Corn Posts Strong Close to End the Week

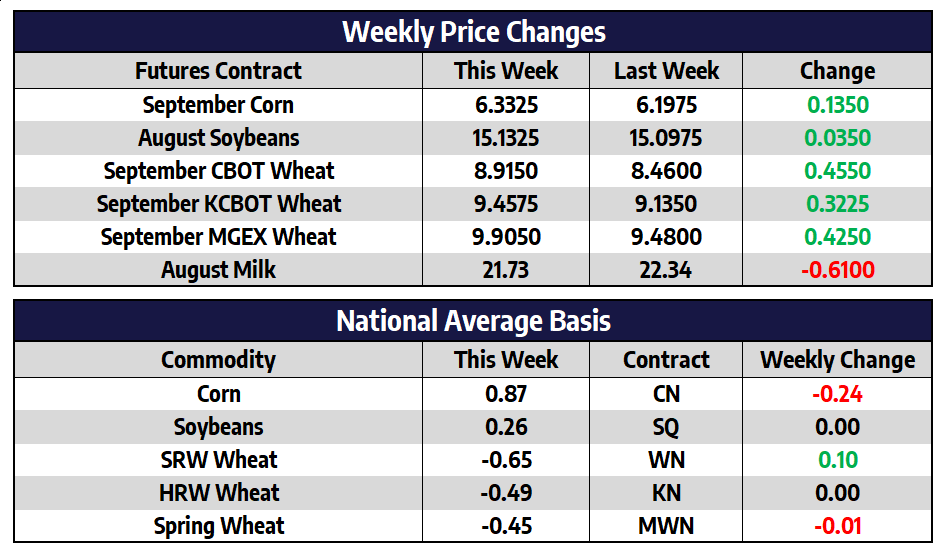

- September corn futures added 13-1/2 cents this week to close at 633-1/4

- December corn futures added 16 cents this week to close at 623-1/2

- Weather models looking ahead to the month of August turned warmer and drier this week, prompting buyers to reenter across most ag commodity markets

- For Tuesday’s USDA Supply and Demand update, traders see US corn ending stocks near 1.442 billion bushels versus 1.4 billion in the June estimate

- Corn used for ethanol last week was estimated at 106 million bushels, corn use needs to average 95.4 million bushels per week to meet the USDA’s forecast

- US corn exports for the month of May reached 283 million bushels, up from 275 million in April, but down 15.2% from a year ago

- After trading to extreme oversold conditions earlier this week, the corn market was due for a bounce, a more threatening weather forecast helped aid the late week push higher

Soybeans Battle Back to Close Higher on the Week

- August soybean futures added 3-1/2 cents this week to close at 1513-1/4

- November soybean futures added 1-1/4 cents this week to close at 1396-1/2

- Rains over the last two weeks have been greatly beneficial, but, the next two weeks are expected to be drier than normal for the entire Corn Belt

- For the USDA Supply/Demand report coming up Tuesday, traders see soybean ending stocks near 211 million bushels, as compared with 280 million in June

- World ending stocks are expected near 99.37 million tons, as compared with 100.46 million tons last month

- With a drier and warmer forecast for the Midwest and a more bullish tilt to outside market forces, buyers returned to the soybean market late this week

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

All Wheats Turn Higher this Week

- September CBOT wheat futures added 45-1/2 cents this week to close at 891-1/2

- September KC wheat futures added 32-1/4 cents this week to close at 945-3/4

- September spring wheat futures added 43-3/4 cents this week to close at 991-3/4

- The market traded down to the lowest level since February 17 this week, before the start of a recovery bounce

- Traders see all wheat production near 1.745 billion bushels, as compared with 1.737 billion bushels in June

- US wheat exports for the month of May reached just 50 million bushels, down 45.3% from last year

Milk Closes a Volatile

Class III and IV milk futures have pushed lower for about four weeks in a row now. This week’s trade was yet another volatile one, but the market did stabilize late in the week. The August second month Class III contract was down 74c on Tuesday and fell another 24c on Wednesday. Buyers then supported and helped August recover 40c on Thursday. It then fell 9c on Friday, which put the contract down 67c in total for the week. The heavy selling pressure to start the week came from a lower Global Dairy Trade, a commodity-wide selloff, dairy spot market pressure, and technical weakness. The market broke below the May low, which may have also fueled additional selling pressure. The market trend has now turned from an uptrend to a downtrend.