Corn Slightly Lower this Week

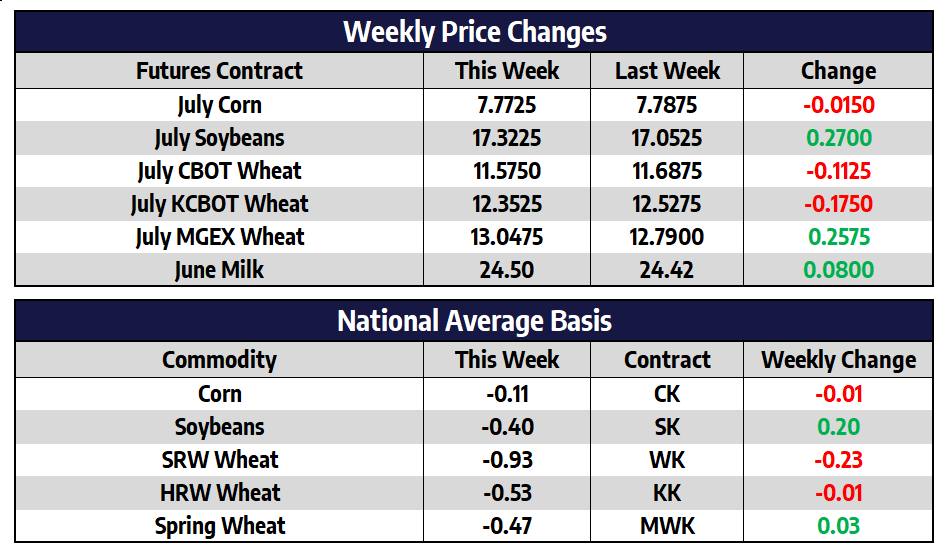

- July corn futures shed 1-1/4 cents this week to close at 777-1/4.

- New crop December corn futures shed 2 cents this week to close at 730.

- Russia’s Defense Ministry said it’s opening sea corridors for international shipping from seven Ukrainian ports, after growing international criticism of an unfolding global food crisis triggered by a Russian blockade. Grain has not been shipped from Ukraine Black Sea ports since February 24.

- December corn found support late this week at its early May lows just above $7 per bushel.

- Moisture across the Midwest over the last few days should be beneficial to early crop development.

- With just one trading day left in the month of May December corn futures are down 20-3/4 cents on the month. This would be the first month lower for new crop corn since December of last year.

Soybeans Make Run Towards Contract Highs

- July soybean futures added 27 cents this week to close at 1732-1/4, this was the highest weekly close for the contract.

- November soybean futures added 22-1/4 cents this week to close at 1544, this was the highest weekly close for the contract.

- Soybeans attempted to make a topside break of their pervious range this week, conformation will come with a daily close above the February 24th

- The USDA will allow participants who are in the final year of their CRP contract to request voluntary termination of their contract without penalty following the end of the primary nesting season. While this change will more than likely not impact this year’s crop acreage total, the impact may be felt in years to come.

- A positive tilt to outside markets and energies helped support soybeans this week.

- Traders remain concerned over the impact of China lockdowns on their economy, and more active export flow from Brazil.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Winter Wheat Lower this Week

- July CBOT wheat futures shed 11-1/4 cents this week to close at 1157-1/2.

- July KC wheat futures shed 17-1/2 cents this week to close at 1235-1/4.

- July spring wheat futures added 25-3/4 cents this week to close at 1304-3/4.

- The head of the United Nations World Food Program, David Beasley, said earlier this week that Russia’s blockade of Ukrainian ports, which have obstructed shipments of grain out of the country, is a “declaration of war” on global food security.

- The USDA attache from India cut their 2022/23 wheat crop forecast to just 99 million tons from 110 million previous. Heat stress from an unprecedented spike and temperatures starting in mid-March hit yields by 10-15%.

- Harvest selling pressure could appear soon in the winter wheats as producers will more than likely market excess grain at these prices.

Class IV Milk Finishes Week at All Time Highs

The Class IV milk trade has caught a bid the past couple weeks, as butter and powder prices once again soar in the United States. Over the past two weeks, US butter has gained 17.25c to $2.8775/lb, while US powder has added 13c to $1.86/lb. Neither market has had enough strength to push into new highs for the year, but the demand surge has brought these products within striking distance of new highs. The turnaround in demand for these products has taken Class IV milk up into new all-time highs. June 2022 Class IV milk added 50c this week to $25.55, after having added $1.05 last week. The contract that set the record this week is the July contract, which added 55c this week to $25.75.

The support in Class IV helped keep Class III milk futures slightly higher this week, despite a slow week for the cheese trade. The US spot cheese block/barrel price closed lower Tuesday, Wednesday, and Thursday of this week and fell 7.625c by week’s close. The US cheese price is still very strong, but did close the week below the recent swing low. Next week’s trade will be shortened due to the Memorial Day holiday, but the following week, there will be another Global Dairy Trade auction. The market will look for those results to see if global dairy prices remain under pressure or not. Recent auctions have seen the GDT Price Index fall 5 events in a row.