Corn Finishes the Day Higher After a Week-Long Rout

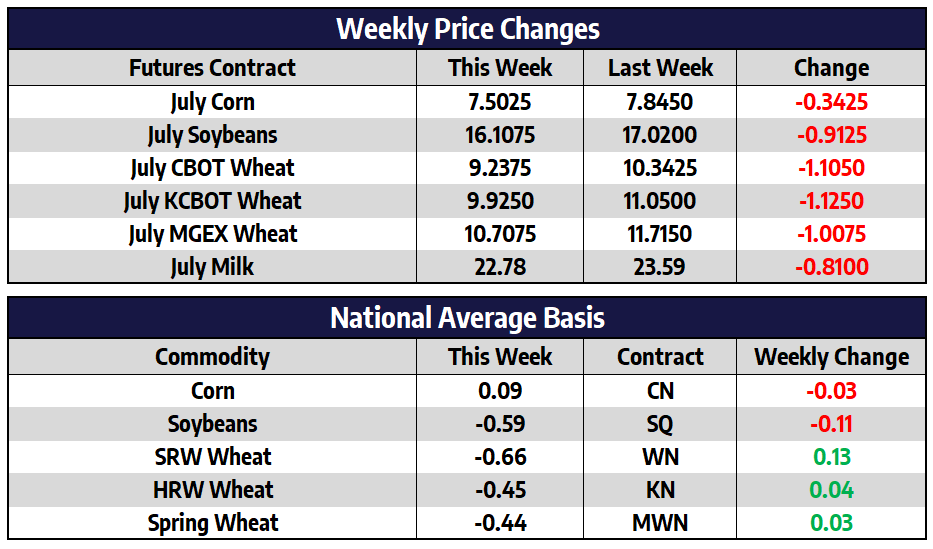

- July CBOT corn futures were up 3-1/2 cents today to close at 750-1/4.

- New crop December CBOT corn futures added 18-1/2 cents today to close at 674. This will be the most heavily traded contract now as the July futures will go into expiration next week. July options expired today. Most old crop bids will roll to the September contract.

- Corn futures recovered some of the week’s losses today but remain below the 100-day moving average (681-1/2 Dec) on all but the July contract. This is a key support level that triggered increased selling when prices fell below it yesterday.

- A rain event is expected Sunday into Monday in the eastern Corn Belt and Tennessee River Basin bringing much-needed relief to those areas, which have become very dry over the last weeks. Should this event dissipate and/or Sunday weather models turn drier, the market could need to put back some weather premium into prices.

- Agroconsult increased their estimate for Brazil’s corn production to 114.8 million tons. This is up from their May estimate but below the USDA’s June estimate at 116 million tons. They also increased Brazil’s export estimates by 6 million tons to 43 mmt, likely on new business to China. .

- Brazil corn is cheaper than the US as that county’s second crop harvest – which makes up 80% of production – is heating up.

- Hedge funds have been heavy sellers on the break, as next week brings both the end of the month and end of the quarter.

New Crop Soybeans Down More Than $1 on the Week

- July CBOT soybean futures gained 17-1/2 cents today to close at 1616-3/4.

- New crop November CBOT soybean futures were up 8-3/4 cents today to close at 1424-1/4.

- Soybean futures prices have fallen below the 100-day moving average for the first time since December. The break below the long-term support level spurred heavy fund selling. The November contract saw its highest daily trading volume to date.

- Agroconsult increased their Brazil soybean production estimate by 2.6 million tons to 126.9. Brazil’s soybean basis has been under pressure from heavy farmer selling and export values are cheaper than the US.

- Crude oil futures gained more than $2 today and that helped to support the soybean bounce.

- On a continuous front-month chart, soybean futures today tested the bottom of the range (~1580) that prices have been trading in since February. Can it rebound into next week as it did during the same week in 2011? The chart looks very similar, albeit today’s prices are nearly $3 higher.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

All Wheats Lower This Week

- July CBOT wheat futures fell 13-1/2 cents today to close at 923-3/4.

- July KC wheat futures were down 12-1/2 today to close at 992-1/2.

- July spring wheat futures fell 9-3/4 cents today to close at 1070-3/4.

- CBOT wheat futures fell again this week and have given back 75% of the gains from the Ukraine/Russia war on the Chicago wheat contract. Prices are under pressure from seasonal weakness and continued lower into the weekend despite higher trade today in other commodities.

- Wheat futures have fallen into oversold territory on momentum charts and are due for a bounce.

- It still seems unlikely that Ukraine will be able to ship out of the Black Sea any time in the near future as Russia had recently bombed two grain loading facilities.

- India, once thought to fill the export gap, has lowered crop prospects on extreme hot and dry conditions.

Market Weaker on Bearish Cold Storage Report

On Thursday the USDA reported that total natural cheese in refrigerated warehouses as of May 31 totaled 1.512 billion pounds – which is a new record. This was up 2% from April and was up 4% from the same month last year. This put a bearish tone back into the market because even though milk production across the country is down year-over-year, cheese inventories are still building. The rising inventory levels could be a detriment to current cheese prices that still hold up at an elevated price of $2.11875/lb. Additionally, if the recession talks pan out, cheese demand would likely begin to weaken. The US cheese trade saw sellers offer blocks 1c lower and offer barrels 2.25c lower in response to the USDA report. The drop in cheese along with the fact that the US butter price fell 4c to $2.9150/lb kept pressure on milk futures on Friday.

July Class III milk fell 68c to $22.78 while the third month August contract fell 55c to $23.50. Class IV also ran into some selling pressure, dropping 19c in July and 42c in the August contract. The milk market still holds an uptrend as no longer-term support levels have been taken out yet. This is the time of year when seasonality could kick in as the market tends to get a summer rally on the hotter conditions. With milk production output down each month so far this year, along with cow numbers down over 100,000 head from a year ago, it should provide support to dairy. However, the cheese price will need to be watched closely in the coming days to see if buyers will still support these levels over $2.00/lb.