Corn Rallies After Last Week’s Losses

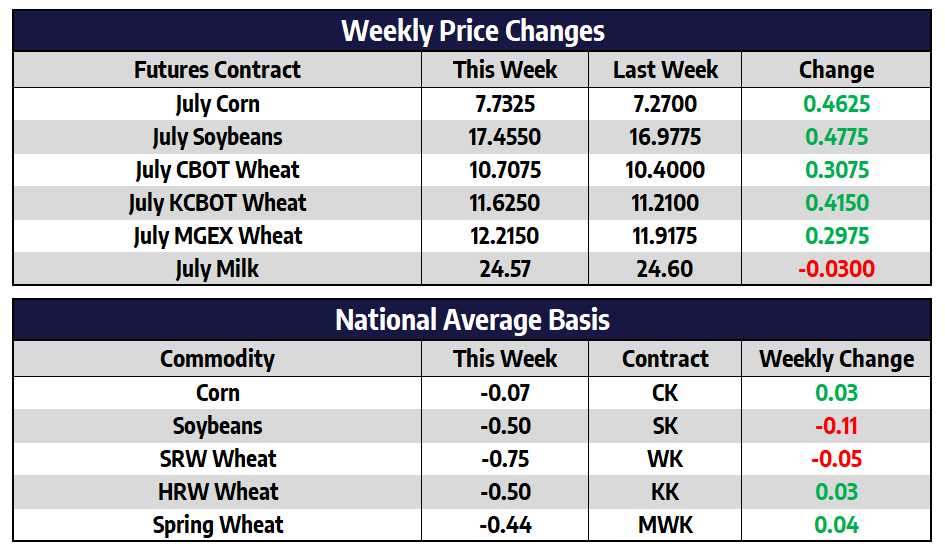

- July corn futures added 46-1/4 cents this week to close at 773-1/4.

- December corn futures added 30-1/2 cents this week to close at 720-1/2.

- Old crop 2021/22 corn ending stocks rose by 45 million bushels to come in at 1.485 billion bushels this month, this was 50 million bushels higher than pre-report trade expectations.

- New crop 2022/23 corn ending stocks rose by 40 million bushels to come in at 1.4 billion bushels, this was 60 million bushels higher than pre-report trade expectations.

- World new crop 2022/23 corn ending stocks came in five million tons higher than last month at 310.45 million tons. Much of the increase came from a bigger anticipated crop in Ukraine.

- Exporting said larger crop out of Ukraine may be the bigger issue, talks between Russia and Ukraine aimed at providing safe passage for Ukraine’s old crop grain ended in failure this week.

- With no huge surprises in the USDA report today, market focus will shift back to weather and the June 30 updated acreage estimates.

Soybeans Run to New Contract Highs

- July soybean futures added 47-3/4 cents this week to close at 1745-1/2.

- November soybean futures added 41-1/4 cents this week to close at 1568-1/4.

- 2022/23 US soybean ending stocks were lowered by 30 million bushels this month to come in at 280 million bushels, this was below the average trade guess prior to the report of 307 million bushels.

- The US Dollar Index posted strong gains this week adding nearly 2%, this puts the index back above its March 2020 highs.

- Front-month soybean futures traded within a nickel of their all-time highs set in 2012 this week, tight old crop supplies continue to inch prices higher.

- New crop soybeans traded to new contract highs this week before backing off on Friday. A weekly close below 1531 would look poor technically.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

All Wheats Higher This Week

- July CBOT wheat futures added 30-3/4 cents this week to close at 1070-3/4.

- July KC wheat futures added 41-1/2 cents this week to close at 1162-1/2.

- July spring wheat futures added 29-3/4 cents this week to close at 1221-1/2.

- The outlook for 2022/23 US wheat this month is for increased supplies, unchanged domestic use and exports resulting in higher ending stocks.

- No spring wheat yields were included with this estimate, NASS will make its first assessment of spring wheat next month.

- Russia’s 2022/23 wheat crop rose to 81 million metric tons from 80 mmt in May, India’s crop fell to 106 mmt from 108.5 mmt in May and Ukraine’s wheat crop was left unchanged at 21.5 mmt.

Sellers Push Spot Trade Lower Friday

Dairy sellers were aggressive in Friday’s spot session across the cheese, butter, and powder markets. Sellers offered barrels 6.25c lower to $2.2425/lb on 9 loads traded. A good amount of inventory has been hitting the market, as the 9 loads traded today follows the 10 loads traded yesterday. The drop in barrel price Friday takes the barrel market down overall for the week by 0.25c. Block cheese fell 2c to $2.2550/lb on 1 load traded on Friday, which puts blocks down 1.50c overall this week. The butter trade couldn’t hold $3.00/lb as sellers moved 5 loads on Friday to push the market to a close of $2.9750/lb. Powder fell 1.50c for the second day in a row, down to $1.8550/lb.

Class III and IV milk futures had a steady week of trade overall, but ended Friday on a sour note heading into next week. Second month Class III fell 33c to $24.62 on Friday while second month Class IV was down 8c to $26.19. Next week should be a light week for news for dairy, so spot market trade will likely dictate price action. The market will watch to see if sellers get aggressive with spot butter near $3.00/lb and with the US block/barrel average cheese price at its lowest level since late March. The cheese market has quietly been drifting lower for a couple weeks now as regional cheese reports are hinting at inventories starting to build once again. Export demand for cheese has reportedly been strong though.