Corn Posts Poor Technical Action This Week

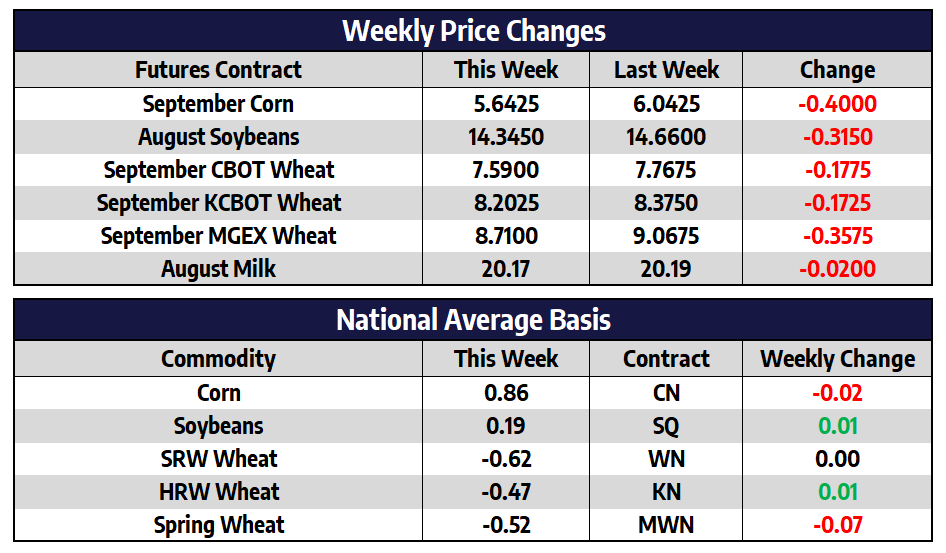

- September corn futures shed 40 cents this week to close at 564-1/4

- December corn futures shed 39-1/2 cents this week to close at 564-1/4.

- With help in mediation from Turkey, Russia and Ukraine signed a deal today to re-start exports of Ukrainian grain; The deal is said to be in place for 120 days and covers three Ukrainian ports

- French corn crop conditions fell to a three-year low to 75% rated good or very good condition as of July 18, from 83% a week earlier

- The market has pushed down to oversold levels which should support some short-term buying interest

- Traders will continue to monitor outside market forces as well as look ahead to the August WASDE report for any yield adjustments to the US national average

Soybeans Lower on the Week

- August soybean futures shed 31-1/2 cents this week to close at 1434-1/2

- November soybean futures shed 26-1/2 cents this week to close at 1315-3/4

- The Climate Prediction Center is forecasting above-normal temperatures and below-normal precipitation for the Midwest during the month of August

- November soybean traded down to their lowest level since January this week breaking below the $13 mark

- The US dollar was lower this week for only the second week since mid-May, this was a welcome sign to the soybean market

- November soybeans traded down to the lowest level since January 19 overnight before the market recovered off of the lows

- China will auction 500,000 tons of imported soybeans from its state reserves on July 29, the National Grain Trade Center said on Friday

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

All Wheats Lower this Week on News of Ukrainian Agreement

- September CBOT wheat futures shed 17-3/4 cents this week to close at 759

- September KC wheat futures shed 17-1/4 cents this week to close at 820-1/4

- September spring wheat futures shed 35-3/4 cents this week to close at 871

- A deal to restart Ukrainian grain exports signed today by representatives of Ukraine, Russia, and the United Nations drove European and US wheat prices lower to end the week

- Front month CBOT wheat prices traded to their lowest levels since January to end the week

Another Down Week For Milk

Dairy futures were pressured lower this week from a softer spot market in addition to a variety of bearish news items. To start, this week’s Global Dairy Trade auction fell 5% lower as global prices remain under pressure. In the auction, GDT cheese fell 2%, butter fell 2.10%, skim milk powder fell 8.60%, and whole milk powder fell 5.10%. Global prices have been in a steady downfall since the March highs. On Thursday the USDA said that June milk production was up 0.20% on a year-over-year basis despite a 78,000 head reduction in milk cow numbers. Finally, Friday’s Cold Storage report showed that US cheese in inventory for June rose 5% from the same month last year. At week’s end, August 2022 Class III settled at $20.23 while August Class IV settled at $24.47.