New crop corn lower this week

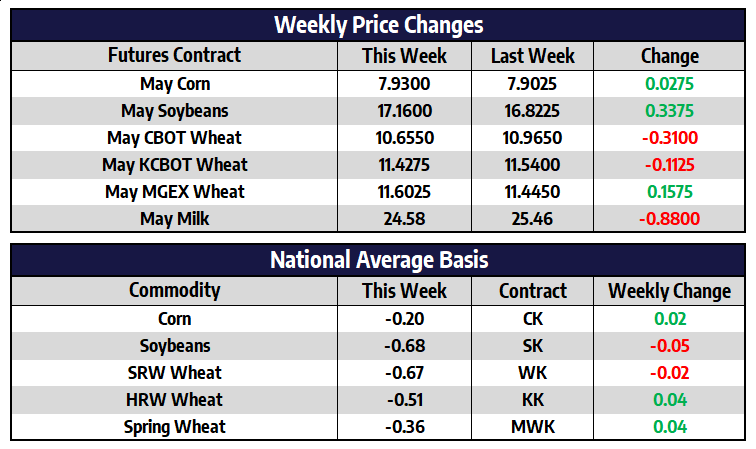

May corn futures added 2-3/4 cents this week to close at 793. New crop December futures shed 11-1/4 cents this week to close at 724. This is only the third down week for new crop corn since the start of the year. Weekly export sales were lackluster this week and may be a warning sign that high prices have started to cut into demand. Although mainstream media continues to highlight the tightening of global grain supplies, late-week price action for corn was poor. Fresh new buyers will be needed to propel this market above its 2012 highs. A bigger weather scare will more than likely be needed to do so.

While planting progress has been slow to start the growing season, history tells us it is too early to panic about planting delays. Last spring 73% of the corn crop was planted during the four weeks of May with 50% of the crop planted in the first two weeks of the month. On average over the last forty years, the second week of May has accounted for the week with the largest percentage of corn being planted, averaging 20.5%. While high prices this year have added to the angst to get the crop in the ground, history tells us it is too early yet to get riled up about delayed planting.

Soybeans push higher this week

May soybean futures added 33-3/4 cents this week to close at 1716. New crop November futures added 3-1/2 cents this week to close at 1505. Overnight, Indonesia decided to ban exports of cooking oils and raw palm oil material from April 28 until a date to be later decided. This was big news to the edible oil market, as Indonesia is by far the largest vegetable oil exporter in the world. Indonesia was expected to export 28 million tons of palm oil this year. The largest soybean oil exporter, Argentina, is expected to export just 5.9 million tons of oil this year.

The weekly export sales report showed that for the week ending April 14, net soybean sales came in at 460,244 tons for the current marketing year and 1,240,000 for the next marketing year for a total of 1,700,244. Cumulative soybean sales have reached 99.2% of the USDA forecast for the 2021/2022 marketing year versus a 5-year average of 94.6%. Chinese crushers have slowed soybean purchases for deliveries through August, as poor margins may have reduced demand.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheats mixed this week

May CBOT wheat futures shed 31 cents this week to close at 1065-1/2. May KC wheat futures shed 11-1/4 cents this week to close at 1142-3/4. May spring wheat futures added 15-3/4 cents this week to close at 1160-1/4. SovEcon raised its 2022 Russian wheat crop forecast this week to a record 87.4 MMT, which would be up 15% from last year. The Russia-based ag consultancy cited record planted area, along with “excellent crop conditions and good inputs availability.” Although rain will be needed in the Plains to improve conditions, a rallying US dollar, combined with very poor export sales, are weighing heavily on wheat futures. The continued conflict in Ukraine should provide underlying support but seasonals are weak in the coming weeks for wheat.

Dairy Spot Markets Close Lower This Week

There has been a noticeable shift in supply and demand in the dairy spot trade over the past few sessions, with the Class IV products leading the market lower. During this week’s trade, the US spot butter market fell 8.75c and closed down at $2.6675/lb. The spot powder market fell a total of 6.75c and closed down at $1.7550/lb. Both markets look to be headed towards a short-term downtrend as demand weakens. Over in the Class III side, the whey trade was unchanged this week at $0.6350/lb, while the block/barrel average cheese price was down 2.50c for the week. The US cheese price still remains elevated near multi-year highs, up at $2.38125/lb. Strong international demand for US cheese has helped support the high price. The weakness in the spot products kept Class III and IV milk futures lower. Second month Class III fell 91c while second month Class IV fell 40c.

This week was a busy one for news across the dairy trade with a Global Dairy Trade auction, a Milk Production report, and a Cold Storage report. To recap the events, the GDT auction was a bearish event, falling 3.60% overall. This was the third down event in a row for the GDT as global demand cools. Each product in the auction was offered lower. In the milk production report, production in March fell 0.50% from the same month last year. Cow numbers did increase 15,000 head from February, though. In this Friday’s Cold Storage report, the USDA said that total natural cheese in storage at the end of March 31, 2022, was down 1% from last month and down 1% from the same month last year.