Front month corn closes above 2021 highs this week

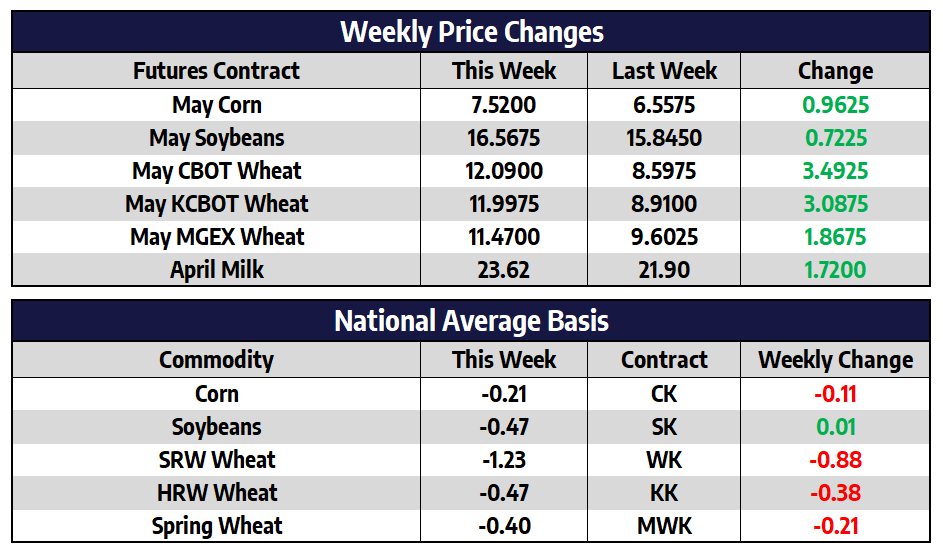

May corn futures added 96-1/4 cents this week to close at 7.52. New crop December corn futures added 49-3/4 cents this week to close at 629-1/2. Ethanol production for the week ending February 25th averaged 997,000 barrels per day, which was below expectations. Ethanol stocks continue to remain elevated currently 11.2% above last year’s levels. The Biden administration said on Thursday they would be studying whether waiving US biofuel blending mandates could help stabilize soaring prices for key food ingredients like corn. This would be a big hit to the ethanol industry.

Brazil’s safrinha corn crop was 64% planted as of late last week, this compares with the just 39% that was planted in the same week last year. This was an 11% jump week over week for the safrinha crop. Mato Grosso, Brazil’s largest safrinha corn state, was 94% planted as of this week compared to 54.6% last year and 77% on average. In Mato Grosso safrinha corn planting has steadily stayed above average by 2-5 days nearly the entire year so far. The ideal planting window for the second crop has now closed but due to the high price’s farmers will continue to plant corn here into March.

Soybeans follow corn and wheat higher

May soybean futures added 72-1/4 cents this week to close at 1656-3/4. New crop November soybean futures added 32 cents this week to close at 1447. Brazilian farmers are concerned about procuring their fertilizer needs in the coming months. The war between Russia and Ukraine has caused fertilizer supply chain disruption from major producers like Russia and Belarus. Russia provides 25% of Brazil’s fertilizer imports along with large amounts from Belarus. It appears Brazil has enough nitrogen fertilizer on hand for the current crop, but the bigger concern is for the 2022/23 summer crop which farmers will start planting in August.

Brazilian soybeans were 44% harvested as of late last week according to AgRural, this is sharply higher than the same week last year when just 25% of the crop was harvested. In the state of Mato Grosso 78% of their soybeans were harvested as of late last week compared to 52% last year and 72% on average. This pace is much better than last year due to the constant rains that hampered harvest in 2021.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat extremely volatile again this week

May CBOT wheat futures added 349-1/4 cents this week to close at 12.09. May KC wheat futures added 308-3/4 cents this week to close at 11.99-3/4. May spring wheat futures added 186-3/4 cents this week to close at 1147. May CBOT wheat futures took advantage of the expanded limits this week trading limit higher every day this week. Continued concerns that the Russian/Ukraine war will continue to rage on for some time helped support the market this week. Ukraine and Russia export 29% of the world’s wheat, both of which are currently offline.

milk Higher on Week

Class III prices pushed to new highs to begin March, led by a $1.20 gain in the April contract with a close at $23.68. That contract held a daily high on Friday of $24.00, eclipsing the July 2020 peak on the second month chart and sitting just beneath the November 2020 high of $24.09. Spot cheese was a winner this week with its first push over $2.00/lb in a year and a half, gaining 13.75 cents in total, with a close at $2.06/lb. The block/barrel spread, after spending seven weeks within a nickel of even, has pushed to 18 cents as blocks have led the way higher. On the negative side, spot whey was lower for the fourth straight week with a 2.25 cent drop to $0.7575/lb.