Corn Trades Slightly Higher this Week

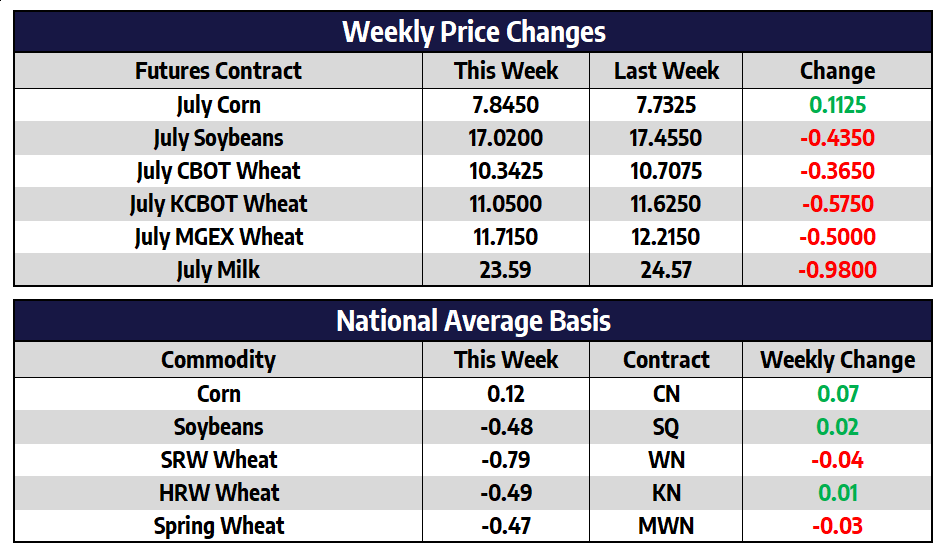

- July CBOT corn futures added 11-1/4 cents this week to close at 784-1/2.

• New crop December CBOT corn futures added 10-1/2 cents this week to close at 731.

• Corn futures managed to hang onto modest gains this week, even as wheat, crude oil futures and equities tumbled lower.

• Triple digit high temperatures are forecast to stretch from Northern Minnesota into the heart of the plains over the weekend.

• Rains are expected to be light across the Midwest over the next seven days, while temperatures are expected to remain above normal.

• Grain growing areas in Europe are experiencing heat similar to the US currently, Temperatures in most of France are forecast to peak near 100 degrees Fahrenheit on Saturday.

• Crude oil futures were slammed lower on Friday afternoon, shedding over 6% and closing below the $110 per barrel level.

Soybeans Head into the Weekend with Poor Price Action

- July CBOT soybean futures shed 43-1/2 cents this week to close at 1702.

• New crop November CBOT soybean futures shed 30-3/4 cents this week to close at 1537-1/2.

• Soybean oil futures declined for a seventh consecutive day on Friday, this matched the longest losing streak for soybean oil since April of 2020.

• Palm oil futures closed at their lowest level since January, as prices tumbled again this week. Indonesia has accelerated shipments of palm oil and Malaysian output is picking up pace.

• November soybeans closed at their daily lows on Friday afternoon, this is not a good look as the market heads into a three-day weekend.

• The US dollar continued its trend higher this week, as the Federal Reverse took aggressive action in its attempt to rein in inflation.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

All Wheats Lower this Week

- July CBOT wheat futures shed 36-1/2 cents this week to close at 10.4-1/4.

• July KC wheat futures shed 57-1/2 cents this week to close at 1105.

• July spring wheat futures shed 52 cents this week to close at 1169-1/2.

• CBOT wheat futures continued their fall lower this week and now sit over $2.50 per bushel below their mid-May highs.

• After an extremely late start to the growing season, immature spring wheat will be under the influence of triple digit temperatures over the weekend.

• NOLA urea physical prices dropped to a low of $410 per ton this week down sharply from where priced topped in March at $935 per ton. Seasonally nitrogen prices tend to find their yearly lows in late summer or early fall.

Class III Breaks Hard this Week

The July Class III contract fell more than a dollar on the week, closing out Friday’s trade at $23.56. Despite finishing 4.3750 cents higher today, the block/barrel average was still down almost a dime on the week at $2.15125/lb. This totals 26.1250 cents of losses since putting in the 2022 high on May 18th, with this week portraying a more bearish tone in the regional cheese reports. If cheese fails to find some footing soon, Class III milk could look expensive with many nearby contracts hanging near $24.00. Conversely, one could argue milk futures had made quite a run from early May to early June and were due for some technical retracement.

After pushing to new contract highs earlier this month, many Class IV contracts have set back. The July contract was 84 cents lower in this week’s trade with a $25.35 finish, 95 cents off the all-time high on the second month chart at $26.30 from the 8th. Spot butter fell 3.50 cents on the week with a close at 2.94/lb and remains at historically strong levels, while spot powder finished Friday’s trade at the recently familiar $1.80/lb spot. The fundamental picture remains more bullish for the Class IV markets compared to Class III, and Tuesday’s GDT Auction will give an update on how US markets compare with the world. Also on Tuesday, the USDA will release May Milk Production.