Corn Lower After USDA Report

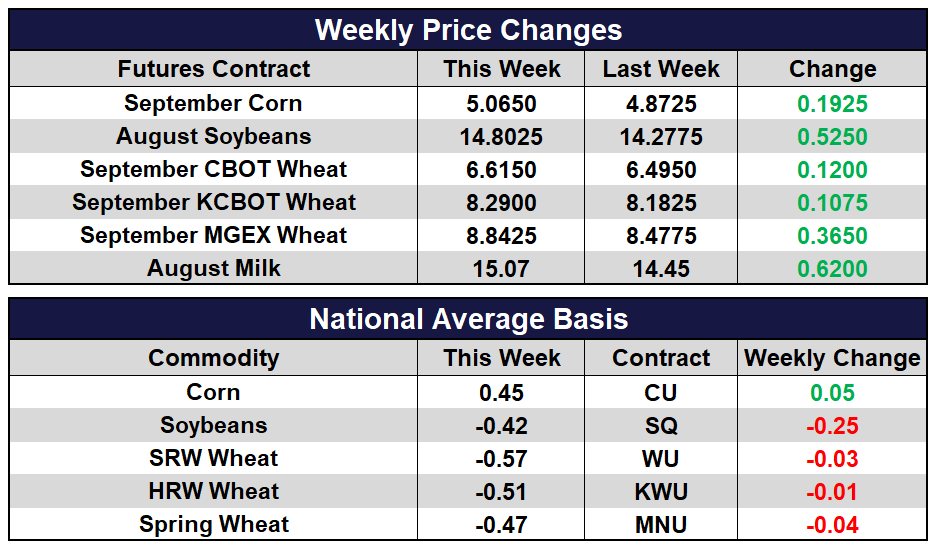

- September CBOT corn futures gained 13 cents today to close at 506-1/2.

- December CBOT corn futures gained 13-1/4 cents today to close at 513-3/4.

- The July futures contract went off the board today, at one point trading 21-1/4 cents higher.

- December corn futures have recouped 70% of the post-Acreage report losses.

- Yesterday’s drought monitor map shows some improvement since the end of June but many key areas are still in drought.

- The 7-day precipitation forecast is minimal in Iowa, Nebraska, and the northern Corn Belt. This could account for some short covering ahead of the weekend weather.

- The USDA’s recent US corn production and carryout numbers came in at the average of analysts’ pre-report estimates, no surprises.

- Corn prices will continue to meet headwinds from Brazil’s second crop corn harvest which is reaching half complete amid tight storage. More Brazil corn will go to market in the coming weeks and further limit US export demand.

Soybeans Finish Near Recent Highs

- August CBOT soybean futures shed 4-1/2 cents today to close at 1480-1/4.

- November CBOT soybean futures gained 1 cent today to close at 1370-3/4.

- The July soybean futures contract expired today and was down sharply on its last day of trading.

- US export sales reported for last week were at the low end of trade expectations. Soy oil sales were also disappointing, as cumulative sales have reached 69.1% of the USDA forecast versus the 5-year average pace of 89.6%.

- New crop soybean prices remain supported by lower US acreage and finished the week near recent highs.

- China has been an active buyer of Brazilian soybeans. China’s June imports were up 25% over last year.

- Expectations for Monday’s NOPA soybean crush report are for 170.568 mb of soybeans crushed in June, down 4.1% from May.

Wheat Rallies as Black Sea Deal Set to Expire

- September CBOT wheat futures gained 21-3/4 cents today to close at 661-1/2.

- September KCBOT wheat futures gained 23 cents today to close at 829.

- September MGEX spring wheat futures gained 22-1/2 cents today to close at 884-1/4.

- The US Dollar Index has been trending lower in July and recently touched its lowest level in 15 months. This makes US exports more competitive on the global market.

- Wheat prices surged in the last minutes of trading as a Russian spokesperson denied earlier reports that Russia had come to an agreement on extending the Black Sea Grain Initiative.

- Strategie Grains estimated European Union wheat production at 126.2 million tons, this is considerably lower than the USDA’s estimate this week at 138 million tons.

- Global ending stocks for the 2023/2024 marketing year were lowered 4.18 million tons (153 million bushels) to 266.53 million tons.

Dairy Markets Find Weekly Gains

- Spot products continue to find eager buyers, butter and cheese prices finished the week higher while powder and whey were both lower.

- Milk futures in Q3 and Q4 for both Class III and IV found gains on the week, breaking multi-week trends lower.

- Dairy cow culling rates have continued to be well above last year’s totals. For the week ending 7/1, rates were 14.5% higher YoY, the highest total for this week in 10 years.

- Fundamental reports and events next week include GDT on 7/18, Milk Production report on 7/20, Cattle and Cattle on Feed report 7/21.