Corn Lower this Week; Forecast Remains Threatening

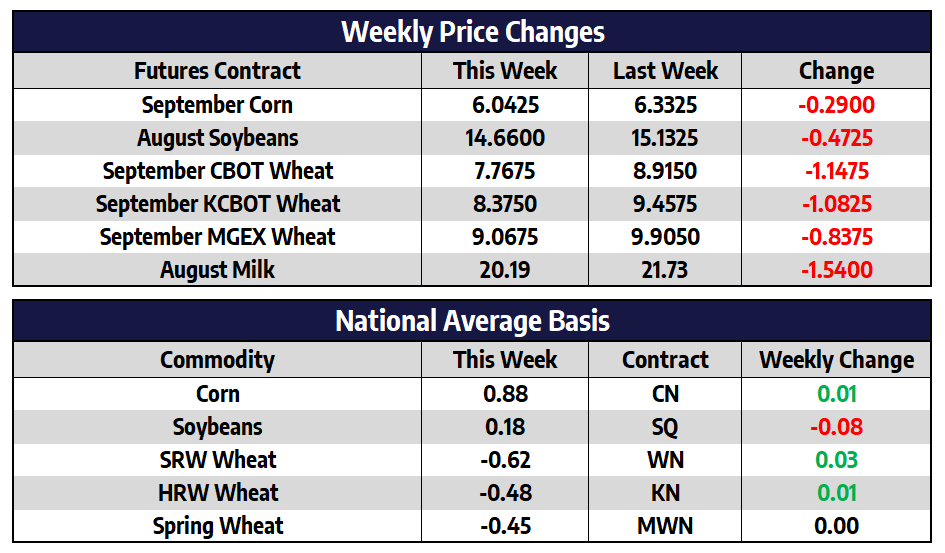

- September corn futures shed 29 cents this week to close at 604-1/4

- December corn futures shed 19-3/4 cents this week to close at 603-3/4

- Brazil is expected to start exporting corn to China before the end of 2022, agreements between the two countries were finalized in May, but they continue to negotiate, which GMO corn hybrids produced in Brazil will be allowed to be exported to China

- Private exporters reported sales of 133,000 metric tons of corn for delivery to China in the current marketing year this morning. The USDA retracted this sale later in the day on Friday

- Hot and dry weather is expected to stress some already thirsty parts of the western Corn Belt over the next two weeks

- With the corn market continuing to battle against forecast larger supplies and weakening demand, a weather led rally may be the last resort to bring byers back to the corn market

Soybeans Lower on the Week

- August soybean futures added 16-1/2 cents today to close at 1484-3/4

- November soybean futures added 6-1/2 cents today to close at 1349-1/2

- Soybean oil futures fell to their lowest levels in six months this week, mostly led by losses in palm oil futures

- A warm and dry weather forecast looking out into August provided late week support to the soybean market to end the week after a rough start

- NOPA crush for the month of June came in at 164.7 million bushels, this was up 8% from June of 2021 and the second-best June of all time

- November soybean traded down too, but nicely held last week’s lows near the 1320 area

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

All Wheats Lower this Week

- September CBOT wheat futures shed 3-1/2 cents today to close at 810-3/4

- September KC wheat futures shed 5-1/2 cents today to close at 862-1/4

- September spring wheat futures shed 5 cents today to close at 913-3/4

- Wheat export sales were substantially higher than last week this week, coming in at 1.02 million metric tons for the current marketing year

- SRW sales over the first six weeks of the marketing year are the 5th best start in the last 22 years and largest since 2013/14

- After a nearly 20% drop in the last 18 months, the euro is currently trading near even with the US dollar for the first time in over 20 years

- Continued talk of an agreement to ship Ukrainian wheat out of the Black Sea pressured the wheat market this week

Rough Week for Dairy

The August Class III milk contract fell $1.59 this week to close at $20.16, the worst-performing week for the rolling second month since November 2020. Spot cheese, which started its downtrend before Class III futures weakened, was not immune to the selling this week by falling 11.3750 cents to close at $2.0325/lb. It had become evident in recent months that the supply and demand equation for cheese was at a crossroads with bearish Cold Storage and Dairy Product Production reports fighting against bullish export demand, but the supply burden has begun to weigh on the market. The block/barrel average has been above $2.00/lb for nearly five months and will need to battle the negative momentum next week to keep that streak alive.