1463-3/4. Export sales for soybeans remained solid this week coming in at 1.36 million tons for the current marketing year, as well as 1.5 million tons for the next marketing year. Unknown destinations made multiple purchases of soybeans for the next marketing year this week. These purchases are more than likely China.

Those within the National Oilseed Processor Association (about 95% of all US soybean processors) crushed 182.2 million bushels of soybeans in January, down 4.2 million from the December record crush. This number was a big miss of nearly 12 million bushels below what traders had anticipated prior to the report. Soybean crush will need a very strong summer to reach the USDA’s 21/22 marketing year projection of 2.215 billion bushels, this projection is a 3.5% jump from last year’s number.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat mixed this week

March wheat futures shed 3/4 of a cent this week to close at 797. March KC wheat futures added 11 cents this week to close at 835-1/4. March spring wheat futures shed 3/4 of a cent this week to close at 960-3/4. The on-again-off-again conflict between Ukraine and Russia left Chicago wheat slightly lower on the week this week. The coming week is expected to remain dry for the US Plains region but the 6–10 day forecast is calling for below-normal temperatures and above-normal precipitation.

Milk Trades Lower This Week

A quiet week of trade in the dairy market without much new news, along with a noticeable shift in spot market demand, kept futures on the defensive. March through August 2022 Class III futures finished the week down anywhere from 13c to 36c. For Class IV, the market came off of record price levels as the second month contract was down 45c for the week. Spot butter, powder, and whey were all lower while spot cheese recovered 5.25c and made a charge towards $2.00/lb. The Global Dairy Trade auction from Tuesday was supportive to prices as the overall GDT price index added 4.20%. The auction showed steady bidding in butter, cheddar, and both milk powder varieties. The US market ran into steady selling pressure on Wednesday and couldn’t recover by week’s end. Pressure came from overbought markets and products at their highest prices in years.

The overall trend for the dairy market remains up and there haven’t been too many signals fundamentally of a change yet. However, with a high amount of volatility in the dairy markets over the past few years, recent history shows how quickly these trends can change from bullish to bearish. What once used to be an extremely trendy market is now choppy and the 15-20 month moves now last closer to 5-8 months. We still feel it makes sense to be defensive at these levels by adding sales. We put out a recommendation this week to get each month through December up to 20% sold and added two additional targets to eventually get to 40% sold if the uptrend continues. Next week will be a busy one with a Cold Storage report and a Milk Production report.