December Corn Surges Higher

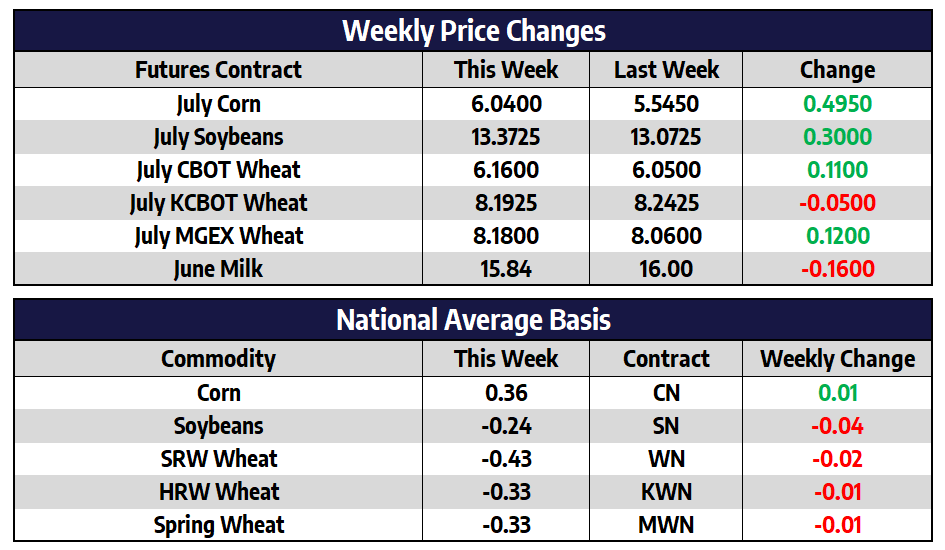

- July CBOT corn futures added 49-1/2 cents this week to close at 604.

- December CBOT corn futures added 34-3/4 cents this week to close at 534-1/2.

- Corn futures surged higher to end the week as we head into the holiday weekend, a continued dry outlook for a bulk of the I-states into the first half of June led the push higher.

- July corn futures pushed higher all five trading days this week, posting its best weekly gains since July of 2022. Strong cash market tone from end users helped support old crop futures.

- The Brazilian consulting agency, Agroconsult, recently increased their estimate of the safrinha corn crop 1.0 million tons to 102.4 million based on good yields in central Brazil. They also indicated the states of Parana, Sao Paulo, Minas Gerais, and Mato Grosso do Sul combined represent 31% of Brazil’s safrinha corn production and that there are 20 million tons of potential production that could still be impacted by adverse weather.

Soybeans Higher This Week

- July CBOT soybean futures added 30 cents this week to close at 1337-1/4.

- November CBOT soybean futures added 14 cents this week to close at 1189-1/2.

- Argentina’s soybean crop is reportedly close to 80% harvested this week. The Buenos Aries Grain Exchange is currently estimating production at 21 million tons, six million tons lower than the most recent USDA WASDE estimate.

- The fast start to the crop and more talk of sluggish demand helped to pressure soybeans this week, as China has reduced the use of soybean meal and corn in livestock feed in a drive to curb reliance on imports.

- Net meal sales this week came in at 341,272 tons for the current marketing year and 50,625 for the next marketing year for a total of 391,897. This was well above trade expectations.

Wheat Mixed this Week

- July CBOT wheat futures added 11 cents this week to close at 616.

- July KCBOT wheat futures shed 5 cents this week to close at 819-1/4.

- July MGEX spring wheat futures added 12 cents this week to close at 818.

- Russia signaled on Thursday that if demands to improve its grain and fertilizer exports are not met then it will not extend beyond the July 17 deal allowing the safe wartime export of the same products from three Ukrainian Black Sea ports.

- The Illinois Winter Wheat tour this week collected data from 57 fields across 19 counties in the southern half of the state. The average yield for all the counties the tour found was 97.12 bushels per acre. Last year’s tour predicted a 68 bushel per acre average yield.

Milk Market Push Lower

- June Class III milk futures finished the week lower for the fifth week in a row. Pressure stems from a sluggish spot whey and cheese market.

- Despite bouncing nearly 10c off the lows earlier in the week, the spot cheese market retreated back lower by week’s end. Sellers continue to be aggressive at these multi-year low price levels.

- The USDA reported this week that US April cheese in storage was down 1%, while butter inventories were up 9.8% from last year.

- The US spot whey price finished the week up a penny to $0.2750/lb despite hitting a new all-time low earlier in the week.

- Weekly dairy cow culling for the week ending 5/13 was up 3.1% YoY.