Corn Futures Sideways Yet Again

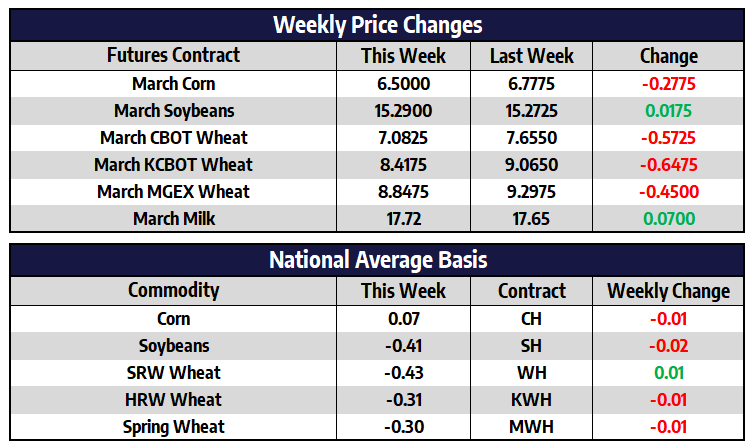

- March CBOT corn futures shed 27-3/4 cents this week to close at 650

- New crop December CBOT corn futures shed 19-1/2 cents this week to close at 576-1/4

- The USDA’s annual outlook forum this week released estimated production numbers for the upcoming 2023 crop. In corn, they estimated planted acres to come in near 91 million acres. This would be up 2.3 million acres from last year

- The US drought monitor update this week showed corn producing areas experiencing drought at 40%, a three percent drop from last week. This is down sharply from October when 71% of US corn producing areas were experiencing drought

- Brazil reported a case of atypical mad cow disease this week in a northern region. Brazil, the main supplier of beef to China has said it will stop beef exports for the time being

- More than half of the second crop corn in Brazil will be planted outside of the ideal climate window according to AgRural. While this is not detrimental to yield potential, this news makes the “finish” to Brazil’s growing season more important to the corn market

Soybeans Quiet as Corn and Wheat Prices Fall

- March CBOT soybean futures added 1-3/4 cents this week to close at 1529

- New crop November CBOT soybean futures shed 12-1/4 cents this week to close at 1374

- For soybeans, the USDA’s outlook forum estimates planted acres will come in at 87.5 million acres, this would be identical to last year’s US planted soybean acres

- This week marked the one-year anniversary of Russia’s invasion of Ukraine. China this week in a position paper called for a resumption of peace talks between Russia and Ukraine, an end to unilateral sanctions and stressed its opposition to the use of nuclear weapons

- Marketing year soybean export sales to date exceed the seasonal pace needed to hit the USDA’s target by 53 million bushels, versus 61 million bushels last week

- While late week weakness plagued the corn and wheat markets, soybean futures faired surprisingly well, much in part to front month soybean meal futures, which were 1% higher on the week

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Lower this Week

- March CBOT wheat futures shed 57-1/4 cents this week to close at 708-1/4

- March KCBOT wheat futures shed 64-3/4 cents this week to close at 884-3/4

- March MGEX spring wheat futures shed 45 cents this week to close at 884-3/4

- In just seven trading days CBOT wheat futures have given back nearly all of the 90-cent rally front month futures built from January 23rd to February 14th

- A winter storm across the northern Plains and Canadian Prairies improved moisture prospects for the upcoming spring wheat crop

Mid-Week Rebound Fails to Hold

Prices during the middle of the week for both Class III and Class IV found some nice gains, but were unable to hold as prices plunged to finish the week. Some of those gains early in the week could have been attributed to a GDT auction event that saw an increased value in cheese, which influenced the domestic spot cheese market higher on Tuesday and Wednesday. The factor likely influencing prices lower starting Thursday was the Milk Production report showing January year-over-year production up 1.3%, while the US dairy herd grew by 9,000 cows. The dairy herd size growing lines up with a report showing US weekly dairy cow culling for week ending Feb 11th was -3.7% YoY. On top of Milk Production and GDT auction was today’s Cold Storage report for January, yet to influence the markets as it was released at 2PM CST, showing cheese stocks in refrigerated warehouses were down slightly from previous month and year ago levels. Butter inventories have made a drastic turn from 5 year lows this past summer to up 21% from last month and up 20% from year ago levels.