Corn Finished Mixed After USDA Report

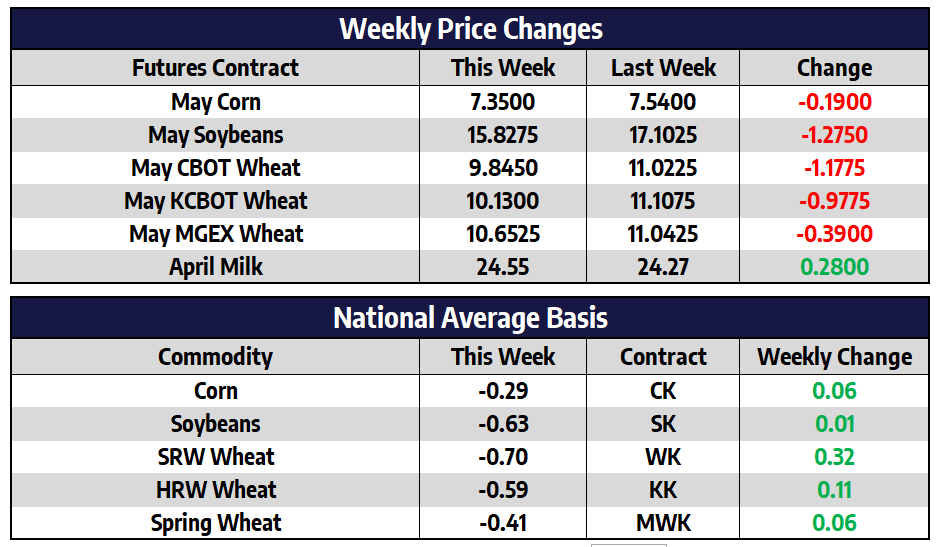

May CBOT corn futures traded 19 cents lower for the week to close at 7354. New crop December corn futures added 19 cents this week to close at 688. It was a wild ride in corn this week. December corn futures were trading as much as 38 cents lower early in the week. The USDA’s Planting Intentions report was the big market mover on Thursday. This spring’s U.S. corn plantings are estimated to be 89.1 million acres. This is below the lowest range of prereport estimates and 4% below the final 2021 figure of 93.4 million acres. New crop corn futures rallied the 35 cents limit at times yesterday but moved lower into the close, finishing the week 19 cents higher. With corn rallying and soybeans selling off since the report, the December corn/November soybean price ratio is now 2.04-to-1. The narrowest it’s been in the past 20 years is 1.74-to-1 in December 2006 when the ethanol boom was taking off. At that ratio, and $14 beans, December corn likely wouldn’t go over $8. At $13 soybeans it stays below $7.50. Corn stocks as of March 1st were pegged at 7.85 billion bushels, in line with analysts’ estimates and 150 million above the same time last year. This allows for ample supplies to absorb additional export demand coming from Ukraine’s inability to export through the Black Sea after Russia invaded. Eventually exporters in Ukraine will find alternate routes or a peaceful resolution to the conflict to market the 13 million tons (512 million bushels) of corn stocks remaining in the country. Word out of Ukraine is that they have begun planting spring crops on about 400,000 hectares of land. This would be ahead of last season’s pace.

Soybeans Sharply Lower

May CBOT soybean futures fell 127-1/2 cents this week to close at 1582-3/4. New crop November soybean futures were 90 cents lower this week to close at 1406-3/4. Soybeans finished sharply lower this week. Initially prices were under pressure from month/quarter end profit taking and ideas that, with Brazil’s crop more than 75% harvested that production estimates had stabilized. Reports that soybeans being exported from Brazil at a rapid pace also weighed. Then yesterday the USDA dealt another blow: estimating that the US would plant a record 91 million acres of soybeans this spring. This is almost 4 million above last years’ final estimate of 87.2 million acres and on the high end of prereport analysts’ estimates that spanned from 86 to 92.2 million acres. Soybean stocks as of March 1st were pegged at 1.931 billion. This is 24% higher than the 1.562 billion bushels estimated at the same time last year. The average of analysts estimates going into the report was 1.902 billion bushels with the range being 1.602 to 1.965 billion. The extra 300 million bushels should more than offset additional demand from a smaller South American crop.

Like what you’re reading?

Sign up for our otherfree daily TFM Market Updatesand stay in the know!

Wheat is Back Above $11

May CBOT wheat futures fell 117-3/4 cents this week to close at 984-1/2. May KC wheat futures fell 97-3/4 cents this week to close at 1013. May spring wheat futures traded 39 cents lower this week to close at 1065-1/4. Wheat futures finished lower across the board as there has been some positive news from Ukraine/Russia negotiations thus taking some of the “war premium” out of the market. The USDA’s stocks and acreage reports had just enough bullish news to pull the market higher yesterday but resumed the selling again today. All Wheat seedings are projected at 47.4 million acres. This is up 1% from last year. The increase comes from winter wheat plantings with spring wheat acres expected to be down 2% from last year. Wheat stocks on March 1st are estimated at 1.025 million bushels, 22% below the 1.314 billion bushels estimated at the same time last year. The market will now look ahead to next Friday’s supply and demand report to see if the USDA will increase US exports and by how much.

Milk Holds on After Early Week Selloff

Milk futures ran into heavy selling pressure to start the week, but buyers supported the market higher on Thursday and Friday to limit losses. Spot cheese buyers bid up blocks 11.50c in total on Thursday and Friday, while barrels rose 9.25c. This brought buying interest back into Class III futures late in the week. The Class IV trade got support from a three day stretch of higher prices for powder, while butter added back a penny on Friday. The US whey price is really struggling, falling 8% on Friday alone. There will be a Global Dairy Trade auction next week Tuesday that will help give the market an idea of where global demand is. The last event was down 0.90%, so this one will be watched closely. Prior to that down auction, the GDT hadn’t posted a single down auction since December 21st.

The dairy market technically and fundamentally remains bullish for now, but a few things are starting to pop up that could be red flags moving forward. First, the US whey price is down about 25% from its high of the year and fell 8% alone on Friday. Further weakness could be a headwind for this Class III market ahead. Second, spot cheese is right up near the 2019 high, which could act as resistance. A strong up day on Friday in cheese is noted, however. Finally, milk cows on farms in the US rose 3,000 head from January to February, which was the first rise since May of 2021. It’s early, but a strong increase in cow numbers could flip production growth back to a positive quickly in the coming months.